This week marked an ESG milestone with the release of the IFRS sustainability disclosure standards. The notion of IFRS S1 and S2 may not immediately spark excitement. However, they are a Big Deal. Their release is the culmination of an intensive, 18-month development process and the consolidation of multiple underlying standards.

- S1 is envisioned as a “global baseline” for sustainability disclosure — focusing on information that can be “reasonably foreseen” to be relevant to investment decisions. S1 builds on SASB with guidance for industry-specific disclosures.

- S2 is used in coordination with S1 to focus on climate-related disclosures. S2 fully incorporates and extends TCFD recommendations. It requires industry-specific, material information about climate-related risks and opportunities, including both physical and transition risks.

IFRS standards are explicitly designed to integrate with corporate financial statements — matching entities, time periods, accounting assumptions, and other key factors. They emphasize the effects of sustainability-related risks and opportunities on current and anticipated future performance, financial position, and cash flows.

Speaking in London at the 2023 IFRS Conference, ISSB Chair Emmanuel Faber said that the new standards provide a consistent, comprehensive language for reporting — one that will be familiar to users of IASB protocols in 140 countries. Faber emphasized that the new standard expands the scope of financial reporting across the value chain. He also articulated three criteria for standards moving forward. According to Faber, standards should be:

- Equitable

- Accessible

- Iterative

It is validating to hear that GRESB’s approach to standard development reflects Faber’s criteria:

- GRESB standards are open and available to all

- GRESB governance process is transparent and accessible to all stakeholders through the non-profit, industry-led GRESB Foundation

- GRESB standard development is iterative — adapting and improving every year to meet the changing needs and circumstances of the market

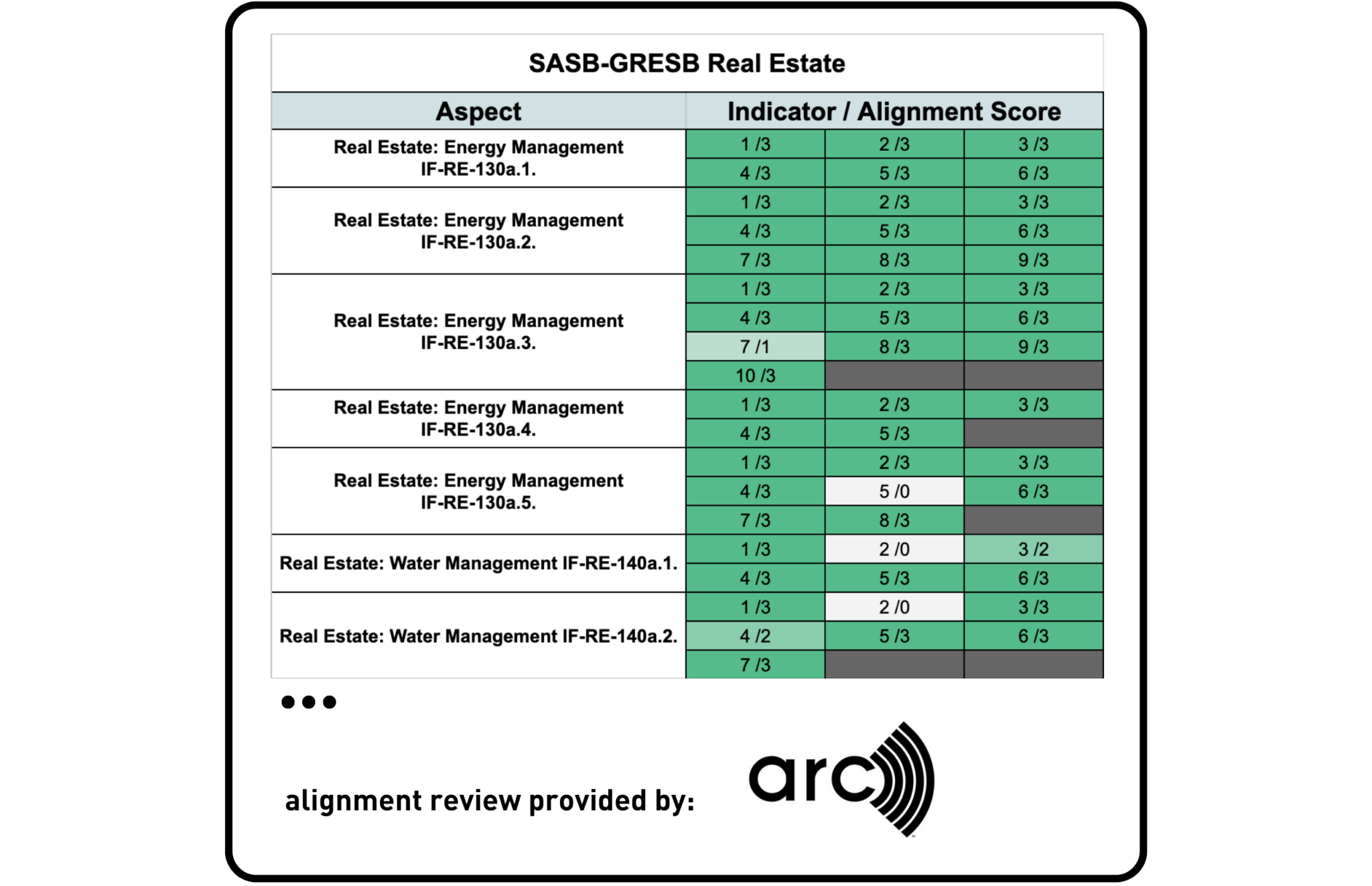

GRESB applauds the new IFRS standards, and it appreciates recognition for the core elements of GRESB’s approach to science-based standards development. To this end, GRESB has conducted a series of framework mapping exercises, looking at how the GRESB Standards align with common ESG frameworks and evaluating alignment with nine different standards. The resulting crosswalks can be explored and downloaded here. Particularly relevant to the new IFRS standards, a recent analysis of the SASB standards found high alignment with GRESB, with nearly 80% of SASB’s RE indicator objectives/scopes and underlying content addressed by GRESB. Significant alignment was also found between GRESB Standards and SASB’s Standard, with an overall alignment of nearly 70% (download the alignment review). We expect similar alignment with the new SASB-based IFRS S1 and S2 standards.

It is notable that the new IFRS standards remain unapologetically focused on single materiality. This means that their definition of materiality is defined explicitly with respect to financial materiality as defined by IFRS’ concept of “relevance to investors.” This structure was inherited from SASB and it presumes that investors are narrowly focused on balance sheet issues with secondary or tertiary concern about the impacts of running the business. The standards do not require disclosure related to broader social and environmental impacts. This strategy may not align with regional regulatory regimes and it has well documented limitations for issues such as public health. IFRS recognizes that this means that the new S1 and S2 standards will need to be used in coordination with more holistic reporting frameworks, such as GRI and GRESB.

Going forward, we celebrate this important milestone, and we recognize its importance in advancing sustainability reporting. We are excited to explore ways to leverage the new standards as we pursue our shared mission of providing timely, relevant, and material information to market participants.

Onward!