Our industry is engaged in an important dialogue to improve sustainability through ESG transparency and industry collaboration. This article is a contribution to this larger conversation and does not necessarily reflect GRESB’s position.

As the demand for sustainable, middle-income housing grows, developers are increasingly turning to innovative strategies that balance environmental responsibility with financial performance. The use of Life Cycle Assessments (LCAs) is one such strategy, offering a data-driven approach to material selection and emissions reduction throughout the building lifecycle.

Real estate firm Stoneweg US is about to break ground on Mosaic, a multifamily development in Pooler, Georgia (Savannah MSA), designed to serve middle-income renters. Situated near the USD 5.5 billion Hyundai Electric Vehicle Metaplant, Mosaic will offer 333 thoughtfully designed, workforce-attainable apartment homes situated 12 acres. This 100% electric development takes a comprehensive approach to environmental performance and emissions reduction, proving that integrating sustainability with attainability for middle-income renters can create both meaningful impact and superior investment returns.

LCA: A building’s nutrition label

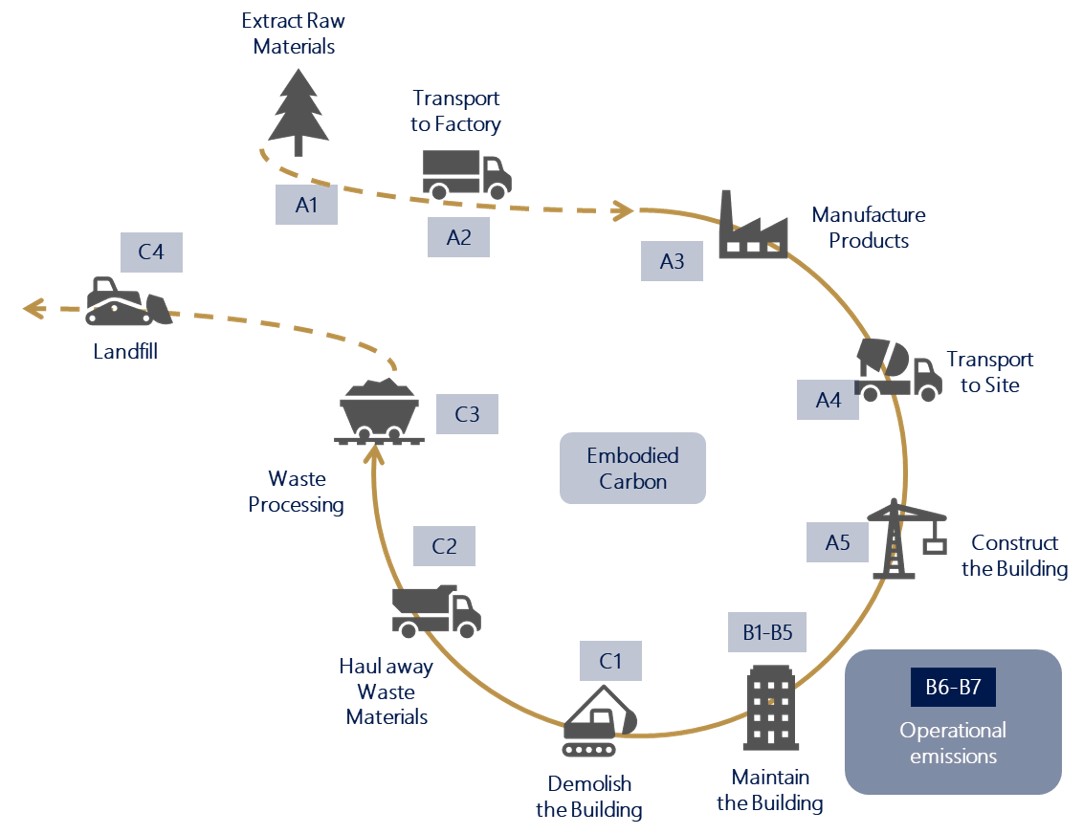

At the core of Mosaic’s design strategy lies a building LCA, developed through the expertise of GRESB Partner Longevity Partners, ensuring a comprehensive understanding of embodied carbon and environmental impact. This LCA provides a complete picture of the environmental impact of every stage of the building’s lifecycle—from material extraction to end-of-life disposal or recycling. By measuring embodied carbon (CO₂e) and utilizing Environmental Product Declarations (EPDs), the LCA guides material selection and sustainability decisions, transforming Mosaic into a data-driven model of environmentally responsible development.

A baseline for improvement

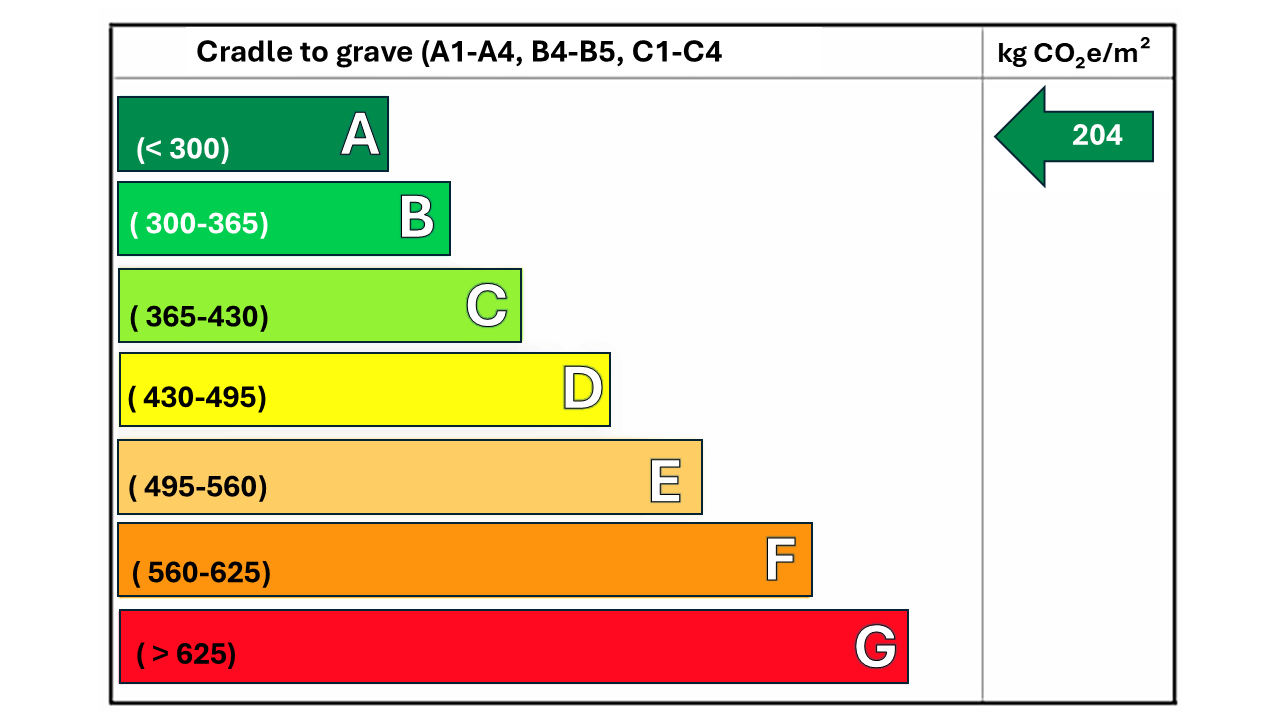

Mosaic’s initial embodied carbon measure of 204 kgCO₂e/m²GFA (A1-A4,B4-B5,C1-C4) is well-below the global market average for apartment buildings based on One Click LCA’s carbon heroes benchmark1. This value excludes building technology, external areas, and impacts related to the construction stage, as these building elements are widely inconsistent across different developments, especially building technology which is calculated at various levels of details using different assumptions and default values.

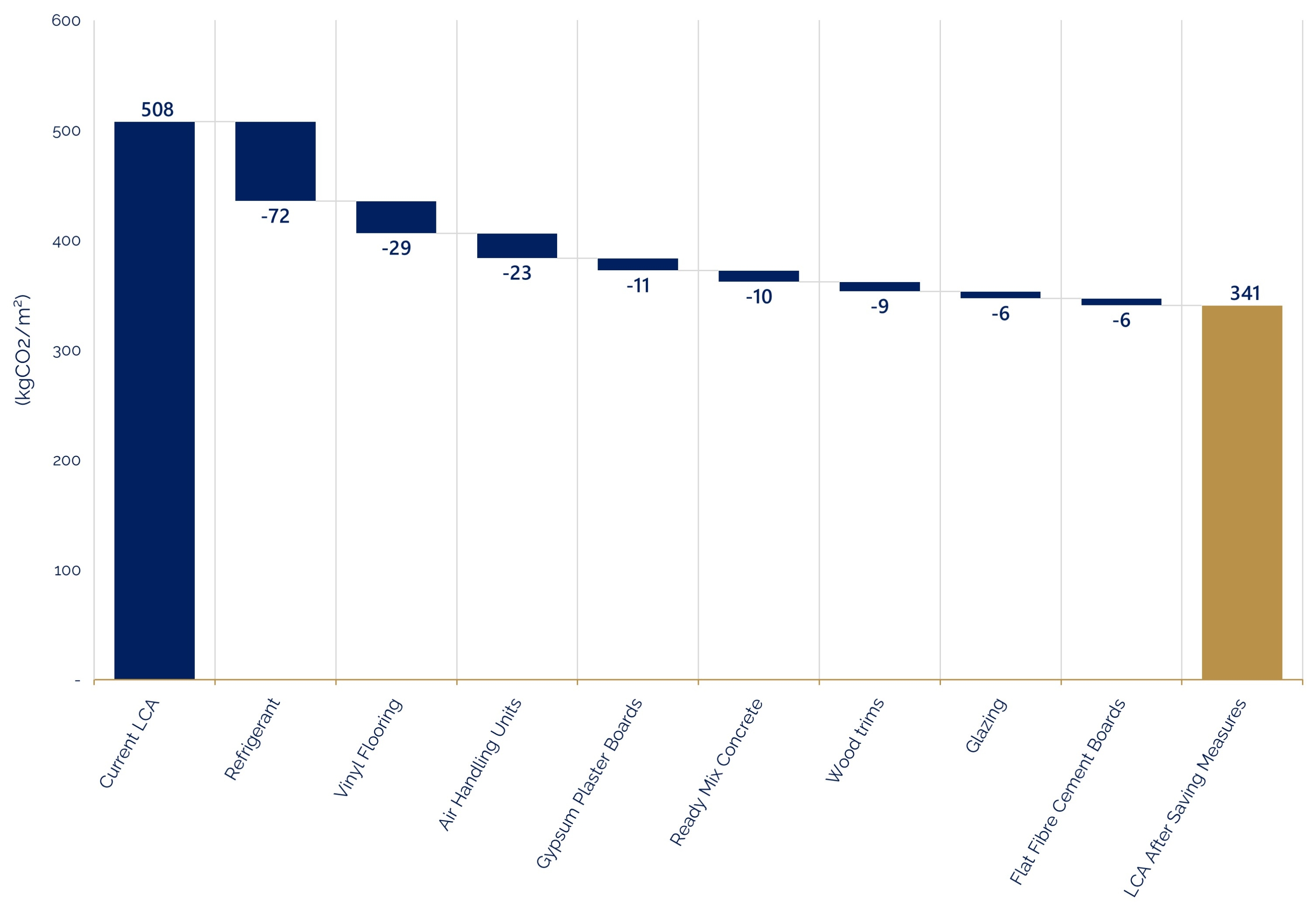

Considering a full scope of lifecycle stages and building elements, Mosaic was estimated to have an impact of 508 kgCO₂e/m²GFA. This can also be considered below industry average, as although little data can be used to compare to in the US, looking at a UK benchmark (GLA), an aspirational benchmark for residential buildings is an impact lower than 800 kgCO₂e/m²GFA.

However, the LCA identifies a pathway to reduce this footprint even further, by up to 33%. This ambitious reduction is achievable through targeted material decisions that prioritize, advanced refrigerants, sustainable flooring, low-carbon concrete, and high-recycled-content drywall. These choices combined represent a projected expense premium equal to approximately 1% of the total budget and will yield significant financial incentives.

The financial upside of sustainability

Sustainability is not just about reducing emissions—it’s also a financial strategy. Mosaic’s commitment to achieving at least an NGBS Gold certification combined with its LCA process unlocks a blended interest rate discount of 27 basis points, translating into over USD 2 million in debt service savings over the term. Beyond cost savings, Mosaic’s market-leading position supports nominal rent increases and a projected 3.3% investment alpha on exit value. Together, these benefits underscore the alignment between environmental stewardship and superior financial outcomes.

Navigating regulatory risks and market demands

Navigating regulatory risks and market demands in the context of emissions and real estate investment involves understanding and complying with a growing number of regulations. These include not only operational carbon or energy efficiency standards under Building Performance Standards (BPS) laws but also emerging legislation targeting embodied carbon at the state and city levels. Additionally, market demands are increasingly driven by investor focus on sustainability, with frameworks like GRESB incorporating embodied carbon metrics. Developers must balance these regulatory requirements and market expectations while addressing challenges such as material availability and workforce education to achieve sustainable development goals.

Material choices that matter

Mosaic’s LCA highlights actionable opportunities for emission reductions:

- Refrigerants: Specifying R-32 refrigerants achieves a 68% reduction in refrigerant emissions, and a 14% reduction of the whole project with a nominal cost impact.

- Air handling units: By updating to these new generation units it reduces the embodied carbon of the whole project by 4%.

- Flooring: Sustainable alternatives to vinyl reduce embodied carbon of the whole project by 6% while enhancing durability and recyclability.

- Concrete: High-recycled-content concrete lowers embodied carbon of the material use by 45%, representing a 2% benefit to the entire project with projected nominal cost burden.

These decisions demonstrate how thoughtful material selection delivers both environmental and financial rewards.

A vision for sustainable leadership

Mosaic exemplifies the collaborative commitment of Stoneweg US and Longevity Partners to combine sustainability with investment excellence. By embracing LCA insights and integrating sustainable practices, Mosaic achieves:

- A 33% reduction in embodied carbon.

- Over USD 2 million in debt savings through interest rate discounts over the term.

Enhanced market appeal and asset value appreciation resulting in a projected 3.3% investment alpha on exit value.

This pioneering approach underscores the competitive advantage of sustainability in multifamily development, setting a benchmark for future projects.

This consideration of, and interest in low carbon products also clearly signals to suppliers that this is becoming a key consideration for developers and investors, further driving reductions and disclosure of the carbon impacts through the supply chain.

Conclusion: Knocking down barriers to building sustainability

The integration of sustainability into multifamily real estate development is no longer a niche consideration but a critical factor in shaping the future of the sector. The time has come when green premiums and other obstacles are no longer material barriers to integrating sustainability to achieve financial performance in multifamily real estate development. Mosaic’s innovative approach to sustainable development demonstrates the synergy between environmental responsibility and financial returns. By leveraging LCA insights, pursuing NGBS Gold certification, and optimizing material choices, Stoneweg US and Longevity Partners together have contributed valuable insights into sustainable multifamily real estate development, helping guide the industry toward more responsible and impactful practices. Mosaic isn’t just a development; it’s a blueprint for the future—where smart investments drive environmental, financial, and social value.

This article was written by Thomas Stanchak, Managing Director of Sustainability, and Ethan Ariav Land Acquisition & Pre-Development Manager, at Stoneweg US, LLC; and Bernardo De Leon, Sustainable Design Country Lead USA, and Theo Meslin, Head of Embodied Carbon and Circularity, at Longevity Partners. Learn more about Longevity Partners here.