What is SFDR, the EU Sustainable Finance Disclosure Regulation?

The EU’s Sustainable Finance Disclosure Regulation (SFDR) is a transparency requirement for financial market participants related to key environmental, social and governance (ESG) indicators. The purpose is to increase market transparency regarding the Principal Adverse Impacts (PAIs) caused by investment products, thereby helping direct capital towards more sustainable investments.

For many asset managers, a key consideration for SFDR is providing investors with relevant and accurate ESG data to support their mandatory reporting.

Report on SFDR with confidence using real data from GRESB

With GRESB, real estate and infrastructure managers can meet the most arduous part of SFDR – reporting on product-level PAIs – while gaining valuable business insights.

- Better data. Unlike other providers, GRESB works with real ESG data, submitted and validated from assets themselves. This means more accurate data to get ahead of future requirements.

- Focused on the hard part. We tackle SFDR’s central data challenge, giving you more flexibility to finish reporting without racking up unnecessary consulting fees.

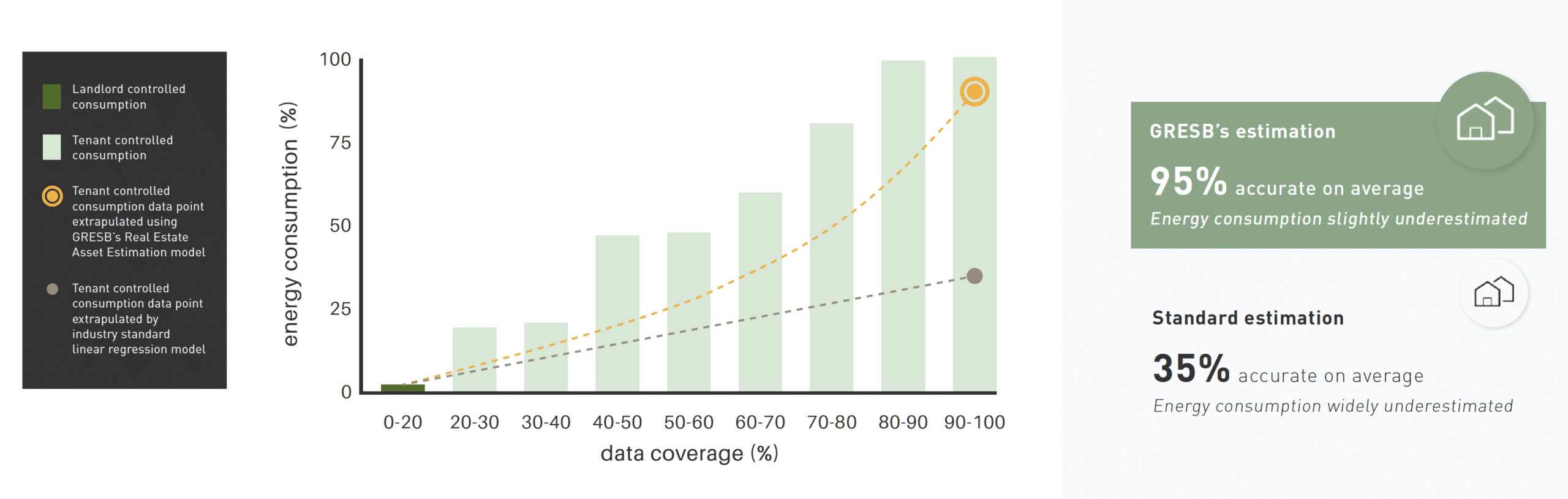

- More accurate estimations. Where real estate entities may have initial gaps in data, we can make better estimations using our global industry assessments. More accurate data now means fewer headaches in the future.

- End-to-end support. As an industry-led platform, GRESB provides robust support services at every step of the process. If you need help collecting data, we can recommend one of our partners.

Download a sample report:

for Real Estate

for Infrastructure Asset

for Infrastructure Fund

GRESB Estimation Model

Users of the GRESB SFDR Real Estate Solution can opt to use the GRESB Estimation Model (GEM) to help improve the quality of their submitted SFDR data. For real estate financial market participants who are missing energy consumption data for the tenant’s portion of a building in their portfolio, GEM can drill down and compare the building’s known data points – like floor size, location and specific property subtype – against the GRESB database. This provides a highly representative estimation for missing data.

Future-proof reporting with high-quality data

The GRESB SFDR Solution is regularly updated to help ensure that fund managers can report on all PAI indicators required under the regulation and keep their stakeholders informed with high-quality, reliable regulatory data.

With the GRESB SFDR Solution, you can:

- Prepare for your entity-level PAI Disclosures in accordance with all regulatory requirements by reporting both quantitative and qualitative SFDR data

- Submit two years of data covering both the 2023 and 2024 SFDR reference periods to facilitate year-on-year comparisons

- Grant investors access to both your SFDR data and reports through the GRESB Portal

- Inform and guide your periodic and pre-contractual disclosures at the product level

- Engage with stakeholders on how you are addressing SFDR through explanation input fields linked to each PAI indicator

- Communicate the EU Taxonomy eligibility and alignment of your financial product

- Identify any data or coverage gaps you may have

Ready to get started?

The SFDR Assessments for 2025 are available now.

Related insights and resources

-

Solve the hardest part of SFDR reporting with real data from a trusted source. Receive a more accurate PAI Statement and the flexibility to get ahead of future regulatory requirements.

-

You can find reference guides for both the SFDR Real Estate and SFDR Infrastructure Assessments at GRESB Documents.