Globally, all industries have seen a great sustainable force and impulse; an incremental change along all its business supply chain; actually, a challenge that is demanding a transformation, from an ESG perspective. Since the beginning of the 2020 decade, followed by the global pandemic and natural disasters – that are more common and stronger than ever – the world is facing the beginning of the ESG (R)evolution.

As an example, President Biden just revealed the US spent during 2020, more than 90 USD billion in weather and climate disasters (NOAA-Climate, 2021); every dollar invested in resilience can save 6 dollars down the road. With this, he announced the record amount in Climate Resilience Funding with the biggest budget in the American history; and even with this, we know that it could not be enough.

As Real Estate professionals, we also know that these changes are going to dare our sector to a 360-degree transformation, starting with Net Zero as the new normal, resilience and climate assessments, certifications, and a whole new package of innovative best practices and technologies that we need to create, learn, and implement as speedy and solid as possible; as the climate change clock is ticking against us. But as always, challenges means also opportunities and as it is mentioned within the 16th edition of the World Economic Forum’s Global Risks Report, five of the seven top risks for business are climate related (WEF, 2021); which means that by performing this transformation we are going to build the needed resilience for our business to survive and to have a competitive advantage from our peers. As well and just as the COP26 has come to an end, the following image shows the main highlights for the Real Estate industry within the COP, where for the first time a day for the Cities, Regions and the Built Environment has taken place.

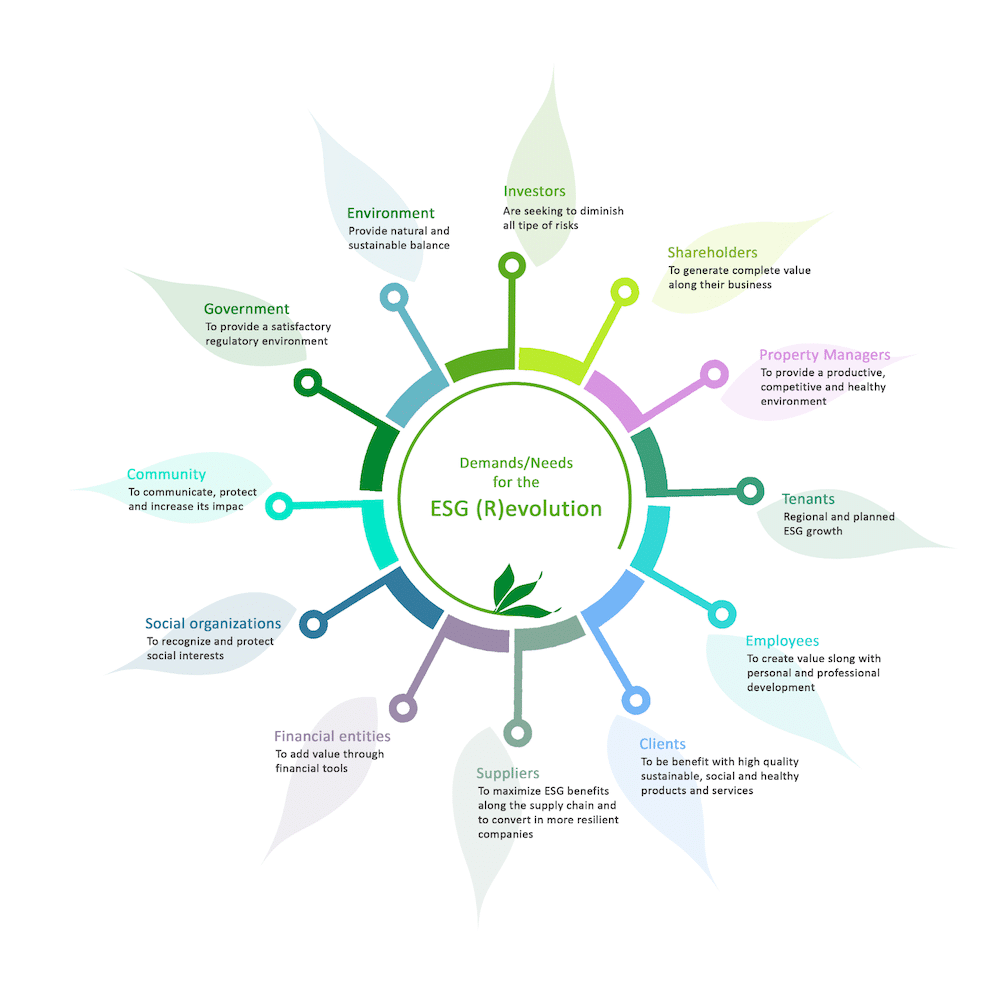

To tackle better this ESG (R)evolution, we need to balance our sustainable efforts within the three aspects of ESG, as well as with the different related players of this sustainability team game: Investors, Employees, Tenants, the Environment, and the Community.

Corporate Sustainability as a team sport – Stakeholder Engagement

There is a direct link between the transformational change approach and effective stakeholder engagement. Studies have shown that effective stakeholder engagement can accelerate the transition to a low-carbon and climate resilient development model (CIF, 2020). Sustainability has proven to be a team sport and more within all the stakeholders.

Goals Establishment

Every private institution has objectives based on strengths and opportunities, allowing generating financial profitability over time. However, these objectives are usually only focused to meet financial objectives. Now and considering the WEF risks, we need to take responsibility for the environmental and social impacts, seeking to permeate them across the business model. Some good practices we want to share are:

- ESG objectives within this (R)evolution, need to have both: short- and long-term vision, at least to 2050, so that the Company and its stakeholders can have the big picture of where are all going within this transformation.

- Review to adhere to the UN-convener Net Zero Asset Owner Alliance or the IEA Net Zero by 2050 Roadmap

- Define all the related energy, water, waste and other KPIs to track at least on an annual basis the advances on your objectives.

- Include your objectives within the Science Based Target Initiative

- Use GRESB and tools to set up and update your targets.

- To generate effective communication channels of the ESG objectives that the company has, not only so that the internal community is aware of what the company is looking for at the sustainability level, but also so that an immersion and alignment of these objectives along the objectives by area and employee, as well as within the supply chain.

- As a cutting-edge topic within the ESG agenda is Biodiversity, we encourage to adhere to the TNFD, as it sets a clear benchmark for how companies report on and incorporate material biodiversity issues within their strategy. As the equivalent of Net Zero for Biodiversity is no further biodiversity loss from this point forward.

Data Collection

Under the premise “what is not measured is not managed and what is not managed cannot be improved”, the establishment of policies, techniques, procedures and / or tools for the adequate collection and management of environmental, social and corporate governance information will give not only the possibility to make better decisions about the data it handles, but it will also allow to improve in areas of opportunity established with its stakeholders and, therefore, achieve its sustainability objectives and improve its profitability in the medium and long term. period.

The close relationship of the mentioned aspects allows a framework focused on collaboration and continuous improvement of ESG aspects across the company. The continuous search for all the ESG and climate related BMP will allow greater certainty towards investors and other stakeholders, as well as increasing profitability and the contribution of significant value of the company in the face of global problems such as the climatic emergency, social inequality, and problems of this ESG (R)evolution.

This article was co-written by Jessica Díaz – Sustainability & Environmental Vice President -, Orlando Arauz -Sustainability Manager – and Julio Leal, PIIMA JV.