Our industry is engaged in an important dialogue to improve sustainability through ESG transparency and industry collaboration. This article is a contribution to this larger conversation and does not necessarily reflect GRESB’s position.

With numerous emerging regulations and market expectations, navigating climate risk disclosure can feel like solving a puzzle with an incomplete picture. However, by proceeding methodically and creating a strategy, solving the climate risk puzzle comes together piece by piece.

To help you fit these pieces together, we’ve developed a four-step guide: quantify your footprint, assess your risks, mitigate your risks, and document your climate story.

Quantify your footprint

To truly tackle an effective climate risk strategy, you must first understand the extent of your environmental impact. Quantifying your carbon footprint is like measuring the pieces of a puzzle before trying to assemble it. Without knowing your starting point, you can’t effectively set or reach sustainability goals.

The carbon footprint of an organization accounts for all the greenhouse gas (GHG) emissions produced directly and indirectly by its activities. These emissions are typically categorized into three scopes:

- Scope 1: Direct emissions from sources you control, such as onsite fuel combustion.

- Scope 2: Indirect emissions from the electricity you purchase and use.

- Scope 3: All other indirect emissions in your value chain, such as those from your suppliers or customers.

Accurate measurement across these scopes is critical to understanding the full scale of your environmental impact. It allows you to pinpoint areas for improvement and create targeted strategies for emission reduction. Without this foundational step, your climate strategy may be incomplete or even ineffective.

Start by using tools and frameworks such as the Greenhouse Gas Protocol and your Conservice data. With information in hand, you’ll have the visibility needed to make informed decisions, track progress, and report on outcomes—ensuring transparency for both internal stakeholders and external audiences.

Assess your risks

Once you’ve quantified your footprint, the next step is to assess the physical and transition risks associated with climate change. These risks can vary based on geographic location and business operations, but are broadly categorized into two types:

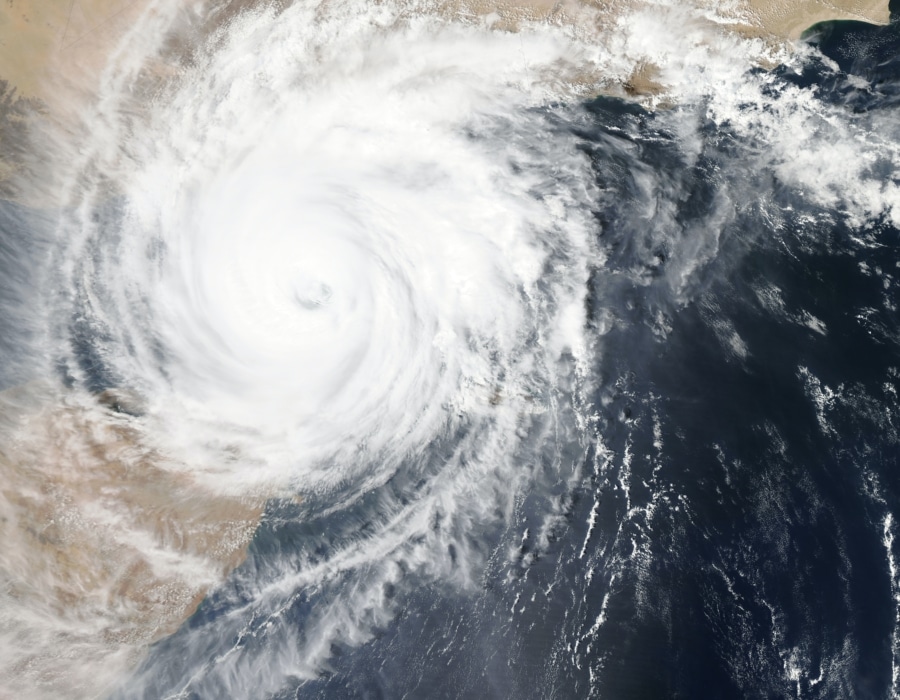

- Acute risks: Sudden, severe events such as hurricanes, floods, or wildfires.

- Chronic risks: Long-term shifts like rising temperatures, changing precipitation patterns, and sea-level rise.

By identifying and assessing these risks, you can gauge the vulnerability of your assets and operations. This involves considering not just the direct physical risks to infrastructure but also how these changes can affect supply chains, energy availability, and even customer behavior. For instance, increased flooding might not only damage facilities but also disrupt supply chains and displace your customer base.

Tools like the Task Force on Climate-related Financial Disclosures (TCFD) offer guidelines for assessing climate-related risks and integrating them into your financial and business planning. By including these considerations in your climate strategy, you’ll be better prepared for both the short- and long-term impacts of a changing landscape.

Failure to assess and plan for these risks can lead to substantial operational disruptions, financial losses, and reputational damage. On the flip side, proactive risk assessment can uncover opportunities for innovation—whether through investments in resilient infrastructure or the development of new, climate-adapted products and services.

Mitigate your risks

Once physical risks are identified, the next challenge is mitigating them. Climate mitigation strategies are essential for protecting your assets, operations, and overall business continuity. This involves both direct actions, such as enhancing physical infrastructure to withstand climate impacts, and broader approaches, such as diversifying your energy portfolio, insurance strategies, divestment, and more.

Risk mitigation typically falls into two categories:

- Physical resilience: This includes adapting your operations to withstand physical risks, like flood defenses for facilities, installing heat-resistant materials, or even relocating operations from high-risk areas.

- Operational resilience: This focuses on making your organization more adaptable. For example, ensuring your supply chains are diversified and prepared to handle disruptions or investing in renewable energy to reduce reliance on volatile fossil fuel markets.

The strategies you develop for climate resilience can help unlock business opportunities. Transitioning to renewable energy sources, for example, can not only mitigate climate risk but also lower operational costs over time. Similarly, by investing in energy-efficient technologies or climate-resistant infrastructure, you can create long-term competitive advantages while demonstrating your commitment to sustainability.

Developing comprehensive risk mitigation strategies not only minimizes the damage from climate change, but also prepares you for future challenges, whether regulatory, operational, or market driven.

Document your climate story

The final step in solving your climate risk puzzle is to document your story. In today’s business environment, transparency is key. Stakeholders—including customers, investors, and employees—want to know what you’re doing to address climate change. But simply reporting numbers isn’t enough; you need to tell a compelling story about your climate management plans.

Documenting your climate efforts is about sharing more than just your successes. It’s about being transparent with the challenges you’ve faced, the processes you have instituted, the risks you’ve assessed, and the steps you’ve taken to mitigate them. This is where your carbon footprint data, risk assessments, and mitigation strategies come together into a cohesive narrative that highlights your organization’s commitment to long-term financial responsibility.

Frameworks like the Global Reporting Initiative (GRI) and the International Sustainability Standards Board (ISSB) offer guidelines for reporting on climate risks and opportunities. Aligning your climate story with these recognized standards will not only build trust with stakeholders but also help you meet regulatory requirements and respond to investor expectations.

When crafting your climate story, focus on both the quantitative and qualitative aspects. Numbers are important, but so is the context around them. Highlight the steps your organization is taking to reduce emissions, increase resilience, and invest in operational performance. Share your vision for the future and how you plan to continue adapting to the evolving climate landscape.

Ultimately, a well-documented climate story doesn’t just enhance your reputation—it can also drive business growth by attracting investors, customers, and partners who prioritize sustainability. It’s the final piece that completes your climate puzzle, showcasing how your organization is leading the way in addressing one of the most pressing challenges of our time.

Let’s get to work

Solving the climate risk puzzle requires a strategic and comprehensive approach. By starting with quantifying your carbon footprint, assessing your physical risks, mitigating those risks, and documenting your climate story, you create a robust framework for addressing climate change head-on. Each piece plays a critical role in helping your organization not only adapt to the realities of a changing climate but also thrive in a future where sustainability is paramount.

The journey may be complex, but with the right tools, strategies, and narrative, you can solve your climate puzzle—one piece at a time.