Stockland is committed to developing and maintaining resilient assets that are equipped to adapt and thrive in the face of climate change. To achieve resilience across our portfolio, we have developed an approach to assess and manage the physical risks posed by climate change at our assets and their surrounding communities. Strategic application of this approach across our portfolio has not only enhanced the operations of our individual assets, but has delivered financial benefits in the form of reduced insurance premiums and avoided maintenance costs. This article describes how we use our resilience assessment process to achieve these benefits.

How do we assess climate resilience?

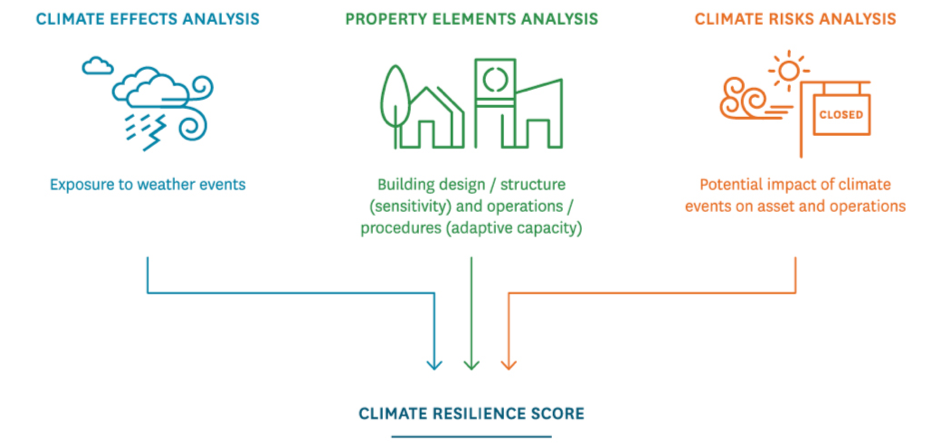

Our approach to portfolio resilience involves mapping the vulnerability of our assets to the physical impacts of climate change, and then undertaking climate resilience assessments, and/or community resilience assessments, at assets in more vulnerable locations. Our climate resilience assessment methodology has been in use since 2012, and focuses on the vulnerability of the asset to climate change, particularly its ability to ensure severe weather impacts and operate without disruption. The methodology defines key resilience attributes, with a focus on location, design, structure, operation and maintenance, utilities and services, and stakeholders. We assess these attributes for their exposure to:

- climate effects, which relates to the degree of exposure a building has to weather events based on its geographic location, such as North Queensland where there is a high exposure to cyclones;

- property elements, which are the physical and operational attributes of a building that make it vulnerable or resilient to those climate effects, such as condition of box gutters expected to cope with high volumes of stormwater; and

- climate risks, which are the potential impacts of weather related events on a building based on its location and attributes, such as loss of trade due to local flooding or air conditioning failure on hot days.

The assessments of each component are combined to provide an overall climate resilience score.

Demonstrating measured improvement over time

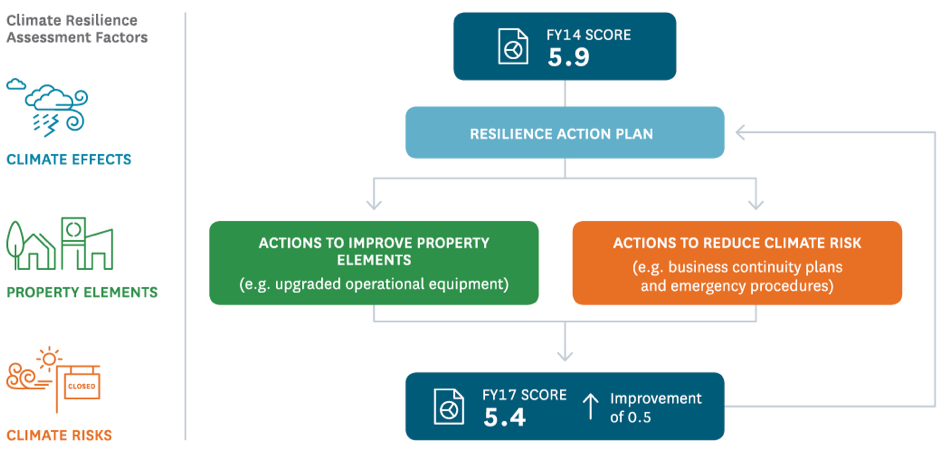

In 2014 we set a climate resilience target for the assets in our North Queensland retail portfolio to improve the regional average resilience score for the portfolio of shopping centres from 5.9 to 5.5 by 2017 (lower scores equate to better resilience). As mentioned earlier, North Queensland is a focus for our resilience initiatives because it is a region with high exposure to tropical cyclones. After assessing the portfolio resilience and setting the target, we implemented resilience initiatives including:

Examples of initiatives and actions included:

- structural modifications such as fastening roofing systems and roof mounted equipment down, enhancing building guttering and the design of stormwater drainage infrastructure, and replacing ageing roofing materials with ‘cool roof’ technologies to reduce urban heat island effect and heat loads on plant and equipment

- performance enhancements such as upgrading air conditioning and electrical equipment to provide greater reliability during days of extreme heat

- procedural specifications such as new business continuity plans and emergency procedures for assets in regions vulnerable to cyclones.

The North Queensland retail portfolio was reassessed following completion of the resilience initiatives, and achieved an average score of 5.4, exceeding our initial target.

Our assets are not islands: considering community resilience

The performance of our assets is linked to the economic wellbeing of their surrounding communities. Our retail town centres, for example, thrive when prosperous, well-connected local residents choose to come together in our centres to dine, shop, and play.

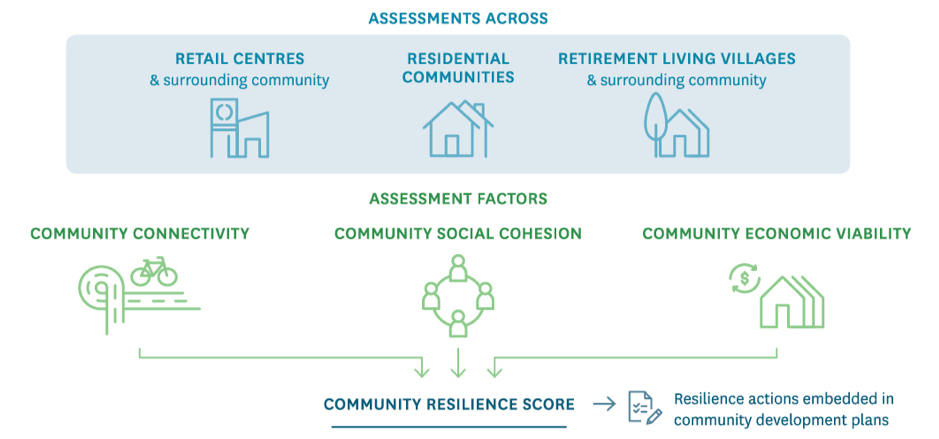

In recognition of links between our communities and our assets, we developed a community resilience assessment methodology, which considers known factors of community resilience such as social cohesion, economic viability and connectivity. The assessment outcomes directly influence our community development planning at our assets.

For example, the community resilience assessment for our Stockland Green Hills (NSW) retail town centre redevelopment identified an above average need for education and job creation opportunities in the local and regional areas. The Green Hills Connectivity Centre is an initiative we incorporated into the centre redevelopment that responds to the needs identified in the community resilience assessment. Over the course of the redevelopment, the Connectivity Centre placed more than 180 people in jobs, exceeding its original target of 100.

Realising value and next steps

Our years of assessing and managing the resilience of our assets has delivered value for our business and for the communities where we operate. Applying our climate and community resilience approach to our assets in cyclone-prone north Queensland, for example, has enabled us to identify and implement risk mitigation measures that have, in turn, substantially reduced our insurance deductible per claim on assets with climate resilience reviews. These insurance benefits are in addition to other benefits that accrue to our business such as:

- optimised asset performance by minimising increases in operating and maintenance costs

- improved decision-making regarding future investments

- increased customer comfort levels within our assets and communities

- maintaining the longevity of assets within our portfolio.

Over the years, we have come to understand that resilience extends beyond how we respond in an extreme weather emergency, and includes managing risks and disruption beyond those caused by our climate. We have recognised that excellence in managing the day-to-day provides the foundations that enable our assets and communities to thrive in the face of short-term shocks and long-term changes.

With our understanding of how resilience can be used to manage change beyond climate impacts at individual assets, we continue to advance resilience across our business by:

- investigating how our business can evolve to be a part of the transition to a low-carbon economy, by considering transition risks material to our operations and business model

- using lessons learned to inform minimum design criteria for developments and major refurbishments

- embedding climate and community resilience assessment into our project lifecycle process, including due diligence criteria for asset acquisitions.

This article is written by Alexander Gold, Stockland.