Our industry is engaged in an important dialogue to improve sustainability through ESG transparency and industry collaboration. This article is a contribution to this larger conversation and does not necessarily reflect GRESB’s position.

In the age of ESG compliance, access to high-quality, verifiable energy data has become an imperative for real estate organizations. Whether you operate in regulated markets, participate in ESG disclosures, or have committed to public reduction targets, you need accurate data to satisfy investor and regulatory requirements and improve energy and carbon performance.

In recent years, a common convention in real estate has emerged as an unexpected barrier to data coverage: the triple-net lease agreement. Under triple-net leases, tenants are responsible for paying utilities directly, and thus have ownership and control over their utility accounts and bills. This can create challenges for landlords who need the data for ESG reporting and compliance.

In this article, we’ll walk through a step-by-step process to collect energy data from your triple-net assets, helping you increase your data coverage and build a strong foundation for your ESG program.

Step 1: Define your use cases

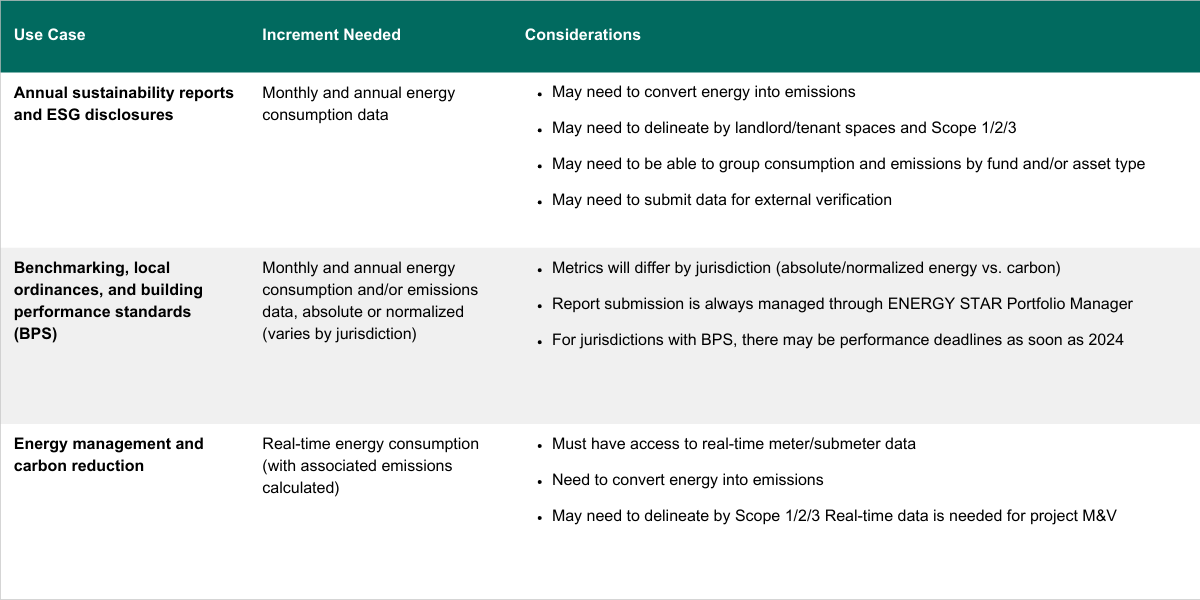

As you begin to plan your energy data capture strategy, it is important to keep the end use cases for the data at the forefront of your mind. Are you creating an annual sustainability report for investors – or participating in an ESG benchmark (like GRESB)? Are your buildings subject to local energy benchmarking ordinances? Do you have corporate energy and carbon targets to make progress on? All of the above examples are excellent reasons to collect energy data, but there are slightly different considerations for each (see image on the right).

Step 2: Get to know the different data sources

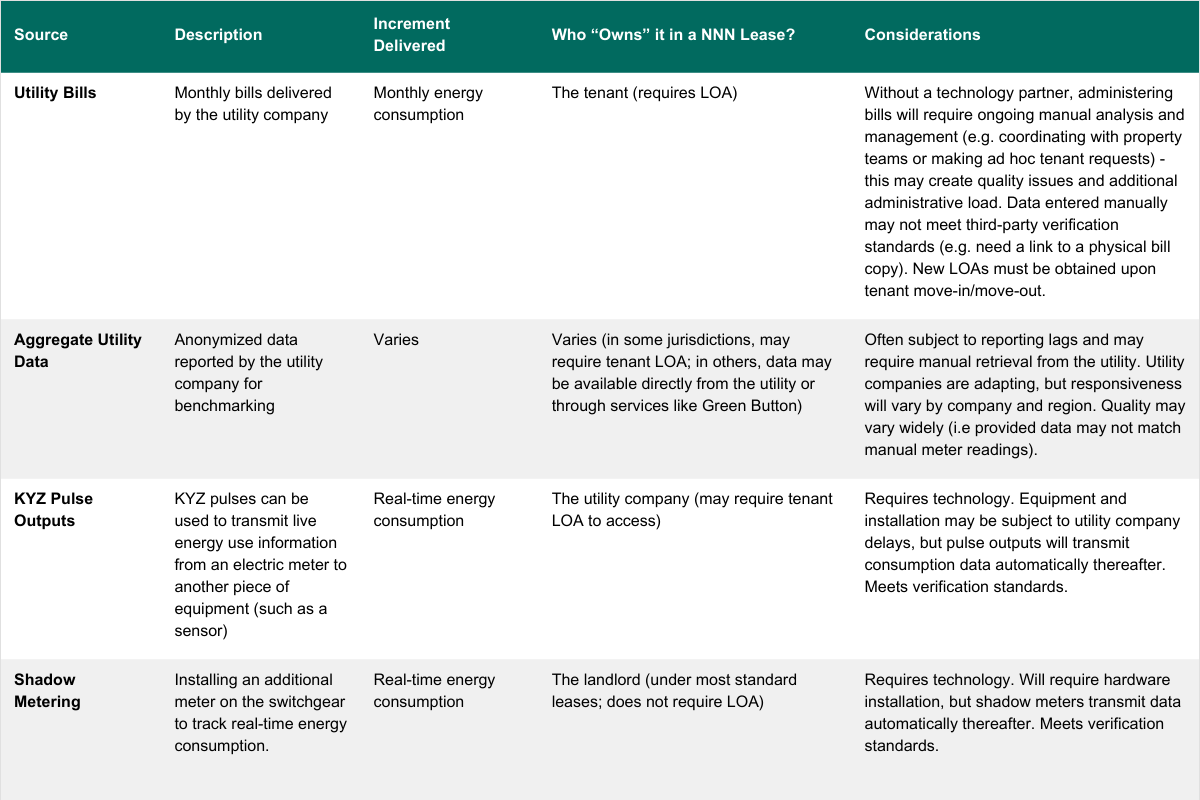

As there are different use cases for data, there are also different sources and technologies that enable data collection, management, and analysis, ranging from bills and aggregate utility data to real-time meter data. Under triple-net leases, there are also often special considerations to factor in.

For data sources (such as utility bills) where tenants have ownership under triple-net leases, note that you will need to obtain signed Letters of Authorization (LOAs) from tenants for the utilities to release the data in question. Though this process can be initiated at any point during a lease and does not require changes to existing language, it can be highly tenant-dependent (more on that below), subject to delays from the utility company, and challenging to administer at scale. Additionally, you will always need to secure new LOAs when tenants move in and out for the utility company to continue to provide data. Including green lease provisions in your standard lease terms can help you take a more top-down approach to engaging tenants with sustainability initiatives and avoid the administrative burden of LOAs. Pulse outputs and shadow metering can also serve as more permanent solutions that reliably deliver high-quality data.

It is also important to keep in mind data quality and ease of management. Ideally, the data sources you select will support automated collection and aggregation, making it easier to report, stay in compliance, and manage energy and carbon initiatives on an ongoing basis.

For example: if you need to report GHG emissions, your system for data management (whether manual, homegrown, or through a technology partner or consultant) must enable you to easily apply the correct emissions factors to your energy consumption data. Additionally, many ESG disclosures now require that data meet third-party validation standards. This means that there must be clear linkages to primary data sources (such as physical bills and/or meters), and that the data must be exportable and auditable.

In both of the above scenarios, a manual workaround that may initially seem simpler to get off the ground (such as having property teams input bill data into a spreadsheet after securing LOAs, or reconciling lower-quality data provided in batches by the utility company) could prove costly and unsustainable in the longer term. Evaluate your use cases against the data sources listed above to ensure you land on a solution that can scalably meet your needs.

Step 3: Review current lease language

With the first two steps in mind, it is now time to catalogue the levels of data access at your assets. Review current leases at the assets where you have coverage gaps, making sure to coordinate with property management, leasing, and legal teams as needed. In doing so, you may find that there are already green lease provisions in place to facilitate data sharing and other energy initiatives (you can cross-reference against sample clauses from Green Lease Leaders).

On the other hand, you may discover that certain tenants have verbiage about data privacy that you must consider before proceeding further. In these instances, it is important to carefully review any provisions about site access, equipment ownership, and affordances made to the landlord to satisfy investor needs and other reporting requirements. In many cases, shadow metering and aggregate utility data collection may be authorized within the existing lease terms without infringing on tenant privacy. That said, each lease is different, and in situations where you are not sure how to interpret certain language, it is advisable to work with your legal team to ensure every “i” is dotted.

Overall, it is always best practice to engage tenants early and often. Openly communicate the mutual value of energy data sharing for reporting, compliance, and ongoing environmental initiatives. Many tenants have sustainability goals of their own and will prove to be receptive partners.

Step 4: Build your plan

You’ve reviewed your goals, mastered the different energy data sources, and read carefully through your leases. Now it’s time to bring everything together.

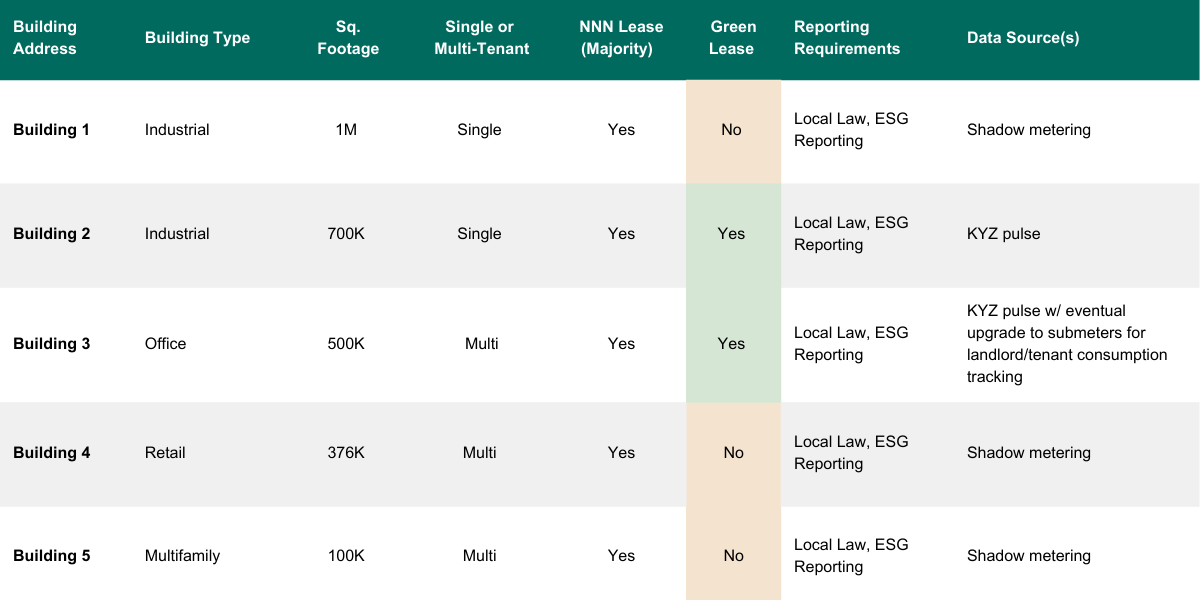

Using a framework like the example on the left, map out your assets, the lease provisions, and relevant reporting requirements to build your data collection plan. If your goal is to increase overall data coverage, prioritize larger assets first (as GRESB calculates data coverage as a percentage of total floor space).

Step 5: Deploy and iterate

Armed with the above plan, you’re ready to execute. The practical work of getting data from all the listed sources will involve a variety of internal and external stakeholders, including asset management, property management, engineering, and IT, as well as any technology providers and consultants you may be working with. Every organization will have different technologies and processes, but the more you can make the case for one centralized approach for the portfolio, the easier your job will be in the long run. Since the field of ESG is rapidly changing, flexibility is key — build in room to iterate as your program grows and your business needs continue to evolve.

Final thoughts

Developing an effective energy data collection and management strategy to support your ESG program can be a time-consuming process, especially where triple-net leases are concerned. It is essential to remember that there is no single, “one-size-fits-all” solution. However, with a clear understanding of your goals, knowledge of energy data sources, and proactive communication with tenants, you can build a plan that meets your requirements, aligns with the expectations of investors, and drives forward your sustainability initiatives, now and into the future.

This article was written by Zoe Williams, Director of Marketing at Aquicore.