Key highlights:

- The Foundation Board has approved the revised building certification criteria proposed by the Real Estate Standards Committee (RESC) after a successful public consultation process.

- The public consultation lasted four months and included more than 100 organizations (listed below).

- Revised evaluation criteria will improve the quality of the schemes recognized within the GRESB Standard.

- GRESB is currently assessing the implementation of the revised criteria, with no changes planned to schemes recognized in the 2025 and 2026 GRESB Standards.

Background

Since its inception, the GRESB Standard has recognized building certifications as a valuable proxy for what is considered a sustainable building. High-quality certifications serve as an additional layer of transparency to investors, distinguishing spaces and facilities that have received third-party recognition for sustainability efforts.

In the last decade, the building certification landscape has significantly evolved and expanded, resulting in an ever-growing number of available schemes covering a wider variety of ESG topics. At the same time, the scope and significance of the GRESB Standard continues to adapt to fast-changing expectations from institutional investors.

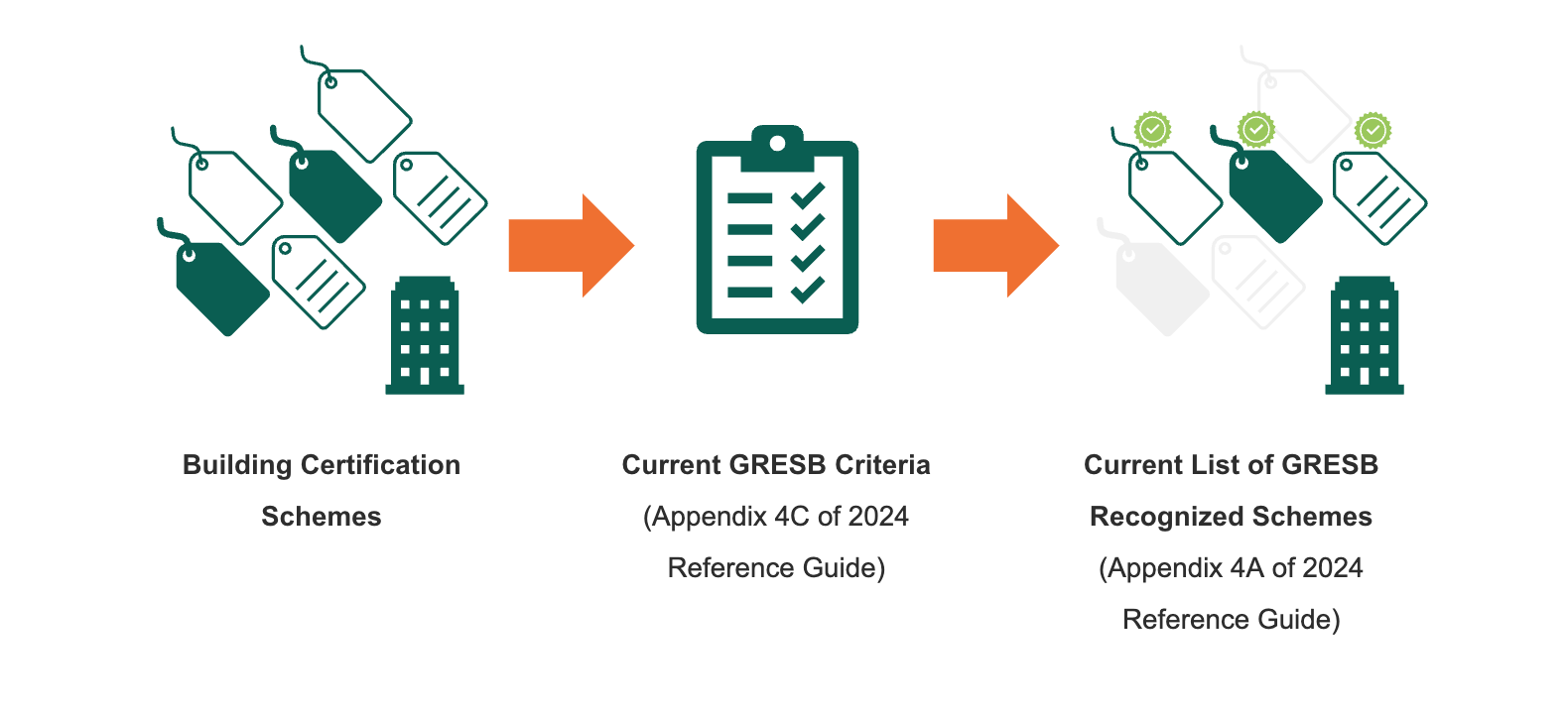

GRESB currently employs minimum criteria to evaluate building certification schemes for recognition within the GRESB Standard. The current list of recognized Building Certification Schemes can be found in Appendix 4a of the 2024 GRESB Reference Guide, and minimum criteria are detailed in Appendix 4c.

GRESB uses criteria to evaluate building certification schemes for recognition in the GRESB Standard.

As announced in March, the GRESB Foundation requested the RESC to assess the current criteria and potentially develop revised criteria. The key objectives of this review were to:

1. Elevate best-in-class schemes, encouraging broader adoption within the industry.

2. Refine the list of accepted schemes, recognizing those with the greatest credibility and impact.

3. Enhance transparency on key evaluation metrics, informing investment decision-making.

Public Consultation

A public consultation process was held from April to June 2024 to gather industry’s views and feedback on the proposed revised criteria. Key stakeholders were solicited for feedback, including:

- Participant Members and Industry Partners

- Partners and other key stakeholders

- Investor Members

Individuals from more than 100 organizations participated in the public consultation through a combination of interviews, survey responses, and written feedback. This provided a wealth of industry knowledge on building certifications and allowed GRESB to evaluate the strength of the revised criteria.

Industry engagement remains central to GRESB’s ability to ensure that standards development is responsive to the needs of the GRESB community. On behalf of the GRESB Foundation, we would like to thank all individuals involved for dedicating their knowledge, time, and effort to this consultation. A list of organizations that contributed to the consultation is included at bottom of page.

Technical review

Overall, feedback from the consultation indicated that revision to the criteria is welcome and that the proposed criteria would generally support the objectives set out by the GRESB Foundation. Industry feedback was incorporated into the revised criteria, before undergoing detailed review by the RESC.

The RESC made refinements, including tailoring the materiality matrix to better suit different types of certifications (i.e. design & construction vs. operational) and alignment of terminology with other key frameworks (e.g. TNFD). Analysis was then undertaken to assess the impact of the revised criteria on the current list of recognized schemes to ensure they remain reasonable and practicable.

Finally, the GRESB Foundation Board approved the revised criteria in September 2024.

Revised quality criteria

The revised criteria will be used to evaluate building certification schemes across different characteristics to ensure they represent best practice. The criteria consider:

| Governance | Ensure strong governance through the integration of a conflict-of-interest management process to uphold impartiality and integrity in the decision-making process. |

| Process | Ability to demonstrate robust development, maintenance, and review of schemes that incorporate best practices, new technologies, and latest scientific research. |

| Transparency | Public disclosure requirements on key features of the certification brands and schemes. |

| Scope | Review and update of scope classification reflecting the emergence of new types of schemes (overarching, thematic, single attribute). |

| Stringency | Introduction of minimum requirements regarding the stringency level met by a scheme in relation to a theme or topic covered. |

Timeline of activities to develop the revised criteria.

Implementation

GRESB’s list of recognized certification schemes is a key resource for guiding real estate strategies globally, and updates to this list are likely to have significant impacts. The GRESB Foundation and RESC are aware of the industry’s reliance on this list and are fully committed to ensuring a smooth transition process for the implementation of the revised criteria.

- For certification scheme providers, GRESB is currently assessing the process to evaluate certification schemes using the revised criteria. Scheme providers are encouraged to familiarize themselves with the criteria to understand the level of evidence that will be required to demonstrate compliance.

- For GRESB Participants, following communication with scheme providers, GRESB will assess the feasibility of updating the list of recognized certification schemes in the GRESB Standard. This will have no impact on the 2025 and 2026 GRESB Standard.

GRESB will provide an update to the industry in Q1 2025 on the implementation of the revised criteria following further analysis.

For any questions, comments, or feedback on GRESB’s Building Certification Evaluation Criteria, please get in touch.

Contact usPublic Consultation contributors

The GRESB Foundation would like to thank the below organizations for taking part in the public consultation:

| Achmea Real Estate | Federation of Rental housing Providers of Ontario | MAPP |

| AIMCo | Frasers Property Australia | Minto Group |

| Alliance HQE-GBC | Frasers Property Limited | MN |

| Allied Environmental Consultants limited | Goodman Europe | National Australian Built Environment Rating System (NABERS) |

| Altera Vastgoed | Gothaer Asset Management AG | New Zealand Green Building Council |

| AustralianSuper | Green Building Council España – GBCE | NN Group |

| Autonomy Investimentos | Green Building Council of Australia | Nuveen |

| AvalonBay Communities | Green Building Initiative | PGGM |

| Avison Young | GREENBALT, UAB | Principal Real Estate |

| Better Buildings Partnership | Greenview | PRODEA Investments |

| BRE | Growthpoint Properties Australia Pty Ltd | PSP Investments |

| Breea | Helvetia Versicherungen | PSP Swiss Property |

| Building Science Institute, Ltd. Co. | HESTA | QuadReal Property Group |

| Caisse de dépôt et placement du Québec (CDPQ) | HIAG Immobilien Holding AG | QUALITEL |

| Canadian Urban Limited |

Hollis Global Limited | RE Tech Advisors |

| Canary Wharf Group | Hong Kong Green Building Council | Salter Brothers |

| CapitaLand Investment | ICADE | SEGRO |

| CERQUAL QUALITEL CERTIFICATION | iContinuum Group, LLC | Sobha Realty |

| CERTIVEA | International WELL Building Institute | SSREI AG |

| ClimateFirst | Invesco | Sunlight REIT |

| CMS | Invitation Homes | Swiss Finance & Property AG |

| Cofinimmo | IREM | TURKECO |

| CSR Design Green Investment Advisory, Co., Ltd. | JLL | U.S. Green Building Council, Inc. |

| Cushman & Wakefield | Kayne Anderson Real Estate | UBS Asset Management |

| DEAS Asset Management AS | Killam Apartment REIT | University of Pittsburgh |

| DELA | Kilroy | Ventas, Inc. |

| Development Bank of Japan Inc. | LaSalle Global Solutions | Verta Asset Management |

| DW Property B.V. | LaSalle Investment Management | W/E consultants sustainable building |

| EastGroup Properties, Inc. | Lendlease | Wacheke Eco Fold Studios |

| Eastnine AB | Longevity Partners | William Warren Properties |

| Environmental Social Governance Solutions Ltd | M&G Real Estate | WiredScore |

| Epsten Group | Majid Al Futtaim |