Our industry is engaged in an important dialogue to improve sustainability through ESG transparency and industry collaboration. This article is a contribution to this larger conversation and does not necessarily reflect GRESB’s position.

Highlights

The recent U.S. elections signal likely shifts in federal sustainability policies. However, five key factors demonstrate why sustainability will remain a strategic necessity for commercial real estate (CRE) companies:

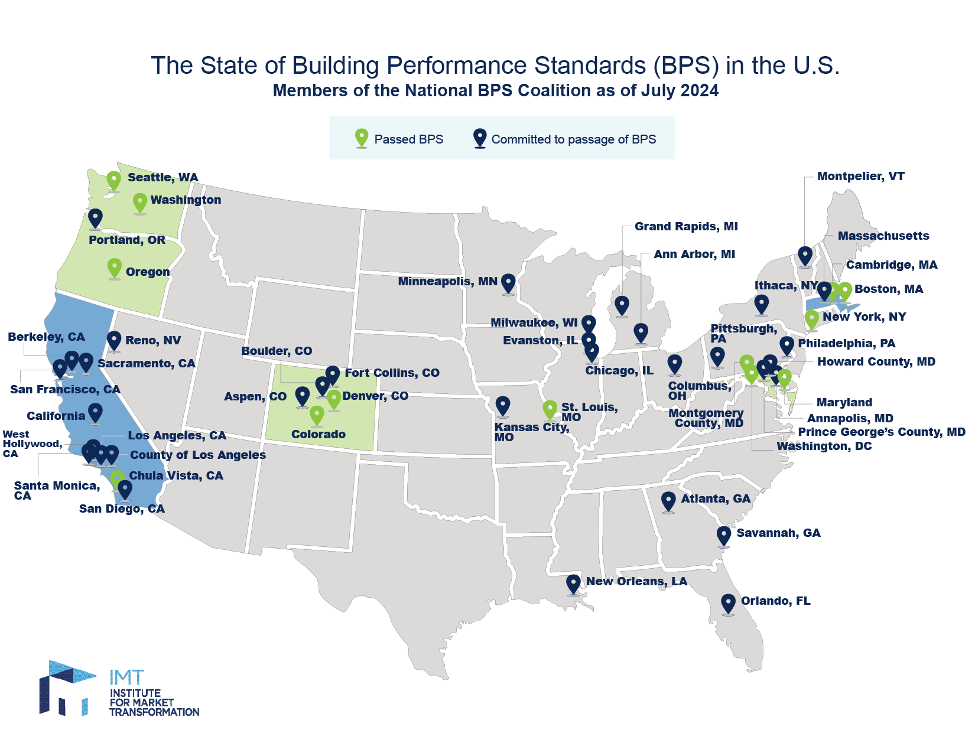

- U.S. cities and states lead on climate regulation, implementing building performance standards and disclosure mandates that drive local economies toward greater efficiency and innovation while advancing corporate climate transparency on a national scale.

- Global sustainability regulations (e.g., Corporate Sustainability Reporting Directive) and investor-driven standards (e.g., IFRS Sustainability Disclosure Standards) push companies to adopt rigorous ESG reporting and risk management practices.

- Climate risks and extreme weather present critical enterprise risks, underscoring the need for resilience planning to protect physical assets, manage escalating insurance costs, and support community well-being.

- Sustainability and decarbonization have become strategic value drivers, delivering measurable ROI through cost savings, enhanced asset value, and long-term resilience while aligning with investor and tenant demand for low-carbon, high-performance spaces.

- Carbon pricing policies are reshaping global markets, putting a price on carbon emissions, incentivizing low-carbon innovation, and channeling revenues into climate and nature initiatives that reward forward-thinking businesses.

Introduction

The results of the recent U.S. presidential, Senate, and House elections, combined with the existing conservative-leaning Supreme Court, signal a likely shift in federal policies related to sustainability. While these changes may raise questions about the future of federal initiatives, the broader momentum toward sustainability in the U.S. remains strong, reinforced by financial and operational advantages, leadership from cities and states, and the rising influence of global standards and regulations.

As the world grapples with extreme weather and other critical sustainability challenges, the CRE industry has shifted into a new paradigm: sustainability is no longer optional — it has become a strategic necessity to protect assets, remain competitive, and deliver long-term value in an uncertain future. This article highlights five strong indicators, among many, that sustainability will remain an emphasis in CRE throughout the upcoming political term and beyond, despite likely federal policy changes.

1) U.S. cities and states lead on climate regulation

As we saw during President-elect Donald Trump’s first presidency, federal policy shifts have historically not diminished the resolve of local governments to implement practical, locally driven solutions for sustainability. Cities across the United States, from New York to St. Louis and Orlando, are advancing building performance standards to achieve their climate goals while fostering increased efficiency and innovation. Beginning in 2025, penalties for noncompliance will take effect in major markets like New York and Denver, emphasizing the need for emissions reductions to mitigate transition risks and retain investor confidence. To learn more, see our 2024 article on sustainable building ordinances.

At the state level, California, the fifth-largest economy in the world, enacted landmark climate legislation in 2023 that will take effect in 2026. These regulations require detailed disclosures on climate risks (SB 261) and emissions (SB 253), including Scope 3 emissions, and apply to both public and private companies — going beyond the scope of the federal SEC climate rules finalized earlier this year, which now face an uncertain future with the new administration.

Similarly, states like New York, Illinois, and Washington are pursuing comparable climate disclosure mandates. Given the broad reach of the California rules, companies subject to other state laws would likely already be mandated to report under the California rules. Still, the implementation of overlapping requirements across multiple economically significant states could raise the bar for corporate climate reporting practices nationwide, potentially forming a de facto national standard for climate disclosures in the absence of federal regulation.

2) Global sustainability regulations and investor-driven standards

Globally, sustainability and climate regulations have surged in recent years. International financial markets are moving decisively toward alignment around standards that demand rigorous, comparable, and transparent reporting on sustainability and climate-related risk management, most notably the European Sustainability Reporting Standards (ESRS) and International Financial Reporting Standards (IFRS) Sustainability Disclosure Standards. These were developed in collaboration to maximize alignment and interoperability, reducing reporting burden on corporations.

- ESRS: Under the 2021 Corporate Sustainability Reporting Directive (CSRD), large companies must report sustainability risks and impacts (including climate) according to the ESRS, impacting both EU (starting in 2025) and non-EU headquartered companies (starting in 2026).

- IFRS Sustainability Disclosure Standards: Published in 2023 by the International Sustainability Standards Board (ISSB), the IFRS S1 and S2 standards provide a universal framework for disclosing sustainability and climate-related financial risks. Jurisdictions, including Australia, the UK, Brazil, Singapore, Hong Kong, Japan, and China are in the process of aligning their disclosure regimes with these standards, either through partial or full adoption.

Even without mandatory regulations, demand from influential investors has positioned IFRS compliance as a critical strategy for companies aiming to align with globally endorsed practices and attract capital. Investors have long expected large companies to report financially material metrics under frameworks like TCFD and SASB — both now integrated into IFRS — making IFRS the logical next step toward globally standardized sustainability reporting. Prominent members of the ISSB investor advisory group, including BlackRock, Vanguard, Bank of America, and Goldman Sachs, are actively championing IFRS adoption, with many revising their proxy voting and stewardship guidelines to prioritize compliance with IFRS S1 and S2.

For investors, requiring IFRS for investment screening streamlines disclosures, enhances portfolio comparability, and ensures the rigor needed for informed decision-making. For companies, this improved transparency and consistency offers a chance to showcase their commitment to sustainable innovation and robust risk management, setting them apart from industry peers still relying on outdated practices.

3) Climate and extreme weather risks as core enterprise risks

Climate change and extreme weather are no longer distant concerns — they present critical enterprise risks that demand attention at every level of strategy and operations. A recent survey by Stanford University and the MSCI Sustainability Institute found that 93% of investors believe climate issues will affect investment performance within two to five years. Companies must navigate the dual challenges of addressing transition risks from climate regulations at city, state, and international levels while managing the increasing frequency, intensity, and unpredictability of extreme weather.

As of November 1, 2024, 24 climate-related disasters cost the U.S. USD 61.6 billion, emphasizing the critical need for proactive adaptation to mitigate financial risks. For the CRE industry, the stakes are particularly high, as asset value is intrinsically tied to physical properties often located in areas of significant risk of extreme weather, such as coastlines. A 2024 study on Hurricanes Harvey and Sandy showed lasting declines in transaction prices for commercial properties in impacted areas, with no clear sign of rebound during the study. Beyond devaluation, properties face rising financing costs and reduced insurance availability. Deloitte projects that by 2030, CRE insurance premiums in high-risk U.S. areas could double, making resilience planning essential to controlling costs and preserving long-term value.

Even in politically conservative states like Florida, climate adaptation has become a priority out of necessity. Although Governor DeSantis declined federal funding for clean energy projects under the Inflation Reduction Act in 2024, he has championed the Resilient Florida program, funding hundreds of resilience initiatives since 2021, including vulnerability assessments, flood mitigation projects, and resilience planning. These efforts provide crucial support to communities like southwest Florida, devastated by Hurricane Ian in 2022, and highlight how resilience initiatives protect human lives and livelihoods.

For real estate companies, resilience planning goes beyond protecting physical assets — it is a strategic investment in operational continuity and the well-being of our communities. As demand for resilient properties grows, buildings better equipped to handle extreme weather will also be better able to hold their value, attract forward-thinking investors and tenants, and maintain a competitive edge in an increasingly volatile market.

4) Sustainability and decarbonization as strategic value drivers

Due to the urgency of addressing climate risks like extreme weather, corporate sustainability has accelerated in recent years, but its momentum has been building for decades due to clear economic and operational benefits. As early as the 2000s, U.S. CRE owners prioritized energy efficiency to enhance asset performance, even without regulatory mandates. Today, energy efficiency remains central to sustainability performance, with U.S. federal building research showing that high performance buildings have 23% reduced operating expenses compared to legacy stock buildings. High performance green buildings also tend to have higher asset values, rental premiums, and occupancy rates.

The rapid decline in renewable energy costs has similarly fueled the green transition, with the International Energy Agency reporting an 89% drop in the cost of electricity for new solar projects since 2010. States such as Texas and California are leading in renewable energy adoption, with Texas’s solar market alone growing by 35% in 2023.

President-elect Donald Trump has signaled that future funding under the 2022 Inflation Reduction Act could be reduced under his second presidency. Yet, it is important to note that nearly 80% of federal clean energy investments from the policy thus far have supported projects in conservative-led districts, underscoring bipartisan recognition of the job opportunities renewables create and their role in bolstering national energy independence and security. Globally, clean energy investment this year is expected to exceed the investment in fossil fuels by nearly 100%, marking clean energy as an unstoppable, market-driven force.

Investor demand for sustainable assets also continues to grow, with a 2024 survey by Capital Group showing that nine in 10 global institutional investors now incorporate sustainability factors into decision-making. Bloomberg predicts that global ESG assets, managed with various sustainable and ESG investing strategies, will exceed USD 40 trillion by 2030, accounting for over 25% of the projected USD 140 trillion in assets under management.

This global trend aligns with rising tenant and investor interest in low-carbon spaces that offer both operational savings and a commitment to international climate agreements. By 2030, tenant demand for low-carbon spaces is projected to outpace supply threefold, as recent research from JLL highlights, creating a competitive edge for CRE assets that prioritize sustainable upgrades now.

The value of sustainability goes beyond environmental strategies like energy efficiency and carbon reduction. Strong social policies are linked to better employee retention, while transparent, ethical governance builds trust and strengthens relationships with stakeholders. A well-rounded sustainability approach is a resilient, forward-looking investment that positions companies to navigate future challenges and drive lasting value.

5) Carbon pricing as a market-based decarbonization driver

Finally, carbon pricing is emerging as a pragmatic, market-driven approach to advancing global stewardship of our planet. These mechanisms, including carbon taxes and emissions trading schemes (ETSs), are expanding globally, now covering nearly a quarter of emissions through over 70 programs. In 2023, carbon pricing generated a record USD 104 billion in revenues, reflecting an increasing commitment among governments to put a cost on carbon pollution and incentivize innovation and efficiency. Research published in Nature Communications earlier this year confirms the impact of carbon pricing, showing emissions reductions of 5–21% across 17 global schemes, even at modest price levels.

Key International Policies:

- EU’s Emissions Trading System (ETS) (2005)

- South Korea’s Emissions Trading Scheme (KETS) (2015)

- Canada’s Greenhouse Gas Pollution Pricing Act (2018)

- China’s National Emissions Trading System (ETS) (2021)

- EU’s Carbon Border Adjustment Mechanism (CBAM) (2026)

Key U.S. State-Level Policies:

- California’s Cap-and-Trade Program (2006)

- Regional Greenhouse Gas Initiative (RGGI) (2009)

- Washington’s Climate Commitment Act (2021)

To learn more about the landscape of carbon pricing globally, visit the World Bank Group’s State and Trends of Carbon Pricing Dashboard and International Carbon Action Partnership ETS Map.

Carbon pricing presents both challenges and opportunities for real estate companies. These policies can increase costs by driving up prices for fossil fuel-powered utilities and carbon-intensive materials like concrete and steel, raising both operating and construction expenses. However, they also encourage market-driven innovation and cost-effective solutions by incentivizing decarbonization measures such as energy efficiency retrofits, electrification, and renewable energy adoption. With over half of global carbon pricing revenues reinvested into climate- and nature-related projects, these incentives are further amplified, providing additional support for companies that prioritize low-carbon strategies.

Conclusion

Sustainability is not only the right thing to do for our communities and planet, but it also presents a strategic advantage for businesses. While the federal administration may bring shifts in policy, the momentum behind sustainability is too robust for U.S. businesses to ignore. Local governments continue to lead with ambitious climate goals, investors demand alignment with global sustainability disclosure standards, and carbon pricing is creating a more equitable playing field for low-carbon strategies.

More than ever, sustainable practices are demonstrating their ability to reduce costs, generate value, and enhance long-term resilience. Adopting these strategies positions CRE companies to thrive in a world where sustainability and prosperity go hand in hand.

This article was written by Carli Schoenleber, Senior Communications Manager, Content and Engagement Specialist, Dana Weiss, Senior Director of ESG and head of Resilience, Ying (Paris) Mo, ESG Manager, and Vanessa Vlasak, Associate ESG Manager, at Verdani Partners. Learn more about Verdani Partners here.

References

Hyman, G. (2024, November 13). Trump may thwart federal climate action, but opportunities for progress remain. World Resources Institute. https://www.wri.org/insights/trump-climate-action-setbacks-opportunities-us

Governor Gavin Newsom. (2024). California remains the World’s 5th largest economy. https://www.gov.ca.gov/2024/04/16/california-remains-the-worlds-5th-largest-economy/

Cooley. (2024, September 11). Developments in California and other state climate legislation. https://www.cooley.com/news/insight/2024/2024-09-11-developments-in-california-and-other-state-climate-legislation

ESG Book. (2023, June 19). Global ESG regulation increases by 155% over the past decade. https://www.prnewswire.co.uk/news-releases/global-esg-regulation-increases-by-155-over-the-past-decade-301854054.html

EFRAG. (2024). ESRS–ISSB standards interoperability guidance. https://www.ifrs.org/content/dam/ifrs/supporting-implementation/issb-standards/esrs-issb-standards-interoperability-guidance.pdf

European Commission. (2024). Corporate sustainability reporting. https://finance.ec.europa.eu/capital-markets-union-and-financial-markets/company-reporting-and-auditing/company-reporting/corporate-sustainability-reporting_en

Mirza, Z. (2024, May 2). EU adopts CSRD reporting delay, gives non-EU companies until 2026 to comply. ESG Dive. https://www.esgdive.com/news/eu-adopts-csrd-reporting-delay-gives-non-eu-companies-until-2026-to-comply/715023/

IFRS. (2023). IFRS S1 general requirements. https://www.ifrs.org/issued-standards/ifrs-sustainability-standards-navigator/ifrs-s1-general-requirements/

IFRS. (2023). IFRS S2 climate-related disclosures. https://www.ifrs.org/issued-standards/ifrs-sustainability-standards-navigator/ifrs-s2-climate-related-disclosures/

de Wit, E. et al. (2024, June). Review of climate-related financial disclosure regimes around the world. Norton Rose Fulbright. https://www.nortonrosefulbright.com/en/knowledge/publications/9261bbcf/review-of-climate-related-financial-disclosure-regimes-around-the-world#section6; Interesse, G. (2024, June 20). China releases ESG reporting standards for businesses. China Briefing. https://www.china-briefing.com/news/china-releases-esg-reporting-standards-for-businesses/

McNally, F. (2024, October 3). US investors push for ISSB standards amid disclosure ’paralysis’. Responsible Investor. https://www.responsible-investor.com/us-investors-push-for-issb-standards-amid-dcisclosure-paralysis/

Stanford Graduate School of Business, Hoover Institution, Rock Center for Corporate Governance, & MSCI Sustainability Institute. (2024). 2024 institutional investor survey on sustainability. https://www.msci-institute.com/wp-content/uploads/2024/04/2024-cgri-msci-sustainability-survey-FINAL.pdf

NOAA National Centers for Environmental Information. (2024). Billion-dollar weather and climate disasters. https://www.ncei.noaa.gov/access/billions/time-series/US/cost

Holtermans, R., Niu, D., & Zheng, S. (2024, June 17). Quantifying the impacts of climate shocks in commercial real estate markets. Journal of Regional Science, 64(4). https://onlinelibrary.wiley.com/doi/10.1111/jors.12715

Schuetz, J. & Devens, E. (2024, September 17). Homes and commercial buildings need substantial investments to become more resilient and sustainable. Who pays for these investments has important equity implications. Brookings. https://www.brookings.edu/articles/homes-and-commercial-buildings-need-substantial-investments-to-become-more-resilient-and-sustainable-who-pays-for-these-investments-has-important-equity-implications/

Burns, R., Coy, T., & Williams, N. (2024, May 29). Climate change impacts elevate US commercial real estate insurance costs. Deloitte. https://www2.deloitte.com/us/en/insights/industry/financial-services/financial-services-industry-predictions/2024/impact-of-climate-change-on-commercial-real-estate-insurance-costs.html

Green, A. (2024, May 1). Florida says no to federal funding aimed at greenhouse gas emissions. Inside Climate News. https://insideclimatenews.org/news/01052024/florida-rejects-federal-funding-pollution-reduction/

Schoenleber, C. (2023). Lean and green. IREM Journal of Property Management. https://journalpm.s3.us-east-2.amazonaws.com/wp-content/uploads/2023/08/29223342/JPM-Sept-Oct-23-Final-spreads.pdf

Energy Star. (2018). The business case for energy-efficient buildings. https://www.energystar.gov/buildings/save-energy-commercial-buildings/finance-projects/business-case

Leskinen, N., Vimpari, J., & Junnila, S. (2020). A review of the impact of green building certification on the cash flows and values of commercial properties. MDPI Sustainability, 12(7). https://www.mdpi.com/2071-1050/12/7/2729

International Energy Agency. (2023). The breakthrough agenda report 2023: Accelerating sector transitions through stronger international collaboration. https://iea.blob.core.windows.net/assets/d7e6b848-6e96-4c27-846e-07bd3aef5654/THEBREAKTHROUGHAGENDAREPORT2023.pdf

Enerknol. (2024, April 11). Texas solar generation increased by 35 percent in 2023: EIA. Enerknol Pulse. https://enerknol.com/texas-solar-generation-increased-by-35-percent-in-2023-eia/

Storrow, B. & Hiar, C. (2024, November 7). With Trump’s win, Biden’s historic climate policies are poised to be undone. Politico. https://www.politico.com/news/2024/11/07/trump-us-climate-action-00187492

Nilsen, E. & Rigdon, R. (2024, June 16). The biggest winners of Biden’s green climate policies? Republicans. CNN. https://edition.cnn.com/2024/06/16/climate/clean-energy-investment-republicans/index.html

International Energy Agency. (2024). World energy investment 2024 overview and key findings. https://www.iea.org/reports/world-energy-investment-2024/overview-and-key-findings

Capital Group. (2024). Perspectives from global investors: ESG global study – Fourth edition. https://www.capitalgroup.com/advisor/pdf/shareholder/ITGEOT-073-1043294.pdf#page=27

(2024, February 8). Global ESG assets predicted to hit $40 trillion by 2030, despite challenging environment, forecasts Bloomberg Intelligence. https://www.bloomberg.com/company/press/global-esg-assets-predicted-to-hit-40-trillion-by-2030-despite-challenging-environment-forecasts-bloomberg-intelligence/

JLL. (2023, November). The commercial case for making buildings more sustainable. https://www.us.jll.com/en/trends-and-insights/research/the-commercial-case-for-sustainable-buildings

World Bank. (2024). 2024 state and trends of carbon pricing.

https://openknowledge.worldbank.org/server/api/core/bitstreams/253e6cdd-9631-4db2-8cc5-1d013956de15/content

Dobbeling-Hildebrandt, N. et al. (2024). Systematic review and meta-analysis of ex-post evaluations on the effectiveness of carbon pricing. Nature Communications. https://www.nature.com/articles/s41467-024-48512-w