What’s new in July

Following the completion of the 2024 GRESB Assessment submissions at the start of the month, we are excited to share the latest updates and insights as we embark on the path towards the GRESB Global Results events in October. This newsletter includes:

- Customize Peer Group functionality available soon

- Infrastructure Standards changes

- Asset Impact product release

- Regional Insights, episodes of the Pulse, and more

For more about what’s going on at GRESB, read below. For any questions, please contact us. (Make sure to whitelist [email protected] in your email settings to continue to receive news and updates from GRESB.)

Customize Peer Group

Are you a GRESB Real Estate Participant who would like to customize your peer group?

Between August 1-15, you will be able to do this directly in the Portal. If you opt for this functionality, your Benchmark Report will feature two rankings: one with the pre-assigned peer group and one with your customized peer group. The comparisons for benchmarking insights will continue to use the pre-assigned groups this year, with plans to switch to customized peer groups in the coming year.

This new functionality follows a successful testing period in which over 700 entities participated, receiving overwhelmingly positive feedback. By customizing your peer group based on location, property type, and legal status, you can align your performance data to better reflect your specific investment realities.

Read more on why we developed this functionality here.

Infrastructure changes

GRESB is making ongoing changes to its Standards (both Real Estate and Infrastructure) on a rolling basis through the end of the year as they are adopted by the GRESB Foundation. These changes will be included in the upcoming edition of the Strategic Roadmap, at which point we will also invite Members to engage with the changes and provide feedback.

To keep you informed, each month these changes will be outlined in the GRESB newsletter. The first changes are in Infrastructure: in data coverage and Scope 2 GHG reporting:

Data coverage

GRESB has added data coverage reporting and scoring across 15 key performance data metrics in the GRESB Infrastructure Asset Standard. In terms of scoring, this equates to 50% of each indicator where data coverage is introduced, across nine performance indicators.

This is a great step forward for Infrastructure and creates yet more scoring differentiation at the asset level, helping drive confidence both in data quality and the comparability of data.

Net Zero: Scope 2 GHG standardized reporting

The GRESB Infrastructure Asset Standard will score reporting of location-based Scope 2 GHG emissions, with the option to also report market-based emissions on a voluntary basis. There is no change to the proportion of score for reporting Scope 2 emissions in the Standards.

This change will significantly improve data comparability and quality for a priority metric while providing more useful immediate insights for investors.

Remember to keep the Strategic Roadmap page bookmarked for reference as changes are published.

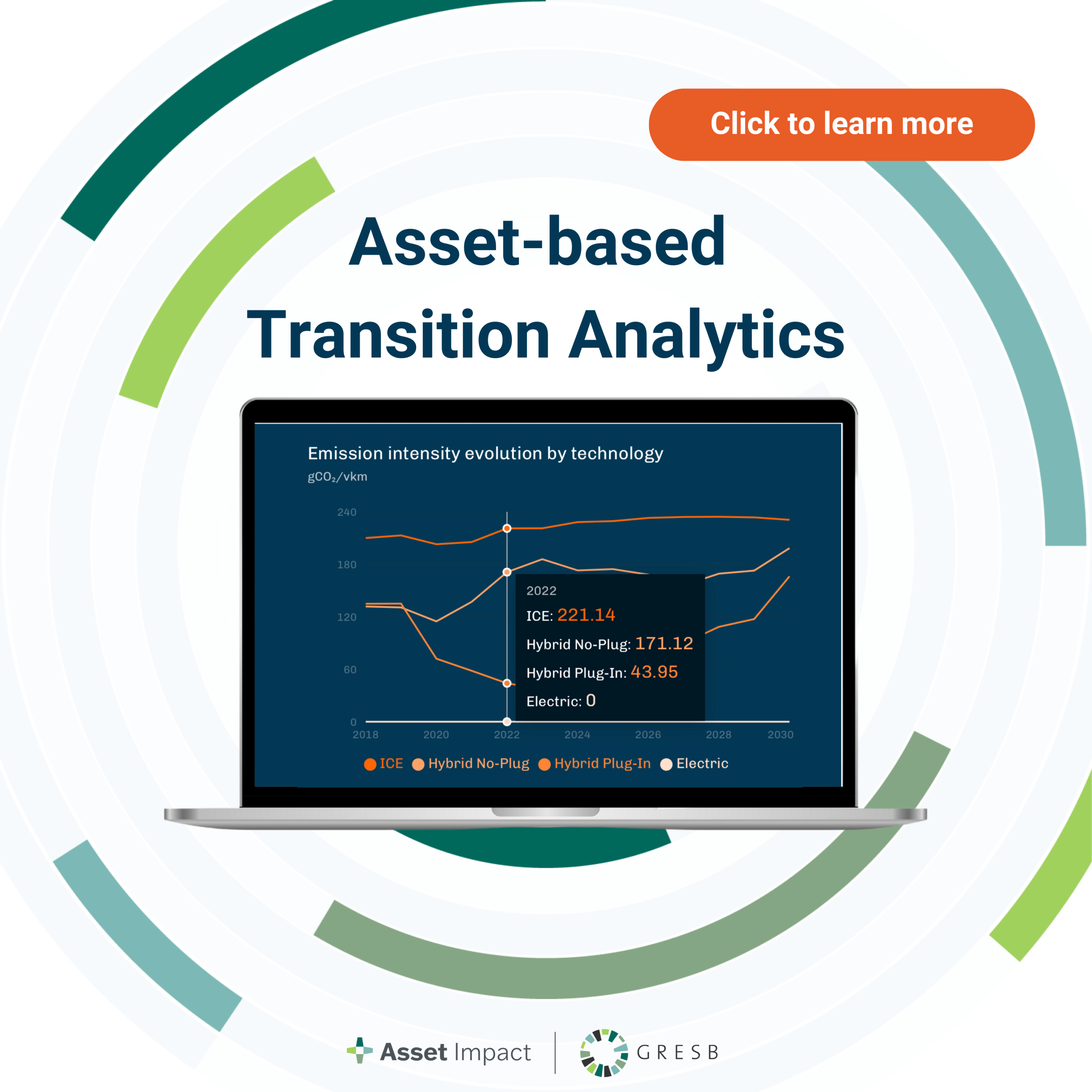

Asset Impact update

Asset Impact’s Transition Analytics

Are you or a colleague managing investments in equity or fixed income portfolios?

Last month Asset Impact – a GRESB product line – released Transition Analytics, a dataset designed specifically to support asset managers and owners focused on public equity and fixed-income portfolios.

The forward-looking company data and production-based metrics enable asset managers and owners to enhance their climate risk strategy, set net-zero sectoral targets, and have more insights to engage companies. This new product is another important step for GRESB, as we expand beyond our traditional real estate and infrastructure offerings.

GRESB’s Asset Impact product line provides financial institutions with detailed, forward-looking activity and emissions analytics for physical assets and companies within 11 climate-critical industries across transport, energy, and heavy manufacturing.

Click here to learn more about the new Transition Analytics or forward it on to your colleague!

Foundation update

Expert Resource Group membership update

The Foundation Board recently approved the addition of 20 new members to the Real Estate and Infrastructure Expert Resource Groups (ERG):

Real Estate: Anggie Rahma Pratiwi (BuildingMinds), Anna Packard (CodeGreen Solutions), Brady Mills (Partner Energy), Emilija Emma (Verco), Francesco Gasperi (Habitech – Distretto Tecnologico Trentino), Jacqueline Hart (International Living Future Institute), Jim Landau (MetLife), Josh Richards (Bridge Industrial), Justyna Tobolska, (Carbon Intelligence), Luc van de Boom (Scaler), Michiel Moll (NN Group), Mitch Seider (PSP), Ridhima Nayyar (RioCan), Stephane Hedont (MoZaiC Asset Management), and Sanjaya Ranasinghe (WiredScore).

Infrastructure: Francesca Pezzoli (Snam), Kirk Stafford (Harbert Management Corporation), Mark Edwards (Gatwick Airport), Miles Wu (State Super) and Mitch Seider (PSP).

Congratulations to all the new members! To see a list of all the current ERG members, please visit the GRESB Foundation page.

Foundation stakeholder engagement

GRESB investor members received their quarterly newsletter at the end of June and one of the pieces of immediate feedback was a request for insight from existing investor members to first year members on how they interpret and respond to their funds’ first GRESB scores.

Please reach out to [email protected] if you would like to receive a copy of the investor member newsletter, offer your insights as an experienced investor member, or need support with interpreting your results.

Standards Development

The GRESB Foundation Board will continue to review several new proposals from the Real Estate and Infrastructure Standards Committees during its July meeting. Once approved, details will be shared on the Foundation page.

TNFD Forum

We’re pleased to announce that GRESB has joined the Taskforce on Nature-related Financial Disclosures (TNFD) Forum, which unites leading institutions to deliver high-quality information to key decision-makers and empowering them to integrate nature-related risks into their risk management strategies.

This move highlights GRESB’s dedication to fostering nature-positive financial decisions worldwide. Read our news release for more details on GRESB’s TNFD membership.

GRESB Accredited Professional Program

Open to GRESB Members, Participants, Partners, and individuals seeking to expand their knowledge in sustainability reporting, the GRESB AP credential will equip you with the expertise to understand, report, and manage sustainability data and performance within the GRESB Real Estate Assessment.

We now have over 100 GRESB APs! Join them by taking the GRESB AP exam to qualify for the credential and renew annually to keep your knowledge current. You can start your AP journey here.

GRESB, Regional, and Industry Insights

GRESB thought leadership: Driving Sustainability Performance Through Asset-Level Data

In his paper “Driving Sustainability Performance Through Asset-Level Data”, Parag Rastogi, Director Real Asset Analytics at GRESB, discusses how relying solely on aggregated portfolio data isn’t enough for decarbonization. He details the importance of individual asset data in making impactful changes and highlights that upgrading high-consumption assets can yield significantly greater energy savings than optimizing already green ones.

This work was developed in collaboration with BuildingMinds as part of their informative whitepaper series on “Resilient Real Estate”. Download the full chapter here and read the Financial Times SustainableViews coverage (paywall) here.

The Pulse by GRESB

The Pulse by GRESB is an informative content series featuring the GRESB team, partners, GRESB Foundation members, and other experts, published on Spotify, LinkedIn, and YouTube. Listen to the latest episodes below:

To peer or not to peer: That is your question

Listen here

Hidden in plain sight: understanding embodied carbon for real estate

Listen hereRegional insights: coming soon!

Every year, GRESB hosts timely events to equip the real assets community with the necessary insights and data to contribute to the creation of a sustainable world. GRESB Regional Insights are live, in-person events that bring together the real assets community to discuss the most pressing issues affecting the market today and highlight leadership in action, best practices across our community, and the regional highlights from the annual GRESB Benchmark.

Co-hosted by GRESB Partners, the Regional Insights Events provide opportunities to engage with industry experts, network with like-minded professionals, and gain valuable knowledge to advance the industry’s sustainability goals. We are proud to co-host this year’s series with our valued partners who help shape the global conversation around the future of responsible investing.

Keep an eye out as we confirm more locations, dates and open registrations for these events!

GRESB Regional Insights events 2024 – GRESB

Industry Insights from our Partners and Members

The theme this month was Biodiversity, and we received a diverse set of approaches to what is an extremely diverse topic:

- Biodiversity Net Gain comes into force – what does it mean for you? | CMS

The UK has implemented Mandatory Biodiversity Net Gain (BNG) provisions to address its biodiversity crisis, requiring new developments to achieve a minimum 10% increase in biodiversity. - The importance of biodiversity data for real estate investors and the role of ESG data platforms | Scaler

Integrating biodiversity considerations in real estate is essential for ecological balance and property resilience, with biodiversity data enhancing market value amid increasing regulatory pressures. - The Real-world Parallel of “The Matrix”: Loss of Biodiversity | Conserve Consultants

Escalating human activities risk irreversible environmental changes, paralleling “The Matrix”, and highlighting the need to integrate biodiversity into financial and business strategies. - Biodiversity and Decarbonization: A Symbiotic Relationship in the Built Environment | CodeGreen Solutions

Nature-based design approaches and materials use are integral factors in the path to decarbonization, and not separate objectives. - Another step towards green transition: EU’s Deforestation Regulation | CMS

With rising global concerns about sustainability, the European Union’s Deforestation Regulation (EUDR) underscores the connection between environmental policy and business strategy.

We also received a pragmatic ESG overview article:

- How to develop an impactful ESG strategy in 5 steps | Catalyst

As regulations tighten, an ESG strategy is crucial for the construction and real estate industry to comply, enhance reputation, attract investment, and ensure sustainable growth.

All our GRESB Insights can be found here. If you are interested in contributing, the topic for August is Sustainable Finance & Energy Transition. See our editorial calendar for details.

GRESB and industry events

Join us at the global event focused on private infrastructure investing!

Anna Olink, Director, Real Estate Engagement EMEA, and David Thomas, Director, Infrastructure, will provide insights on the infrastructure market at the tenth edition of SuperReturn Global Infrastructure this October. This event offers many high-quality sessions on topics including renewables, infrastructure, energy transition, real estate, and more. A unique networking opportunity with 350+ leading players from 30+ countries, including 150+ GPs and 130+ institutional investors.

GRESB events on-demand

All our recent GRESB Inside ESG events are now available on demand at these links:

- GRESB Inside ESG: Going beyond climate – Biodiversity in Focus

- REAL Solutions – Unlocking real value from asset-level data

- How Water Efficiency Drives Environmental Excellence, with HydroPoint and Smartvatten

- Navigating Sustainable Investments with GRESB

- Building Tomorrow: Introducing GRESB’s new Infrastructure Development Asset Assessment

- The Role of Asset-Based Data in Climate Action

- Maximizing the Value of Your Green Building Certificate with GRESB

Industry Events

International Green Build Conference (IGBC 2024) | July 23 | Petaling Jaya, Malaysia

An exciting opportunity to hear from industry leaders, innovators and professionals on advancing sustainable practices in the built environment.

What Ownership Needs: Evolving Sustainability by IREM and CBRE | August 15 | Online

Gain insight on the evolving landscape of sustainability in the real estate industry. The webinar will cover trends in the market, increased demands from investors and how property managers can help owners with sustainability.

IPE Infrastructure & Natural Capital Global Conference & Awards 2024 | September 12-13 | Munich, Germany

Explore the vital role infrastructure plays as a component of institutional portfolios and gain further insight into improving the quality of ESG data management in infrastructure, with GRESB Infrastructure Associate, Fabio Schweinoster Manfroni, attending as a speaker.

Net-zero Investor’s Real Estate Summit | September 25 | London, UK

Hear from GRESB’s Director of Real Estate, Charles Van Thiel, uncover long-term strategies and pathways to achieving net zero. This event is designed for asset owners or those with an interest in real estate investment.

3rd Annual ESG Real Estate and Data Management Forum| September 26-27 | Stockholm, Sweden

We invite you to join Anna Olink, GRESB’s Business Development Director of Real Estate for EMEA, leading a panel that on environmental sustainability and financial strategy, and the integration of biodiversity considerations into de-carbonization efforts.

2nd Annual GRESB Americas Institutional Investor Forum 2024| October 1 | New York, USA

We are thrilled to partner again with the Real Estate Limited Partner Institute (RELPI) to gain insight into best practices in sustainability and pushing industry change. Open to GRESB and RELPI members, as well as qualified individuals and organizations.

Morningstar Sustainable Investing Summit 2024 | November 7-8 | Amsterdam, Netherlands

A platform for investors, academics, politicians, and experts in sustainability to share their knowledge on ESG investing, climate finance, corporate governance, human rights, data privacy, biodiversity, and much more.

See our events calendar for a full overview of all upcoming events.

Careers

GRESB is growing and looking for new people! Please feel free to share with your network.

Our most recently added open positions:

- Senior Product Manager | Amsterdam / Berlin / Paris / London

- Director, Infrastructure – Product | Amsterdam

- M&A and Special Projects Internship | Amsterdam / Paris

- Working Student – Finance and Business Support | Amsterdam

What are we reading

- ISSB delivers further harmonisation of the sustainability disclosure landscape as it embarks on new work plan | IFRS

- Infrastructure plus pragmatism is the recipe for G7 growth | Financial Times

- Denmark Becomes First-Ever to Impose CO2 Emissions Tax on Agriculture | ESG News

- Dutch pension fund sets up new member-engaging approach on sustainability | IPE

- BlackRock, Google solar tie-up to power Taiwanese data centres | Infrastructure Investor

Sign up for the newsletter

Want more insights from GRESB? Subscribe to our email newsletter.