As sustainability continues to gain prominence in the real estate industry, investors and fund managers are increasingly recognizing the potential impact of responsible investment practices on financial performance. In recent years, there has been a significant shift in investor sentiment towards sustainable investing, driven by factors such as increasing awareness of climate change, regulatory changes, and evolving stakeholder expectations.

Investors understand that sustainable practices go beyond simply fulfilling ethical responsibilities, but they can also have tangible financial benefits. Environmental factors, such as energy efficiency and resource management, can lead to reduced operating costs and increased property value over the long term. Social factors, such as tenant satisfaction and community engagement, can enhance tenant retention rates and attract high-quality occupants. Governance practices, including transparent reporting and effective risk management, can improve operational efficiency and mitigate potential risks.

Recognizing these potential benefits, investors and fund managers are incorporating sustainability considerations into their investment strategies and decision-making processes, but how do these practices and disclosures effectively impact a fund’s financial performance? Through recent studies on this topic, we are able to draw some key takeaways on the linkage between GRESB participation and non-listed real estate fund returns in Europe, Asia Pacific, and the US.

Sustainability and Private Equity Real Estate Returns

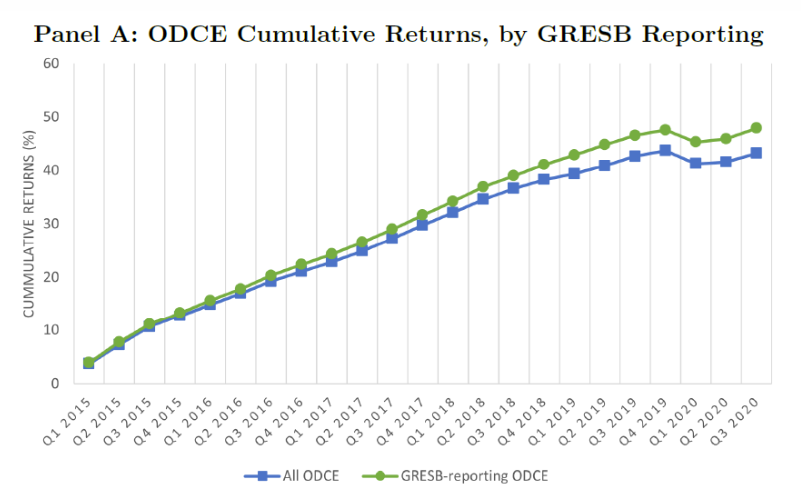

“Sustainability and Private Equity Real Estate Returns,” a recently published academic study by Avis Devine (York University), Andrew Sanderford (University of Virginia), and Chongyu Wang (University of Hong Kong), leverages GRESB data to explore the relationship between private equity real estate (PERE) fund performance and voluntary sustainability disclosures. Specifically, the study examines the relationship between the financial performance of the NCREIF Open Ended Diversified Core Equity (ODCE) Index funds* and ESG reporting to GRESB.

Key finding:

Results from the study indicate that GRESB reporting is associated with a 0.35% increase in an ODCE fund’s total quarterly return. This represents a notable increase, as the mean ODCE quarterly total return is 1.94%. With respect to PERE funds’ GRESB performance, the models demonstrate that every one-point increase in scoring is associated with a 0.09% quarterly or 0.36% increase in annualized total returns.

Additional takeaways:

- Adoption of GRESB has increased significantly in the past five years, with GRESB reporting becoming a fundamental expectation for NCREIF ODCE funds.

- Both GRESB participation and performance are significant predictors of fund returns.

- GRESB participation and performance are associated with the price appreciation component of fund total returns, but not with the income component.

- The relationship between fund returns and GRESB participation and scores are independent of local conditions (economic, demographic, and physical) which may shape sustainable investment decisions.

ESG Insights in Non-listed Fund Performance

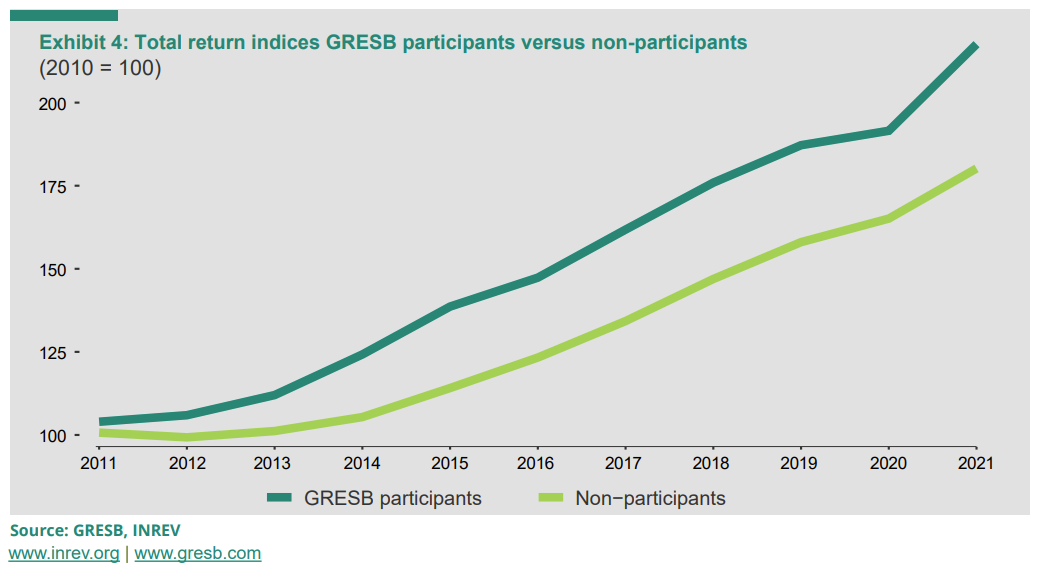

To better understand the impact of sustainable business practices on the financial performance of non-listed real estate funds in Europe, INREV and GRESB recently commissioned a paper to link fund-level financial returns with GRESB Scores.

The report discusses the evolution of European non-listed real estate funds as measured by INREV Annual Fund Index by analyzing the effects of participation in the GRESB Real Estate Assessment on their financial performance. The report covers 11 years of fund-level data through INREV fund-level total returns, GRESB participation, and GRESB Scores. By combining the INREV and GRESB information, the report assesses whether sustainability efforts have had any pervasive effects on fund returns.

Key finding:

Funds participating in the GRESB Assessment outperformed non-participating funds, even when controlling for differences in fund size, investment style, and leverage. Over the full 11 years, GRESB participants delivered a buy-and-hold return of 40 percentage-point higher than non-participants, equivalent to around 1.8% a year.

Additional takeaways:

- The process of participating in benchmarking is considered non-random. Early participants in the GRESB Real Estate Assessment are large funds with low leverage, two factors that correlate with excess returns.

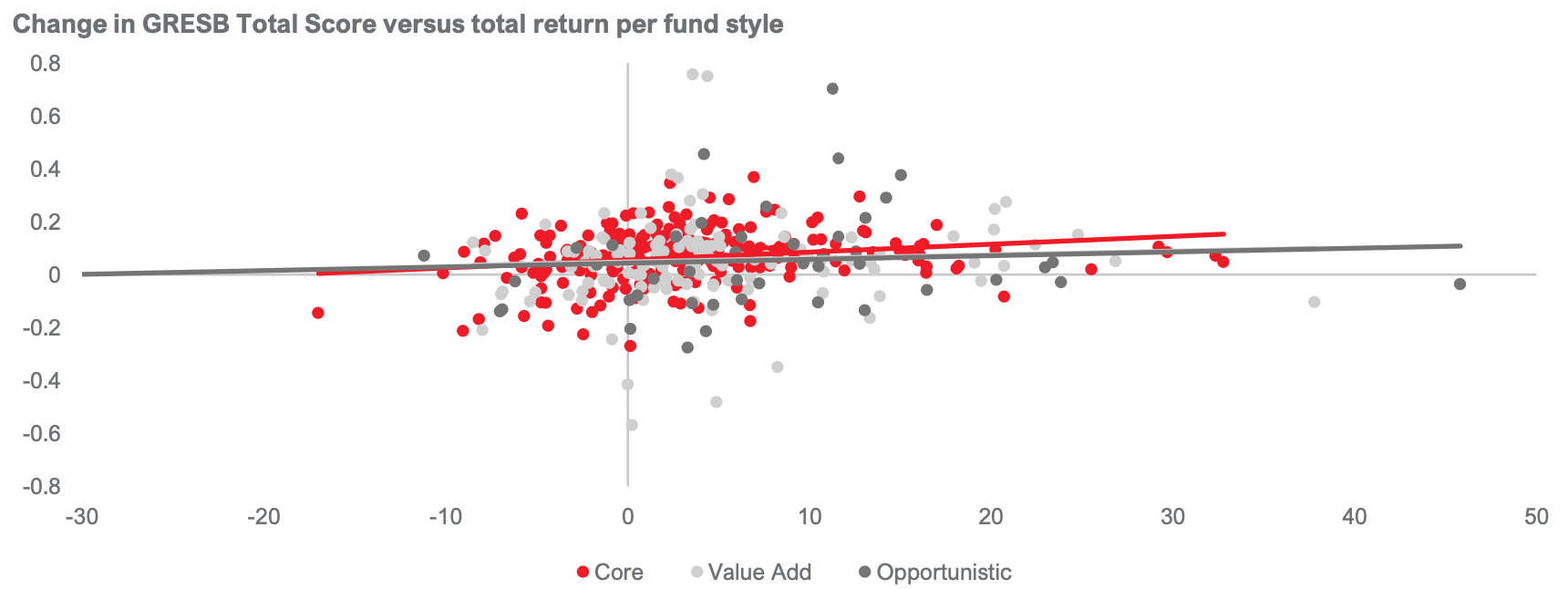

- While the report identifies relevant GRESB Environmental, Social, Governance, Management, and Performance sub-score effects on fund returns, the same is not observed at an aggregated level. Although a higher total GRESB Score does not appear to immediately trigger higher total returns, the report finds that improvements in the GRESB Performance Score and the GRESB Environmental Score have.

The influence of ESG on Asia Pacific Real Estate Fund Performance

ANREV and GRESB recently published “The Influence of ESG on Asia Pacific Real Estate Fund Performance.” This new report delivers an in-depth look at how the integration of sustainable business practices impacts non-listed real estate fund performance in the Asia-Pacific region. Offering valuable insights into the growing alignment between sustainable practices and fund returns, the report demonstrates how responsible practices can enhance both portfolio resilience and returns.

Key findings

- Strong management and governance drive performance: A significant positive relationship exists between high management and governance scores and fund returns. Funds that allocate resources and implement effective policies to achieve strong management scores demonstrate robust organizational control, which serves as a reliable indicator of fund success and sustained performance.

- Positive trends for early adopters: Funds joining GRESB early on appear to generate higher returns, indicating that continued sustainability improvements can drive financial success.

- Return drivers in ESG-integrated funds: Larger, open-end, sector-focused funds, and those with low leverage are more likely to achieve high GRESB scores and better performance, showcasing the advantage of economies of scale and specialization.

By combining GRESB’s comprehensive benchmarking data with ANREV’s extensive fund database, this report illustrates how high GRESB Scores contribute to both environmental responsibility and enhanced financial stability, offering insights into potential long-term value for fund managers and investors. Additionally, the analysis identifies trends among early and late GRESB adopters, offering a nuanced view of how sustained ESG efforts and high governance standards are linked to enhanced fund outcomes. Drawing from over a decade of GRESB data, the findings are essential for investors looking to understand the benefits of sustainability in enhancing portfolio resilience and returns.

Looking ahead

The link between GRESB participation and financial returns in the non-listed real estate landscape is becoming increasingly evident. These findings highlight the importance of integrating sustainability considerations into investment strategies and decision-making processes, with GRESB participation and performance providing investors with valuable insights into the sustainable practices and potential financial performance of real estate funds.

As the focus on sustainability intensifies, these studies contribute to the growing body of evidence supporting the positive relationship between responsible investment practices and financial returns in the real estate industry.

*The ODCE index tracks open-end funds pursuing a core investment strategy, generally characterized by low risk, low levered, stable properties geographically diversified across U.S. markets. At the time of this research, all funds active on the index had actively adopted GRESB Real Estate Assessment reporting.