What’s new in June

The last week of June? Already? That means only days to go until July 1, when GRESB Reporting closes for 2024. It’s a critical time of the year, and we have a few important updates.

- GRESB Reporting – almost there!

- Accredited Professional Program (AP) now available

- GRESB Foundation update

- New Insights, events, episodes of the Pulse, and more.

For more about what’s going on at GRESB, read below. For any questions, please contact us. (Make sure to whitelist [email protected] in your email settings to continue to receive news and updates from GRESB.)

The Assessment Portal closes July 1

GRESB Participants probably need no reminders, but the Assessment Portal closes on July 1, 2024. Make sure you submit your Assessment by the deadline!

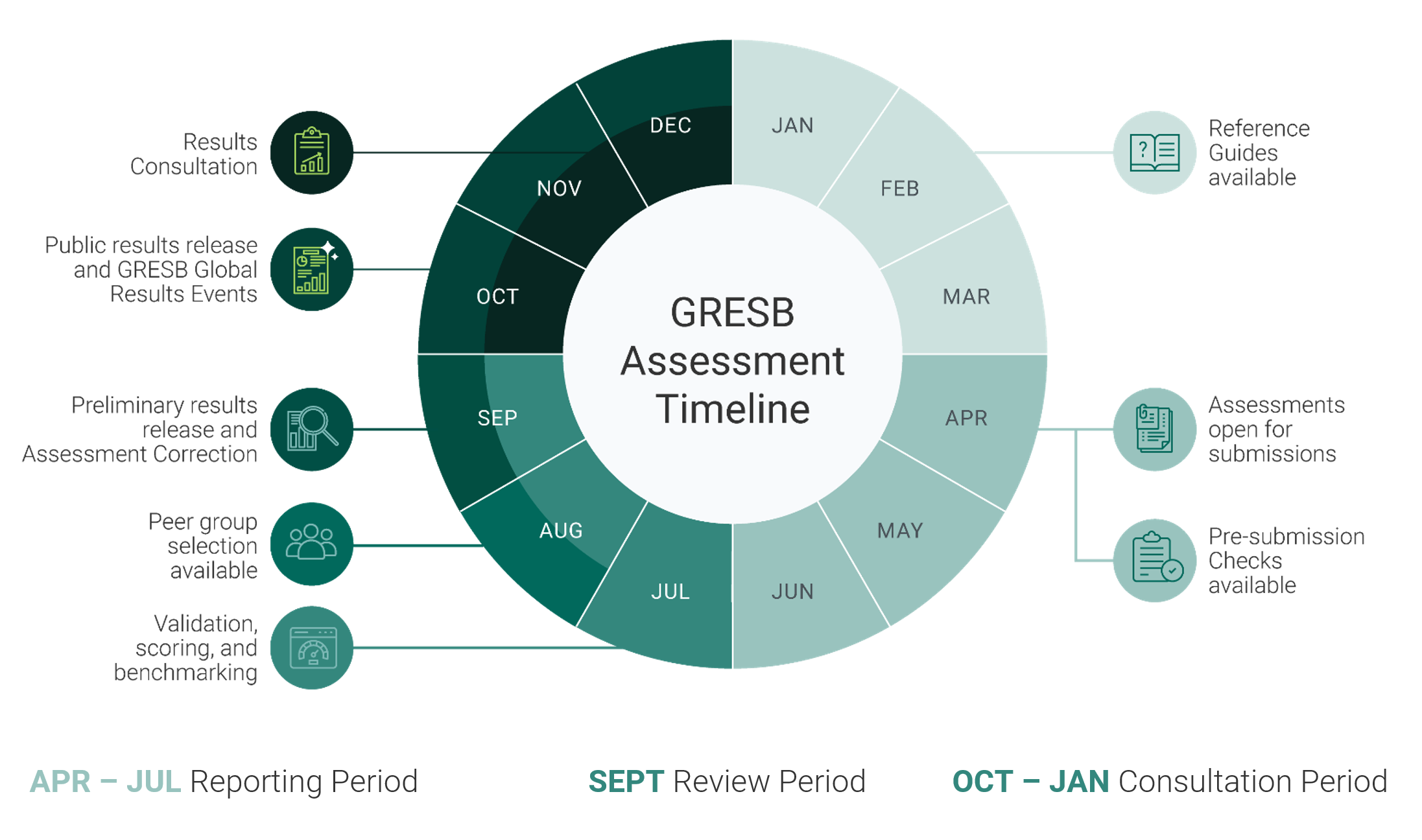

Please keep the following dates in mind after the Portal closes:

- August 1-5: Are you a GRESB Real Estate Participant and would like to customize your peer group? Well, this functionality will soon be available in the Portal. If you choose this option, you will receive two rankings: one with the assigned peer group and one with your customized peer group.

- September 2: Launch of preliminary 2024 GRESB Real Estate and Infrastructure Assessment results.

- September 2-15: The Assessment Correction service available for those that would like to correct any reporting mistakes.

- October 1: Launch of 2024 GRESB Real Estate and Infrastructure Results for Participant and Investor Members. The Results Consultation service will become available shortly thereafter, until January 15, 2025.

Need last-minute guidance? All the steps you need are here. To learn more about what you can expect in the coming weeks and months, please refer to our GRESB Assessment timeline.

GRESB Accredited Professional program

After a successful launch for Partners, the GRESB Accredited Professional (GRESB AP) program is now available to everyone. It is designed to empower professionals with the knowledge and skills needed to excel in sustainability reporting within the real assets industry. Contact us to discuss group pricing.

Open to GRESB Members, Participants, Partners, and individuals seeking to expand their knowledge in sustainability reporting, the GRESB AP credential will equip you with the expertise to understand, report, and manage sustainability data and performance within the GRESB Real Estate Assessment.

Take the GRESB AP exam to qualify for the credential and make sure to renew it annually to keep your knowledge current. The AP certificate is valid for 12 months, and you can start your AP journey here.

Asset Impact Update

GRESB’s Asset Impact team is excited to unveil a new set of advanced asset-based climate analytics and forecasts tailored for asset managers and owners. The analytics delivers detailed absolute emissions, emission intensities and activity data from listed companies across 11 climate-critical sectors over an 11-year time horizon.

Asset managers and owners can leverage this data to set precise sectoral targets in line with NZAOA guidance, comply with regulations like SFDR, manage climate risks, and strategically allocate capital.

Keep an eye out for the launch soon, or contact us at [email protected].

Foundation update

Foundation stakeholder engagement

The GRESB Foundation continues to expand its engagement with GRESB stakeholders. In May, we hosted a social sustainability roundtable at LaSalle’s offices in London. The event gathered market leaders to discuss how to drive improved awareness around social sustainability, the state of the market, and the metrics and tools to manage effective engagement. The discussion included representatives from AINDA Energia, British Land, Hines, Ivanhoe Cambridge, and PSP Investments, as well as many others. If you would like to engage on the topic of social sustainability or receive the slides and full recap of the event, please email [email protected].

2025 Standards workplan

The Real Estate and Infrastructure Standards Committees continue to endorse proposals for changes to the 2025 Standards, which are then brought to the Foundation Board for approval. (For a refresher on the approval process, please revisit the GRESB Foundation 2024 Roadmap.) During its most recent meeting, the Foundation Board approved the first changes to the 2025 Real Estate Standards, which adjust scoring weights for residential real estate portfolios and aim to more accurately reflect indicators that are inapplicable or less/more material to the residential sector.

Standards Development

GRESB has received important feedback about the evolution of the Standards from stakeholders around the world, highlighting a priority on the speed and direction of Standards development. In response, the GRESB Foundation Board has unanimously voted on the development of a plan to guide the 2025 Standards development. The plan will include increased acceleration and more thematic transparency.

Additional details will be shared in the 2025 Roadmap, which will be published in the fall.

Investor update

The quarterly Investor Newsletter will be sent to all investor members in the coming days. The highlights include updates on the standards committees, content, tools, and engagement suggestions relevant to Investor Members. If you are an Investor Member and would like to sign up to receive the investor newsletter or are interested in attending a fall Investor Masterclass in NYC or Toronto, please email [email protected].

GRESB Events

GRESB Inside ESG: Going beyond climate – Biodiversity in focus

Join us on July 2 for a GRESB Inside ESG webinar, “Going Beyond Climate: Biodiversity in Focus,” to explore evolving sustainability metrics and market opportunities beyond traditional climate concerns. This event is crucial for staying ahead in the rapidly changing sustainability landscape.

In collaboration with GRESB Foundation, NextEnergy Capital, and Goldman Sachs AM, the webinar will discuss incorporating biodiversity into investment strategies. Antonina Ivanova (Associate, Infrastructure at GRESB) will introduce biodiversity in the real asset industry. Sarah Welton (Director, GRESB Foundation) will then lead a discussion with Lizzie Adams (VP, Head of ESG for Real Estate Investing Americas at Goldman Sachs AM) and Hing Kin Lee (VP, Nature at NextEnergy Capital), sharing real-world market participant experiences.

Don’t miss this chance to gain valuable insights and engage with experts on the critical intersection of biodiversity and investment.

|

GRESB events on demand All our recent GRESB Inside ESG events are now available on demand. Watch our latest webinars below: |

GRESB Insights

GRESB thought leadership

A couple of thought-provoking articles this month from the GRESB team:

- Brown-to-green strategies can increase capital impact

Did you know that a brown-to-green investment can achieve 30 times greater energy reduction compared to simply making a green asset greener?In their article for PERE, GRESB’s Chief Innovation Officer Chris Pyke and Real Assets Analytics Director Parag Cameron-Rastogi dive into the transformative potential of brown-to-green strategies. Through a compelling thought experiment, they illustrate the differing effects of these investment strategies on capital impact, concluding that capital flowing to brown portfolios in any region would have a much larger impact than a comparable investment in already-green assets.Read more (registration required) here.

- Building certifications: How to impose an expiration date

Green building certifications are crucial for assessing sustainable design and performance in real estate. However, since varying global certification schemes complicate this for investors and asset managers, the GRESB Foundation made building certifications a focal point in the 2023 Standards development process, leading to significant updates in 2024. This acknowledges the enduring relevance of certifications, between those issued recently and those awarded over a decade ago.GRESB’s Alodie McLaren, Senior Associate for Real Estate, outlines the need for this update and the implications of it for our members on reporting requirements.Read the full article here.

The Pulse by GRESB

The Pulse by GRESB is our content series featuring the GRESB team, partners, GRESB Foundation members, and other experts, published on Spotify, LinkedIn, and YouTube. Listen to the latest episodes below:

Under the hood: recent technology improvements to the GRESB user experience

Listen here

Diving into GEM: The methodology behind REAL Benchmarks

Listen hereIndustry Insights

The theme this month was “The S in ESG”, and we received a diverse set of approaches to what is an extremely diverse topic. Access below:

- The price of connection: Residence engagement and social value | Utopi

Social value influences asset values and community well-being, which highlights the need to address resident needs for sustainable communities within ESG frameworks. - The S in ESG | CBRE

Social sustainability, although harder to quantify than carbon emissions, impacts global communities and is essential for creating equitable and healthy communities. - Unpacking social metrics in ESG reporting for real estate: Challenges and solutions for fund managers | Scaler

Amid evolving ESG metrics and increased stakeholder scrutiny on societal impacts, real estate fund managers face distinct challenges in navigating social metrics and overcoming reporting hurdles. - Corporate America’s DEI dilemma: Balancing legal risks and diversity commitment | Verdani Partners

Following the Supreme Court’s decision on race-based affirmative action in college admissions, corporate America is navigating legal complexities while striving to maintain diversity commitments. - Unlocking social impact: The key to affordable rental housing with lease insurance | LeaseLock

Amid high housing costs and financial challenges, rental investors are innovating with deposit replacements to ease renter barriers. - Integrating social value in the life sciences sector: A success story | EVORA Global

The life sciences sector’s increasing focus on social value blends ethical responsibility with investor appeal, enhancing societal impact and setting a benchmark for other industries. - Driving demand: An integrated solution to boost TOD infrastructure and real estate | Nippon Koei

Asia’s rail industry faces high costs and changing user behaviors, stressing the need for digital solutions and careful planning in major projects.

All our GRESB Insights can be found here. If you are interested in contributing, the topic for July is Biodiversity. See our editorial calendar for details.

Upcoming industry events

Improve your Smart Building Ratings by mastering GRESB & NABERS

June 27 | Online

Gain invaluable insights into optimizing your building’s performance, network with peers and industry experts, and learn how to leverage GRESB and NABERS. GRESB’s Member Relations Manager EMEA, Alexander Steel, will be speaking.

Driving Demand: An Integrated Solution to Boost TOD and Real Estate

June 28 | Online

Urbanization and the push for sustainable living have made Transit-Oriented Development (TOD) a key strategy in urban planning. Join us online on June 28 to explore successful models and strategies that foster vibrant, resilient urban communities.

This webinar will delve into how digital infrastructure and innovative solutions can generate demand for public transit, thereby enhancing the effectiveness and sustainability of urban development.

3rd Annual ESG & Decarbonizing Real Estate Forum

July 10-11 | California, USA

Discover what lies ahead for ESG within the real estate sector at IMN’s ESG & Decarbonizing Real Estate Forum. In this third edition in Dana Point, CA, GRESB’s Chris Pyke, Chief Innovation Officer, will be a featured speaker.

The net zero benefits of occupier engagement and how to achieve them

July 10 | Online

In this webinar, find out how addressing Scope 3 through occupier engagement can reap rewards, and the best route to making progress.

Property Resilience, Risk Mitigation, and Insurability

July 18 | Online

Dive into strategies for climate-proofing your assets with Partner Energy, including assessing and mitigating physical and transition risks.

See our events calendar for a full overview of all upcoming events.

What are we reading

- Social impact across the built environment | WGBC

- Less than 30% of companies are ready for upcoming ESG assurance requirements: KPMG survey | ESG Today

- Finalization of three EFRAG ESRS IG documents (EFRAG IG 1 to 3) | EFRAG

- DOE Announces National Definition of a Zero Emissions Building | US Department of Energy

- The EU’s Taxonomy’s update on the ground | European Commission

Sign up for the newsletter

Want more insights from GRESB? Subscribe to our email newsletters here.