What is the GRESB Infrastructure Fund Assessment?

The GRESB Infrastructure Fund Assessment provides the basis for systematic reporting, objective scoring and peer benchmarking of the ESG management and performance of infrastructure funds around the world. The process is unique in the ESG space and leads to deep data insights for investors and infrastructure fund managers.

Why infrastructure fund managers participate in GRESB Assessments

- Identify areas of risk, opportunity and impact in your infrastructure fund

- Attract new investors seeking more comprehensive risk, opportunity and impact analysis

- Systematically improve your investor engagement

- Benchmark your performance against your peers and see new opportunities for action

- Report validated ESG performance information to the market using a global industry standard

What the fund assessment covers

The Infrastructure Fund Assessment includes a Management Component, which is aligned with the Management Component in the Infrastructure Asset Assessment. Addressing ESG management and investment processes, this component reviews factors related to:

- Leadership

- Policies

- Targets

- Reporting

- Risk management

- Stakeholder engagement

The other component is the Performance Component. A fund’s underlying assets may participate in a complementary Infrastructure Asset Assessment, with these scores informing the fund’s Performance Component Score. While the participation of underlying assets is not required, only funds with at least 25% of assets participating will receive an overall GRESB Score and be allocated to a corresponding peer group.

Data is self-reported by Assessment participants each year, between April 1 and July 1, subject to a multilayer validation process after which it is scored and benchmarked. The result is high-quality data that investors and participants can use in their investment and decision-making processes.

Funds that participate

The GRESB Infrastructure Fund Assessment is designed to assess funds across a wide range of sectors, including energy generation, energy transmission, water resource management, transportation and social infrastructure. Typical infrastructure funds participating in the GRESB Infrastructure Fund Assessment include:

- Sector-focused funds with investments in toll roads

- Geographic-focused funds with investments in a specific region, such as North America or Oceania

- Segregated accounts that are globally diversified offering exposure to several sectors

Systematic assessment process

Validation

GRESB has established a robust data validation process to underpin the accuracy and reliability of its output. It is based on a three-layer data quality control process designed to ensure submission of high-quality information. The approach to validation was developed by PwC and involves third-party verification by SRI.

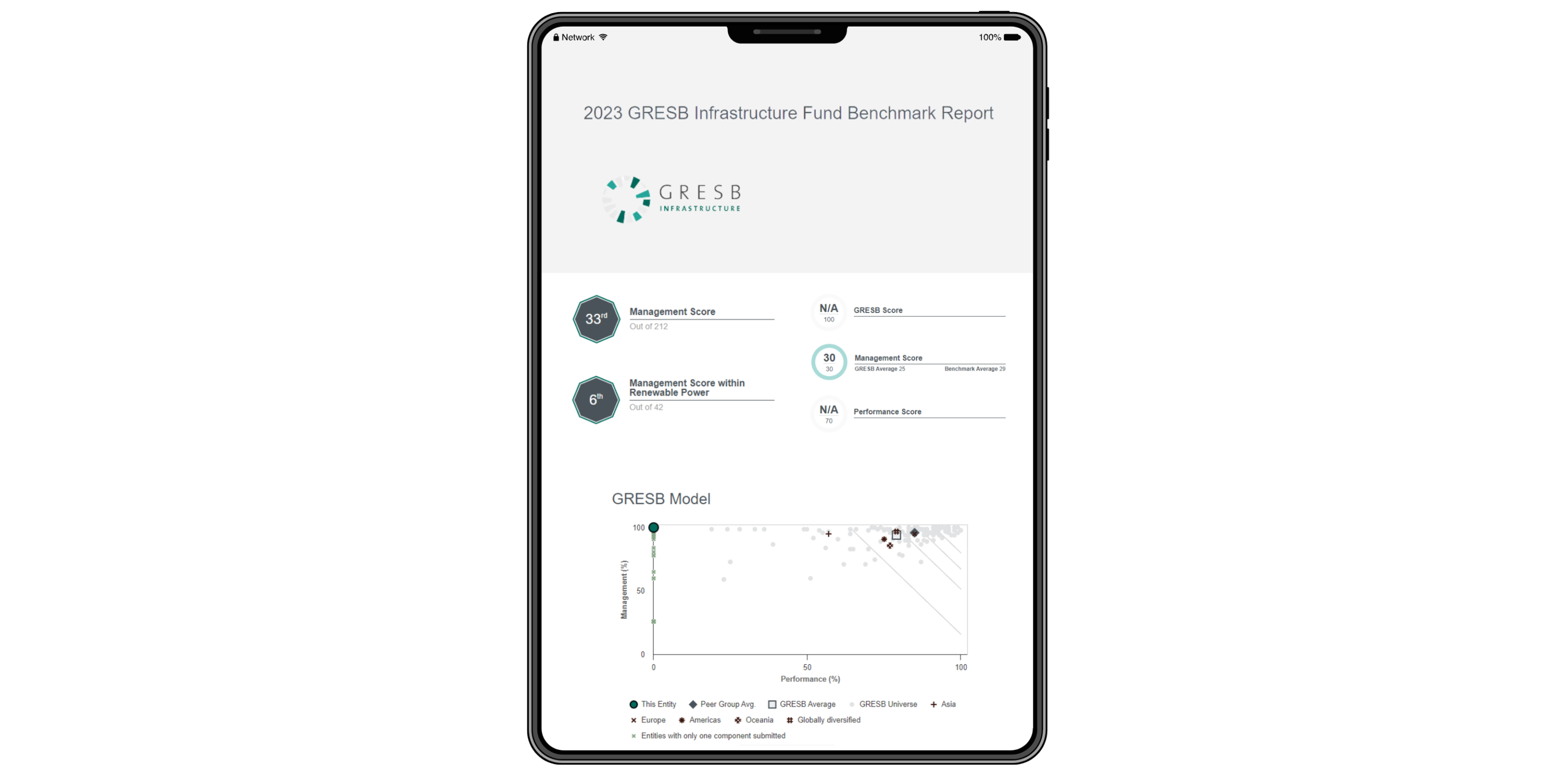

Objective scoring

The GRESB Scoring Model is based on an automated system, which uses a technology platform designed for GRESB by a third party that specializes in data analysis software development. The scoring is completed without manual intervention after data input.

Peer benchmarking

Peer comparisons that account for country, regional, sectoral and investment type variations provide a powerful lens through which to benchmark performance. Each participant is assigned to a peer group, based on the entity’s legal structure (listed or private), property type and geographical location of assets.

Assessment results

Assessment results are available to infrastructure funds in October, based on 12 indicators that contribute to the overall score.

In addition to the overall scores, fund participants can access powerful analytical tools and services that provide in-depth analysis of sustainability performance, enable detailed peer group comparisons and highlight industry best practices.

First year participants can submit the Infrastructure Fund Assessment without providing GRESB Investor Members with the ability to request access to their results. This is referred to as a “Grace Period.”

Assessment Resources

- Core resources – Official GRESB documentation including GRESB Standard and Reference Guides and scoring documents.

- Assessment Templates & tools – To use while completing the Assessment.

- Reporting Resources – Useful documents to help you during the GRESB reporting process.

- Assessment Standard Changes – Useful resources to stay updated on changes to the GRESB Standards.

- Results Interpretation – Documents that will assist you in understanding and gaining insights from your results.

- Linguistic Supplements

Have a look at our Participant Members.

Have questions about the Infrastructure Fund Assessment? Contact us!

"*" indicates required fields