Infrastructure is a relatively young asset class with a developing investor base. Increasing interest in this sector reflects wide-spread recognition for a large gap between infrastructure needs and investment, as well as the prospect for relatively stable income streams and diversification.

Infrastructure is a relatively young asset class with a developing investor base. Increasing interest in this sector reflects wide-spread recognition for a large gap between infrastructure needs and investment, as well as the prospect for relatively stable income streams and diversification.

Australian pension funds were among the first private investors in infrastructure followed by pension funds and insurance companies in North America and Europe. The last couple of years, sovereign wealth funds from Asia and the Middle East also have become important investors in infrastructure.

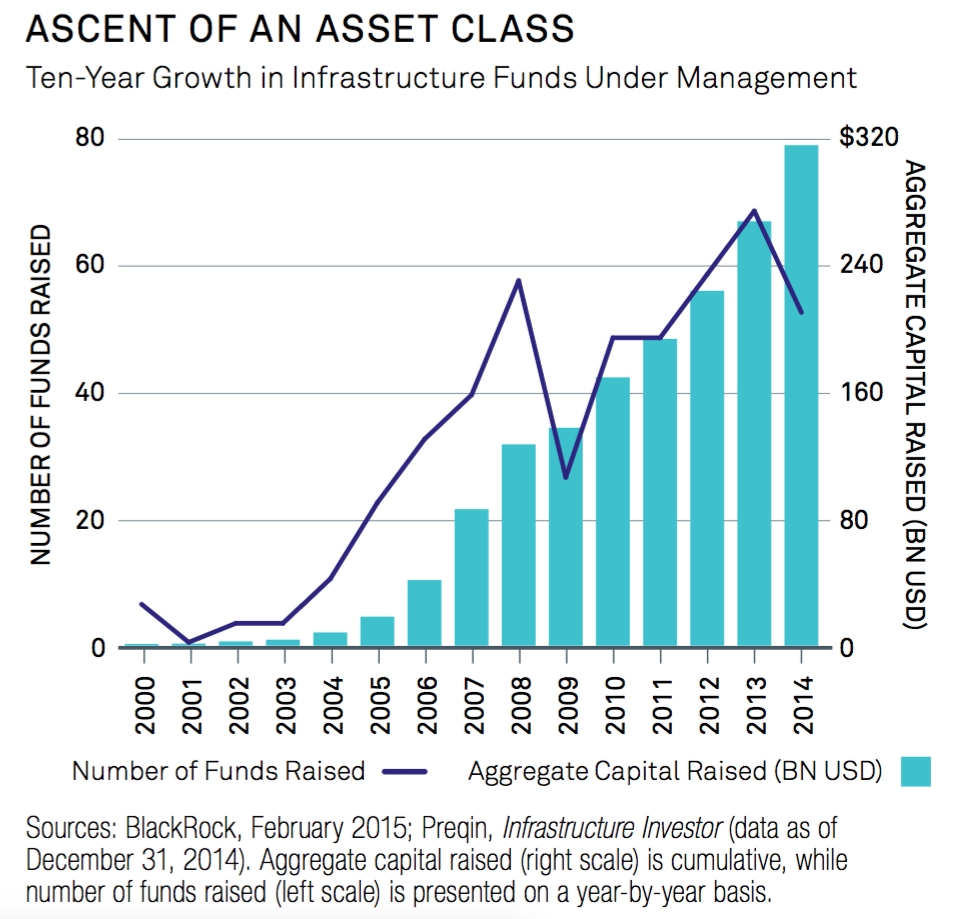

As a result, the number of infrastructure funds has quadrupled over the last 10 years. Market research from Preqin reports 47 infrastructure funds in the market in January 2007 compared to 179 in January 2016. Preqin data also show that the average allocation to infrastructure from investors increased from 2,5% in 2010 to 3% in 2015, while the top 100 largest infrastructure investors increased their allocations from 5,9% to 6,4%.

This increase in allocation is accompanied by significant changes in investment strategy. Larger pension funds, insurance companies and sovereign wealth funds shifted from funds to direct investments. This strategy gives these investors more control and potentially reduces fees.

While investor interest and options have increased, the supply of high-quality, comparative environmental, social, and governance (ESG) information about investments has not kept pace. There are no globally applicable tools to understand, report, and compare ESG performance. This creates challenges since ESG information is particularly important when making long-term investments that may be sensitive to a range of ESG-issues, such as environmental regulation, social disruption, or governance.

GRESB and a group of institutional investor members are working to fill this gap with tools to assess, score, and benchmark ESG performance for infrastructure investments. See the GRESB Infrastructure Assessment here.

This article was written by Emke Bus.