Amsterdam, November 18, 2022: GRESB has launched a new SFDR Reporting Solution for infrastructure, designed to help managers with Article 8 or Article 9 funds meet the most arduous part of the new regulation – reporting on product- and entity-level ESG practices. This new offering complements the SFDR Reporting Solution for real estate, which was released in July.

SFDR Reporting Solution

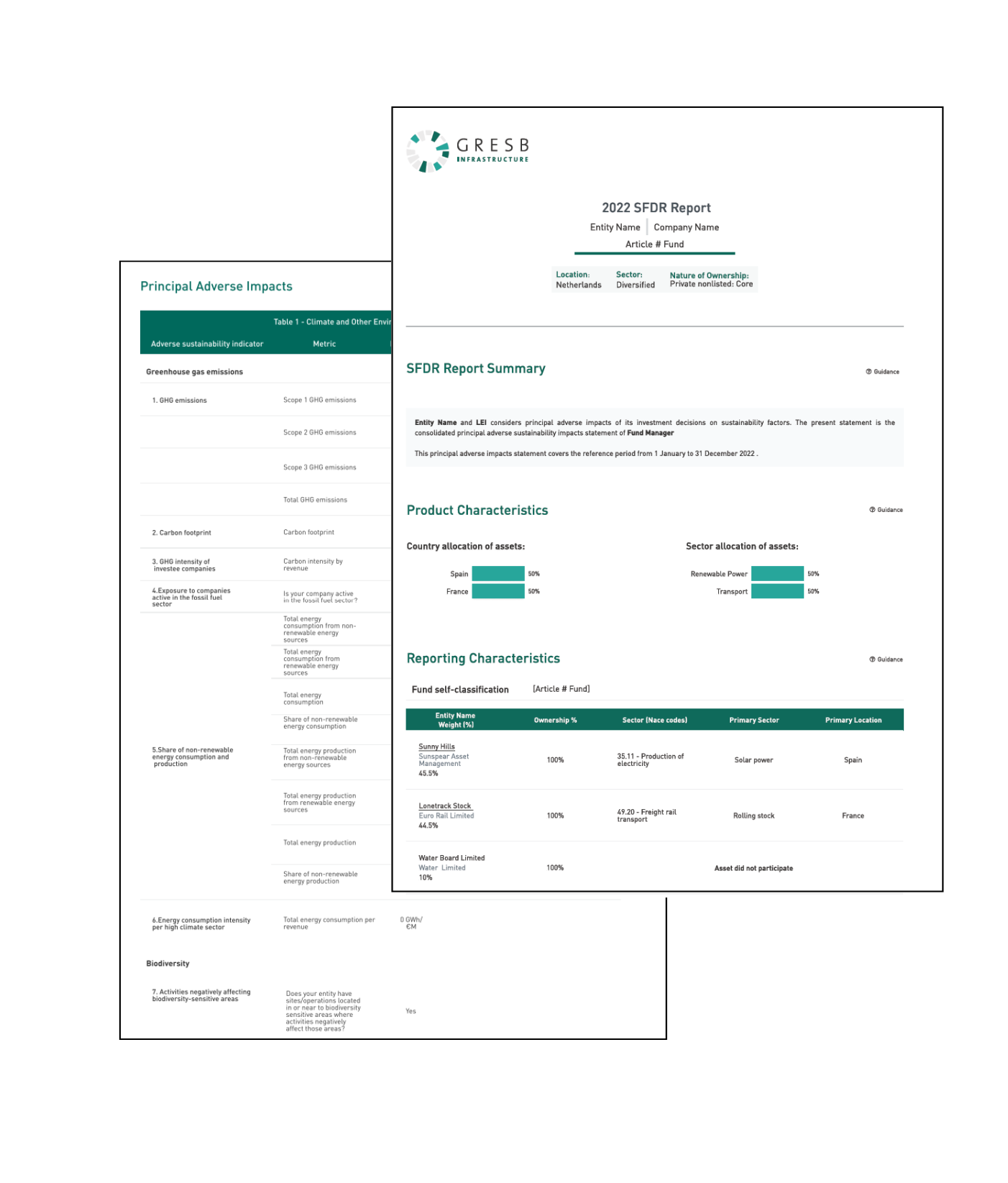

The SFDR Reporting Solution provides a report that includes all the information needed for a fund manager to inform a Principal Adverse Impact Statement, a core requirement under SFDR. The report – which will be made available following the completion of the new SFDR Assessment for infrastructure – highlights a fund’s:

- Overall product characteristics and environmental and social impacts, as defined by SFDR

- Aggregated performance based on asset-level reporting for each of the Principal Adverse Impact Indicators

The SFDR Reporting Solution maintains the fund-asset link connection for existing GRESB participants and leverages the GRESB infrastructure methodology to provide a standardized approach to SFDR reporting. The final report can also be generated as many times as needed without an additional fee by editing the SFDR assessment.

GRESB is offering the SFDR Reporting Solution for infrastructure at a discounted price in 2022 to provide fund managers with the unique opportunity to prepare for SFDR early by identifying data gaps and assessing portfolios’ current Principle Adverse Impacts before reporting becomes mandatory in 2023.

Product availability

The SFDR Assessment for infrastructure is now accessible in the GRESB Portal.