What is the GRESB Real Estate Assessment?

The GRESB Real Estate Assessment underpins the investor-driven global ESG benchmark and reporting framework for listed property companies, private property funds, developers, and investors that invest directly in real estate.

The Assessment evolves each year to reflect what investors and the industry consider to be material issues in the sustainability performance of real estate investments. The methodology is consistent across regions, investment vehicles, and property types, and it aligns with international reporting frameworks.

Assessment participants report the data themselves on an annual basis between April 1 and July 1, with the data being subject to a multi-layer validation process after which it is scored and benchmarked. The result of this process is high-quality, validated data that investors and participants can use in their investment, engagement, and decision-making processes, as well as to identify risks and opportunities in relation to regulations such as TCFD.

The Real Estate Assessment generates two benchmarks:

- The GRESB Real Estate Benchmark, which considers management and performance factors

- The GRESB Development Benchmark, which considers management and development factors

Managers receive GRESB Benchmark Reports and scores, which they can choose to share with investors.

Why asset managers participate in the GRESB Assessments

- Identify areas of risk, opportunity, and impact in your portfolio and assets

- Attract new investors and meet their expectations with comprehensive and standardized ESG data and analysis

- Systematically improve your investor engagement and demonstrate your commitment to sustainability

- Gain a clear picture of your ESG performance, how it compares against peers, and what you can do to improve

- Report consistent, validated ESG performance information to the market and regulators using a global industry standard

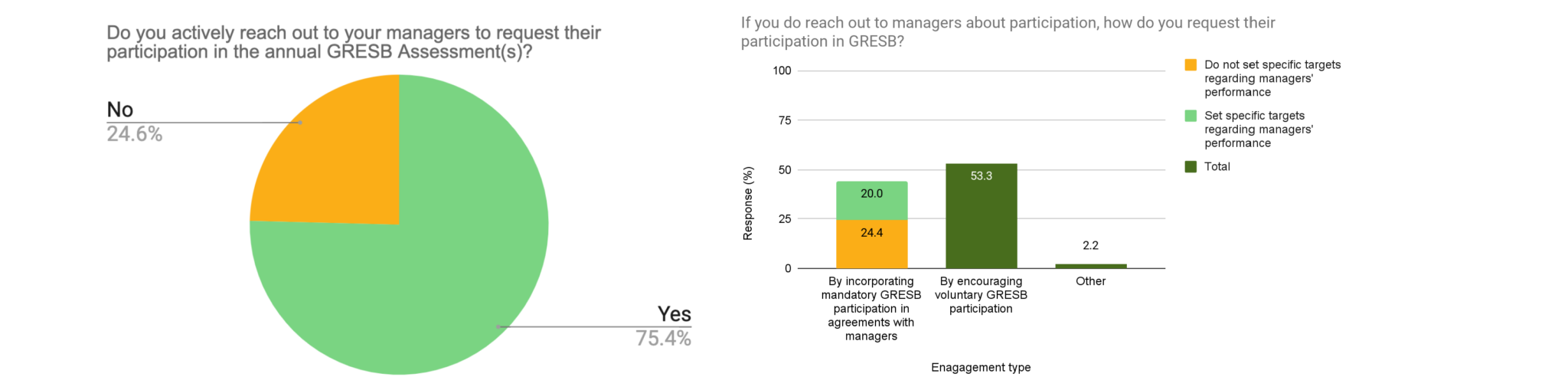

A GRESB Investor Member survey conducted in late 2022 found that over 75% of surveyed investors engage with their managers to encourage GRESB participation, with 32% of investors making participation mandatory.

What the Real Estate Assessment entails

Management Component

The Management Component measures an entity’s strategy and leadership, policies and processes, risk management, and its stakeholder engagement approach using information collected at the organizational level.

Performance Component

The Performance Component measures an entity’s asset portfolio performance using asset- and portfolio-level information. Suitable for companies or funds with operational assets, it includes information on performance indicators, such as energy, GHG emissions, water, and waste.

Development Component

The Development Component measures an entity’s efforts to address ESG issues during a building’s design, construction, and renovation phases. It is suitable for entities with completed or ongoing projects in new construction (building design, site selection, or construction) or under major renovation.

Participants who complete the Performance and Management components receive a GRESB Standing Investments Benchmark Report, while participants who choose to complete the Management and Development components receive a GRESB Development Benchmark Report. Those who complete all three components receive both reports.

Easing into the Real Estate Assessment

First-time participants can benefit from a range of approaches when it comes to reporting to GRESB in their first year.

GRESB offers all first-year participants access to the “Grace Period,” a useful feature that allows participants to choose whether they want to allow investors to request access to their results. Participants who choose to use the Grace Period in the first year find that this allows them to get familiar with GRESB reporting without having to undergo scrutiny from investors.

Some managers may also find that starting with just the Management Component of the GRESB Assessments can be beneficial in their first year as it enables them to begin reporting on their ESG practices without needing to delve into performance data until they feel ready. This approach allows managers to start showing their commitment to sustainability while reducing the burden of first-year reporting.

All participants can also request a Pre-Submission Check and take advantage of the Assessment Correction to check and verify submissions. On average, GRESB participants see a 10-point increase in their GRESB score in their second year of reporting.

Assessment process

The GRESB Real Estate Assessment is a systematic process for companies, funds, separate accounts, and joint ventures.

Validation

GRESB has established a robust data validation process to underpin the accuracy and reliability of its output. It is based on a three-layer data-quality control process designed to ensure submission of high-quality information. The approach to validation was developed by PwC and involves third-party verification by Sustainability Assurance Services.

Objective scoring

The GRESB Scoring Model is based on an automated system, which uses a technology platform designed for GRESB by a third party that specializes in data analysis software development. The scoring is completed without manual intervention after data input.

Peer benchmarking

Peer comparisons that take into account country, regional, sectoral, and investment type variations provide a powerful lens through which to benchmark performance. Each participant is assigned to a peer group, based on the entity’s legal structure (listed or private), property type, and geographical location of assets.

Early Access to Asset-Level Data via Asset Analytics

As of 2025, real estate investors and managers can access asset-level data from the GRESB Assessment submissions through the Asset Analytics tab in July.

The data in the Asset Analytics tab will be refreshed when final results are released in October. Participants can choose if and when to share their data with investors in July, October, or not at all.

Early access is designed to support proactive engagement, earlier insights, and informed decision-making across real estate portfolios.

Assessment results

In October, assessment participants receive their assessment results and the relevant benchmarking reports based on the assessment components they completed.

Each component carries its own score, which is factored into the entity’s GRESB Score and GRESB Rating. In addition to these results, participants receive the Portfolio Analysis Tool and the GRESB Benchmark Report. These outputs provide an in-depth analysis of sustainability performance, enable detailed peer group comparisons, and highlight industry best practices.

GRESB participants can also choose to take advantage of our Assessment services to enhance their ESG reporting experience with GRESB, get the most value from their ESG efforts, and obtain relevant guidance and feedback on their results.

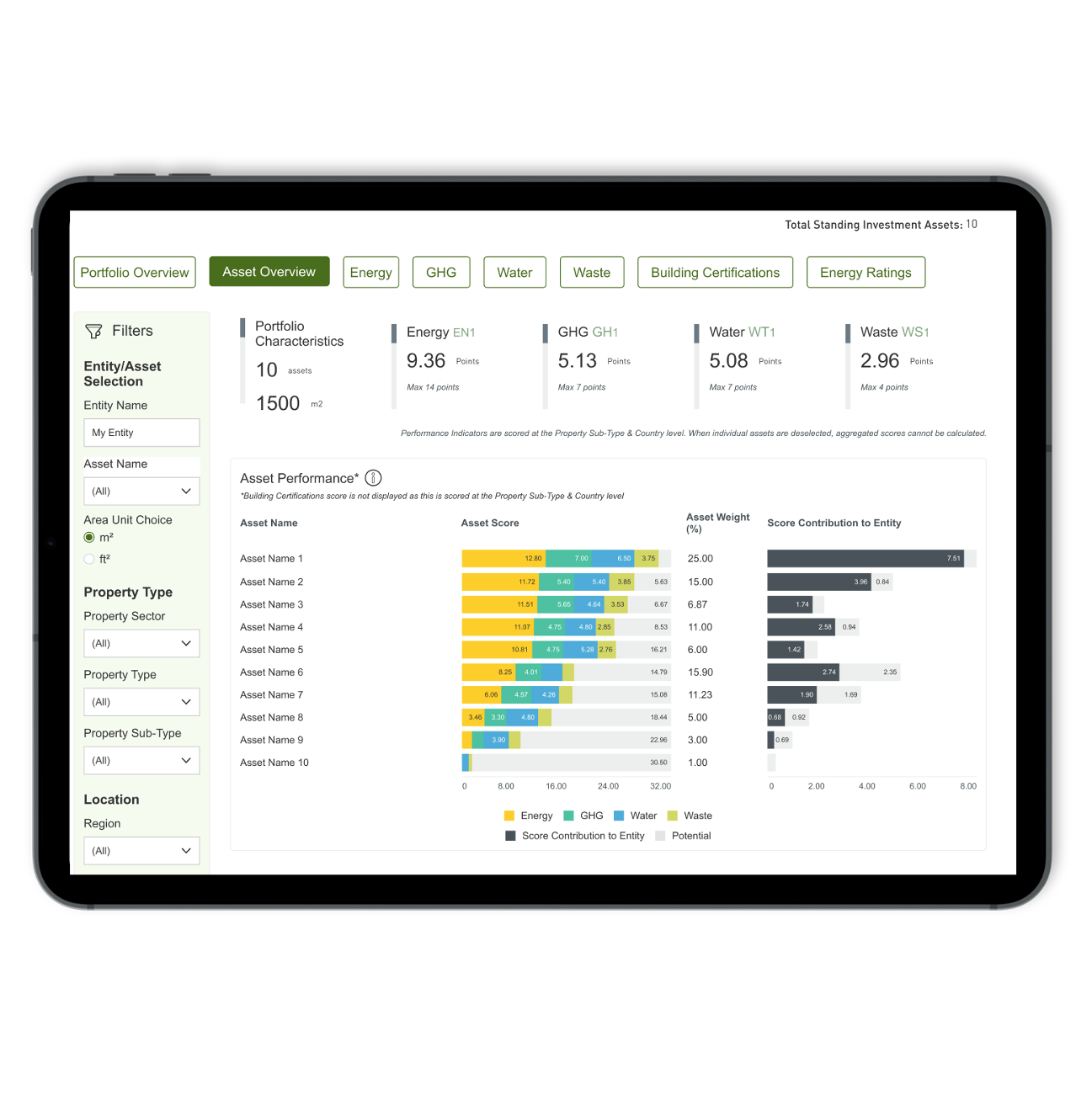

Score Contribution for Real Estate Participants

Score Contribution is a new membership feature that gives real estate participants deeper insights into how individual assets contribute to their portfolio’s performance and overall GRESB Score—both in aggregate and across key performance metrics.

All GRESB Real Estate Members can access Score Contribution insights directly in the GRESB Portal as part of their GRESB membership.

Assessment resources

- Core resources – Official GRESB documentation including GRESB Standard and Reference Guides and scoring documents.

- Assessment Templates & tools – To use while completing the Assessment.

- Reporting Resources – Useful documents to help you during the GRESB reporting process.

- Assessment Standard Changes – Useful resources to stay updated on changes to the GRESB Standards.

- Results Interpretation – Documents that will assist you in understanding and gaining insights from your results.

- Linguistic Supplements

Have a look at our Participant Members.

Interested in the Real Estate Assessment? Contact us!

"*" indicates required fields