White Peak is a Swedish fund manager and developer of residential properties in China. The company contributes to the country’s future urban development by applying innovative Swedish building technology and a unique approach to sustainability and community integration.

Business type: Fund manager and real estate developer

Reporting region: China

AuM: USD 2 billion

Use of GRESB: GRESB Real Estate Assessment (Development)

NEO owns, develops, and manages seven certified green buildings in Bonifacio Global City, Philippines, to provide a more sustainable business environment with a reduced carbon footprint. In 2013, NEO partnered with SM Investment Corporation (SMIC) to expand its office portfolio management approach.

Business type: Property company and real estate manager

Reporting region: Asia-Pacific

Use of GRESB: GRESB Real Estate Assessment

Reporting entities: 7 assets

With more than 20 years of experience, Aberdeen Investments infrastructure capital team invests directly in public-private partnerships and concession style infrastructure assets globally, focusing on essential public services, social mobility, and decarbonization with the objective of producing long-term sustainable returns.

GRESB Assessments, tools, or products used: GRESB Infrastructure Fund Assessment, GRESB Infrastructure Asset Assessment, GRESB SFDR Reporting Solution

AuM: More than USD 4 billion across the infrastructure capital platform (as of June 23)

Region: UK, Europe, USA, Latin America, and Australia

Sino Land Company Limited (HKSE: 083) is one of the leading property developers in Hong Kong. Its core business includes development of properties for sale and investment and is complemented by a full spectrum of property business ranging from hotel operations to property services, encompassing property management, car park management, cleaning and environmental services, security services as well as hospitality services.

Business type: Property company and real estate developer

Reporting region: China – Hong Kong Special Administrative Region

Market capitalization: HKD 78,695 million (as of June 30, 2023)

Use of GRESB: GRESB Real Estate Assessment (Standing Investment & Development)

Vivenio Residencial Socimi S.A. is a property company whose corporate purpose is the development, acquisition, and management of residential properties for rental in Spain.

Business type: Property company

Reporting region: Europe, with a focus on Spain

GAV: EUR 1.425 billion as of December 2022

Use of GRESB: GRESB Real Estate Assessment

Brookfield India Real Estate Trust (BIRET) is India’s first 100% institutionally managed real estate investment trust. BIRET’s portfolio comprises five Grade-A office parks in campus format across key gateway markets of India – Mumbai, Gurugram, Noida, and Kolkata. BIRET is sponsored by an affiliate of Brookfield Asset Management Inc, one of the world’s largest alternative asset managers and investors across more than 30 countries.

Business type: Real Estate Investment Trust

Reporting region: Asia

AuM: INR 164 billion (approximately EUR 1.83 billion), as of March 31, 2023

Use of GRESB: Real Estate Development Benchmark & Public Disclosure

PATRIZIA Infrastructure is a long-term investor, partnering with clients to invest in true infrastructure assets that protect real investment value while providing predictable cash returns. This is achieved by investing in assets with clear and measurable cash flows and adding value through active asset management.

Business type: Infrastructure fund manager

Reporting region: Global

AuM: EUR 60 billion

Use of GRESB: GRESB Infrastructure Fund & Asset Assessments and SFDR Reporting Solution

Nucleus Office Parks is the operating platform for fully owned Blackstone Offices in India, managing an industry-leading portfolio of over 20 million square feet of Grade A commercial assets spread across all key markets.

Business type: Asset manager

Region: India

AuM: Approximately 20 million sqft

Use of GRESB: GRESB Real Estate Assessment

Mahindra Lifespaces develops thriving residential communities and enables business ecosystems through its premium residential projects, integrated cities, and industrial clusters.

Business type: Real estate developer

Region: India

Market capitalization: ~INR 72.2 billion (USD 885.8 million) as of September 30, 2022

Use of GRESB: GRESB Real Estate Assessments & Public Disclosure

QuadReal Property Group is a global real estate investment, operating and development company focused on office, industrial, logistics, residential, retail and alternative assets. Additionally, QuadReal invests in equity and debt in both public and private markets and through operating companies.

Business type: Direct investor, real estate manager

Reporting region: Canada

AuM: CAD 67.1 billion

Use of GRESB: GRESB Real Estate Assessment

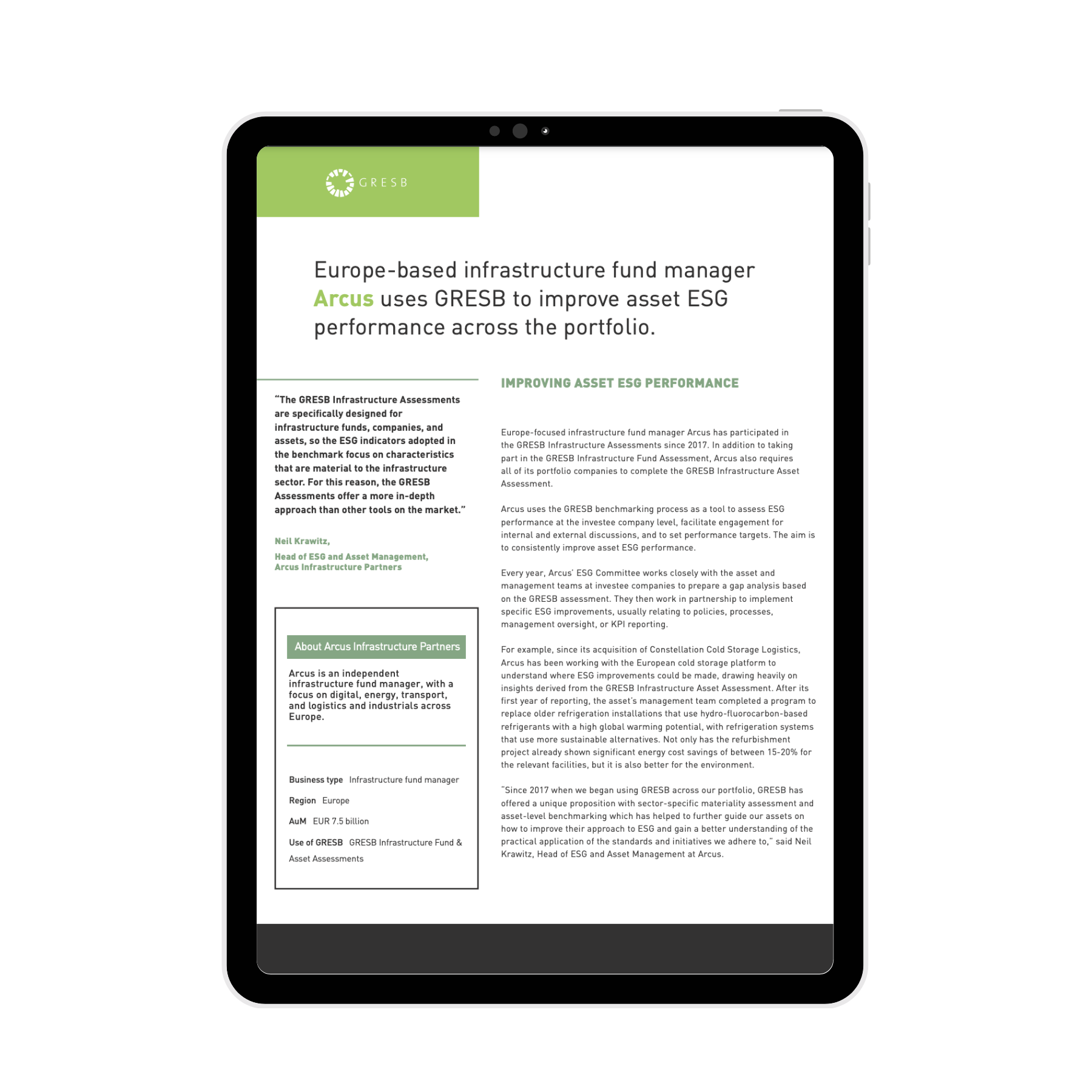

Arcus is an independent infrastructure fund manager, with a focus on digital, energy, transport, and logistics and industrials across Europe.

Business type: Infrastructure fund manager

Region: Europe

AuM: EUR 7.5 billion

Use of GRESB: GRESB Infrastructure Fund & Asset Assessments

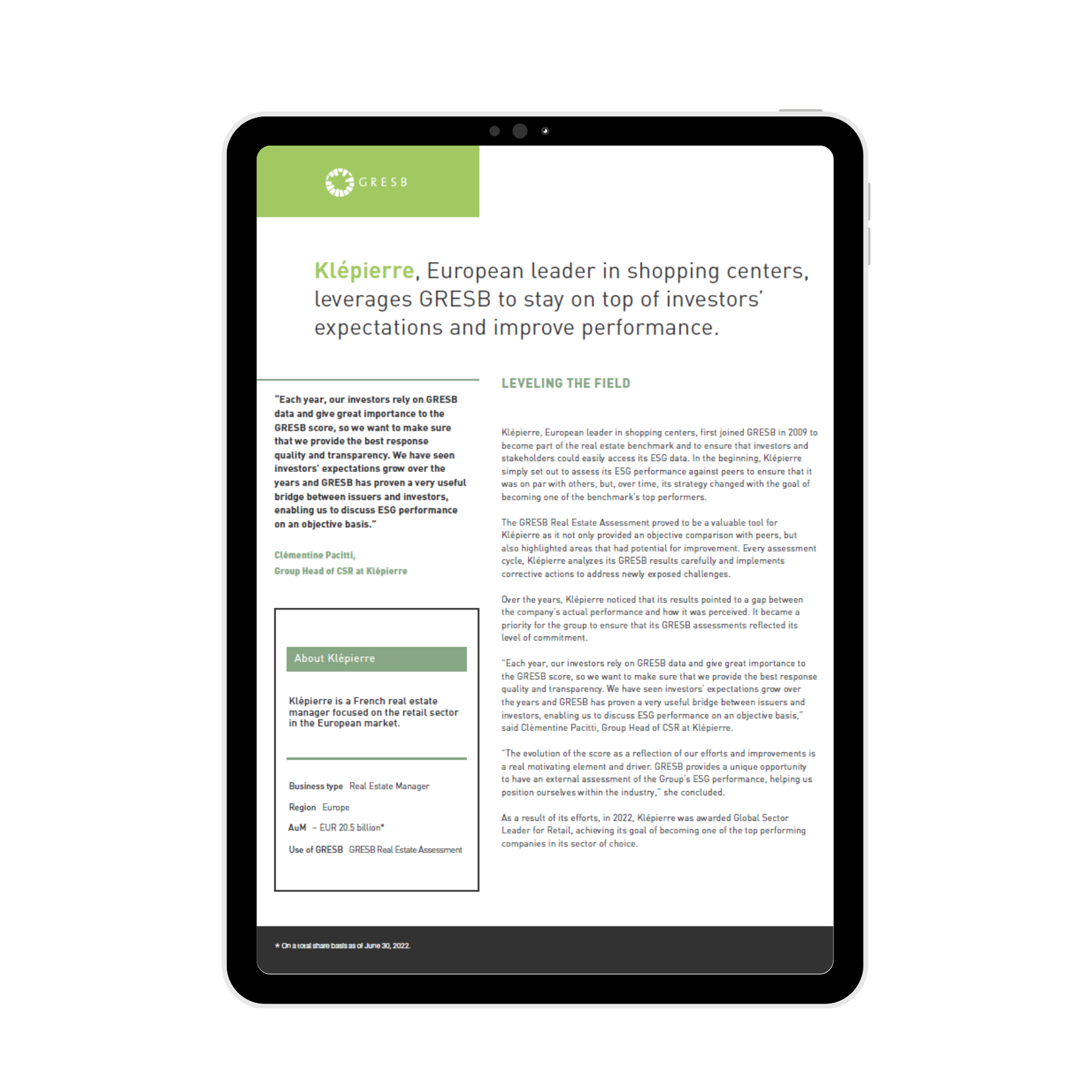

Klépierre is a French real estate manager focused on the retail sector in the European market.

Business type: Real Estate Manager

Region: Europe

AuM: ~ EUR 20.5 billion (on a total share basis as of June 30, 2022)

Use of GRESB: GRESB Real Estate Assessment

Keppel Land is an innovative urban space solutions provider that leverages technology to deliver sustainable and customer-centric solutions that enrich people and communities, focused in the areas of sustainable urban renewal, senior living, urban living, retail, and largescale integrated developments.

Business type: Real Estate Manager

Region: Asia

Total Assets: SGD 14.1 billion (as of December 31, 2021)

Use of GRESB: GRESB Real Estate Development Benchmark

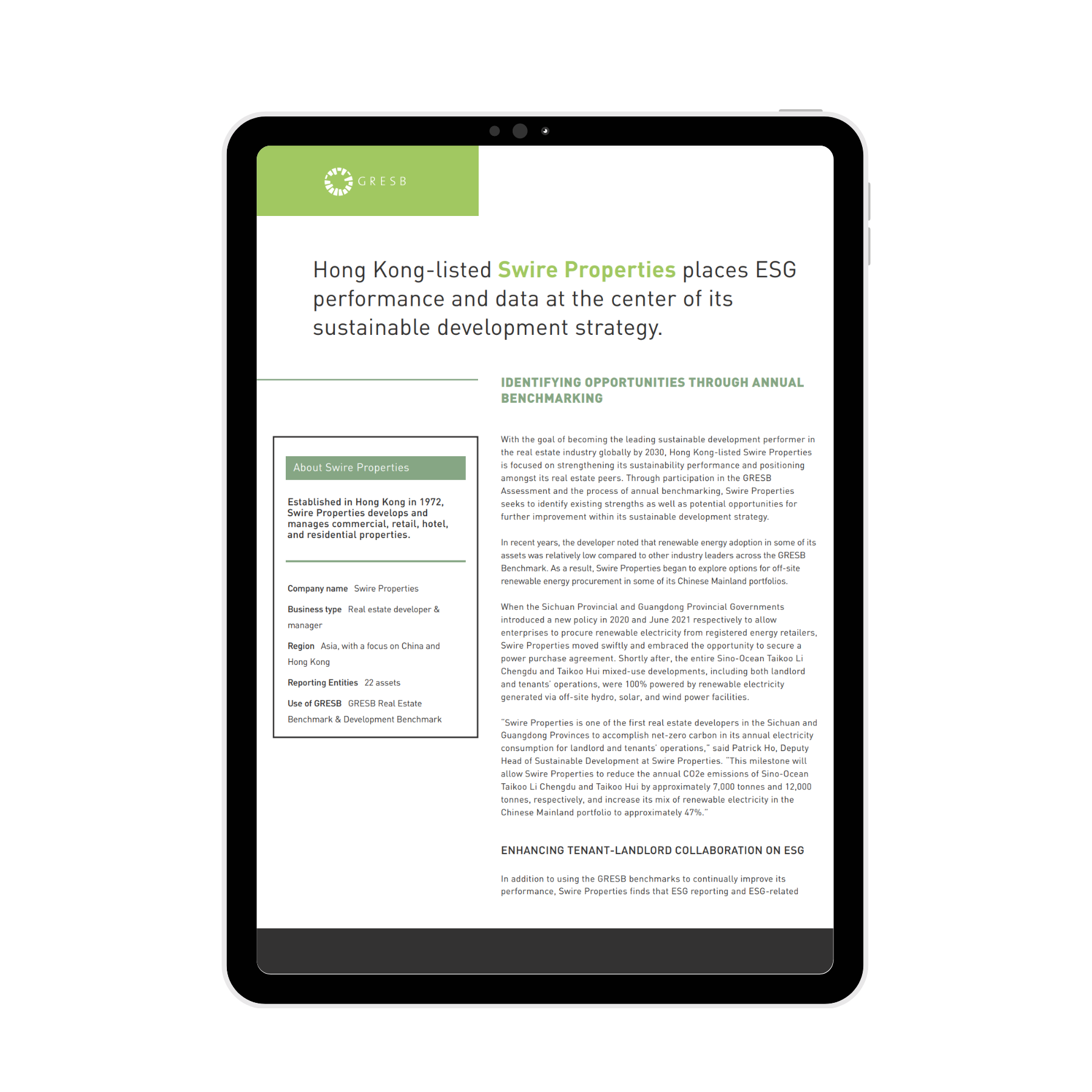

Established in Hong Kong in 1972, Swire Properties develops and manages commercial, retail, hotel, and residential properties.

Business type: Real estate developer & manager

Region: Asia, with a focus on China and Hong Kong

Market capitalization: HKD 104 billion

Use of GRESB: GRESB Real Estate Benchmark & Development Benchmark

Eastnine is a Swedish real estate company focused on modern and sustainable office and logistics properties in the Baltics and Poland.

Business type: Real estate manager

Region: Baltics and Poland

AuM: EUR 605 million

Use of GRESB: GRESB Real Estate Benchmark & Climate Risk Platform

GRESB Investor Members—number more than 150 across the globe—play a central role in shaping a more sustainable real assets industry. Our investor case studies highlight how GRESB data and insights are integrated into investment and decision-making processes. Explore how leading global investors use GRESB to drive better risk-adjusted returns, meet regulatory and stakeholder expectations, engage with managers, and build more sustainable and productive portfolios for long-term success.

Members directory

More than 2,300 real asset managers report to GRESB. Explore the directory and see who’s defining the future of sustainability in real assets.