Infrastructure is the foundation and connective tissue of society. In its broadest sense, it covers everything above and below surface (including both land and water). That’s buildings; energy generation (renewable and conventional) and transmission; road, rail and the various modes of transport using it; transport hubs like ports and airports; clean and dirty water; etc. So, rather than thinking about a building, we should think about a building in its urban grid, whether that is a precinct or neighborhood, a city, a state, a country, a continent, or the entire world.

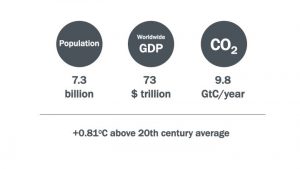

With urbanization continuing (it is expected that by 2050, two-thirds of the then-9.5 billion people live in cities) and the global middle class rising, the world is facing a significant need for the services provided by infrastructure: energy, water, mobility, and much more. In fact, there is a massive need for infrastructure investment, estimated at USD89 trillion until 2030. But it’s not just new investments: McKinsey estimates that there is a backlog of USD15-20 trillion in maintenance (the average airport terminal is witness to that). At the same time, humanity is facing the biggest challenge of its time in climate change and its potentially devastating consequences.

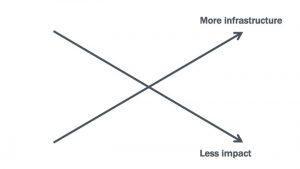

Infrastructure stands central in this challenge. Its often fixed structures will be directly affected by sea rise and extreme weather events; the emissions from infrastructure represent an important part of global carbon emissions. However, infrastructure also offers part of the solution, through renewable, green energy generation and savings from energy efficiency projects. So, while society needs (much) more infrastructure, the next generation of infrastructure must deliver needed services and protect human health and the environment.

Infrastructure stands central in this challenge. Its often fixed structures will be directly affected by sea rise and extreme weather events; the emissions from infrastructure represent an important part of global carbon emissions. However, infrastructure also offers part of the solution, through renewable, green energy generation and savings from energy efficiency projects. So, while society needs (much) more infrastructure, the next generation of infrastructure must deliver needed services and protect human health and the environment.

The global capital market has an important role to play in guiding this balancing act by establishing clear performance expectations for new infrastructure investments and engaging with existing infrastructure investments, to improve the environmental, social, and governance (ESG) performance of the urban infrastructure over time. This role naturally aligns with the capital market’s fiduciary duty: as infrastructure capital commitments can span decades, understanding long-term risk is critical for prudent investment. The global capital market is also vital in funneling private capital into clean energy investment, such as wind, solar, and hydro projects. Such investments are increasingly profitable, independent of energy subsidies, and can replace investments in traditional energy generation (the clean energy arm of RWE, Innogy, provides an example of how energy generation companies may profit from renewable energy investments).

The global capital market has an important role to play in guiding this balancing act by establishing clear performance expectations for new infrastructure investments and engaging with existing infrastructure investments, to improve the environmental, social, and governance (ESG) performance of the urban infrastructure over time. This role naturally aligns with the capital market’s fiduciary duty: as infrastructure capital commitments can span decades, understanding long-term risk is critical for prudent investment. The global capital market is also vital in funneling private capital into clean energy investment, such as wind, solar, and hydro projects. Such investments are increasingly profitable, independent of energy subsidies, and can replace investments in traditional energy generation (the clean energy arm of RWE, Innogy, provides an example of how energy generation companies may profit from renewable energy investments).

To make informed investment decisions, institutional investors need data. Today, GRESB released the inaugural GRESB Infrastructure Report which presents the aggregated data of the first globally applicable, investor-focused assessment of environmental, social, and governance (ESG) management and performance for infrastructure assets and funds. The initiative has been inspired and guided by 10 leading institutional investors. The GRESB Infrastructure assessment has been embraced by almost 200 infrastructure assets and funds in its first year, spanning 53 countries and 6 continents. The new assessment provides unprecedented transparency for investors to make more informed decisions, and infrastructure companies and funds to improve their ESG performance. This new information will accelerate a critical market transformation by recognizing and rewarding infrastructure funds and assets that demonstrably contribute to a low-carbon, resilient society.

To make informed investment decisions, institutional investors need data. Today, GRESB released the inaugural GRESB Infrastructure Report which presents the aggregated data of the first globally applicable, investor-focused assessment of environmental, social, and governance (ESG) management and performance for infrastructure assets and funds. The initiative has been inspired and guided by 10 leading institutional investors. The GRESB Infrastructure assessment has been embraced by almost 200 infrastructure assets and funds in its first year, spanning 53 countries and 6 continents. The new assessment provides unprecedented transparency for investors to make more informed decisions, and infrastructure companies and funds to improve their ESG performance. This new information will accelerate a critical market transformation by recognizing and rewarding infrastructure funds and assets that demonstrably contribute to a low-carbon, resilient society.

This article is written by Nils Kok.