As sustainability grows in importance within the industry, so does providing transparent ESG disclosures. As the global ESG benchmark, GRESB works with real estate and infrastructure companies around the world to ensure that they can provide transparent and consistent data to investors. In the APAC region in particular, investors have been pushing for increased participation in the GRESB Assessments as a tool for ESG data reporting and to facilitate nuanced conversations between investors and their portfolio companies.

With TCFD-aligned disclosures soon to become mandatory in many jurisdictions in APAC, investors in the region are now urgently seeking climate-related data to inform their investment processes and decision-making. Already, GRESB has partnered with numerous investment firms and published a multitude of case studies that explore the ways in which institutional investors integrate GRESB into their investment strategy. GRESB’s investor member base is now comprised of more than 170 institutional and financial investors, representing USD 51 trillion in assets under management, and continues to grow, displaying the mainstream power that ESG data holds.

“Don’t wait until you’re in an engagement conversation to think about ESG. Focus on providing transparent data… The investment markets have moved on. ESG is no longer a niche investment theme – it is mainstream.”

John White

Senior Managing Director and Global Investment Strategist, Heitman

Why is GRESB important to APAC investors?

The transition into responsible investment practices is a growing movement, one that is encouraging investors to reward companies that are transparent regarding their ESG outcomes.

Investors in APAC are coming together to make GRESB the ‘common language’ in the dialogue about material sustainability topics. With the TCFD pushing regulatory bodies to align disclosures with global frameworks, investors are looking for a baseline on which they can track climate-related disclosures and risk management practices.

For the third consecutive year, a coalition of institutional investors has joined forces to actively engage with real assets companies in APAC to encourage their participation in the GRESB Assessments.

This year, 18 institutional investors representing USD 8.1 trillion in assets under management, including JP Morgan, Brookfield, and B&I Capital, have engaged with companies in the APAC region to strengthen dialogue around ESG.

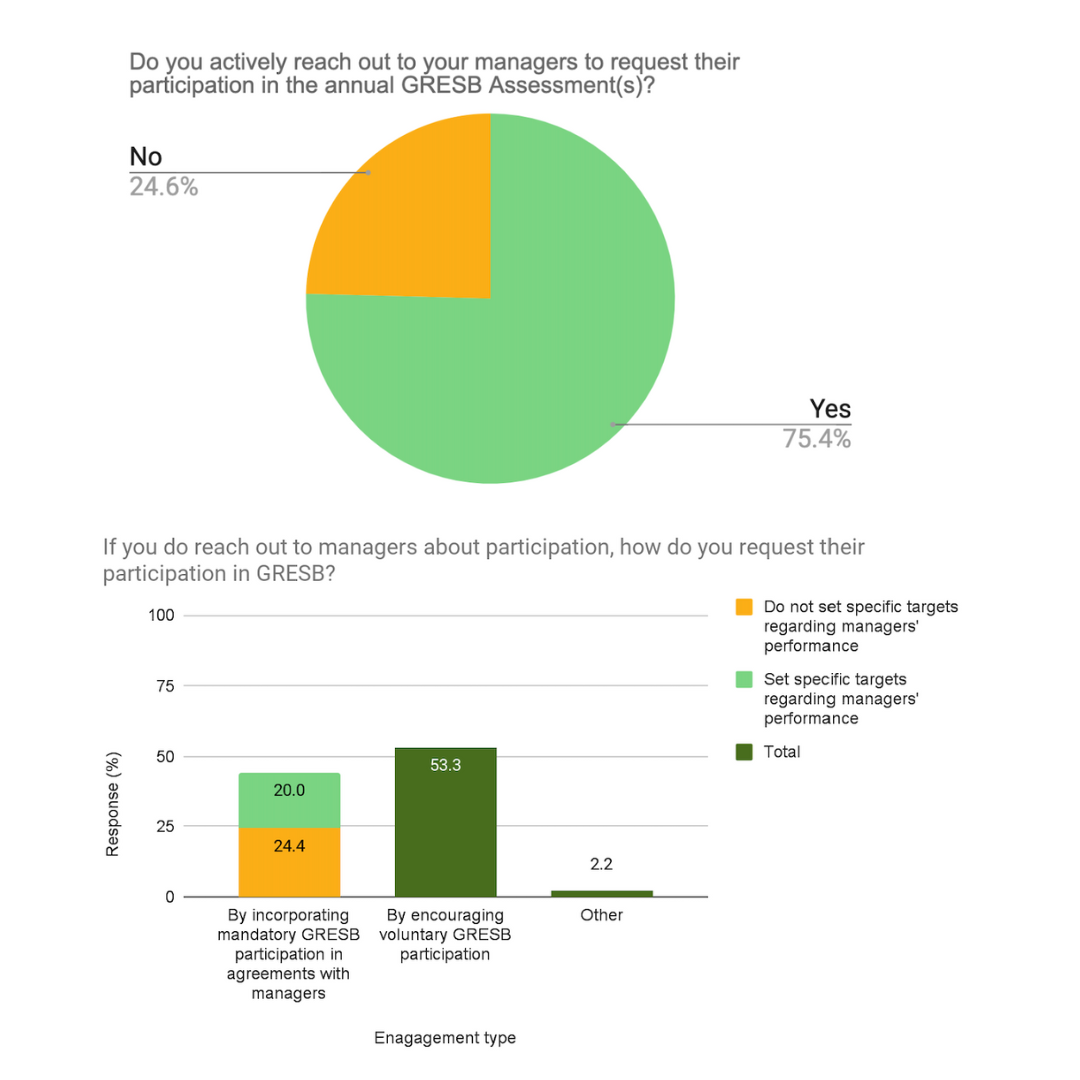

Encouraging listed real estate companies and REITs to make ESG disclosures in line with the GRESB Standards via participation in the annual GRESB benchmarks, this push is reflected in GRESB’s most recent end-of-year survey of global GRESB investors. In fact, 75% of respondents report actively engaging with their managers to request participation in the GRESB Assessments, with one-third of investors now requiring mandatory participation. Half of respondents also rely on GRESB data to analyze the environmental footprint of their overall portfolio, making the need for replicable and comparable data even greater.

TCFD requirements in Asia

Created in 2015 by the Financial Stability Board, the Task Force on Climate-related Financial Disclosure (TCFD) sets consistent guidelines and a reporting framework for companies to disclose climate-related financial risk. In places such as Hong Kong, Singapore, and Malaysia, TCFD-aligned disclosures will soon be mandatory, leading investors to push for a global framework for ESG disclosures.

GRESB’s recent Investor Member Survey found that the majority of surveyed investors believe that GRESB will be the platform of choice for managers to report on climate-related financial disclosures and transition risk data.

The latest 2022 TCFD Status Report indicates that TCFD adoption in APAC is at 47%, largely driven by Australia and Japan, with an overall increase in average level of disclosures within APAC representing an 11% jump from the previous year.

Climate-related data is becoming increasingly crucial for investment decision-making processes, which is why investors need disclosures on material ESG information that they can trust. As such, GRESB provides the trustworthy transparency investors are looking for, as a tool that can provide validated and standardized ESG information about real estate assets.

Do you want to find out more about TCFD and what it might mean for you? Take a look at GRESB’s on-demand webinar, ”Inside ESG: Navigating TCFD Requirements in Asia.”

A growing benchmark

Participation in the GRESB Real Estate Benchmark increased by 21% in Asia alone in 2022, signaling a growing embrace of ESG practices and reporting. In line with the global benchmark, Asia participants have seen significant score increases year over year, with their second year of reporting registering the biggest jump.

In fact, a recent GRESB analysis of the performance of first-year participants found that the average participant score increases by 10 points in both the Performance and Development components and by 3 points in the Management component in the second year of participation.