Amsterdam, January 24, 2024 – GRESB, the global ESG benchmark for real estate and infrastructure investments, announces the release of the Carbon Footprint Dashboard. This interactive tool marks a significant step in empowering GRESB’s real estate investor members with extensive insights into their portfolios’ energy consumption and greenhouse gas (GHG) emissions.

Powered by asset-level data, the Carbon Footprint Dashboard offers real estate investors a comprehensive view of the energy usage and GHG emissions within their GRESB portfolios, enabling them to make informed decisions that benefit both their investments and the planet. The tool allows investors to visualize and analyze data on a country and property sector basis, filling in any data gaps through GRESB’s industry-leading estimation model. This, in turn, can also aid investors in meeting disclosure requirements.

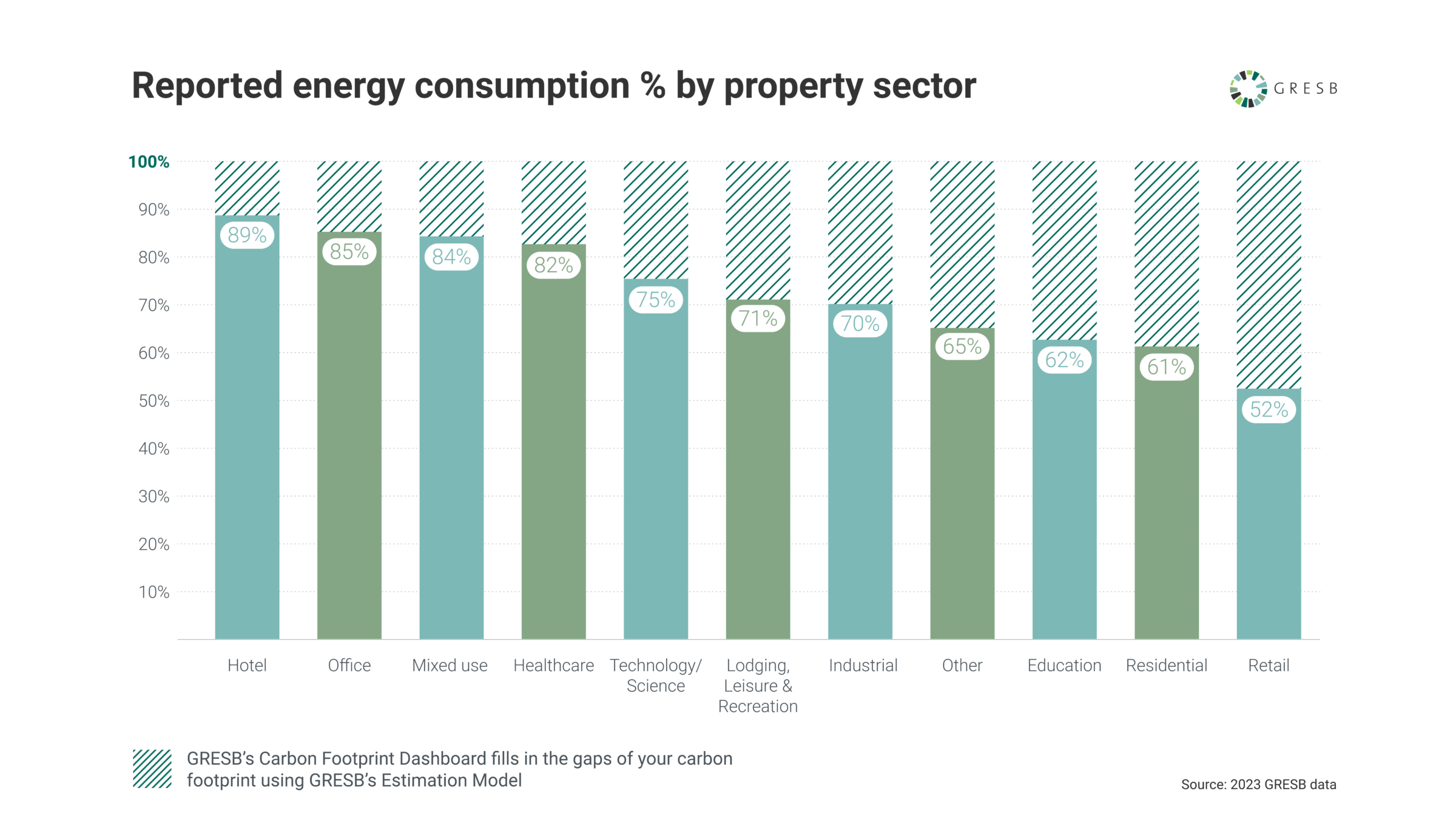

Reported energy and GHG emissions data can vary significantly across property sectors and assets, creating a critical data gap for investors worldwide in calculating their portfolio’s carbon footprint. Notably, according to GRESB data, the hotel and office sectors report the highest percentage of building-level energy consumption data across property sectors, at 89% and 85%, respectively. In contrast, the residential and retail sectors present lower figures at 61% and 52%, respectively. Consequently, investors in these sectors encounter substantial challenges in determining their portfolio’s carbon footprint due to incomplete data.

GRESB’s new dashboard addresses this issue by enabling investors to accurately estimate missing data using GRESB’s Estimation Model, ensuring complete coverage across energy and GHG data and providing investors with a holistic view of their carbon footprint. GRESB’s Estimation Model uses known building data points—such as floor size, location, and property subtype—to generate highly representative estimations from a global database of over 170,000 assets within the GRESB benchmark.

“GRESB is dedicated to supporting investors in their sustainability journey. The launch of the Carbon Footprint Dashboard reinforces our commitment to providing invaluable tools that drive positive environmental impact within the real estate sector,” said Sebastien Roussotte, CEO at GRESB.

The Carbon Footprint Dashboard aligns with the Partnership for Carbon Accounting Financials (PCAF) methodology, ensuring that investors can calculate their share of energy consumption and GHG emissions according to globally recognized standards.

Learn more about the Carbon Footprint Dashboard at gresb.com/carbon-footprint-dashboard.

Navigating Sustainable Investments with GRESB

Interested in learning more about the GRESB Carbon Footprint Dashboard? Join us online on February 27-29 for “Navigating Sustainable Investments with GRESB.”

With multiple sessions focused on EMEA, APAC, and the Americas, the webinar will present the Carbon Footprint Dashboard and discuss top-of-mind insights for investors.

About GRESB

GRESB is a mission-driven and industry-led organization providing standardized and validated Environmental, Social, and Governance (ESG) data to financial markets. Established in 2009, GRESB has become the leading ESG benchmark for real estate and infrastructure investments across the world, used by 150 institutional and financial investors to inform decision-making.

Media contact:

Tyler Guthrie

Director of Communications, GRESB

[email protected]