Sponsoring Partner: EVORA GLOBAL

Greetings to our GRESB Americas community

Hello GRESB Americas region!

The new year has started like a rocket for GRESB with a slate of new services and programs already launched or set to debut soon! In addition to our ongoing annual progress in real estate and infrastructure assessments, we have exciting innovations planned for the year. Please take the time to read this newsletter carefully and share it with others at your organization—there is a lot of innovation and updates to stay on top of and we do our best to cover it here.

Like all of you, we are hard at work preparing for the launch of the 2024 GRESB Assessments on April 1. The 2024 Standards have been updated, reference guides have been released, and all of the behind-the-scenes development work is undergoing final tests. We are very confident this is going to be yet another great GRESB reporting period.

We encourage all members to complete any GRESB-related administrative tasks well before the assessment open on April 1. These tasks include:

- Finalizing any new or renewal Membership agreements

- Registering your funds and assets in the GRESB Portal

- Updating the authorized users on your GRESB account

- Confirming any new funds or assets to be submitted this year

Completing these administrative tasks in advance reduces the potential for confusion or surprises when it is time to submit your assessment responses.

Please reach out to your GRESB representative to review your plans for this year and make sure everything is set up for your success. The GRESB Americas team is here and ready to support you during this busy time.

As always, thank you for your continued support of GRESB and the advancement of sustainability and efficiency across real assets.

Regards,

Tom Idzal

GRESB Head of Americas

Navigating sustainable financing in the US real estate debt market with EVORA

In its latest white paper, “Navigating Sustainable Financing in the US Real Estate Debt Market,” GRESB Global Partner EVORA Global explores the growth of sustainable debt in real estate, comparing how equity and debt investments approach sustainability.

The article delves into the driving forces behind the rise of sustainability in the US real estate debt market, including reducing carbon, adapting to regulations, managing reputation, and effective risk management.

Practical advice on how to enhance real estate sustainability is provided through EVORA’s CRE8 Sustainability Principles. These principles guide you through the importance of establishing a strong structure, following standards, integrating sustainability into decision-making, using the right tools, staying engaged, ensuring necessary disclosures, constantly evaluating progress, and seeking expertise.

Read the full article here to elevate your understanding and practice of sustainable financing with EVORA’s latest insights and CRE8 Sustainability Principles.

2024 Standards & Reference guides

GRESB’s 2024 Real Estate and Infrastructure Standards & Reference Guides are now available. These resources will help you prepare for the 2024 GRESB Assessments and get familiar with the changes introduced this year. Please see the documents below, including a new Standard and Reference Guide for our newly launched GRESB Infrastructure Development Asset Assessment:

- Real Estate Standard & Reference Guide

- Infrastructure Fund Standard & Reference Guide

- Infrastructure Asset Standard & Reference Guide

- Infrastructure Development Asset Standard & Reference Guide

Make sure to also check out our updated “How to prepare for a successful reporting period” guide for a quick walkthrough of the key steps to take in preparation for the 2024 Assessments.

GRESB’s Carbon Footprint Dashboard

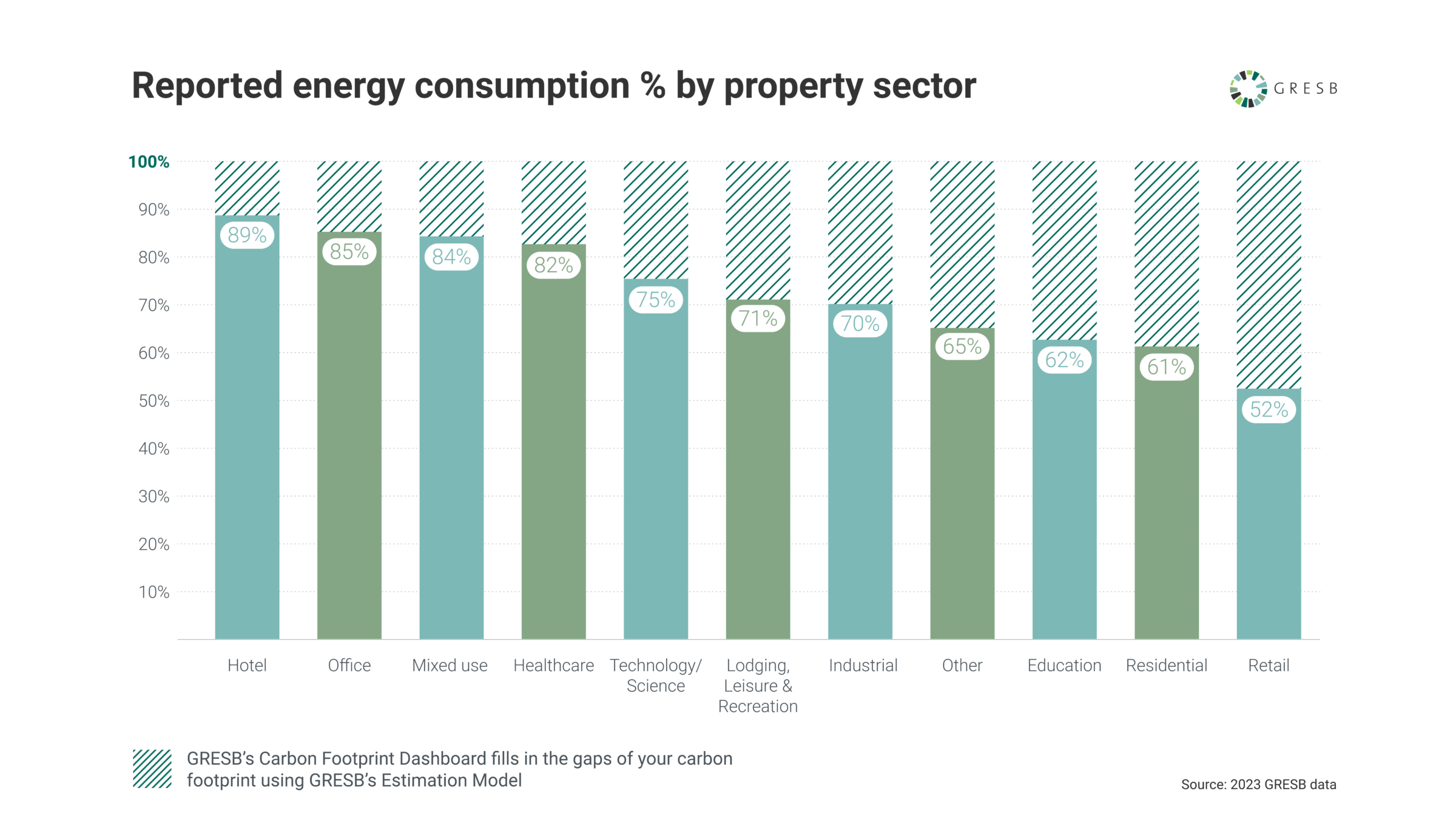

Powered by asset-level data, GRESB’s newly launched Carbon Footprint Dashboard offers real estate investors a comprehensive view of the energy usage and GHG emissions within their portfolios, enabling them to make informed decisions that benefit both their investments and the planet.

This interactive tool allows investors to visualize and analyze data on a country and property sector basis, filling in any data gaps through GRESB’s industry-leading estimation model. By estimating energy usage and GHG emissions based on real-world data provided to GRESB, the Carbon Footprint Dashboard ensures that real estate investors have complete data coverage and a holistic view of their portfolio’s environmental impact.

Learn more about the Carbon Footprint Dashboard and watch a demo here.

GRESB Americas events

For investors: Navigating Sustainable Investments with GRESB

Join us on February 29 at 10 am EST to gain a deeper understanding of how you can benefit from GRESB as an investor member and explore the latest advancements in sustainable investing.

During the webinar, we will cover key updates and improvements that were rolled out for GRESB’s investor members in recent months, including the recently released Carbon Footprint Dashboard.

For first-time participants: Top 5 Reasons to Join GRESB in 2024

Undecided about GRESB in 2024? Tune in for our brand-new, on-demand webinar: “Top 5 reasons to join GRESB in 2024”!

Designed specifically for organizations new to GRESB in the Americas region, this webinar will discuss what you can expect in your first year of reporting and share programs for first-time GRESB participants that make getting started easier.

Elena Daniel, Senior Vice President and Head of Environmental, Social and Governance at Logistics Property Company, will share her experience as a first-year participant, diving into lessons learned and sharing key advice for those getting ready to participate this year.

The webinar is available on demand. Watch it now.

ICYMI: Introducing the GRESB Infrastructure Development Asset Assessment

GRESB recently hosted a webinar introducing the brand-new GRESB Infrastructure Development Asset Assessment. Launching in April 2024, the Assessment will provide companies with assets in construction or pre-construction with a way to accurately reflect their overall sustainability efforts using dynamic materiality.

The webinar delves into the specifics of the new assessment, explaining how it fits within the wider GRESB Infrastructure Assessments and diving into its customized methodology and approach to materiality. The event also features Sabine Chalopin, Head of ESG, Sustainable Infrastructure at Denham, a GRESB participant gearing up for the 2024 development assessment, sharing firsthand insights into the challenges and opportunities of ESG during the development phase.

You can now watch a recording of the webinar by signing up here.

Introducing The Pulse by GRESB

The Pulse by GRESB is our new interview series where we discuss the newest and most topical issues in sustainable real assets — from GRESB and ESG to the wider industry

Episode 1: What’s up with residential real estate?

For our first episode, we are bringing you a conversation featuring Tyler Guthrie, Director of Communications, and Charles van Thiel, Director of Real Estate. The two chat about what’s new in residential real estate, the positioning of the industry within the GRESB Benchmark, changes coming around the corner, and much more.

Watch the first episode on YouTube and find out more about The Pulse by GRESB on our website.

New GRESB Americas Partners

We would like to extend a warm welcome to our new GRESB Americas Partners:

- Assembly OSM | Partner

- Brightly | Premier Data Partner

- Constellation | Premier Partner

Upcoming Americas events

Responsible Investment Forum 2024 — New York | PEI

February 20-21, 2024 | New York, NY

Advocacy Impact Day + ESG Summit | IREM

February 27-28, 2024 | Washington, DC

Decarb DC 2024 | Building Innovation Hub

February 29, 2024 | Tysons Corner, VA

NAREIM Sustainability 2024 | NAREIM

March 5-6, 2024 | Atlanta, GA (NAREIM members only)

PREA 2024 Spring Conference | PREA

March 21-22, 2024 | Nashville, TN

Women in Private Markets Summit North America 2024 | PEI

May 15-16, 2024 | New York, NY

Top of mind

Navigating a changing market | GRESB

Global Risks Report 2024 | World Economic Forum

Seven Sustainability Trends to Watch in 2024 | MIT Sloan Management Review

U.K. pension funds may consider climate change | Pensions & Investments

ESG Insights: 10 Things That Should Be Top of Mind in 2024 | Harvard Law School Forum on Corporate Governance

Thanks to our Global Partner, EVORA Global, for sponsoring and contributing to this newsletter.