Our industry is engaged in an important dialogue to improve sustainability through ESG transparency and industry collaboration. This article is a contribution to this larger conversation and does not necessarily reflect GRESB’s position.

As environmental, social, and governance (ESG) data grows increasingly important for regulatory compliance, financing requirements, and competitiveness, more than simply following in the footsteps of industry peers is required. The complexities of sustainability and the imperative for prompt action demand that real estate companies construct their own data-driven strategies, tailored to their unique business model. This transition fundamentally transforms ESG data from a compliance necessity into a strategic asset, essential for uncovering risks and opportunities and forging a resilient trajectory for long-term success. The critical role of data is highlighted in investor-facing frameworks like GRESB, where 19.5 percent of the GRESB Score for the Real Estate Assessment hinges on data coverage. This emphasizes that even data reflecting subpar performance is valuable.

Barriers to optimizing ESG data integrity

However, to fully harness the potential of data, owners must address prevalent challenges in acquiring high-quality data at both the portfolio and building levels. This is especially true in the key environmental domains for real estate — energy, water, and waste management. For utility data, owners may face challenges in three areas:

- Data availability centers on how easily data can be sourced from entities like utilities or tenants. As investors increasingly prefer quarterly reporting over annual reporting, property owners require consistent access to year-round data.

- Data coverage measures the extent of data available for a property or entire portfolio, aiming for the industry benchmark of “whole-building data,” including landlord- and tenant-controlled areas. This becomes challenging when tenants manage their utility expenses in triple-net lease situations.

- Data quality assesses the precision, depth, and reliability of the data. Quality data accurately reflects business operations, is meticulously gathered and verified, and balances manual and automated processes for efficiency and accuracy. Frameworks like GRESB and CDP award higher points for third-party data assurance, and some benchmarking ordinances are also starting to require this (e.g., Boston, Washington D.C.). Despite the upfront costs, sustainability assurance has been shown to pay for itself by reducing capital costs.¹

Technological innovations and trends

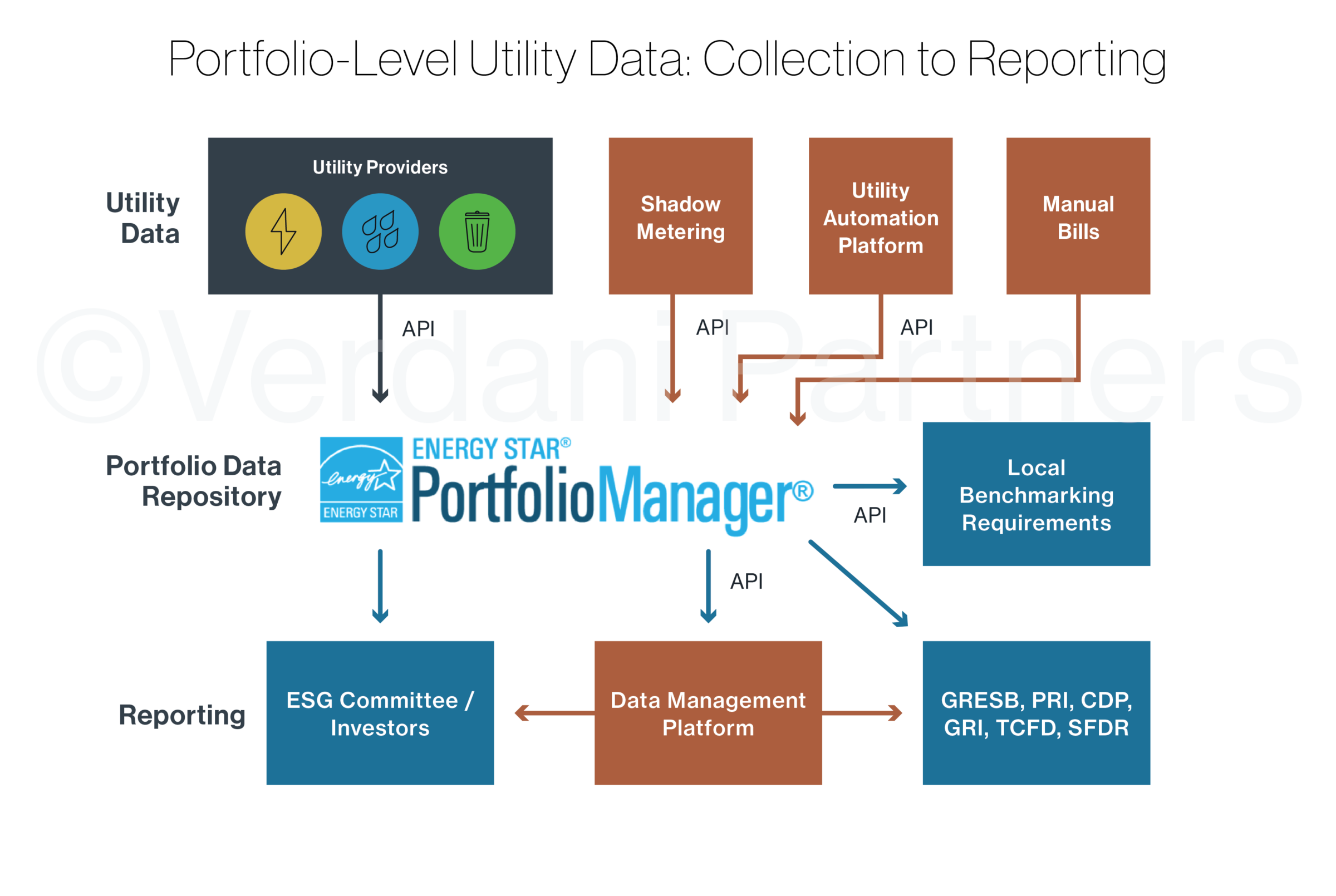

In the past decade, the real estate sector has witnessed a surge in innovative technologies to enhance data availability, coverage, and quality while streamlining the data collection and management process. Some of the key innovations involve application programming interfaces (APIs), data management platforms, and shadow meters.

The role of APIs

APIs facilitate secure data transfer between systems, replacing the cumbersome process of manually entering information from utility bills. Catalyzed by benchmarking laws that require utilities to share energy data with property owners, APIs now enable easy data sharing from utilities to platforms like ENERGY STAR Portfolio Manager. This approach has expanded to include water and even waste data, a traditionally harder-to-track metric. Innovations like Waste Management’s integration with ENERGY STAR Portfolio Manager exemplify this progress.

Utility automation and ESG data management platforms

Utility automation (e.g., WatchWire, Conservice, and Schneider Electric) and ESG data management platforms (e.g., Measurabl, Scaler Global, and Deepki) have significantly improved the collection, management, analysis, and reporting of environmental data. These platforms are vital in identifying data coverage gaps and opportunities for cost savings and operational improvements. They provide advanced analytical tools, including visual data trend representations and performance metrics, enhancing decision-making processes. Additionally, these systems are vital for ensuring regulatory compliance and aligning reporting with frameworks like GRESB and CDP.

Shadow metering

When tenant utility data is hard to obtain, shadow metering for electric, gas, and water can be a solution for improving coverage and obtaining whole-building data. Shadow metering involves installing meters to capture whole-building data and can be arranged with all types of leases. Although this method does not provide historical data, it ensures complete data from the point of installation, benefiting future reporting cycles.

Beyond utility data: Expanding the ESG data scope

Scope 3 emissions

The focus on Scope 3 emissions data has grown notably in recent years, becoming a new standard for emissions reporting. This shift is especially crucial in the real estate industry, where Scope 1 and 2 emissions are often overshadowed by Scope 3 emissions.² These include sources across the value chain, namely building materials and tenant emissions. Recent regulations, such as California’s SB 253 and the EU’s Corporate Sustainability Reporting Directive, now mandate Scope 3 emissions reporting, aligning with the IFRS Sustainability Reporting Standards that regard it as a best practice. Investors are actively pushing for this change, filing resolutions for companies to report on Scope 3 emissions and set science-based targets.³ This shift necessitates more advanced systems for tracking and validating emissions data across supply chains and enhancing collaboration and transparency. Lendlease, a leader in this space, advocates for an industry-wide supplier reporting platform to securely exchange digitized Scope 3 emissions data.⁴

Green building certifications

The ESG landscape is also witnessing growing investor interest in green building certification data as a proxy for assessing the sustainability of real estate companies. Investors are requesting specific data points, such as the number of green building certifications a company holds, the number of assets with valid certifications, and the percentage of square footage certified by programs like LEED. These data points offer investors a tangible measure of a company’s commitment to sustainable practices, making green building certifications crucial in evaluating a real estate firm’s overall ESG performance.

Social metrics

Historically lagging behind environmental data regarding collection and reporting, social data is now catching up amid rising demands for broader ESG reporting, particularly around diversity, equity, and inclusion (DEI). Companies are identifying financially material social metrics, such as employee sentiment across various demographic groups, to better understand and address workplace satisfaction and engagement issues that impact recruitment and retention. This includes conducting DEI surveys with optional demographic questions, enabling companies to pinpoint and address specific concerns among different groups. Additionally, human rights considerations are becoming crucial, with CRE companies beginning to scrutinize their operations and supply chains for potential risks like forced labor or discrimination. Starting with their immediate operations and extending to direct suppliers and beyond, businesses are gradually developing strategies to assess and mitigate these risks, reflecting the growing importance of comprehensive social data tracking in enhancing their overall ESG performance.⁵

Conclusion

Accessible, comprehensive, and precise ESG data is critical to advancing corporate sustainability and securing a competitive edge in the real estate industry. Technological advancements such as APIs, ESG data management platforms, and shadow metering are overcoming data integrity challenges, streamlining the collection and analysis process for strategic decisions and investor reporting.

In real estate, effective ESG management now goes beyond traditional utility data, compelling owners to incorporate a broader range of data types, including Scope 3 emissions, green building certifications, and social metrics, which are becoming increasingly important for a complete representation of ESG performance and identifying potential risks and opportunities.

As demand for diverse ESG data grows, leveraging innovative technologies to improve connectivity, enhance data accuracy, and foster industry collaboration is critical to transforming complex data landscapes into actionable, sustainable solutions.

This article was written by Carli Schoenleber, Senior Communications Manager, Content and Engagement Specialist with contributions from Kelsey Ceccarelli, Director of Engineering, Denita Toneva, Engineering Manager, Lauren Rodriguez, Associate Engineering Manager, Chika Acholonu, Associate Director of ESG, DEI Committee Lead, and Jackie Royds, Associate Communications Designer.

References

- Casey, Ryan J., and Jonathan H. Grenier. “Save money by having your sustainability report assured.” Journal of Accountancy. Association of International Certified Professional Accountants, April 11, 2018.

- Wolman, Jordan. “The emissions disclosure gap is wide, but it’s narrowing.” Politico. Axel Springer SE, February 23, 2023.

- Bousso, Ron. “Group of 27 Shell investors co-file new climate resolution.” Reuters. Thomson Reuters Corporation, January 16, 2024.

- “Lendlease’s Scope 3 Emissions Protocol: Our Reporting Boundary.” Lendlease. Accessed March 8, 2024.

- Salgado Rodriguez, Elena and Melany Wild. “Business and Human Rights: Towards a Decade of Global Implementation.” S&P Global, Report, Zurich, 2021.