The United Nation’s 26th annual climate summit in Glasgow, Scotland updated commitments to achieve global climate targets and sounded a call to action for climate priorities across sectors.

World Leaders Stepped Forward (But Not Far Enough)

The Paris Climate Agreement, signed by world leaders in 2015, outlined climate action goals that needed to be achieved in order to limit the rise of global temperature to well-below 2 degrees Celsius (2C). In the time since, global urgency has skyrocketed, motivated by the sixth iteration of the Intergovernmental Panel on Climate Change’s report released in August was appropriately dubbed a “code red” for humanity.

This year’s COP26 was a future-defining opportunity to revisit the off-track Paris targets, and set minimum requirements for what every participating country must do in the next three decades to maintain a 1.5C warming scenario.

The summit culminated in all 197 countries signing the “Glasgow Climate Pact,” which recognized that carbon emissions must be reduced by at least 45% by 2030 from a 2010 baseline and invited parties to consider actions to reduce other greenhouse gas emissions by 2030.

The pact is a good start, as evidenced by the inclusion of unprecedented commitments such as the “phasing down” of coal (a top polluter), as well as the first recorded pledge to end inefficient fossil fuel subsidies, and a promise to develop verifiable and robust carbon markets.

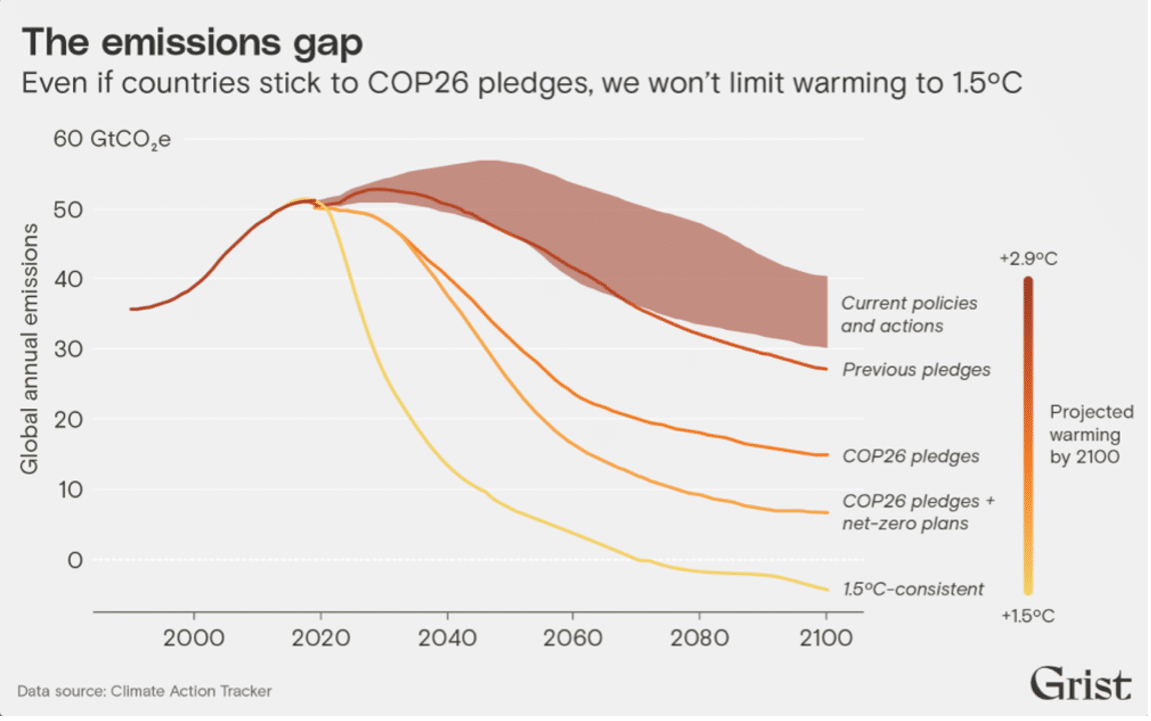

This cross-border collaboration is only a start, however, considering the emissions gap that remains between COP26 pledges and projected warming scenarios.

Original data sourced from an analysis by the data firm Climate Action Tracker (CAT), which showed that if COP26 targets for 2030 were achieved, the world’s warming will still reach 2.4 degrees C.

Everyone Agreed It’s Time to Scale Efforts

In a rare consensus, global governments and sector leaders agreed that climate action must accelerate. The UN now urges updates to countries’ nationally determined contributions (NDCs) annually rather than every five years.

Notably, this call for acceleration affected the climate financing landscape, as evidenced by adaptation and mitigation finance exhibits in the Pact, as well as announcements of a massive flow of private capital toward decarbonizing the economy. The Glasglow Financial Alliance for Net Zero (GFANZ), for example, was forged across 450 private banks, insurers and asset managers representing the global finance industry and committed to directing $130 trillion to position their investments to stand up to the net-zero challenge. Though this alliance fails to include any formal pledge to divest from fossil fuels, it points to a progressive trend.

COP Laid a Foundation The Private Sector Can Continue to Build Upon

The conference left the world wondering whether these pledges will be upheld, and how the emissions gap will be bridged. As poignantly phrased in a Forbes opinion piece by Solitaire Townsend, “when it comes to climate action, [COP26] was a terrible ceiling, but an excellent floor” – meaning, climate change is far from solved, but the conference sounded the alarm across governments, sectors, and marketplaces to encourage radical transformation.

In tandem with COP26, the private sector has seen an unprecedented number of corporate commitments to decarbonize as well as a movement toward formalizing science-based targets. A November announcement made by the Science-Based Targets Initiative and UN Global Compact indicated that over 1,000 companies, representing $1.3 trillion in market capitalization, have set 1.5C-aligned targets, indicating that the global campaign to scale corporate climate commitments has emerged into the mainstream. For many reasons, such as the physical impacts of climate change on buildings, to the rising pressure from investors, real estate companies are under immense pressure to meet their net-zero goals. However, COP made clear that companies can’t afford to wait for the public sector and international leaders to lead the goals to fruition.

While a daunting task, this moment is the golden hour for “implementation” of ESG pathways to achieve net-zero in the business world – and the market is poised to favor those that follow through on these targets.

Tell a Story with Your ESG Strategy

COP26 served as a reminder that “all hands on deck” is the only route to ensuring a sustainable future for all. At an organizational level, this rings true, too. For a company to meet decarbonization goals, ESG must be fully integrated into its business strategy, operations, and culture. And that starts at the top – the ESG governance model is essential to ensuring sustainability becomes a part of the dialogue across all levels of the organization.

Members of an organization rely on a clear thru line to the purpose of the changes they’ll be ushered to make to carry out the ESG strategy. And that why element corresponds to one, or all three, of ESG’s essential R’s: returns (on investment), results (e.g., reductions in energy usage and thereby emissions,), and resilience (e.g., how strong a company and its assets stand against climate-related risks).

With strong ESG strategies in place, companies can work to fill the gap between climate ambitions, like those made at COP26, and the climate action required by science to, in effect, build the walls and ceilings of our global climate goals.

Sustento Group delivers customized ESG solutions to help clients across the U.S. shape their sustainability stories, realize superior risk-adjusted returns, and stay ahead in a rapidly changing environment. Reach out if you’d like to learn more.

Written by Emily Kulaga, Senior Sustainability Coordinator at Sustento Group.