What is the GRESB Infrastructure Development Asset Assessment?

The GRESB Infrastructure Development Asset Assessment is a new assessment as of the 2024 reporting year, focusing on greenfield development and pre-operational assets. It was developed to provide companies with assets in construction or pre-construction a way to accurately reflect their overall sustainability efforts. It draws from and aligns with existing GRESB Assessments and external ESG frameworks, using a ‘dynamic materiality’ to more accurately reflect an asset’s unique characteristics and development state.

The Infrastructure Development Asset Assessment helps provide a full picture of performance at both the asset and fund level.

Benefits for assets:

- Gain a nuanced view of sustainability efforts during pre-construction and construction phases

- Apply relevant materiality based on sector, location, and development phase

- Use results for strategic decision-making right from the start and improve sustainability strategies throughout an asset’s lifecycle

- Access a development asset-specific benchmark, enabling comparison with peers at the same stage of development

- Share results and asset-level data for the development phase with funds and investors

Benefits for funds:

- Get a development-specific asset benchmark, with no impact from operational assets

- Apply relevant materiality to differentiate your assets by sector and development phase

- Generate a more accurate fund benchmark with scores from both respective asset assessments

- Engage investors throughout the entire lifecycle of an asset – from design to end of life

- Leverage an asset’s pre-operational scores for green lending opportunities

What the development assessment covers

The Infrastructure Development Asset Assessment is a single assessment, with a number of indicators focused on ESG management practices and performance. It focuses on the overall efforts undertaken by an organization in the pre-development and development phases of a greenfield project.

The assessment’s scoring uses dynamic materiality, which changes how various ESG issues are scored depending on the characteristics of the asset and the current phase the development project is in – whether pre-construction or construction.

What does this mean in practice?

While several ESG indicators will be scored equally for all assets, others will be scored differently, or will not be applicable, depending on factors like the asset’s sector, location, and number of employees. And a smaller selection of indicators only become applicable after an asset moves from the pre-construction to construction phase of its lifecycle.

To ensure full and fair scoring of all assets regardless of sector and project phase, scoring potential from non-applicable indicators and those impacted by dynamic materiality will be reallocated across the rest of the assessment.

This means that all assets have the potential to achieve full marks in the assessment, in relation to the sustainability efforts of the project team.

What types of assets can participate in the assessment?

The GRESB Infrastructure Development Asset Assessment is suitable for any type of greenfield, pre-operational infrastructure asset or infrastructure company that invests in greenfield, pre-operational assets.

Similar to the existing GRESB Asset Assessment that is focused on operational assets, this new assessment applies sector-based materiality weighting, meaning it is designed for assets in any sector, as long as the asset is pre-operational. The ESG standards for this assessment have been developed in collaboration between GRESB and the GRESB Foundation, which owns and oversees the standards that underpin all GRESB Assessments.

Assessment process and results

The Infrastructure Development Asset Assessment works like other GRESB Assessments. Managers, asset owners, and asset developers report their ESG data to GRESB annually, from April through the end of June. Preliminary assessment results are shared with participants in September and final results are made available in October.

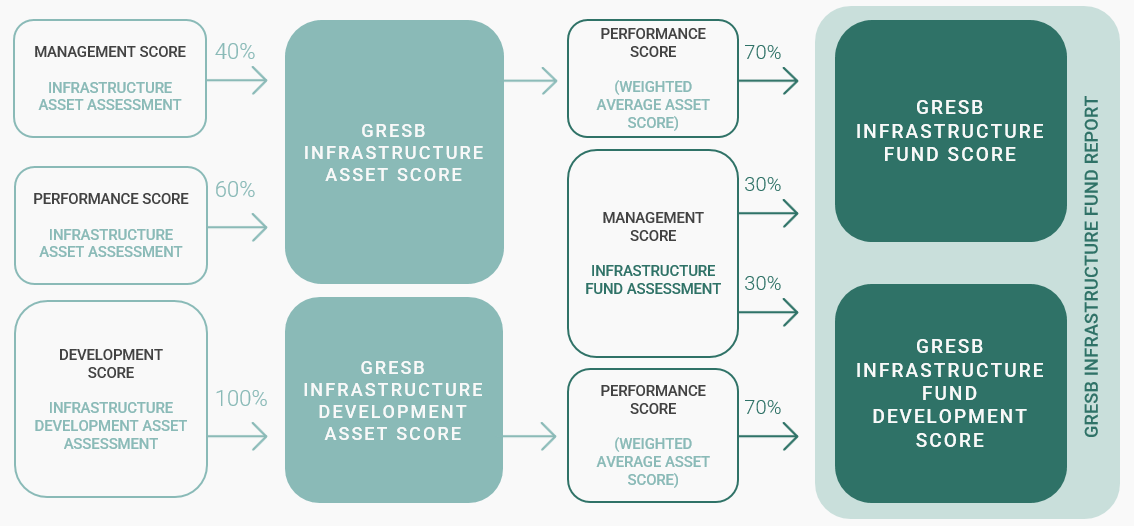

Through the Infrastructure Development Asset Assessment, participants receive a Development Asset Benchmark Report that shows where their assets stand in relation to peers as well as business intelligence on how to improve over time. The results can also be paired with an organization’s Infrastructure Fund Assessment, resulting in an Infrastructure Fund Development Score alongside the existing Infrastructure Fund Score within the GRESB Infrastructure Fund Report.

GRESB’s new assessment for infrastructure assets in development

If you’d like to learn more about the GRESB Development Asset Assessment, watch a recording of our recent webinar: “Building Tomorrow: Introducing the GRESB Infrastructure Development Asset Assessment”

…

Assessment resources and Q&A

- Core resources – Official GRESB documentation including GRESB Standard and Reference Guides and scoring documents.

- Assessment Templates & tools – To use while completing the Assessment.

- Reporting Resources – Useful documents to help you during the GRESB reporting process.

- Assessment Standard Changes – Useful resources to stay updated on changes to the GRESB Standards.

- Results Interpretation – Documents that will assist you in understanding and gaining insights from your results.

- Linguistic Supplements

Have a look at our Participant Members.

-

Dynamic materiality is a flexible scoring approach that adapts to the specifics of a project. It assesses various ESG issues differently based on the characteristics of the asset and the current phase of the development project, such as pre-construction or construction. Dynamic materiality redistributes scores across all ESG indicators, ensuring that the evaluation of a project’s sustainability is contextually nuanced and reflective of the project’s unique circumstances at any given point in its development lifecycle.

-

Indicators RP2.1, RM3.1, RM3.2, MA1, and HS3 are not scored until the asset is in the construction phase, when they become material.

-

Only funds with at least 25% of their underlying assets reporting to GRESB will receive a GRESB Development Fund Score, as long as at least one of the underlying asset has taken the GRESB Infrastructure Development Asset Assessment.

-

The GRESB Infrastructure Development Asset Assessment is suitable for the evaluation of assets, or groups of assets, in the construction or pre-construction phase. The assessment could be taken by investors, fund managers, infrastructure companies, asset operators, developers, and EPCs (Engineering, Procurement and Construction companies).

-

If the submission pertains to a single pre-operational asset or a group of pre-operational assets, the recommended assessment is the Development Asset Assessment. For a single operational asset or group of operational assets, the recommended assessment is the Asset Assessment.

For a group of assets in the pre-operational and operational phase, it is recommended that these are split into separate entities and complete separate assessments as described above. If the participant chooses not to take this approach and report only one entity with both operational and pre-operational assets then the entity should complete the Asset Assessment while designating its pre-operational assets as greenfield facilities that are outside the reporting boundaries.

-

A user has the ability to switch between assessments via the “intent to submit” button before an assessment response is started. Once an assessment response is started, it is not possible to change to the other assessment unless the current assessment response is deleted and a new one is created.

-

Yes, assets completing the GRESB Infrastructure Development Asset Assessment for the first time can choose to take advantage of the Grace Period.

Have questions about the Development Asset Assessment? Contact us!

"*" indicates required fields