Key takeaways

- The Customize Peer Group functionality is now officially a part of the Real Estate Benchmark Report.

- You can log in to the Portal between August 1-20 to customize your peer groups.

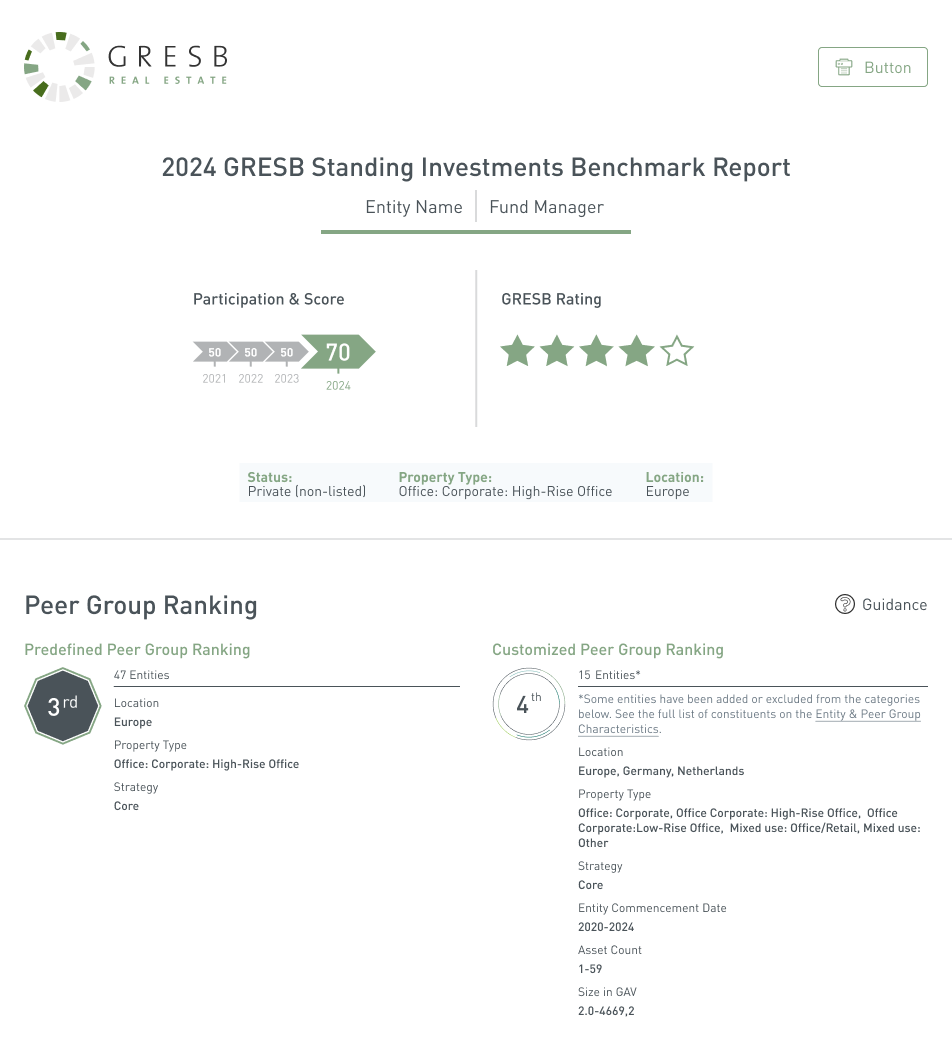

- If you choose to use this feature, you will see two rankings: a pre-defined group ranking and a customized group ranking in the 2024 Benchmark Report.

For many real estate managers, interpreting and making the most of the vast amount of data generated through the GRESB Assessments can be a challenge. At the same time, investors are increasingly asking for more clarity and comparability in their benchmarks – looking to better understand how their funds compare against peers in various ways.

To address these needs, GRESB has introduced a “Customize Peer Group” functionality to its Real Estate Benchmark Reports, which allows participants to tailor their benchmarks to more closely align with the realities of their investment portfolios. Empowering fund managers to define how they are compared against the industry allows them to unlock more insights and have better conversations with investors.

How does GRESB pre-define the peer groups?

The GRESB Real Estate Assessment offers valuable benchmarking for your portfolio by providing a ranking in context to peers. This information is delivered through GRESB Benchmark Reports which, until 2023, predetermined the peer group that a fund was part of based on an established algorithm.

The GRESB definition of a peer group is a set of funds or entities that are categorized together based on similar characteristics to facilitate performance comparison, and it must consist of at least six entities, although the size of those entities may vary heavily. These peer groups do not affect scores but help readers of the report understand the context of the insights provided.

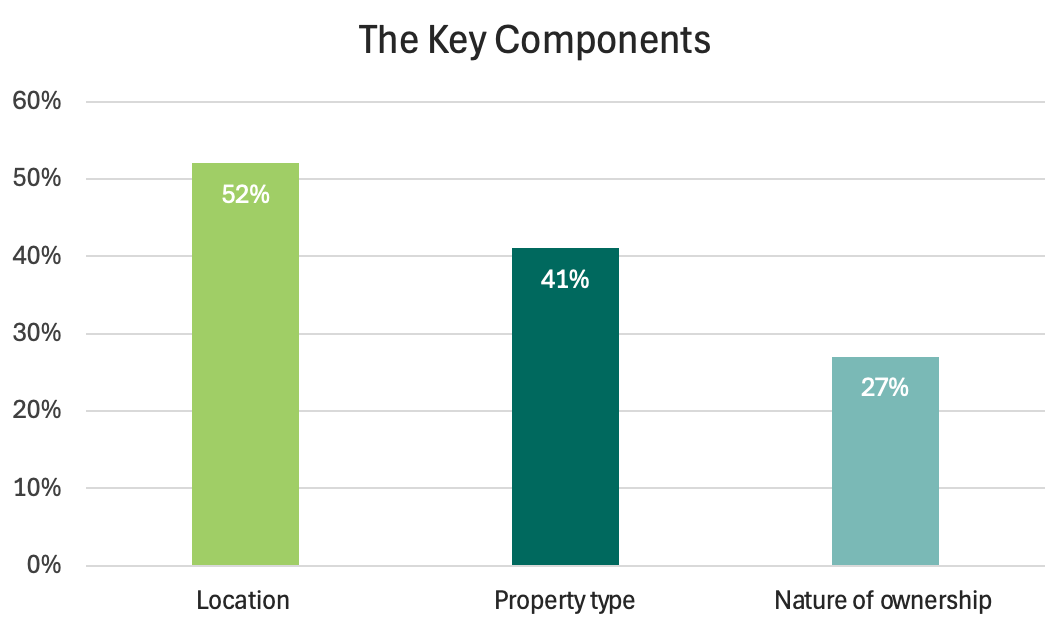

The Portal considers three key characteristics when forming and assigning these groups:

- Property type: The methodology aims to match funds into a peer group at the property sub-type. If this is not possible, it goes to the property type level and then, if needed, to the property sector, requiring at least 75% GAV.

- Location: The first attempt to create a peer group is at the country level, and if no group can be created it goes to the sub-region, before moving on to the region, and then finally the super-region, requiring at least 60% GAV.

- Legal status: The methodology aims to match entities with the same legal status for a given peer group, which are: listed, unlisted, or government entity.

The methodology behind creating the optimal peer group is through a set of trials. Based on these characteristics, the Portal first aims to match entities at the highest level of granularity and moves outward, becoming less specific if there aren’t enough entities that match at the highest specificity to compile six in a group together. If the minimum requirement for the gross asset value is not met, the funds are placed in the diversified category.

Additionally, the investment style of the portfolio, and whether the assets are tenant controlled, can be considered as an added layer of granularity. Using this information, the Portal creates groups with entities that are most comparable.

To learn more about the peer group allocation methodology, you can refer to the latest Real Estate Reference Guide.

The GRESB Customize Peer Group functionality

While the pre-defined peer groups are a useful way to start comparing a fund against peers, GRESB Participants have asked for ways to improve the process by which peer groups were assigned, to better reflect the specific strategies of the fund.

So, in the 2023 reporting year, GRESB introduced the functionality for real estate entities to customize their peer groups in a test phase. Prior to receiving their preliminary results, participants could log into the GRESB Portal to see how they were being allocated to peer groups, at which level of granularity, and could indicate their preferences for each characteristic to build a new peer group composition.

During the test phase, over 700 real estate entities – from a total of 2,084 – used the functionality. The reasons for changing peer groups were diverse, with no general trend in how entities chose to customize, meaning that the allocation methodology wasn’t inherently flawed, and remains a good first step when paired with the flexibility provided by the new functionality.

What was customized during the 2023 test phase?

The most frequently changed criterion was location (52% of total participants), the majority of them choosing to add more locations for a less granular selection. Christina Djambazca, Product Manager at GRESB, explains the reason for this trend as “the desire to adjust to the investing reality”. In a recent episode of the Pulse, she illustrates an example of a fund that has most assets located in the Netherlands, but an investor is not specifically seeking to compare against other Dutch funds, rather the larger European market.

This serves as an excellent illustration of how investors derive value from Benchmark Reports, enabling them to more clearly assess a given fund within the investable universe. By leveraging the comprehensive data coming from the GRESB universe, investors can make more informed and strategic investment decisions, ensuring a well-rounded and comparative analysis of potential opportunities.

Following location, 41% of participants modified by property type, which included actions like adding more property types/sectors, changing sector classifications, or removing property type as a criterion for the peer group. Lastly, 27% of participants changed their group’s nature of ownership classification, with the majority of them selecting both listed and non-listed entities to appear in their customized peer groups.

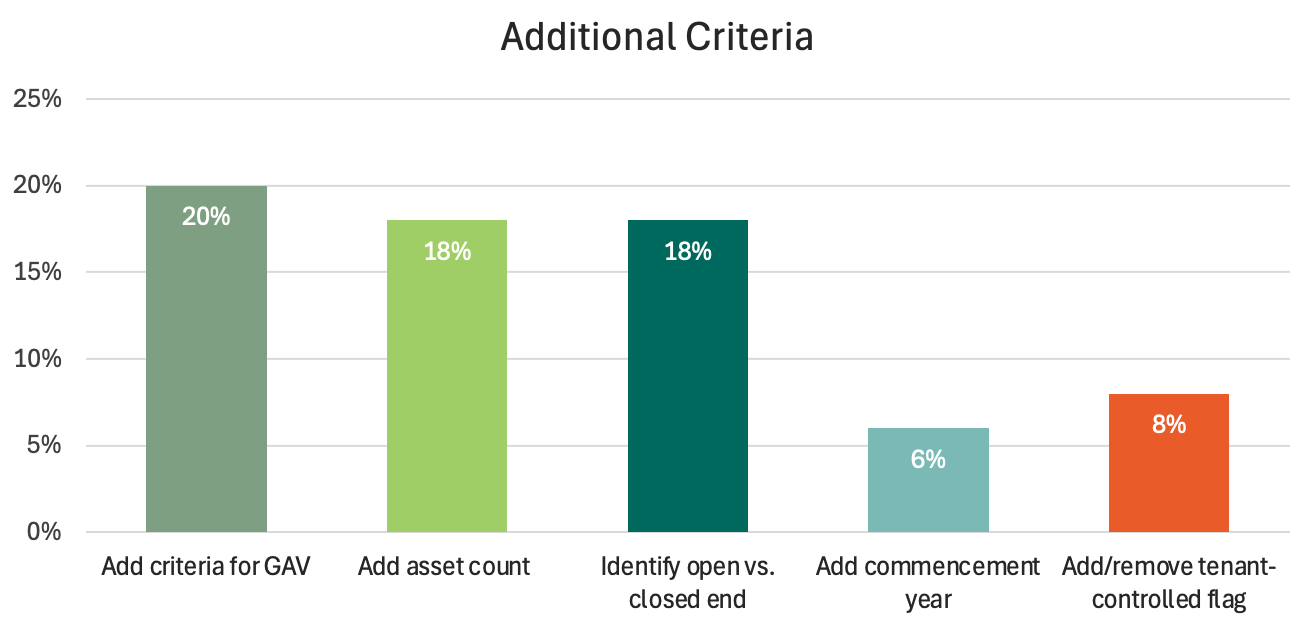

In addition to the main three components (location, property type, and nature of ownership), participants were able to add new criteria for GAV (20% of participants) and/or asset count (18% of participants) as indicators for portfolio size, the classification of open vs. closed end (18% of participants), and commencement year (6% of participants). They could also add or remove the tenant-controlled flag (8% of participants).

What was the outcome of changes during the test phase?

Within the trial period peer groups, 47% increased in size, gaining an average of 18 entities. In contrast, 32% of the groups decreased in size, on average by 22 entities, while 18% maintained their original size. With the growing size of the peer groups, 39% of participants saw their rank drop by an average of nine places, while 32% improved their rank by an average of 11 places, and 29% maintained the same rank.

While one might think that participants might adjust the peer group criteria to achieve higher relative rankings, this was not borne out by the data. There was no trend of participants adjusting to claim leadership within a given peer group by creating favorable conditions. Rather, changes were clearly made to improve allocation so entities would belong to the most relevant comparable universe for their investors.

This new feature directly addresses a genuine user need: the flexibility to choose peer groups that provide the most meaningful context for investors evaluating these funds.

Next steps for the 2024 reporting year

If you wish to use this functionality, you will need to log in to the GRESB Portal between August 1-20.

You can see how to select your peer group on the Portal here.

What will you see in your 2024 Benchmark Report?

If you choose to customize your peer group, you will receive two rankings this year: one with the pre-defined peer group and one with your customized peer group. The main reason is to provide continuity for investors used to seeing the predefined peer groups.

You will have access to the details of your customized peer group added to the “Entity & Peer Group Characteristics” section, alongside your pre-defined peer group.

One important note: the comparison insights will continue to be based on your pre-defined peer group, and not the customized one, even if you chose to use this functionality.

Conclusion

The “Customize Peer Group” feature aims to provide more relevant and actionable insights by improving data contextualization. This update, driven by participant feedback, will allow for more tailored benchmark comparisons, supporting better strategic decisions for investors.

Stay up to date about these developments via the contact form below, to fully leverage the potential of customized benchmarking in your investment strategy.

"*" indicates required fields