Our industry is engaged in an important dialogue to improve sustainability through ESG transparency and industry collaboration. This article is a contribution to this larger conversation and does not necessarily reflect GRESB’s position.

The pursuit of net-zero carbon (NZC) and carbon neutrality is no longer a distant vision in the European real estate industry; it is a present-day imperative. To foster a sustainable future, both developers and interested parties must adopt comprehensive carbon reduction strategies. This entails comprehending and addressing the carbon triad of whole-life, embodied, and operational carbon.

The UKCCC 2019 report stated that for the UK to meet its 2050 NZC goals, residential building emissions would need to be almost entirely eliminated. Similarly, the UKGBC stated that “A big shift is needed to change behavior, improve efficiency and switch to low carbon heat.” These insights, paired with outlined expectations and government timelines between now and 2050, make the next decade the most vital to achieving NZC. For the real estate sector, 2022 to 2024 is when the Government-stated timeline specifies, we must: “Develop an evidence base for future homes and future building standards.”

We are in the middle of a period that will specify the very standards of future liveable, sustainable buildings… but what’s needed to achieve these goals? I think we all know the answer – data.

“As investors, lenders, and tenants make their own decarbonization commitments, they will need to demonstrate that their real estate is indeed decarbonizing. Thus, much of the value of decarbonizing will come from the ability to demonstrate emissions reduction to potential stakeholders. Building the ability to monitor and progressively reduce emissions on the path to net zero will create an opportunity for players to differentiate.” (McKinsey & Company)

Reducing carbon emissions long-term and driving towards NZC all needs to start with low-carbon design. In new builds that can be down to sustainable materials in walls, floors, and air tightness from windows and doors. But outside of these tried-and-true methods, it all has to start with understanding whole life carbon, and the role of embodied carbon.

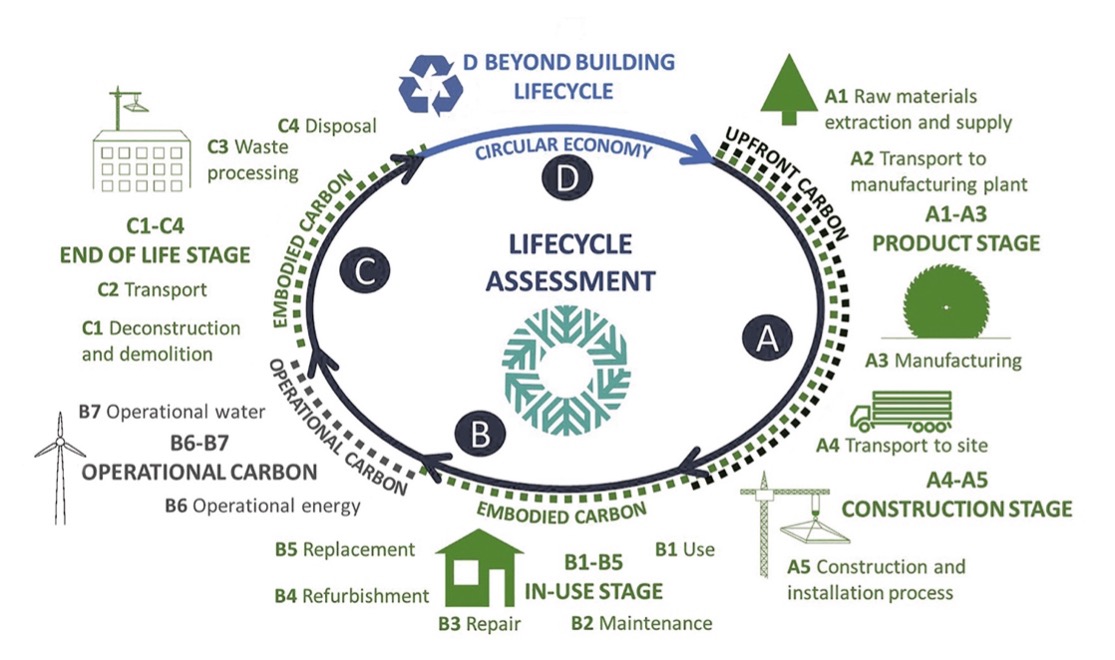

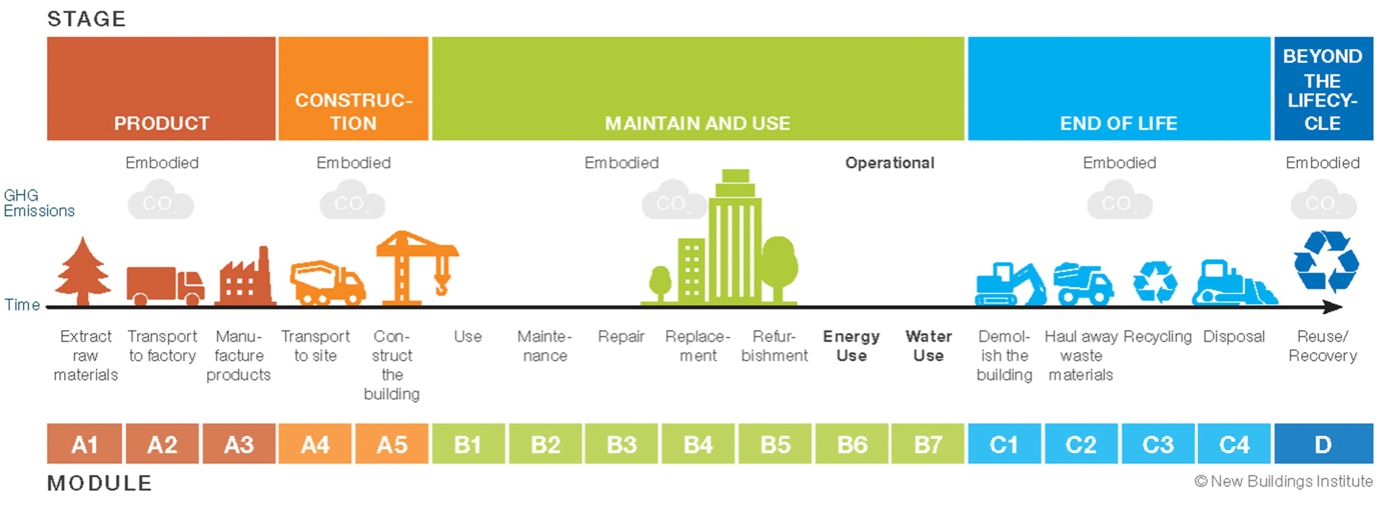

Whole life carbon provides an all-encompassing perspective, incorporating all phases from conception to demolition, ensuring that sustainability is integrated into every aspect of a building’s existence. Consideration of embodied carbon, or the carbon emissions associated with materials and construction, is crucial for making informed decisions that can substantially reduce environmental impact. Operational carbon, which reflects emissions during the building’s use phase, must be continuously monitored and optimized to meet the most stringent efficiency standards.

Whole life carbon = Embodied carbon + operational carbon

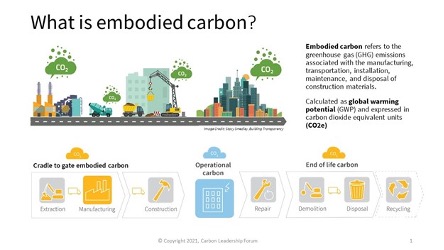

What is embodied carbon?

Embodied carbon refers to the amount of carbon dioxide (C02) emitted during the following stages of a Building’s life:

- Manufacturing

- Transportation

- Construction

- Maintenance

- Demolition and disposal

In the context of real estate, it’s the carbon emitted from the extraction of materials for a building and the construction / build of that building, along with site transport, etc.

Why calculate embodied carbon?

As with anything relating to ESG, without data no real change can happen. We all need to have a baseline understanding and a baseline measurement of our environmental impacts now, so we can start to change behaviours, find more sustainable materials and more sustainable methods, to then map reductions accurately. Calculating embodied carbon is a key part of this ecosystem.

With an embodied carbon calculation, investors, developers, consultants, engineers, and the full construction lifecycle can start to find pathways to reducing carbon in every stage of a project. Only with this calculation should carbon offsetting strategies begin – as then it’s based off real-world data and the success of those strategies can be modelled, and reported on, accurately.

For example, if outliers in the data show maintenance is your main carbon generator, then you know to invest in reducing your operational carbon footprint with smart technology and utility usage reduction. Versus if outliers in the data show manufacturing your building materials is your main carbon generator; then you can find strategies to reduce that. As they say, every change – no matter how small – makes a difference when it comes to NZC.

“Real-estate players have a wide array of options for how to proceed, including low-carbon development and construction; building retrofits to improve energy efficiency; upgrades to heating, cooling, and lighting technology; and technology to manage demand and consumption.” (McKinsey & Company)

According to CBRE, the best way to incorporate carbon offsets into your decarbonization approach:

- As part of a defined strategy with a set scope and percentage of emissions you will offset

- With a short-, medium-, and long-term plan for purchasing offsets

- With ongoing monitoring and reporting on the performance of any offsets you purchase

In other words, all connected to data…

The benefits of calculating embodied carbon?

Accurate and reliable data are essential to the success of these endeavors. Without accurate calculations and clear methodologies, our efforts will remain aimless and our objectives elusive. We can transform theoretical aspirations into tangible realities by utilizing cutting-edge technology, generating comprehensive reports, and embracing cross-sector collaboration.

The benefits of calculating embodied carbon go beyond just reducing your carbon emissions. That is the key output, yes; but there are even more long-term benefits of calculating and reducing your embodied carbon:

- Financial benefits:

- Cost savings: Reducing carbon and reducing costs go hand in hand. This could be in the context of reducing your Carbon Tax bill and/or in the context of OpEx when maintaining your assets. Building carbon-efficient real estate or retrofitting assets into more carbon-efficient assets will see a significant reduction in energy consumption, and in a cost-of-living crisis that feels like a big positive.

- Funder & bank requirements: Enter SFDR Article 6, 8, and 9. Connected to the EU Sustainable Finance Action Plan, and otherwise known as “Green Funds,” having proven carbon reduction strategies or carbon neutral assets will gain you access to this green finance. But ultimately, to gain access to these funds, you must showcase strong ESG performance, of which embodied carbon is just one piece of the puzzle.

2. Benefits of enhanced carbon insights:

- Informed decision-making: It goes without saying, but data in real estate allows for informed decision-making. Decisions based on real-world insights from your portfolio of assets. This could be shifting your transportation processes or even producing the right policies and procedures to align with ESG best practice.

- Facilitating certifications: There is proven benefits of achieving industry benchmarks like GRESB and Asset Level Certifications like BREEAM, Fitwel, HQM, ILFI Net Zero… the main one being avoiding those brown discounts and seeing an increase in asset value. Not only that but key certifications like Fitwel drive enhanced social value, key for engaging residents and improving tenant retention.

The path to net-zero carbon and carbon neutrality is neither quick nor easy. It requires creativity, perseverance, and a shared vision. But with the proper tools, knowledge, and commitment, we can transform the European real estate landscape, aligning profits and principles to create a world in which sustainability is not an option, but a defining feature of our built environment.

The benefits go on, and for more information on embodied carbon calculations or carbon reduction strategies suited to your portfolio – make sure to speak to Utopi’s ESG Advisory team.

This article was written by Ben Roberts, Chief Growth Officer, at Utopi.