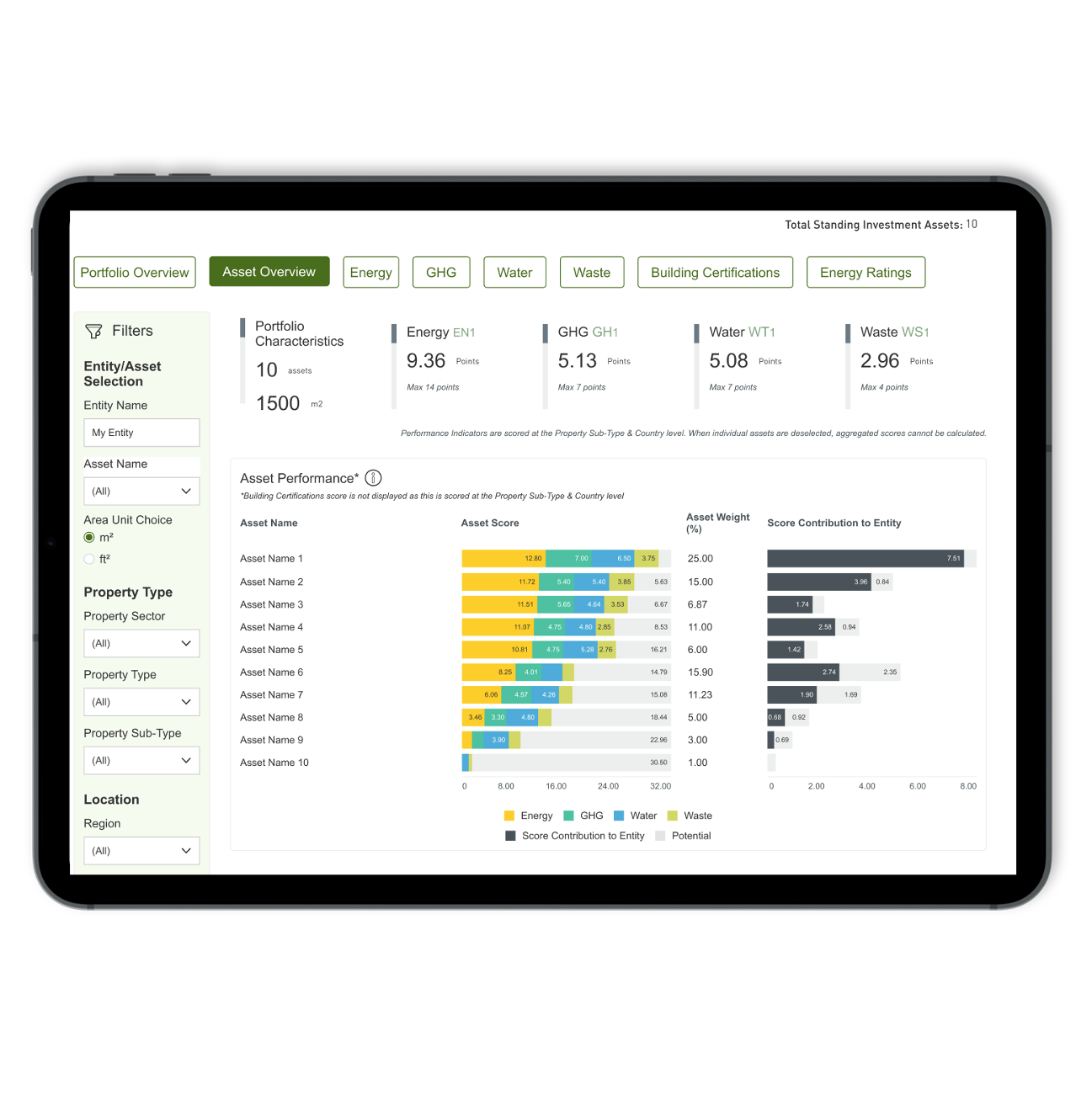

Amsterdam, March 17, 2025 – GRESB, the global sustainability benchmark for real assets, is pleased to introduce “Score Contribution” – a new membership tool that gives real estate managers greater insights into how individual assets contribute to a portfolio’s overall GRESB Score, in the aggregate and across key performance metrics.

“With Score Contribution, real estate managers gain a clearer understanding of how each asset contributes to their GRESB Score, helping them identify the best opportunities for targeted improvements,” said Sebastien Roussotte, CEO of GRESB. “Starting in March 2025, this new tool will be available to all existing GRESB Real Estate Participants at no additional cost, empowering them with the insights to make data-driven decisions that enhance efficiency, resilience, and sustainability across their portfolios.”

The introduction of Score Contribution marks an important milestone for GRESB, which has devoted significant resources in recent years to enhance the experience of its members and provide them with the tools needed to maximize the impact of their sustainability efforts. With it, members can:

- Understand their GRESB Scores at the asset level

- Engage stakeholders more effectively with granular insights

- Take action where it matters most

Now available in the GRESB Portal, Score Contribution is available to all Real Estate Participants. Access is private to the individual reporting entity and not accessible by investors.

Learn more about Score Contribution.

For media inquiries, please contact Tyler Guthrie at [email protected].

About GRESB

GRESB is a mission-driven and industry-led organization providing standardized and validated sustainability data to financial markets. Established in 2009, GRESB has become the leading sustainability benchmark and insight provider for real estate and infrastructure investments across the world, used by 150 institutional and financial investors to inform decision-making.

The annual GRESB assessments and benchmarks include more than 2,200 real estate portfolios and funds as well as more than 850 infrastructure participants, including funds and assets, collectively representing USD 9 trillion in gross asset value.