Expanded Benchmarking Capabilities

As of June 2025, REAL Benchmarks includes performance thresholds for the top 15% and top 30% of assets, along with new ASHRAE thresholds. The new capabilities support EU Taxonomy alignment analysis and empower users to choose the benchmarks that best suit their needs and strategy.

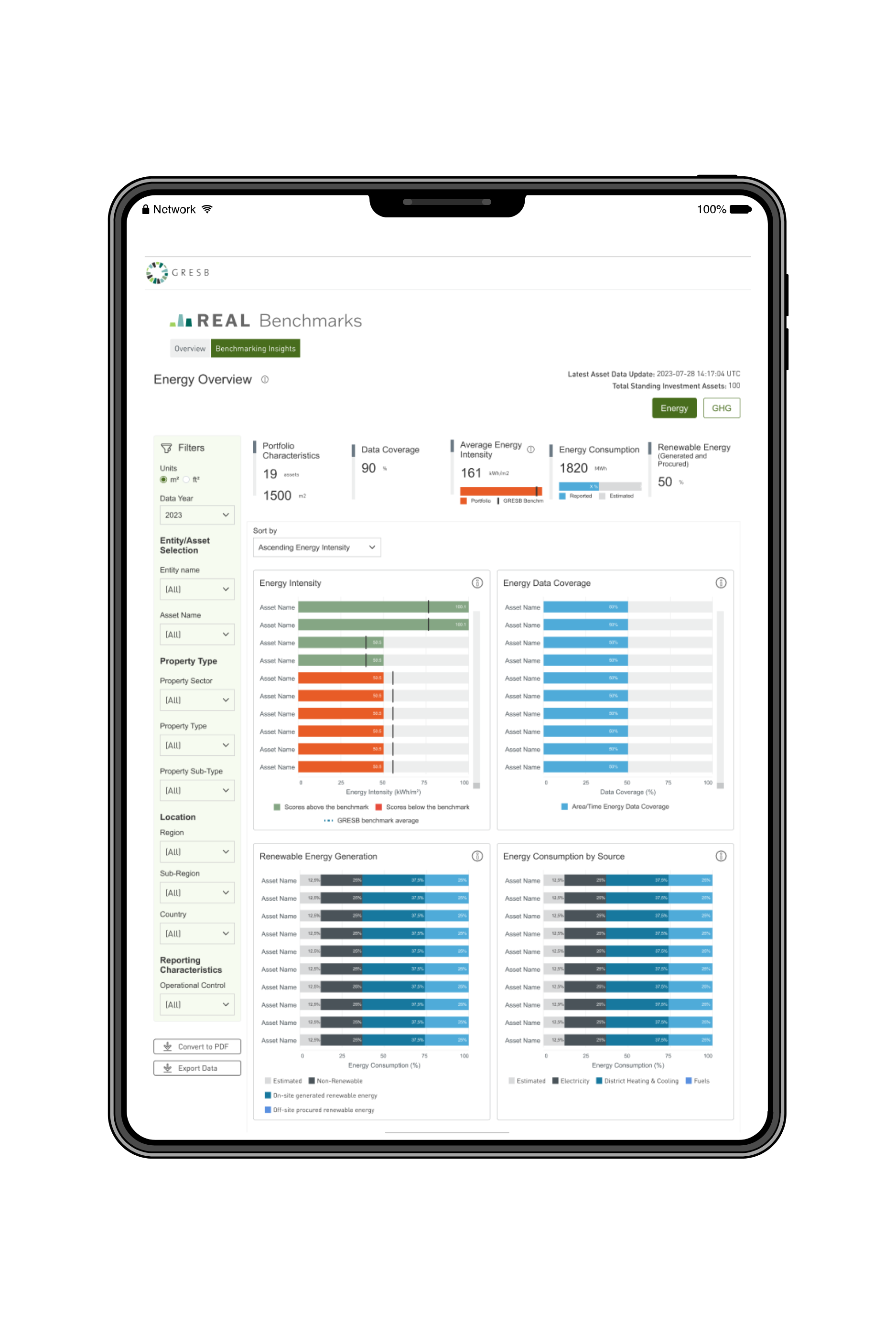

REAL Benchmarks – asset-level insights for real estate

For real estate fund managers and listed companies, asset-level performance data can be a key component to making strategic decisions across a portfolio. Unfortunately, far too many managers suffer from significant gaps in building-level data and lack a sufficiently granular benchmark to truly compare their assets’ relative performance against.

GRESB’s REAL Benchmarks is a private dashboard for real estate managers and companies to delve into the energy and GHG emissions data of all assets within their portfolio, allowing for detailed analysis of how each asset contributes to the portfolio’s overall performance.

The dashboard is available year-round and automatically updated when data is edited in the GRESB Asset Portal.

Performance thresholds

New performance thresholds for the top 15% and 30% of assets — along with ASHRAE thresholds — have been introduced to support deeper insight and EU Taxonomy alignment.

Introducing REAL Benchmarks

Find out how REAL Benchmarks empowers real estate managers to make faster, more informed decisions.

Understand each asset’s impact on your portfolio

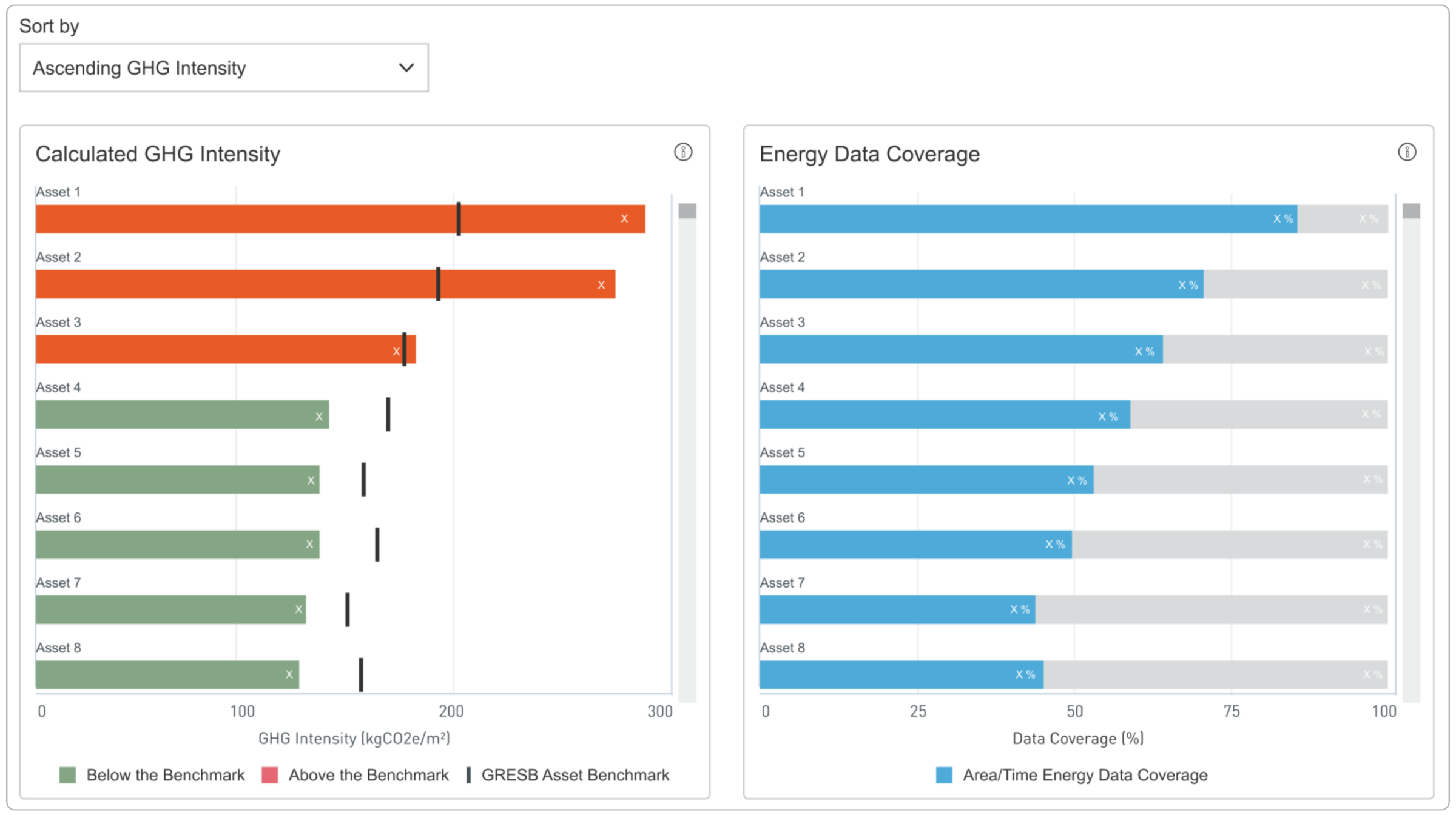

- REAL Benchmarks shows you exactly which assets are under- or over-performing against peers, and by how much, within GRESB’s universe of 200,000+ global assets.

- See which assets need additional investment in data collection.

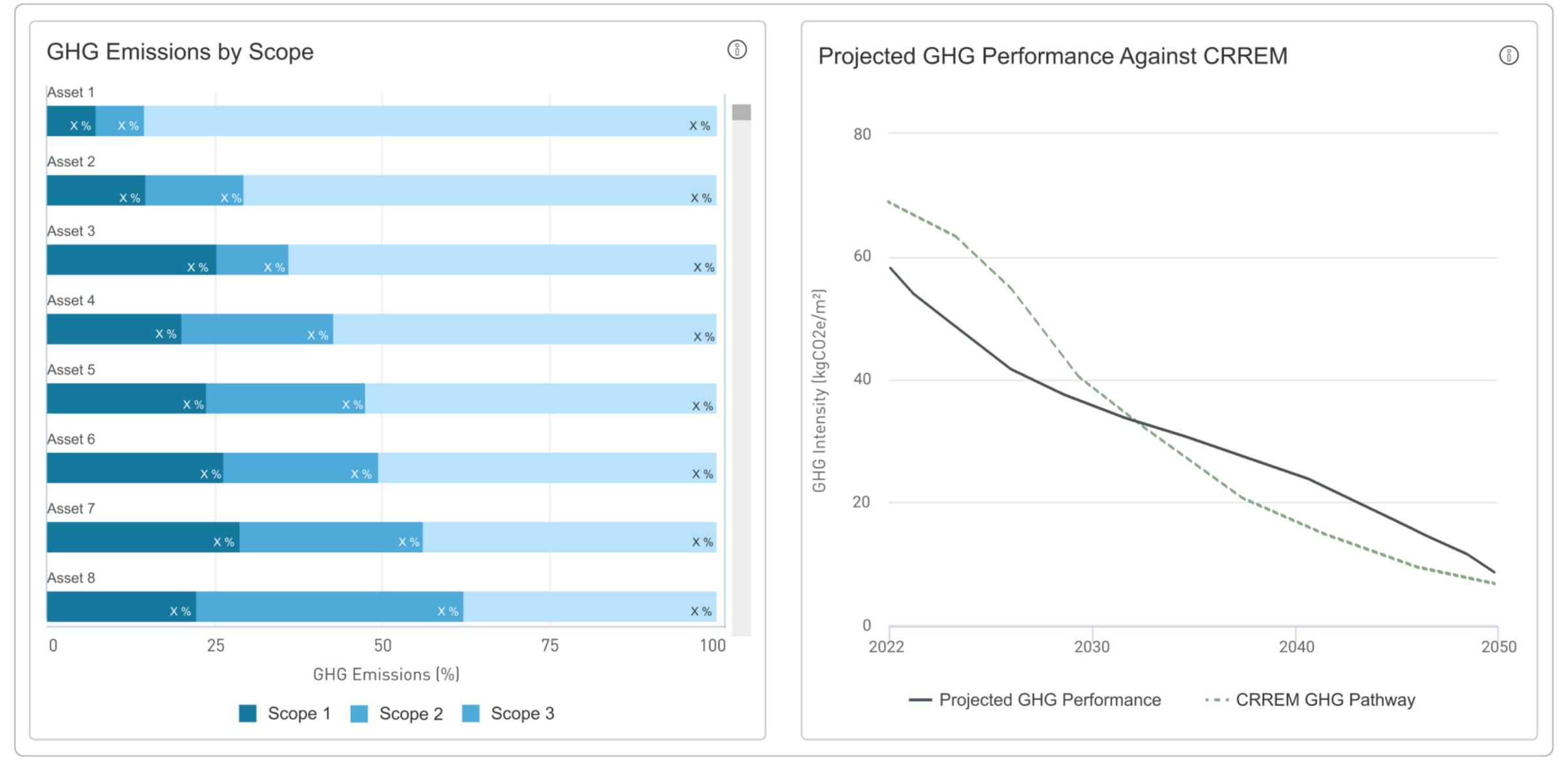

Dive into emissions by scope and project GHG performance

Regardless of what type of assets you hold or where they are located, REAL Benchmarks allows you to filter by property type, location, and percentage of ownership to view detailed energy and GHG data by cohorts and better understand the projected GHG performance of those assets against decarbonization pathways such as CRREM.