What is transition risk?

Transition risks are business-related risks that follow societal and economic shifts toward a low-carbon and more climate-friendly future. These risks can include policy and regulatory risks, technological risks, market risks, reputational risks, and legal risks. These risks are interconnected and often top of mind for investors as they attempt to navigate an increasingly aggressive low-carbon agenda that can create capital and operational consequences to their assets.

For asset managers and investors alike, estimating the overall transition risk associated with a portfolio can be a daunting task.

Get up to speed quickly on the transition risks residing in your portfolio

For GRESB Members, getting an executive-level understanding of transition risk across portfolios and a projection of when individual assets may become at risk is both easy and inexpensive. This is because:

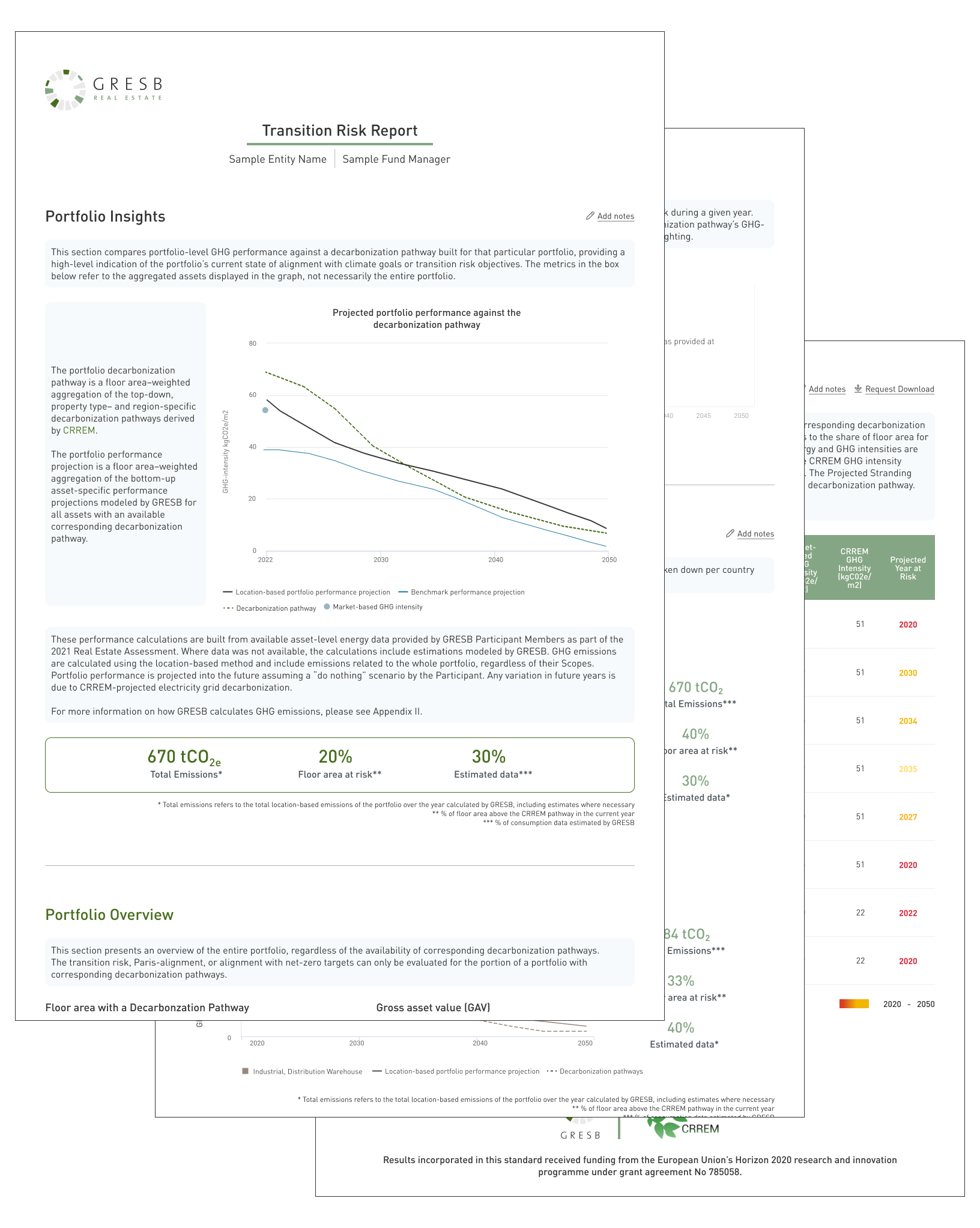

- Your insights are already prepared. The Transition Risk Report draws on existing asset-level data in the GRESB Portal, making it the quickest and most cost-effective way to uncover transition risk without additional reporting.

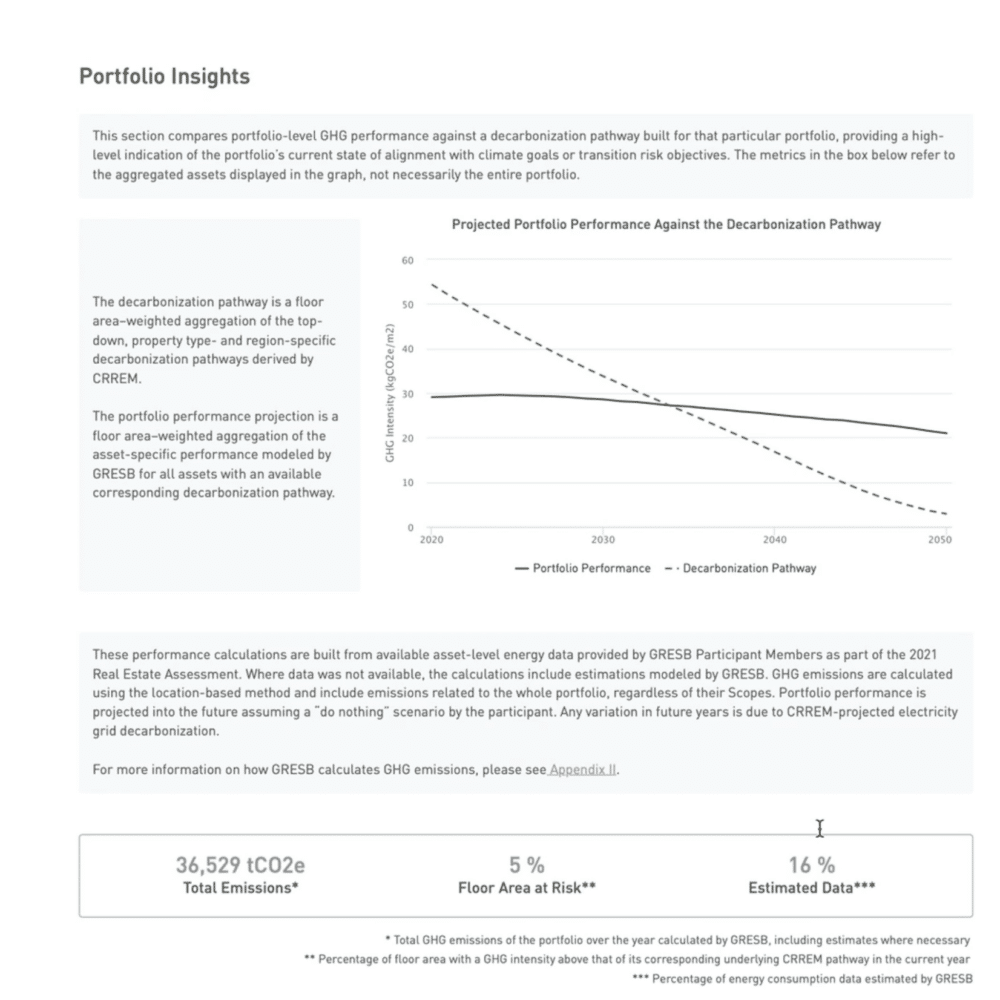

- We show you three levels of insights. Built from asset-level data, the Transition Risk Report provides a clear picture of risk in individual assets and aggregated across regions. The global summary is a snapshot of your whole portfolio.

- GRESB leverages real data from 170,000 assets. Real data means more useful insights. If any of your asset data is missing, GRESB makes accurate estimations using our granular, worldwide asset-level database.

- Insights are science based. The Transition Risk Report benchmarks assets against CRREM’s scientifically reviewed and industry-accepted decarbonization pathways.

Another benefit is that the report is ready to share with investors, because the underlying data is already standardized in GRESB’s Benchmarks and in a format they expect.

See an example Transition Risk Report.

GRESB continues to improve the Transition Risk Report to ensure that it remains a valuable tool that meets the evolving needs of GRESB participants amidst an ever-changing landscape of sustainability and investment challenges. Key 2023 improvements include:

- Percentage of ownership: Get a more accurate assessment of the transition risk of your portfolio based on percentage of ownership.

- Benchmarking insights: See how your portfolio compares to all assets in the database that match the composition of your portfolio.

- Market-based emissions: Get insights into market-based emissions.

- Excel download of asset-level data: Request an Excel download of asset-level data.

- Investor access: Have more meaningful conversations with investors. Investors can now request access to the Transition Risk Report and participants have the ability to add comments to their report.

- Unit of measurement: View the report in square feet if you reported using this unit in the Real Estate Assessment.

Request a demo

Interested in learning more about the GRESB Transition Risk Report? Request a demo today.

Otherwise, GRESB Members that already participate in an assessment can get their report now by contacting us.

GRESB and CRREM together

CRREM – An EU-funded Horizon 2020 project that stands for the ‘Carbon Risk Real Estate Monitor’ was launched in collaboration with other consortium members.

CRREM translates Paris Climate goals into regional trajectories against which assets and portfolios can be benchmarked. These pathways underpin GRESB’s Transition Risk Report and show when individual assets are at risk of being stranded because they are not in compliance with local regulations or have entered obsolescence. The use of CRREM’s 1.5C pathways has been endorsed by both the UN-convened Net-Zero Asset Owner Alliance and the Institutional Investors Group on Climate Change.

GRESB’s Estimation Model

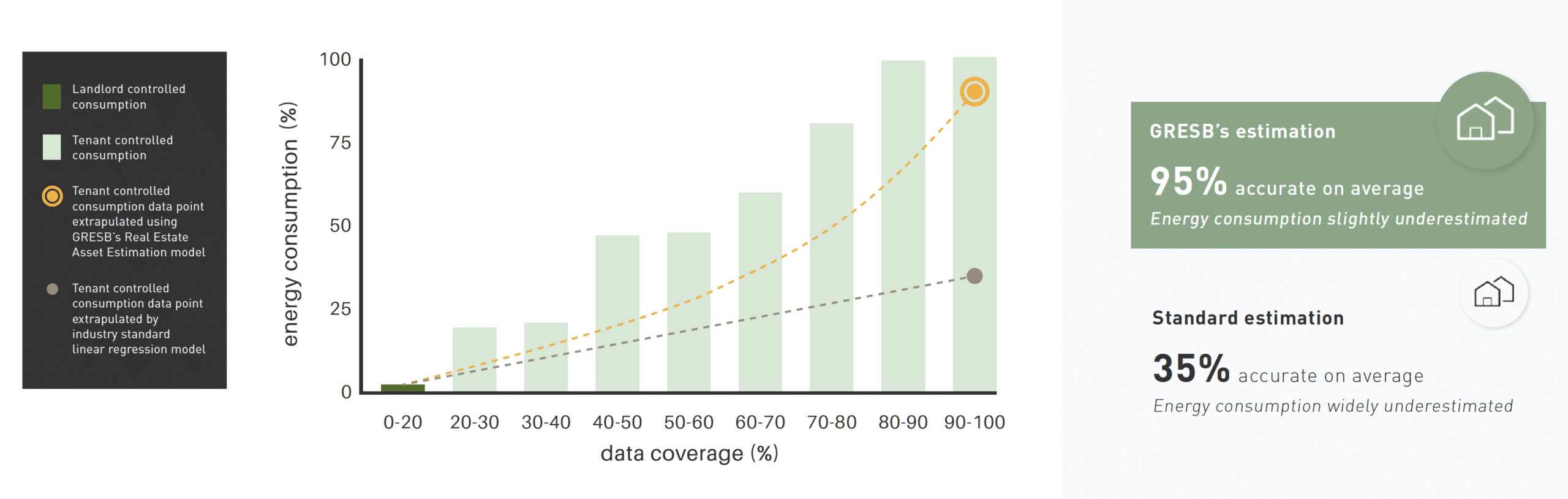

In cases where energy consumption data is missing, GRESB’s Estimation Model (GEM) can drill down and compare a building’s known data points – like floor size, location, and specific property subtype – against the GRESB database.

The figures displayed here are based on a blind test comparing both GEM and an alternative estimation based on a linear extrapolation (a common estimation approach) against a set of properties in the Netherlands, in this case multifamily mid-rise buildings.

More questions about the Transition Risk Report?

..