Press Release: October 18, 2018 – IPCC report stresses need to decarbonize real estate sector by 2050 – to address this challenge property investors are collaborating with the EU-funded Carbon Risk Real Estate Monitor (CRREM) to identify and measure GHG reduction targets and opportunities aligned with the Paris Agreement

Press Release: October 18, 2018 – IPCC report stresses need to decarbonize real estate sector by 2050 – to address this challenge property investors are collaborating with the EU-funded Carbon Risk Real Estate Monitor (CRREM) to identify and measure GHG reduction targets and opportunities aligned with the Paris Agreement

Are real estate investments at risk of increasingly stringent energy efficiency regulation and climate change? – Funded through the European Commission’s Horizon 2020 research and innovation program, the Carbon Risk Real Estate Monitor (CRREM) initiative will establish science-based carbon reduction pathways for European commercial real estate portfolios and develop a carbon risk assessment tool for investors to understand downside risks and identify carbon efficient retrofit opportunities. CRREM now launched its website, which aims to help investors measure, understand and reduce carbon risks inherent to commercial real estate portfolios.

Carbon risks receive increasing attention by investors and policy makers

This month has been a wake-up call for investors and policy makers on the risks posed by climate change:

- The IPCC[1] declares that limiting global warming to 1.5°C is strictly necessary to prevent severe damage to global ecosystems, while the world is heading to 3°C degrees under current projections. The report stresses that the world “requires rapid, far-reaching and unprecedented changes” and especially “transitions in land, buildings and cities.”

- The Nobel Memorial Prize in Economic Science was awarded to William Nordhaus and Paul Romer for their research on the economics of climate change and sustainable development.

- The One Planet Summit saw global leaders underscore 12 commitments related to financing climate resilience.

- The Global Climate Action Summit in San Francisco highlighted how local and regional private and public are increasingly committing to climate action.

Contrary to the announcement by EU commissioner for climate action and energy Mr. Miguel Arias Cañete in August 2018, the EU has not voted in tougher GHG pledges and plans to stick to the reduction target of 40 % (instead of 45 %) until 2030 (compared to 1990).

Why the real estate sector needs to decarbonize

The world has an estimated remaining carbon budget of 750 billion tons of carbon to limit global warming below 2 degrees compared to preindustrial levels. Given annual emissions of about 40 billion tons, the global budget will be consumed within less than 20 years. The IPCC as well as the International Energy Agency (IEA) estimate that global emissions will have to peak before 2020 and then trail off steeply if we are to comply with the Paris Agreement. Given that the real estate and construction sector accounts for 30-40 % of all emissions, energy efficiency improvements in real estate are posed to play a pivotal part in curbing global carbon emissions.

Understanding the necessary decarbonisation pathways and climate risks is vital for owners of real estate assets. As one of the largest real estate investment managers in Europe, Aberdeen Standard Investments is contributing to this important project which will help investors better understand and act on climate-related financial risk.’ Ruairi Revell (ESG Manager, Real Estate) | Aberdeen Standard Life

Survey reveals sector insights on status quo and need for action

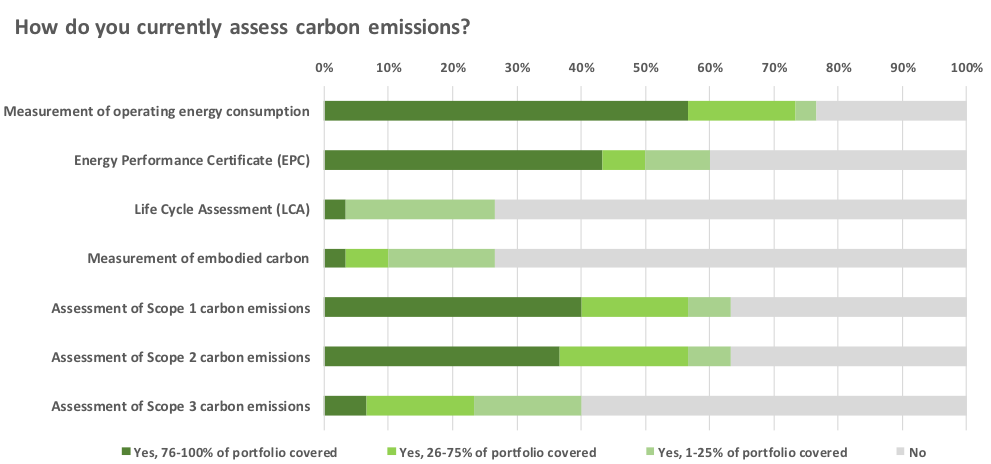

CRREM conducted an initial industry survey representing EUR 260 billion assets under management to understand how European Real Estate Investors currently measure and reduce carbon risks. The survey showed that while the industry has made significant progress over the last years, there is still much room for improvement. For 50% of the investors, decarbonization is rudimentary or still not a board room topic, 18% do not perform any carbon risk assessments for their portfolio and 32% only partially.

Digging deeper, most market participants stated that they currently only focus on operational carbon from buildings. Given that the entire building and construction supply chain needs to be decarbonized, ‘embodied carbon’ (e.g. emissions from production, transportation and disposal of building materials and the construction) and therefore more advanced techniques like LCA and WLC need to be increasingly promoted. The new IPCC-report clearly stresses that all impacts of the real estate industry – regardless if carbon emissions are direct or indirect – must reach zero by 2050.

Respondents also made a clear statement regarding their motivation for energetic retrofits: it’s either compliance with regulation (60%) or higher profits (74%). This is an important finding for policy makers to select the “right” instruments to trigger higher retrofitting rates for the existing building stock. Interestingly 60% of market participants state that their internal targets are already higher than what is presently required by regulation. 74% are even aiming to increase their financial budget for retrofits within the next five years significantly.

Risk of ‘stranded assets’ is obtaining more attention

Within the European Union, buildings are responsible for approx. 36% of emissions. As 75% of the EU’s building stock is estimated to be energy inefficient according to current technological standards, environmental regulation in the property sector offers regulators quick wins to reduce emissions. A large number of buildings in the EU will face significant markdowns if retrofit efforts fail to meet rising energy and carbon requirements. Already 24% of the investors stated that they would require a risk-premium for properties with a poor carbon footprint. 15% even consider disinvestment of buildings with poor performing carbon profiles. CRREM will help investors to identify ‘stranding risks’ of inefficient assets to facilitate carbon efficient investment in retrofits. The term ‘Stranding risk’ denotes the risk of premature write-downs or devaluations due to, for example, strengthened carbon regulation or market expectations regarding energy efficiency.

Sustainable development is only possible, if we draw the full potential of carbon reduction in the building sector and if investors are aware of the risks entailed by buildings that do not meet climate protection targets.’ Roger Baumann | COO and Head Sustainability Global Real Estate | Credit Suisse Asset Management (CH)

43% of companies responding to the CRREM industry survey stated that they are not familiar with the term ‘stranded asset’, even though enhanced regulation to promote energy efficiency is foreseeable, exposing investors with energy-inefficient buildings to the downside risks of stricter building codes, carbon taxes, and related hikes in energy prices.

CRREM: research, methods and software combined with industry support

The CRREM research consortium consists of five EU-based institutions experienced in the field of carbon research in real estate: GRESB, University of Alicante, Ulster University, IIÖ Institute for Real Estate Economics and Tilburg University’s TIAS Business School.

While the 2018 GRESB Assessment results show that 71.2% of European property companies and REITs undertake an asset level carbon risk assessment before new acquisitions, and 65.3% do so for standing assessments, there is still no common framework for measuring carbon risks at an asset level within the European Union. By establishing this framework, CRREM will enable investors to better understand the climate-related financial risk present within their portfolio.’Sander Paul van Tongeren | Co-Founder and Managing Director | GRESB.

The CRREM project is supported by a European Investor Committee (EIC) that advises the project, consisting of both investors and industry stakeholders.The EIC includes representatives from: EPRA, Landsec, PGGM, INREV, METRO, WorldGBC, ULI Greenprint, Union Investment and Credit Suisse Asset Management.

Understanding climate risk has never been more important, especially as property investors seek to disclose the impacts that climate change is having on their portfolios. The CRREM project will support Landsec in achieving our science-based carbon reduction target by allowing us to better understand the risks and opportunities for existing and future assets. This information will be vital in ensuring Europe’s built environment can transition to a low carbon economy in line with the Paris Climate Agreement.’Tom Byrne | Sustainability Manager | Landsec

Industry practitioners interested in building climate resilience into their portfolio can get involved with CRREM at www.crrem.eu, where the project consortium will publish research reports, announce webinars and events, and launch the CRREM risk assessment tool. The EIC is open to additional representatives. Interested investors can contact GRESB.

For more information: www.crrem.eu

Contact: [email protected]

[1] Intergovernmental Panel on Climate Change; IPCC Special Report on Global Warming of 1.5ºC (SR15) released on 8 October 2018.