Climate-related reporting products leverage existing GRESB Assessment data to provide powerful insights for real estate and infrastructure asset managers without additional reporting burdens

Amsterdam, May 16, 2022: GRESB – the global ESG benchmark for real estate and infrastructure investments – has launched two new products to help asset managers get ahead of emerging sustainability-related business challenges, with one focused on net zero alignment and the other TCFD requirements.

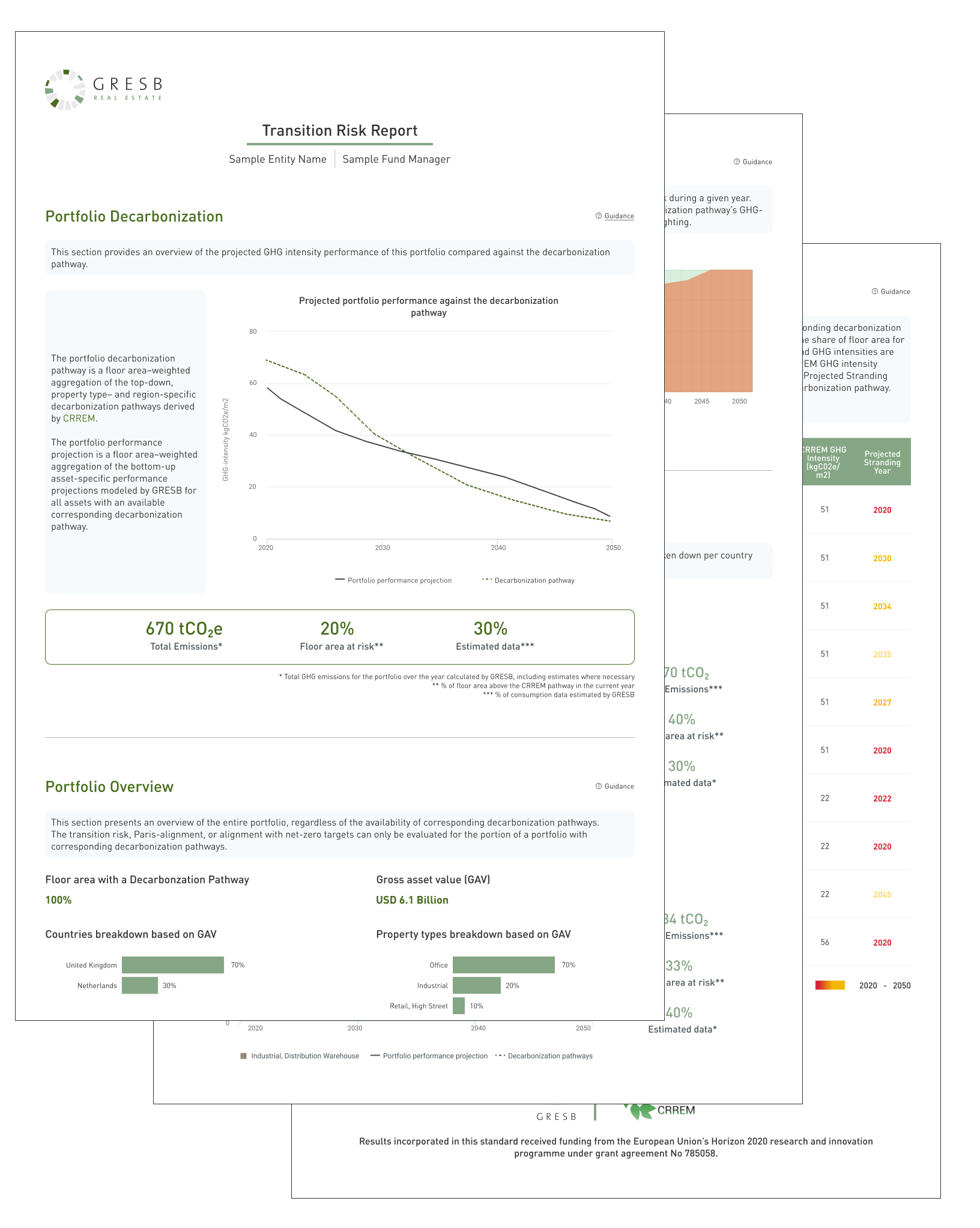

Transition Risk Report

The first new product is the GRESB Transition Risk Report, which shows real estate portfolio managers which of their assets are most exposed to climate-related transition risk and how this may affect their portfolio over time, at both a country and global level.

The report draws on asset data already provided through the annual GRESB Real Estate Assessment, benchmarking the data against CRREM’s science-based decarbonization pathways. Where needed, the report also makes use of GRESB’s Asset Estimation Model to provide portfolio managers with highly accurate estimations of GHG emissions. The resulting insights allow asset managers to:

- Analyze their portfolio’s overall transition risk exposure

- See where transition risk is concentrated within a given portfolio

- Prioritize decarbonization efforts at the asset level

“Today, 25 percent of global real estate is already facing transition risk,” said Sebastien Roussotte, CEO of GRESB. “As this number rises each year and portfolios are placed under increasing pressure to decarbonize, it’s vital that asset managers have the tools and insights necessary to navigate these risks and to take appropriate action. Because these reports are generated from data already provided through the assessment, there is no need for additional data collection efforts.”

In the real estate sector, the most prominent transition risks relate to policy and regulatory changes stemming from government efforts to meet regional goals established by the Paris Agreement. Assets with excessive transition risk have high GHG emissions compared to local net zero pathways, which may result in the assets being unable to meet future regulatory requirements.

To learn more about the Transition Risk Report or to schedule a demo, please visit: gresb.com/transition

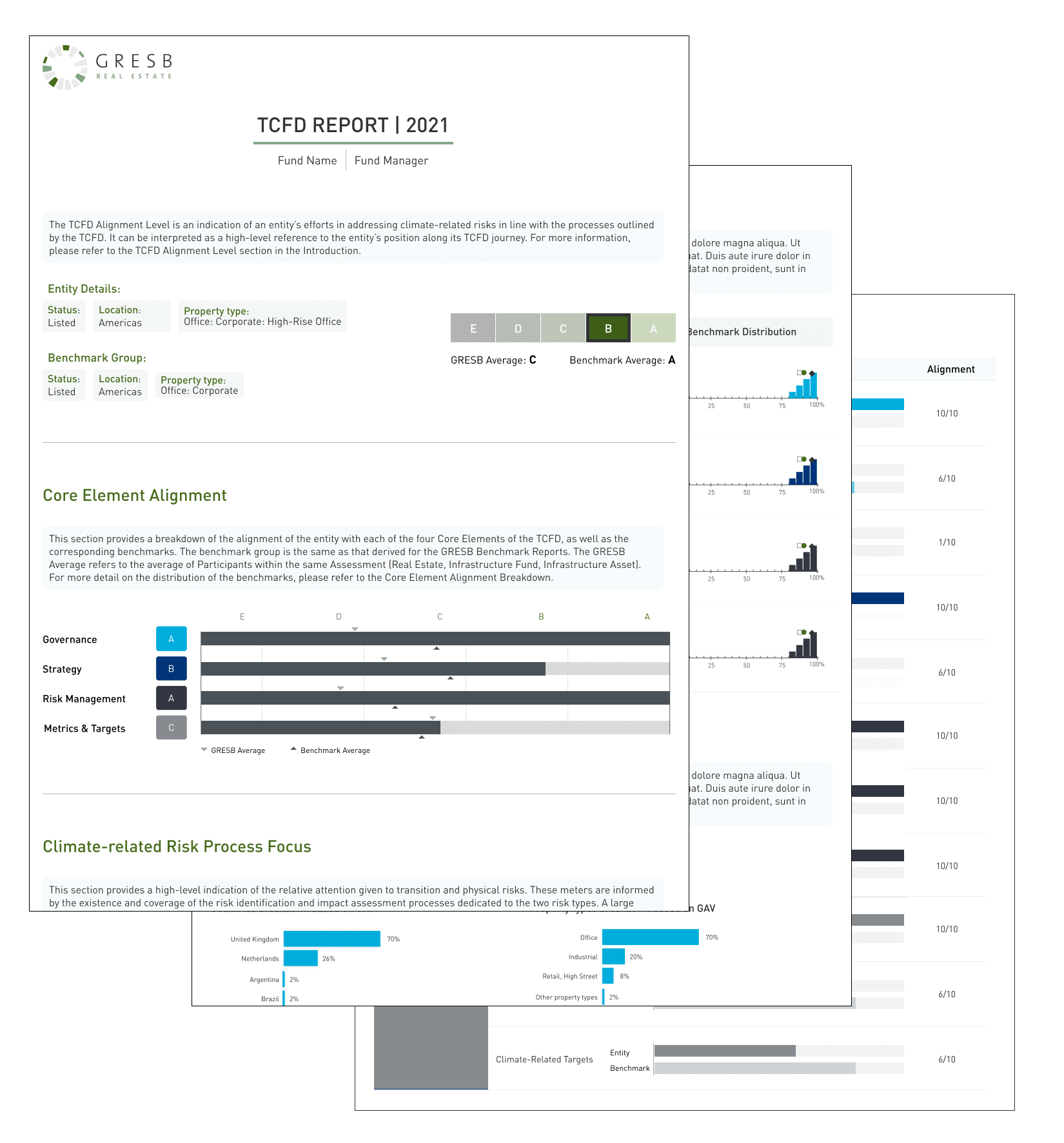

TCFD Alignment Report

The other new product is the GRESB TCFD Alignment Report, which helps participants of any of the three GRESB Assessments – Real Estate, Infrastructure Fund and Infrastructure Asset – to tackle reporting challenges related to the Task Force on Climate-related Financial Disclosures (TCFD).

The TCFD’s final recommendations that were introduced in 2017 as voluntary measures are quickly becoming integrated into regulatory frameworks across the globe. And according to the most recent GRESB data, less than 20 percent of all organizations that participate in GRESB assessments have all of the necessary processes, strategies and data collections systems in place to satisfy TCFD.

Pulling together relevant information already provided to GRESB through the yearly assessments, the TCFD Alignment Report shows an entity how aligned it is to TCFD requirements and provides a clear foundation to develop necessary TCFD processes and reporting efforts. With the report, GRESB Members can:

- Identify TCFD gaps and where improvements can be made

- Compare themselves against peers and see what recommendations are being prioritized

- Learn how they can get fully aligned with TCFD expectations

- Engage with investors, highlighting climate-related risk management processes

“The majority of organizations are not yet ready for TCFD and still need to translate strategies into risk management processes,” added Roussotte. “Just by participating in GRESB Assessments, organizations have already taken the first steps towards TCFD disclosures. Without any additional reporting needing to be done, GRESB Members can see where they stand in relation to TCFD, helping them fulfill regulatory requirements at a very competitive price.”

Learn more about the TCFD Alignment Report or schedule a demo at: gresb.com/TCFD