The real assets industry faces many interconnected challenges that fall under the ESG umbrella, including climate change, resource depletion, social inequality, and governance issues. These challenges can have a significant impact on the value, reputation, and resilience of real asset investments.

GRESB was founded in 2009 to provide real assets investors and managers with a framework for measuring, benchmarking, and reporting on their sustainability performance. Today, we have become a global standard in the industry, covering 2,223 real estate entities as well as 887 infrastructure entities (fund and asset), representing almost USD 9 trillion in gross asset value.

GRESB’s mission is to help the industry address these challenges by providing a rigorous and transparent framework for measuring and improving sustainability performance. By establishing standards in partnership with the industry, encouraging transparency through our assessments, and providing portfolio- and asset-level data and insights, we are helping create more sustainable and resilient investments and communities.

GRESB’s impact

The GRESB Assessments and products have had a significant impact on the real assets industry, providing investors and managers with the necessary data, insights, and tools to make better decisions, improve sustainability outcomes, and create value for stakeholders.

For investors

For investors, GRESB provides a comprehensive and standardized framework for evaluating the sustainability performance of real assets. By measuring and benchmarking the ESG performance of different assets and portfolios, investors can make informed investment decisions that take into account ESG risks and opportunities. GRESB also provides comparable data and insights on sustainability trends and best practices, helping investors identify sustainable investment opportunities and generate a healthy amount of market pressure, which in turn drives the industry to become more sustainable.

GRESB provides insights through a variety of products and services. In addition to the Benchmark Report resulting from participation in the GRESB Assessments, investors also have access to:

- The Portfolio Analysis Tool, which allows investors to calculate the overall environmental footprint of their portfolio and create customized benchmarks to assess their portfolio’s relative performance based on characteristics of their choice.

- The Data Exporter, which allows investors to export the full set of variables for custom analysis and inclusion in existing portfolio management systems.

To learn more about how investors use GRESB data, read our investor case studies.

GRESB results are a springboard to engage with managers and understand a fund’s ESG initiatives that are underway. We start by comparing the ESG performance of a fund against the GRESB average and our portfolio average, then drill into areas of leading and lagging performance to understand key drivers. This allows us to track year-on-year performance, identify portfolio leaders, and share best practices to encourage improvement.Shali Lingaretnam

Head of Investment Stewardship at VFMC

Since 2017, when we began using GRESB across our portfolio, GRESB has offered a unique proposition with sector-specific materiality assessment and asset-level benchmarking which has helped to further guide our assets on how to improve their approach to ESG and gain a better understanding of the practical application of the standards and initiatives we adhere to.Neil Krawitz

Head of ESG and Asset Management at Arcus Infrastructure Partners

For managers

For managers, GRESB provides a roadmap for improving the sustainability performance of their assets and portfolios. By participating in the benchmark, managers can identify areas where they are lagging behind their peers and develop strategies to improve their ESG performance. The curated peer benchmarks also encourage healthy competition, serving as a driver of industry progress.

In addition, GRESB’s reporting requirements help managers communicate their sustainability performance to stakeholders and demonstrate their commitment to sustainability. In short, GRESB participation allows managers to:

- Benchmark their performance against peers

- Identify climate-related financial risks and opportunities

- Engage with investors leveraging objective, GRESB-verified ESG data

- Standardize ESG data collection

To learn more about how managers use GRESB, read our manager case studies.

A growing benchmark

GRESB’s impact can be seen in the continued growth of the GRESB Benchmarks, with more participants joining and submitting their ESG data every year. The GRESB Real Estate Benchmark saw a 15% increase in participation globally, compared to 2022, with the most growth in total numbers coming from the Americas region and the largest percentage increase coming from Oceania. Similarly, the GRESB Infrastructure Asset Assessment and GRESB Infrastructure Fund Assessment continued their steady growth, with markets like Korea driving a disproportionate share (with 26% year-over-year growth in participation).

Another measure of GRESB’s impact on the real assets industry can be found in the continued improvements in average GRESB Scores, which provide an overall measure of ESG performance represented as a percentage (100 percent maximum). GRESB Scores give participants quantitative insight into their ESG performance in absolute terms, over time, and against their peers. In 2023, the average GRESB Scores for the Real Estate Standing Investments Benchmark and for the Development Benchmark increased by one point to 75 and by two points to 83, respectively, compared to 2022. These improvements are a reflection of targeted efforts among participants, who build on their GRESB results and our standardized framework year after year to increase the effectiveness of their ESG strategies and processes.

The continued growth of the GRESB Benchmarks and GRESB Scores indicates overall progress across the real assets industry, signaling not only increased ESG reporting practices but also improvement in sustainability outcomes.

Driving the industry forward

GRESB has been engaging with the real assets industry since its inception. The launch of the GRESB Foundation in 2021 has further solidified GRESB’s role as a “by the industry, for the industry” benchmark.

The GRESB Foundation is an independent, not-for-profit organization (incorporated as a Dutch stichting) that sets global standards for assessing the ESG performance of real estate, infrastructure, and other assets.

Led by a Foundation Board bringing together representatives from GRESB Members and Partners, the GRESB Foundation serves as the central platform for GRESB to engage with the industry, taking ownership and governance of the Standards used by GRESB BV, a separate profit-for-purpose benefit corporation, for conducting its assessments.

The GRESB Foundation, GRESB BV, and GRESB Members work in unison to realize a shared vision of an investment community that leads the way in creating a more sustainable world, one that satisfies present needs without jeopardizing future generations.

Guided by the GRESB Foundation, GRESB has played a pivotal role in promoting best practices and forstering transparency, thereby driving transformation in the industry. Through the establishment of industry-wide ESG reporting and perfomance standards, GRESB has encouraged real assets companies to enhance their sustainability practices and, in doing so, contributed to the creation of a more sustainable future for the industry.

Building a real assets community and fostering innovation

As a forum for investors, managers, asset owners, operators, and consultants to come together and discuss ESG performance and strategies, GRESB has helped build a united real assets community and incentivized companies to adopt and develop more sustainable practices, leading to innovation and progress in the industry.

By prioritizing sustainable performance, GRESB has also helped create accountability and influenced how the real assets industry responds to pressing global issues such as climate change. GRESB’s emphasis on collaboration and knowledge-sharing through its online and in-market events has facilitated the exchange of information and ideas within the industry, which, in turn, has helped identify best practices and innovative approaches to sustainability challenges.

Additionally, GRESB has encouraged companies to set ambitious sustainability targets and to track their progress towards achieving them, connecting participants with a network of expert ESG consultants and software providers as needed to pursue sustainability improvements. This has helped drive innovation in the development of new technologies and solutions that can help companies meet their sustainability goals.

Promoting sustainable investments and transparent ESG practices

GRESB data is increasingly being used to support sustainable investment decisions, particularly in the context of sustainability-linked loans and ESG indices.

Sustainability-linked loans are financial instruments that incentivize companies to improve their ESG performance by linking loan terms and conditions to sustainability performance indicators. GRESB data has emerged as a valuable tool in the establishment of sustainability-linked loans as it provides investors and lenders with an objective view of a company’s ESG performance.

By using GRESB data, lenders can more accurately assess a company’s sustainability performance and set targets that are more meaningful and relevant to the company’s sustainability needs and objectives. This, in turn, provides companies with an incentive to improve their ESG performance as it will result in more favorable loan terms. In this context, GRESB scores and star ratings are often used as loan KPIs.

Similarly, GRESB data is used to construct ESG indices, which are investment products that track the performance of companies based on their ESG credentials. By leveraging GRESB data, index providers can build indices that are comprehensive, objective, and provide investors with a clear picture of a company’s sustainability performance. This enables investors to make informed decisions on where to allocate capital, mitigating risk and prioritizing investments in sustainable companies with transparent ESG practices. In turn, this can incentivize real assets companies to disclose and improve their ESG performance as progressing towards their sustainability goals can help them attract investment.

As sustainable finance continues to grow, GRESB’s role in supporting sustainable investment decisions is likely to become even more critical. Read more about how GRESB data is used for sustainability-linked loans and ESG indices.

An industry-aligned framework

The GRESB Assessments are based on the independently owned and governed GRESB Standards, which are reviewed on an annual basis by the GRESB Foundation. This ensures that material ESG issues are addressed and covered by the GRESB Assessments as they develop and emerge. This is in addition to other contributions to the standards development process, which include stakeholder feedback, analysis of assessment results, market trends reviews, and technical research.

As part of this process, the GRESB Foundation and GRESB BV review and map other important ESG frameworks and standards to understand their alignment with the GRESB Standards and to help reduce the reporting burden for real assets participants.

External frameworks analyzed include IR Framework, CDP, SASB, PRI, and GRI. For each framework, GRESB created an analysis table with the framework’s relevant indicators, which were mapped to specific indicators from the relevant GRESB’s standards, and analyzed the level of alignment between the GRESB indicators and those from the external framework. The resulting alignment scores were then independently reviewed by a third-party with expertise in the industry.

While the degree of alignment may vary across external frameworks, the GRESB Standards provide specific, detailed, and replicable requirements for what should be reported for each ESG topic, which in turn ensures that the information reported to GRESB is comparable, consistent, and reliable across participants.

With the multiplication of frameworks and performance-monitoring KPIs, it is not always easy for stakeholders to know which benchmark to use. The advantage of GRESB is that it is based on the most important multi-sector ESG reporting frameworks, while also ensuring that companies like ours do not have to answer questions that are not relevant to our activity or that, taken out of context, would not allow our investors to understand the real performance of the Group.Clémentine Pacitti

Group Head of CSR at Klépierre

Helping the industry navigate the regulatory landscape

As governments and regulators around the world seek to address pressing issues such as climate change, social inequality, and greenwashing, they are proposing and implementing new regulations and policies that impact the real assets industry directly. The Sustainable Finance Disclosure Regulation (SFDR) in the EU, the Task Force for Climate-related Financial Disclosures (TCFD), the US Securities and Exchange Comission’s newly proposed rules for climate disclosures, and the Business Responsibility & Sustainability Reporting in India are only some of the latest examples of regulations that are being implemented or considered for implementation in the real assets industry.

These evolving regulations and policies are transforming the way that real assets investors and managers operate, and creating both opportunities and challenges for the industry. In this context, it is critical for industry participants to stay abreast of the latest developments and implement strategies to navigate the changing regulatory landscape. GRESB helps real assets managers and investors navigate complex regulatory requirements related to sustainability and ESG reporting, and stay ahead of evolving industry standards.

In addition to the GRESB Assessments, GRESB offers a suite of products aimed at helping the industry comply with regulations and gain a better understanding of their exposure to physical climate and transition risks.

- The SFDR Reporting Solution is designed to help managers with Article 8 or 9 funds report on product- and entity-level Principal Adverse Impacts (PAIs), a core requirement under SFDR. It can also be useful in determining the EU Taxonomy eligibility and alignment of a financial product under the pre-contractual and periodic disclosure requirements of SFDR.

- The TCFD Alignment Report enables entities across the real assets spectrum to identify TCFD gaps, get a better understanding of their TCFD alignment, compare themselves against peers, and engage with investors around their climate-related risk management process.

- The Transition Risk Report can help asset managers and investors identify which of their assets are most exposed to climate-related transition risk and how this may affect their portfolio over time at both the country and global level.

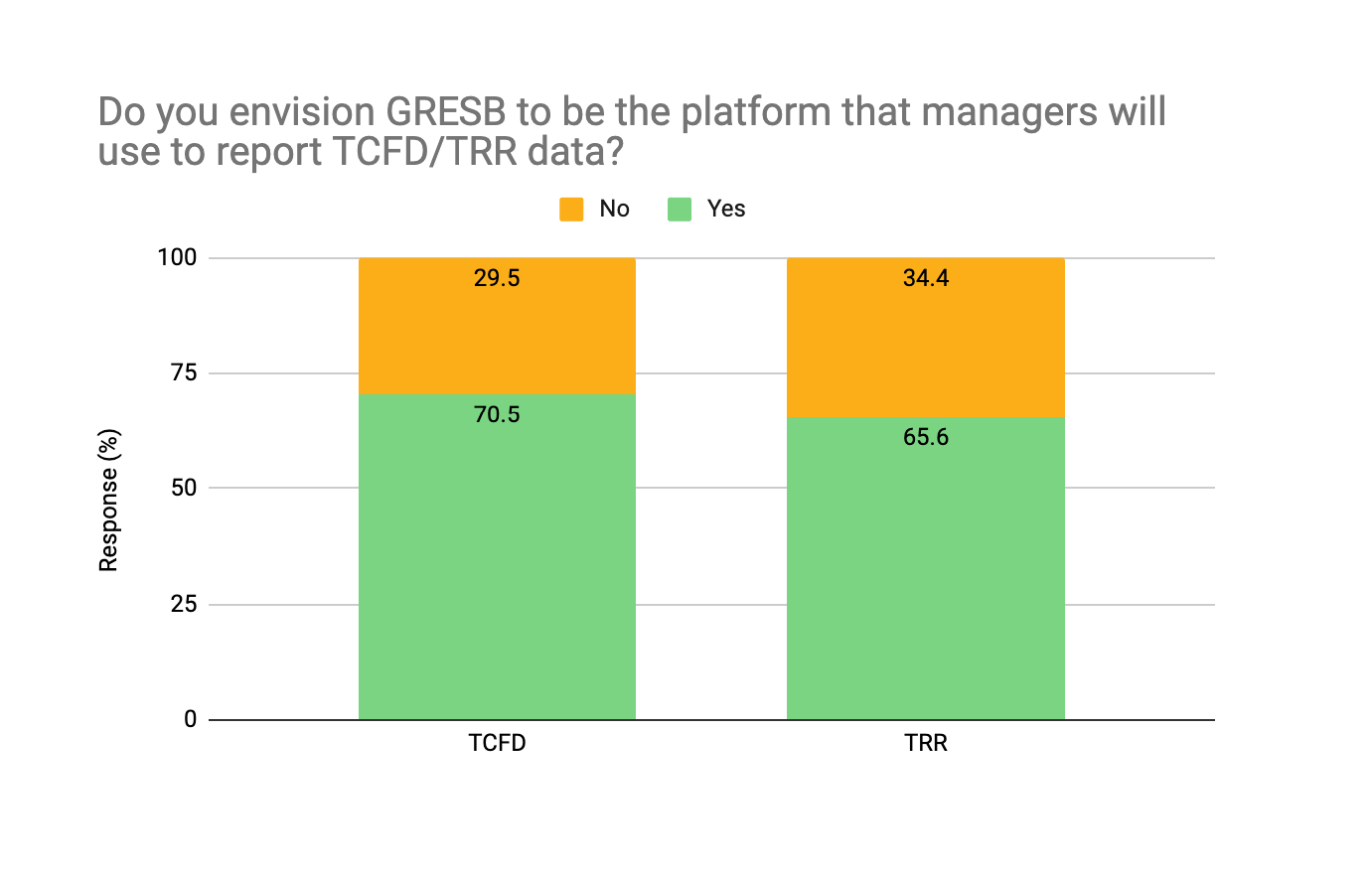

A GRESB Investor Member survey conducted in late 2022 found that the majority of surveyed investors believe that GRESB will be the platform of choice for managers to report on climate-related financial disclosures and transition risk data.

“With increased scrutiny on ESG factors and an evolving regulatory environment alongside concerns of ‘greenwashing,’ there is an imperative to streamline and standardize reporting requirements and standards to promote transparent and comparable disclosure, while at the same time ensuring they remain relevant and context-specific.

As a frontrunner in this space, GRESB plays a key role in helping the investment community navigate this evolving landscape, ultimately enabling a better understanding and assessment of investments risks and opportunities.”

Deepening our industry presence

In December 2022, GRESB acquired Asset Impact (formerly Asset Resolution), an asset-based climate data and analytics provider for financial institutions.

GRESB and Asset Impact share a common mission to equip financial institutions with the tools and insights needed to drive progress towards a more sustainable world. This partnership will allow GRESB to expand and enrich its asset-level data coverage across hard-to-abate sectors, strengthening its assessments and tools while providing GRESB members with more actionable insights and support with asset-driven analysis.

This collaboration with a like-minded organization can drive innovation, improve industry standards, and ultimately accelerate the transition towards more sustainable and resilient real assets.

Interested in learning more about GRESB?

Contact us via the form on the right or follow these links:

> Learn about the GRESB Standards

"*" indicates required fields