What’s new in December

As we approach the end of 2024, we are excited to share some very important updates, releases, and upcoming events, including:

- 2025 GRESB Standards updates & live webinars

- 2025 GRESB Foundation Roadmap

- GRESB product & tools updates

- New GRESB QuickStart service

This is also the time of year we turn to our participants for their valuable feedback via our GRESB Participant Survey. Scroll down to learn more about these updates and how you can provide your feedback.

Lastly, we want to take a moment to express our gratitude to GRESB Investor Members, Participants, Partners, and the wider real assets community. Thank you for your collaboration, insights, and dedication to driving sustainability forward.

We wish you a joyous holiday season and a successful start to the new year. We look forward to continuing our journey together in 2025 and beyond.

2025 GRESB Standards updates & webinars

In November, GRESB announced the release of its 2025 Standards updates. Driven by the GRESB Foundation, these updates to the GRESB Real Estate and Infrastructure Standards maintain the direction of travel established by the Foundation Board while reflecting the Foundation’s commitment to the evolving needs of the industry and lessons learned from 2024. Read the detailed updates to the 2025 GRESB Real Estate & Infrastructure Standards here.

The Road Ahead: GRESB’s Commitment for the Future

We also hosted two live webinars and Q&A sessions on November 21 (EMEA & Americas) and December 5 (APAC) to share more about GRESB’s commitment to a transparent and predictable standards development process and to provide more context on the 2025 GRESB Real Estate Standard updates.

Watch a recording here and access answers to the questions submitted by attendees during the Q&A here.

The Next Chapter in GRESB Infrastructure: 2025 Standards Updates

Join us online on January 15 for a webinar that explores the 2025 updates to the GRESB Infrastructure Standards and their significance for the sustainability performance of infrastructure assets and portfolios. This session will provide infrastructure participants with a comprehensive overview of key trends, regulatory challenges, and the evolving landscape of sustainable infrastructure investments.

Register now to secure your spot. If you can’t join live, register to receive the on-demand recording after January 15.

Foundation update

2025 GRESB Foundation Roadmap & Standards

The GRESB Foundation has released its much-awaited 2025 GRESB Foundation Roadmap. Now in its second edition, the Roadmap outlines future priorities for the Standards, addressing both near- and long-term goals, and detailing changes to the 2025 Real Estate and Infrastructure Standards.

Nareit Leader in the Light winners

Since 2012, Nareit has awarded REITs across several property sectors a Leader in the Light Award based on their GRESB Real Estate Assessments, as well as a supplemental submission evaluating their organizational strategies and performance. These awards are given to REITs that demonstrate leadership in implementing sustainable and socially responsible investment and operating practices, good governance, and transparency. The 2024 Leader in the Light Award winners are:

- Data Centers: Digital Realty

- Diversified: JBG SMITH

- Health Care: Ventas, Inc.

- Industrial: Prologis, Inc.

- Lodging/Resorts: DiamondRock Hospitality Company

- Office: BXP

- Residential: Equity Residential

- Retail: Kimco Realty Corporation

- Self-Storage: Public Storage

- Public Non-Listed REIT: JLL Income Property Trust, Inc.

Foundation Board and Standards Committees application update

The Foundation is grateful to have received so many applications to join the Foundation Board, Real Estate and Infrastructure Standards Committees, and Expert Resource Groups. The Board is currently reviewing all the applications and will announce the new members early next year. The Foundation will continue to accept applications to join the Foundation Board, Real Estate and Infrastructure Standards Committees, as well as the Expert Resource Groups on a rolling basis.

GRESB product & tool updates

The last two months have seen the release of many product and tool updates. Please see a list of products recently updated with 2024 GRESB data below:

- Portfolio Analysis Tool

- Data Exporter

- Transition Risk Report

- Asset Analytics tab

- TCFD Alignment Report

- Carbon Footprint Dashboard

2024 Public Disclosure results are also available in the GRESB Portal.

GRESB QuickStart

Mark your calendar: This January, GRESB is launching QuickStart, a tailored assessment service designed to help first-time participants quickly get acquainted with the assessment process. QuickStart offers a comprehensive introduction to GRESB’s resources and procedures, ensuring participants are well-equipped for a smooth and efficient reporting period.

As part of the program, participants will receive one-on-one demonstrations of key tools including the Real Estate Assessment Spreadsheet or the Infrastructure Materiality & Scoring Tool, depending on the selected assessment. Additionally, they’ll get dedicated support and the opportunity to discuss best practices and receive tailored tips through one-on-one conversations with GRESB experts. Participants will be able to ask their most pressing questions and receive insights specific to their needs.

QuickStart is an excellent opportunity for new participants to confidently engage with GRESB and optimize their reporting process. For more information, visit this page or contact the GRESB Member Success team.

Participant survey

Please take a moment to participate in our 2024 GRESB Participant Survey. Your insights and feedback are crucial in helping us enhance our services and drive sustainability improvements across the industry.

GRESB events

Trends in Investing in Sustainable Infrastructure in Emerging Markets

Investment in sustainable infrastructure is a cornerstone of global sustainable development, driving the energy transition, fostering climate resilience, spurring economic growth, and improving quality of life. Emerging markets are uniquely positioned to play a pivotal role in this transformation, stewarding significant natural capital, minerals for the energy transition, and a growing, dynamic workforce.

Join us online on January 23 and February 6 for two regional webinars that will explore the economic, sustainable development, and investment cases for mobilizing capital into infrastructure in emerging and developing economies. Sign up below:

- EMEA & Americas session: January 23, 2025 | 10:00 AM EST | 4:00 PM CET

- APAC session: February 6, 2025 | 7:00 AM SGT | 10:00 AM AEDT

GRESB events in review

2024 has been yet another incredibly productive year at GRESB marked by a series of insightful events, both in person and online, analyzing the latest trends in sustainability across regions and markets from this year’s results and bringing real asset stakeholders together for knowledge sharing and meaningful discussions.

See our 2024 results events in review.

Did you miss our global event? Check out the key takeaways or watch the recording at your convenience.

All our recent GRESB Inside ESG events are now available on demand here.

Building certifications criteria

After a public consultation period that lasted four months and included more than 100 organizations, GRESB has released the revised evaluation criteria for building certification schemes. The changes aim to improve the quality of the schemes recognized within the GRESB Standard.

Learn more about the revised building certification evaluation criteria here.

Results Consultation

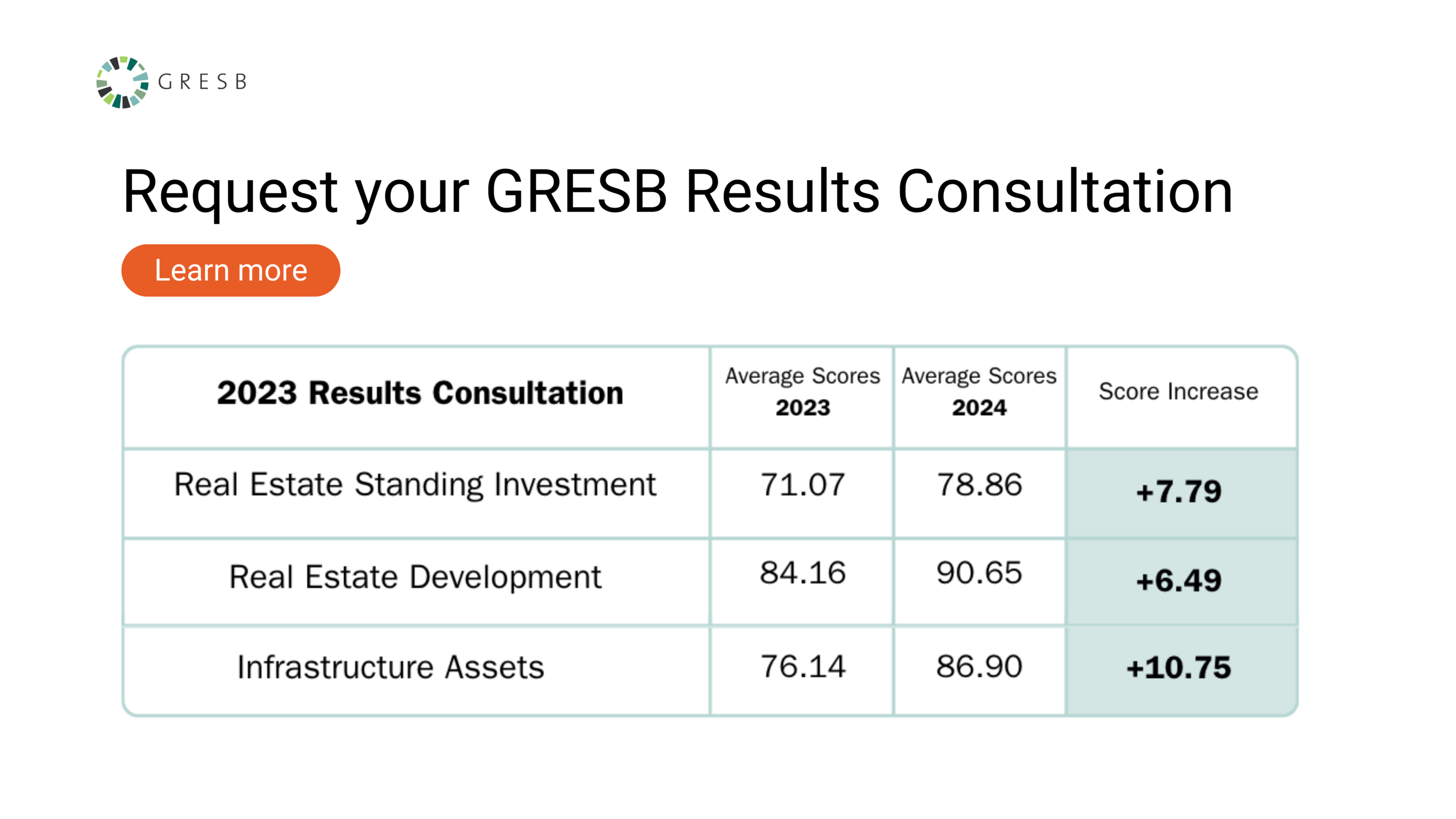

Questions about your GRESB Benchmark Report? The GRESB Results Consultation is available through January 15, 2025.

In 2024, organizations that used the GRESB Results Consultation service increased their GRESB scores by 6.5–10.8 points on average. This service is designed to help participants identify and prioritize focus areas that will make the biggest impact on their GRESB Score and sustainability goals.

In a recent episode of The Pulse, our Chief Customer Success Officer Mathilde Petriat and Sustainability Director at QuadReal Property Group Nisha Agrawal explain how the Results Consultation supports organizations in understanding their scores and advancing their ESG programs effectively.

“Through the program, organizations can clearly figure out and understand where to focus efforts and what initiatives they should implement or drive forward more in order for their ESG programs to have the greatest amount of impact, and how that’s then going to impact their expected GRESB results.” – Nisha Agrawal

Participants who make use of a Results Consultation this year will have the opportunity to book a 1-hour discussion with the GRESB Member Success Team in Q1 2025 to discuss the 2025 Standards updates in more detail.

Learn more about the Results Consultation and request yours in the GRESB Portal.

The influence of ESG on real estate fund performance in APAC

ANREV and GRESB recently published “The Influence of ESG on Asia Pacific Real Estate Fund Performance.” With over a decade of GRESB data, this study provides valuable insights into the relationship between ESG integration and non-listed real estate fund performance in the Asia-Pacific region.

Among its findings, the report uncovers a positive relationship between high GRESB Management and Governance Scores and fund returns. Funds that allocate resources and implement effective policies to achieve strong management and governance demonstrate robust organizational control, which, in turn, serves as a reliable indicator of fund success and sustained performance.

Read key takeaways and access the report here.

GRESB & industry insights

The Pulse by GRESB

The Pulse by GRESB is an informative content series featuring the GRESB team, Partners, GRESB Foundation Members, and other experts, published on Spotify, Apple Podcasts, and YouTube. Listen to the latest episodes below:

The GRESB Standards part 1: How they evolve and what’s in store for 2025

In our two-part series on the evolving GRESB Standards for 2025 and beyond, our speakers provide critical insights to help you prepare for the upcoming reporting year. Discover the key updates shaping the future of the GRESB Standards.

The GRESB Standards part 2: How they evolve and what’s in store for 2025

The conversation on updates to the GRESB Standards continues in part two with a deep dive into the key impacts on scores for 2025 infrastructure participants, along with an exploration of the strategic evolution of the standards beyond 2025.

Industry insights

Industry insights from GRESB:

- What is embodied carbon in the real estate sector and why does it matter? GRESB’s in-house embodied carbon expert and Real Estate Senior Associate Victor Fonseca breaks down the complexities of embodied carbon and shares key insights from the 2024 GRESB Real Estate Benchmark.

- Net-zero targets for infrastructure assets: starting with transparency

GRESB’s Erik Landry, Director, Climate Change, highlights key challenges in setting net-zero targets for infrastructure assets, including defining Scope 3 emissions, choosing metrics, balancing ambition with feasibility, setting clear timeframes, and ensuring transparency around offsets. - Insights from the GRESB & IWBI Social Sustainability Roundtable series

Chris Pyke, Chief Innovation Officer at GRESB, and Kelly Worden, MPH, VP of ESG and Social Sustainability at IWBI, uncover the top insights from the GRESB & IWBI Social Sustainability Roundtable series hosted in New York, Sydney, and London.

Industry insights from GRESB Members & Partners

Insights into embodied carbon, reflections on 2024, and other rolling topics:

- Confronting embodied carbon’s data problem: How do we know where we stand? | Assembly OSM

Reducing embodied carbon is essential for sustainable development in real estate, but inconsistent data and standards across the industry hinder progress despite the urgency of its climate impact. - The rise of sustainable building ordinances: benchmarking, audits and retro-commissioning, and building performance standards | Verdani Partners

As climate challenges intensify, U.S. cities are advancing sustainability through stronger regulations. - Embodied carbon in focus: navigating investor and industry expectations | Sodali & Co.

Investor demand, regulatory changes, and industry standards are increasingly pressuring real estate companies to measure, report, and reduce embodied carbon, especially as operational emissions decline through energy efficiency. - Establishing an embodied carbon strategy in the EU market | SuReal

To tackle embodied carbon effectively, companies must adopt transparent Life Cycle Assessments (LCAs), set ambitious reduction targets, and create actionable plans that prioritize material improvements and circular economy principles. - Thinking outside the (operational) box: the missing piece of embodied carbon | CodeGreen

Embodied carbon is a critical focus for reducing the built environment’s emissions, demanding innovative strategies and collaborative action. - Decarbonizing commercial real estate portfolios in the U.S.: a practical guide | Partner Energy

Adopting a methodical approach when decarbonizing commercial real estate (CRE) portfolios positions portfolio owners to navigate regulatory changes, technological advances, and market expectations successfully. - What 2024 can teach us to improve 2025 | Cundall

The article explores trends from GRESB’s 2024 public results data, such as progress on the embodied carbon front and the uptake of climate risk assessments, and highlights opportunities for both positive environmental impact and score improvements. - Community solar is the fastest growing segment of the US solar market. Is it right for your properties? | Lumen Energy

Community solar democratizes access to solar power, offering financial savings, reducing carbon emissions, and contributing to a more resilient electric grid.

Interested in contributing? Check out the 2025 GRESB editorial calendar for fixed monthly topics and submission guidelines. The topic for January is asset-level performance and insights.

Americas & Oceania newsletters

The Q4 editions of the GRESB Quarterly, Americas and GRESB Quarterly, Oceania newsletters were released in November and December, respectively, wrapping up another year of tailored regional insights for GRESB Members.

The latest edition of the Americas newsletter was supported by GRESB Global Partner Conservice who contributed a timely four-step guide to tackling the climate risk puzzle. Want the Americas newsletter in your inbox? Sign up here.

The latest edition of the Oceania newsletter featured a welcome message from our new GRESB Head of APAC Steven Pringle, insightful takeaways from our Oceania events, and updates to keep you informed on everything real assets in the region. Read it in full and sign up here.

Upcoming industry events

3rd Annual ESG & Decarbonizing Real Estate Winter Forum

February 4-5 | Nashville

A must-attend event for sustainability leaders in real estate investment, IMN’s ESG Forum attracts the top names and biggest players in in the industry to discuss what lies ahead for sustainability in real estate. Use the code GRESB for a 15% discount.

Infrastructure Investor Global Summit 2025

March 17-20 | Berlin

The Infrastructure Investor Global Summit unites leaders shaping global infrastructure. Over four days, gain expert insights, tackle industry challenges, and refine winning strategies. GRESB’s Joss Blamire, Director of Infrastructure Standards, will be speaking.

TRANSFORM

March 18-20 | Sydney

The Green Building Council of Australia’s 7th annual TRANSFORM conference is the industry-leading event at the forefront of the sustainable built environment. TRANSFORM creates the space for industries to come together, collaborate, and develop the solutions that will create meaningful change at scale.

Enhancing Property Value Through Building Optimization | January 30 | London

Discover how industry leaders optimize building performance through data-driven decarbonization. GRESB’s Alex Steel, Manager, Member Relations, EMEA, will be speaking.

Careers

GRESB is growing and looking for new people! Please feel free to share with your network.

Our most recently added open positions:

- Business Development Manager, EMEA | Paris / London

- Director, Infrastructure – Product | Amsterdam

- ESG Manager | Amsterdam

- Marketing, Communications & Events Interns | Amsterdam

What are we reading

- There is abundant value embedded in low-carbon transition plans | PERE

- Real estate insurance: Climate change gets expensive | IPE Real Assets

- Transport infrastructure’s resilience problem | Infrastructure Investor

- Taking the pulse of ESG | IREI

- GIC moves climate risk up the real estate priority list | PERE

- Climate risk drives up property insurance prices, impacting commercial real estate | Reinsurance News

- ESG has a branding problem. Here’s how pension funds, money managers are adapting. | Pensions & Investments

Sign up for the newsletter

Want more insights from GRESB? Subscribe to our email newsletter.