Today, many asset managers struggle to accurately measure and report on their GHG emissions due to missing critical performance data, such as asset-level energy consumption.

GRESB Members participating in the Real Estate Assessment – and using many of GRESB’s solutions and tools for real estate – can take advantage of the GRESB Estimation Model (GEM) to address these gaps. GEM leverages a global database of approximately 208,000 individual assets to provide highly accurate estimations of missing energy and GHG data – whether you have full, partial, or no data available.

How does it work?

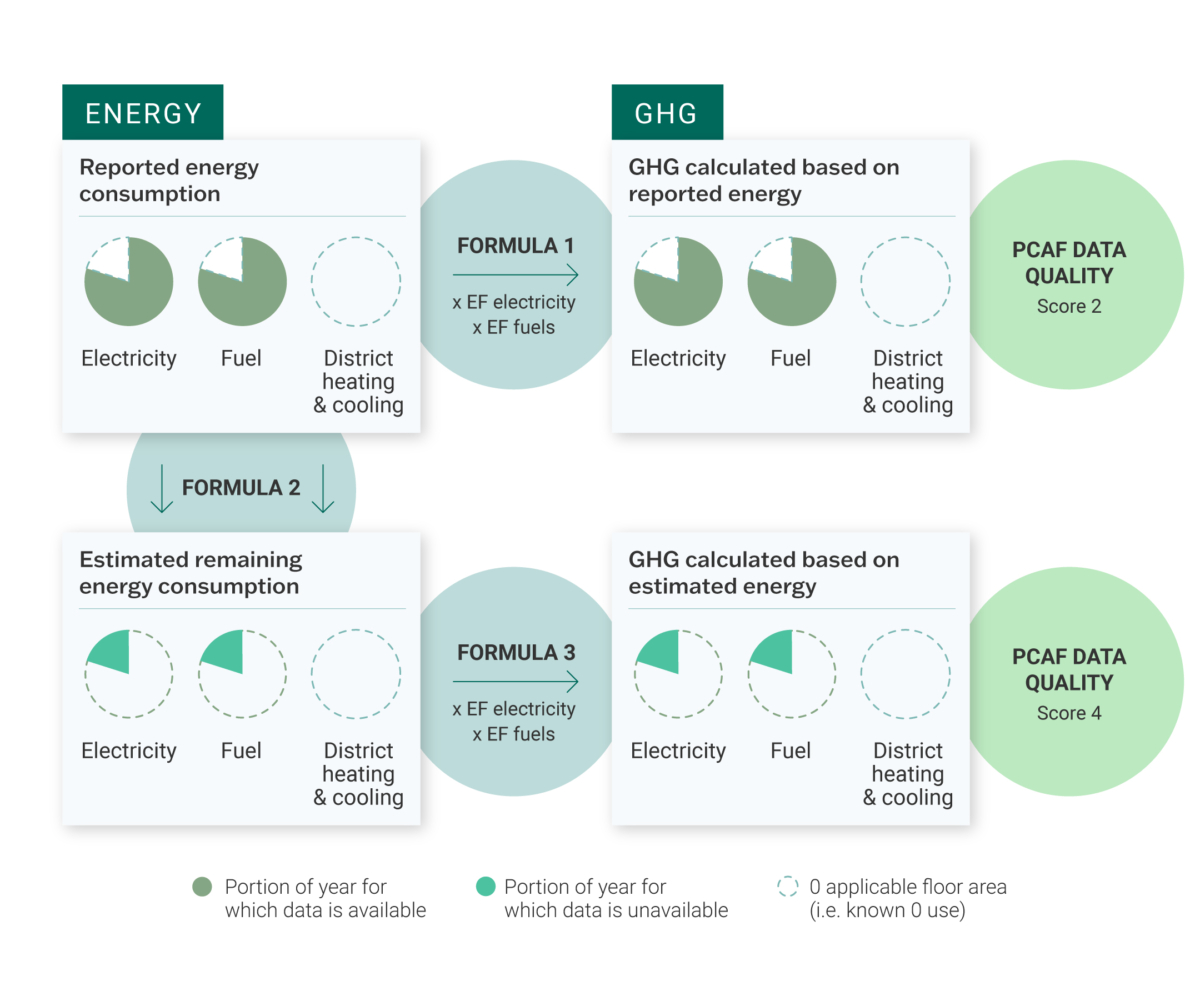

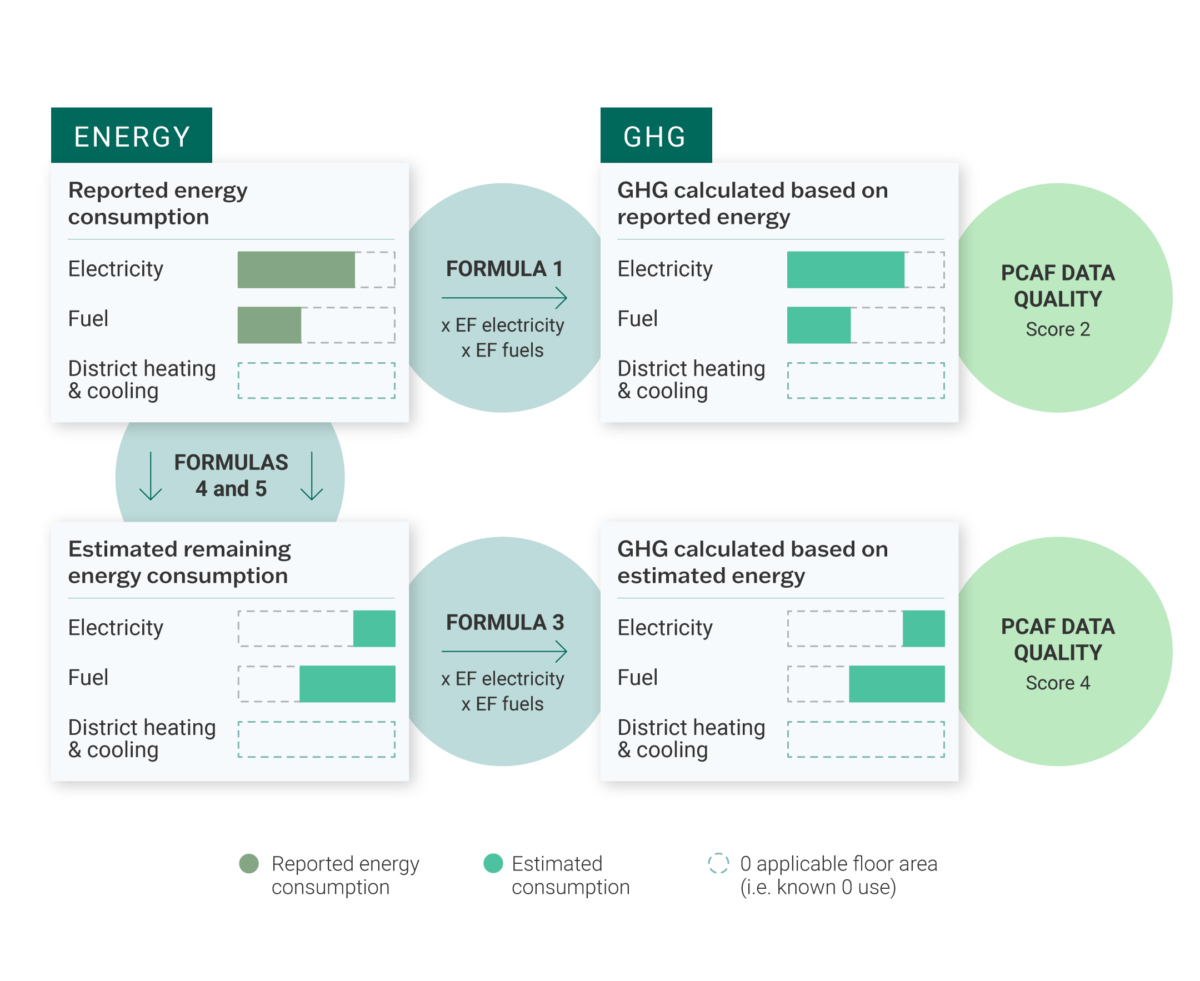

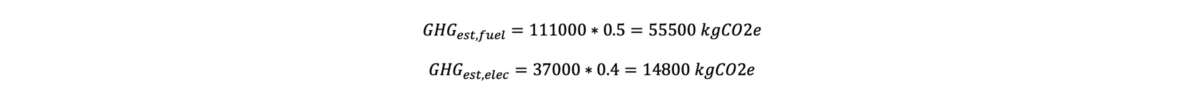

GRESB uses the most representative energy data available, whether directly reported by participants or statistically derived, to calculate GHG emissions for whole assets and, by extension, entire real estate portfolios — regardless of the available energy and GHG data at the input stage.

To help you understand how GEM estimates your missing data, we have included sample calculations below covering four distinct scenarios of asset-level energy data reporting behavior. These scenarios highlight how GEM adapts to different levels of data availability and coverage to produce reliable estimates in each case.

About the sample calculations

Before you dive into the sample calculations, keep in mind:

- All numbers used are sample figures and do not represent any actual data.

- The following emission factors (EF) are used for the purpose of these sample calculations:

- EF for Electricity: 0.4 kgCO2e/kWh

- EF for Fuels: 0.5 kgCO2e/kWh

- All of the sample calculations are presented at the whole-building level. However, if the asset reports at the sub-building level with reporting on energy use per sub-space, the estimation methods will be carried out for each of the building sub-spaces separately.

-

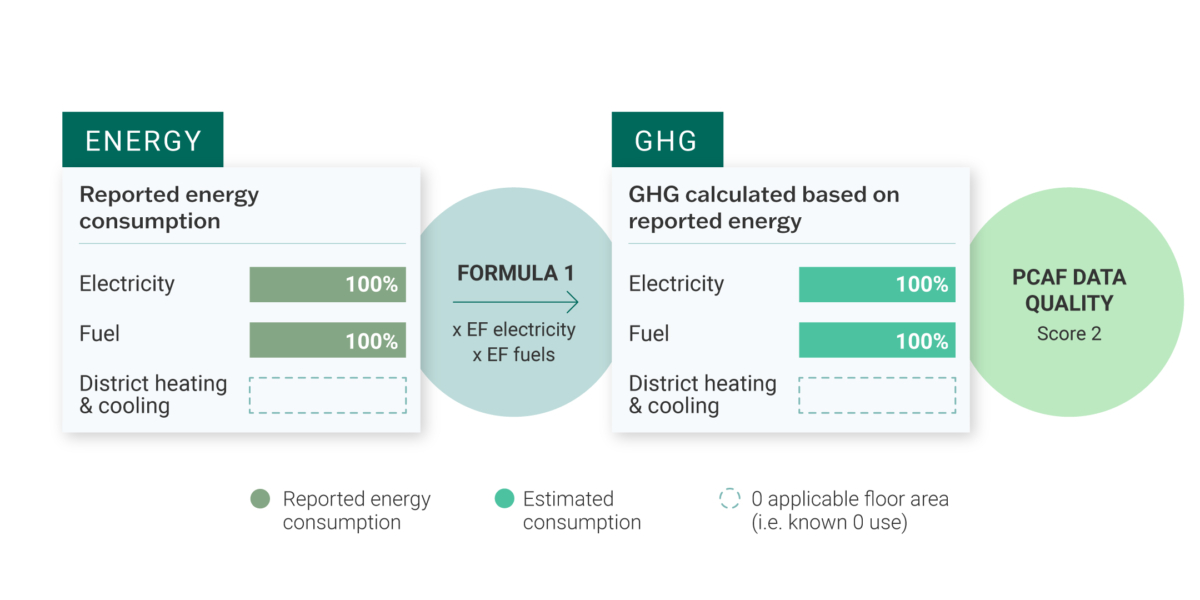

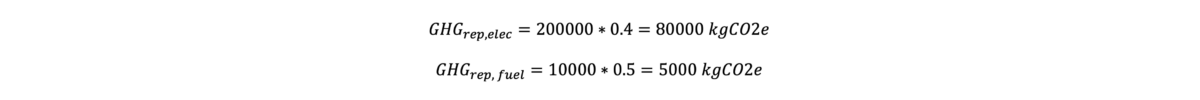

When an asset reports 100% data coverage (in terms of floor area) and 100% data availability (in terms of reporting year), no energy estimation is needed. GRESB only needs to calculate the GHG using the corresponding emission factors per relevant energy type. This asset has a known district heating and cooling consumption of 0 kWh.

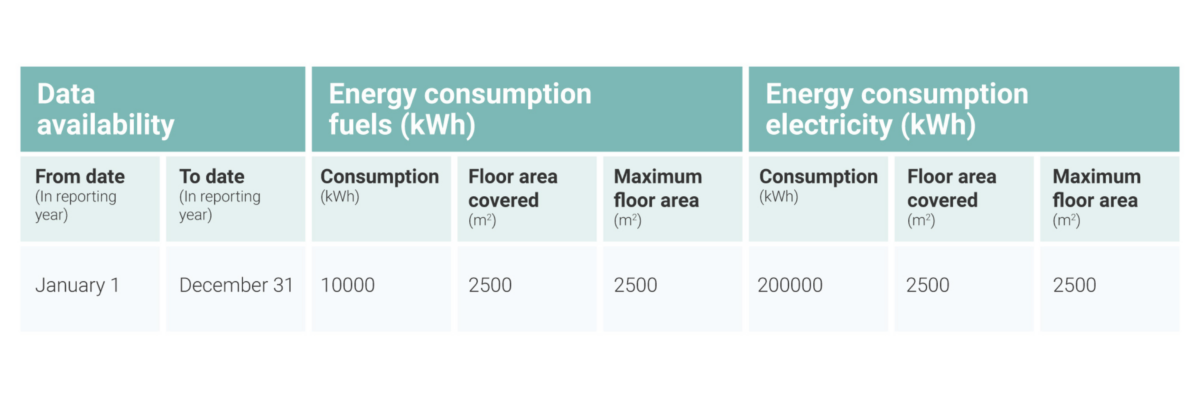

Available data:

Calculation for reported consumption data:

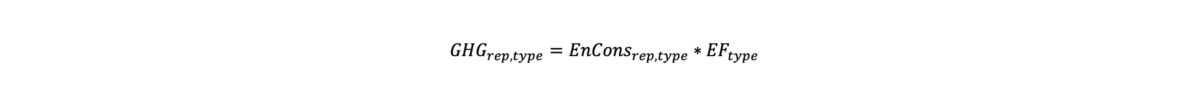

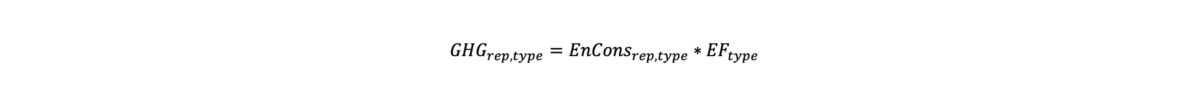

Formula 1

Where:

GHG is the absolute GHG emissions (kgCO2e)

EnCons is the energy consumption (kWh)

EF is an emissions factor (kgCO2e/kWh)

rep signifies reported data, or (for GHG) data calculated from reported data

est signifies estimated data, or (for GHG) data calculated from estimated data

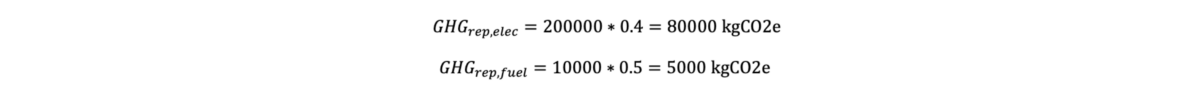

type specifies a particular energy type – i.e, electricity, fuels, district heating and coolingScenario calculation

-

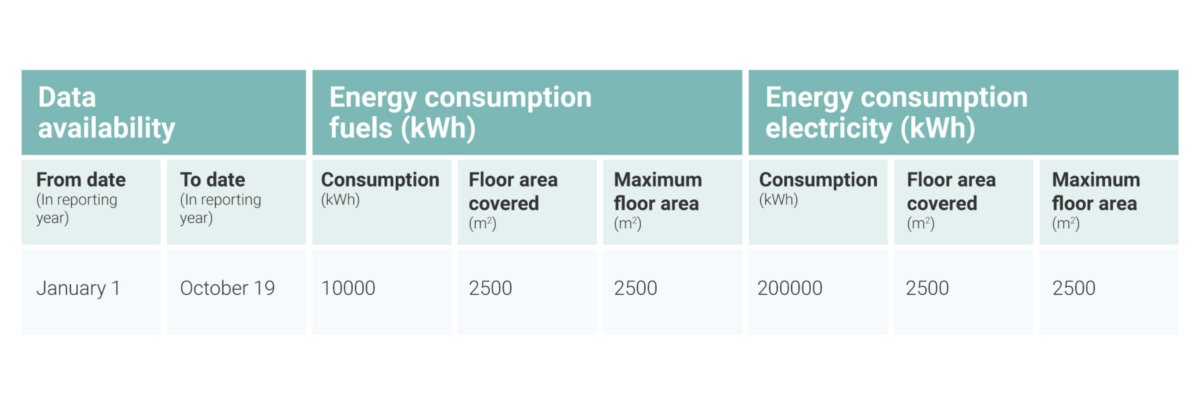

When an asset reports incomplete energy data over a period of time in the reporting year, GEM uses linear extrapolation to complete the energy data for that period. Subsequently, GHG emissions are calculated per energy type for the complete reporting year.

To complete data availability (time), GEM linearly extrapolates for each energy type.

To complete data availability (time), GEM linearly extrapolates for each energy type.

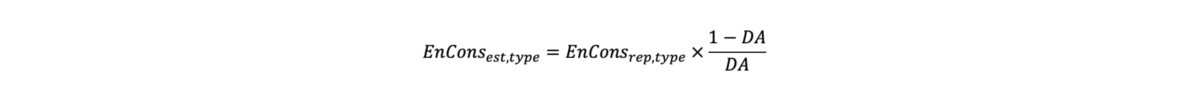

Formula 2

Where:

EnCons_est is the estimated energy consumption for the remaining uncovered time of the year

EnCons_rep is the reported energy consumption for the reported time period

DA is the data availability, or fraction of the year for which data is available

type specifies a particular energy type – i.e, electricity, fuels, district heating and coolingJan 1–Oct 19 is 292 days, which provides the fraction of the year for which data is available.

Scenario calculation

Formula 1

Scenario calculation

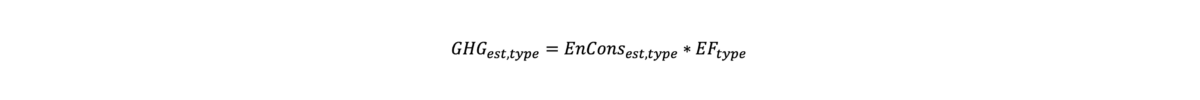

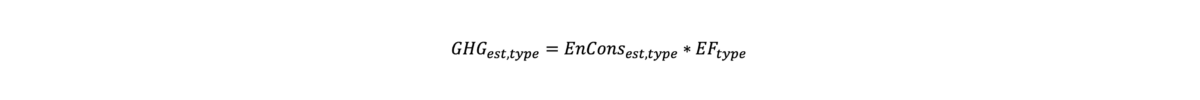

Formula 3

Where:

GHG is the absolute GHG emissions (kgCO2e)

EnCons is the energy consumption (kWh)

EF is an emissions factor

rep signifies reported data, or (for GHG) data calculated from reported data

est signifies estimated data, or (for GHG) data calculated from estimated data

type specifies a particular energy type – i.e, electricity, fuels, district heating and coolingScenario calculation

-

When an asset reports incomplete energy data in terms of data coverage (floor area), GEM uses a weighted combination of the energy intensity of the data provided and the median energy intensity (as per location and property sub-type) to fill in the appropriate gaps and calculate 100% data coverage. Subsequently, GHG emissions are calculated per energy type as per the completed energy data.

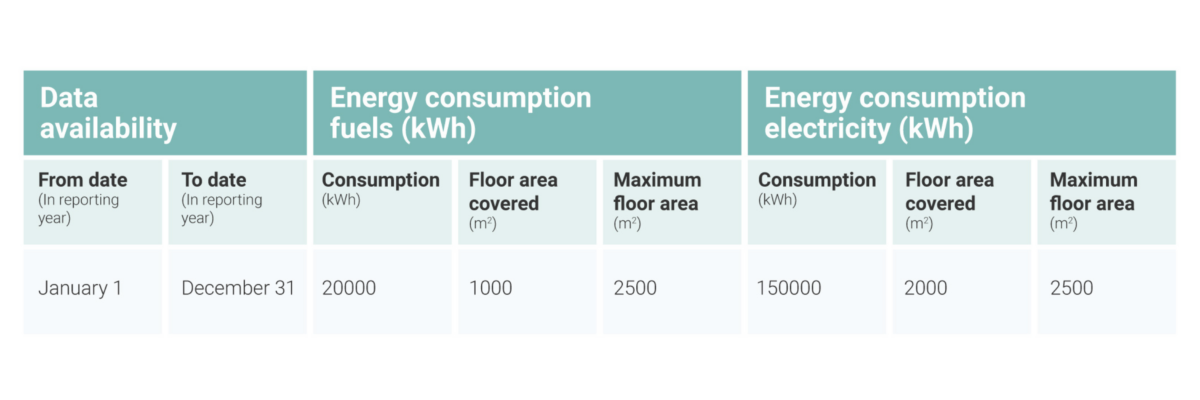

Available data:

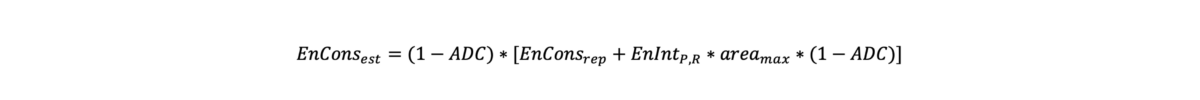

Estimating remaining energy consumption

Formula 4

Where:

EnCons_est is the estimated remaining energy consumption (uncovered area)

EnCons_rep is the reported energy consumption (covered area), cumulative of all energy types

ADC is area data coverage, the fraction of maximum area that is covered by the consumption data

EnInt_(P,R) is the median energy intensity for that property subtype and country

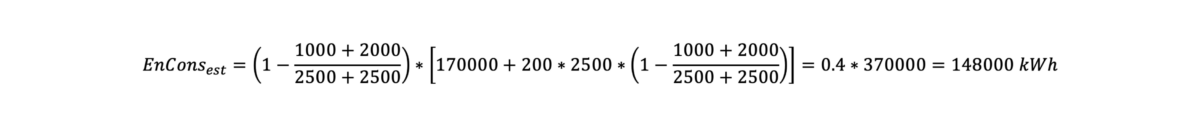

area_max is the maximum floor area, or the size of the subspaceScenario calculation

Estimated energy consumption by energy type

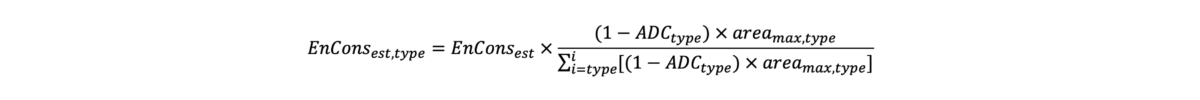

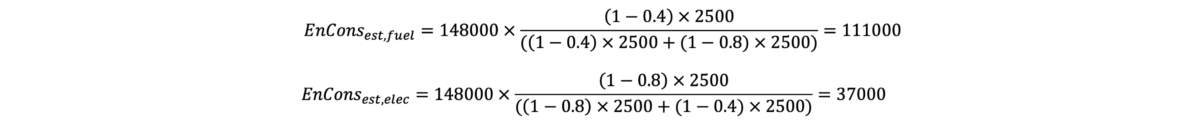

For the purposes of converting energy consumption into GHG emissions, it is important to understand energy consumption per energy type, even for energy consumption that was estimated. Thus, we allocate the estimated energy consumption to different energy types in the following manner:Formula 5

Scenario calculation

Note: The sum of the estimated consumption data for each energy data type equals the estimated consumption data from the non-energy-type-specific energy consumption estimation via Formula 4.

Calculating GHG emissions

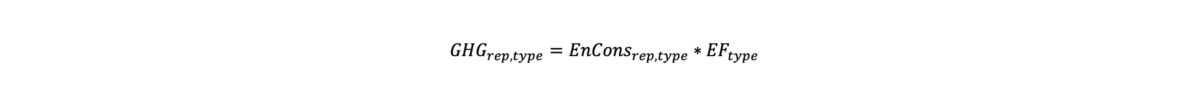

To calculate GHG emissions, the energy consumption is multiplied by the energy type-specific emissions factor (EF).

For reported consumption data:Formula 1

Scenario calculation

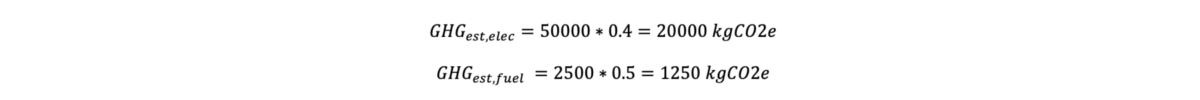

For estimated consumption data:

Formula 3

Where:

GHG is the absolute GHG emissions (kgCO2e)

EnCons is the energy consumption (kWh)

EF is an emissions factor

rep signifies reported data, or (for GHG) data calculated from reported data

est signifies estimated data, or (for GHG) data calculated from estimated data

type specifies a particular energy type – i.e, electricity, fuels, district heating and coolingScenario calculation

-

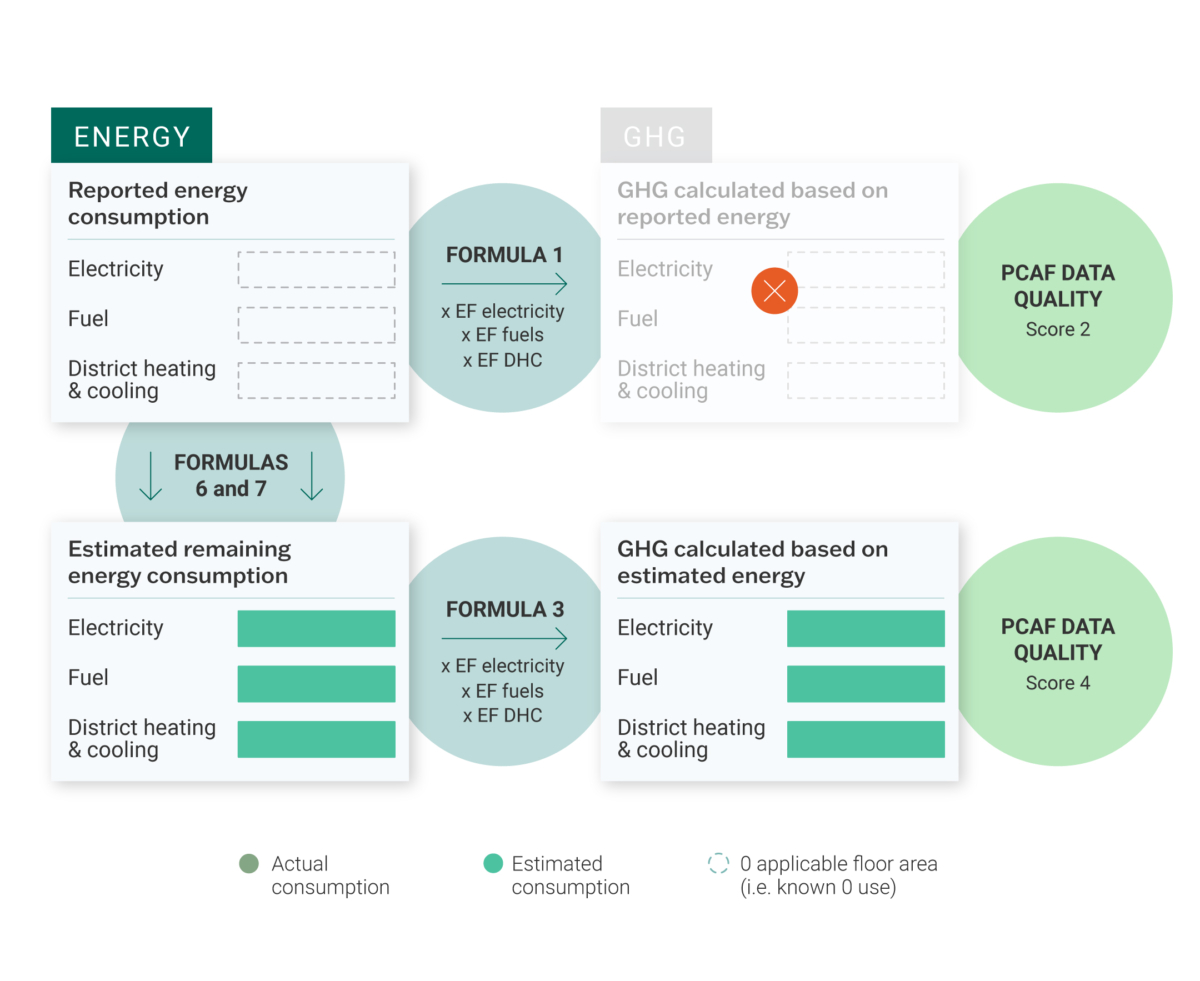

When the asset does not report any energy data (either in terms of floor area or period of reporting year covered), GEM first calculates the combined energy consumption as per the median energy intensity for the location and property sub-type. Energy consumption is then attributed to the different energy types using statistically derived energy mix ratios from the GRESB data set. Subsequently, GHG emissions are calculated per energy type as per the completed energy data.

Available data:

The median intensity, as opposed to the average (arithmetic mean) intensity, is used because it is more representative of the most likely intensity of the missing consumption. The average (arithmetic mean) intensity would likely be skewed toward greater intensities due to outliers on the energy intensive tail end of the distribution.

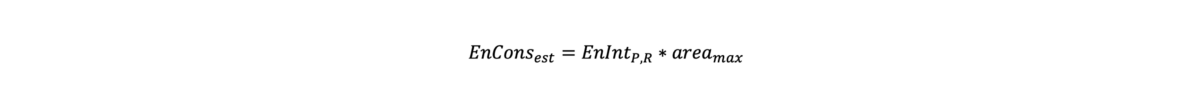

Formula 6

Where:

EnCons_est= Total energy consumption estimate

EnInt_(P,R)= Energy intensity (kWh/m2) for a particular property type (P) and region cross-section (R)

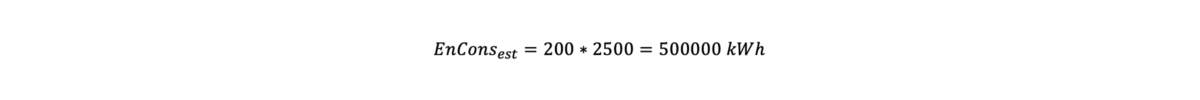

area_max= floor area of the assetScenario calculation

Note: In the event where there is an insufficient number of assets that fulfill the above criteria in the country/property sub-type bucket to calculate a representative average energy intensity, the bucket will be widened to the next bucket following the Real Estate Benchmark Peer Group Allocation Logic outlined in Appendix 3b of the GRESB Real Estate Assessment Reference Guide.

For situations in which there is no reported data on the energy consumption or types of energy used in the building, we use the average ratio of each energy type within the associated property sub-type/country cross-section of our more than 200,000 asset database.

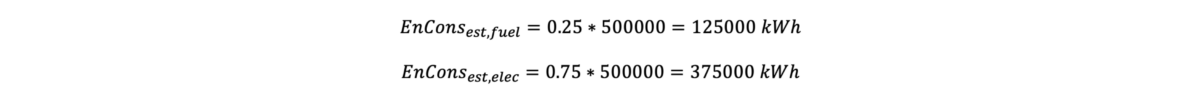

For the sample calculation, let’s assume the cross-section indicates an average energy split of 25% and 75% between fuels and electricity, respectively.

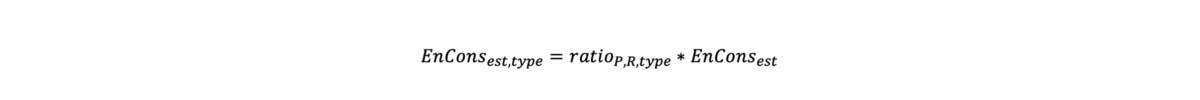

Formula 7

Where:

EnCons_(est,type)= Estimated energy consumption for a particular energy type

ratio_(P,R,type)= Average fraction of energy consumption for a particular property type (P) and region cross-section (R)

EnCons_est= Total energy consumption estimateScenario calculation

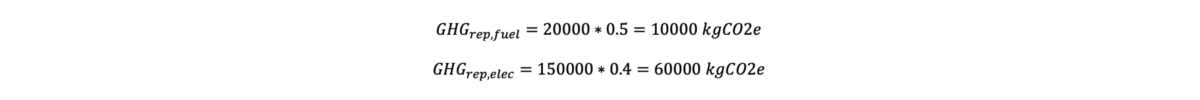

Taking the same EFs as above:

GEM in action

The GRESB Estimation Model is integral to several key GRESB tools and solutions, including the GRESB Transition Risk Report, the SFDR Reporting Solution for real estate, the GRESB Carbon Footprint Dashboard for real estate investors, and REAL Benchmarks.

Through the application of GEM across these tools, real estate managers and investors gain access to enhanced transparency, actionable insights, and tools for managing and improving portfolio performance.

Through its applications, GEM can help you:

- Fill performance data gaps with accurate energy and GHG estimations for assets with full, partial, or no reported data

- Benchmark your assets against peers and decarbonization targets

- Comply with reporting standards such as SFDR

- Improve decision-making through a better understanding of transition risks and decarbonization progress across your portfolio

Methodology

The methodology GRESB uses to calculate GHG intensity of a portfolio is aligned with global standards, such as the GHG Protocol’s Accounting and Reporting Standard for Corporates and the PCAF Global Standard, and consists of:

- Estimating missing energy consumption data

- Converting data into absolute GHG emissions

- Calculating and aggregating GHG intensities

GRESB takes particular care when providing estimations and dealing with imperfect cases with an aim to retain the integrity of the physical reality that the information is trying to reflect. This approach follows commonly accepted frameworks and standards and is transparent in a way that is easily understood and supported by the industry.

-

The first step to calculating GHG emissions for GRESB Members is to fill any gaps in energy consumption data for the full building.

We start by identifying how much of the data for a given asset has been reported. It is very important to track and disclose how much energy data, and subsequently calculated GHG data, is estimated. Otherwise, there is no indication of the data quality of the final metric, which reduces not only the confidence in the final output but also the incentive to continue measuring and gathering high-quality data in the future.

Next, we estimate the remaining energy consumption of a given floor area using GEM. To do this, we use a weighted mix of (a) the energy intensity of the reported data for that floor area type and (b) a median intensity for that property subtype and country, which is derived from about 208,000 individual assets contained in the GRESB Benchmark.

GEM uses the most granular data available. If data is reported at the whole building level, the estimation procedure is conducted at the whole building level. If data is reported at the subspace level, the estimation procedure is conducted at the floor area type level.

For example, if a GRESB Member is missing energy consumption data for the tenant’s portion of a multifamily midrise building in Amsterdam, the model can drill down and compare the building’s known data points – like floor size, location, and specific property subtype – against the GRESB database. Because we have detailed data from a large enough pool of similar buildings, we can construct a representative median intensity to provide a truer picture of the missing data while avoiding the effects of outliers.

For assets with no reported energy consumption data, the GRESB estimation model will use a statistically-derived benchmark based on the most relevant cross-section of asset characteristics to calculate profile of whole building energy consumption performance per energy type.

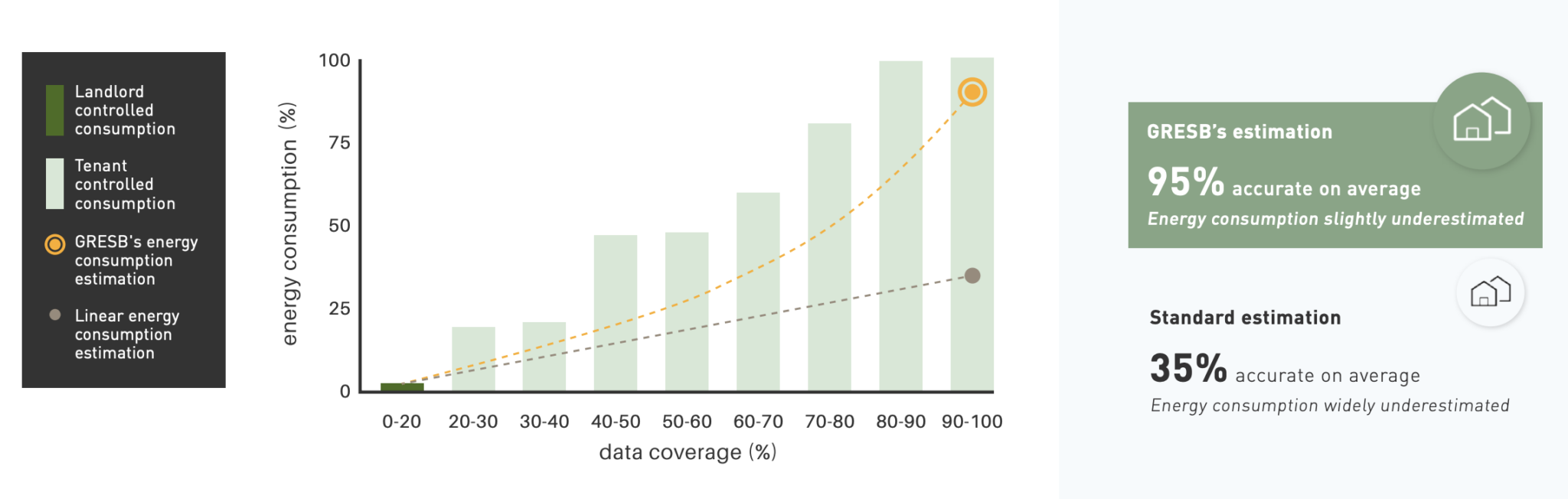

The figure below is based on a blind test comparing GRESB’s asset estimation against an alternative estimation based on linear extrapolation. As you can see, the GRESB estimation is far closer to ‘true’ than a standard alternative approach.

-

At its most basic, GHG emissions associated with a particular amount of energy may be calculated by multiplying that amount of energy (measured in kWh) with the emissions factor (EF, a conversion factor with the unit kgCO2e/kWh) associated with the specific energy source.

GHG emissions = energy consumption * emissions factor

For all reported data, the energy consumption is multiplied by the energy type–specific EF for its reported energy type – electricity, fuel, or district heating and cooling.

Estimated energy consumption data is multiplied by a combined emissions factor that is designed to more accurately reflect the combination of energy types that supply the remaining floor area.

Treatment of Renewable Energy

This methodology follows the location-based method as described in the GHG Protocol Corporate Accounting and Reporting Standard*. As such, renewable energy that is generated off-site is not counted toward the reduction of GHG emissions.

For the calculation of GHG emissions, renewable energy generated and consumed on-site is subtracted from reported building electricity consumption to arrive at a figure that reflects the amount of energy procured from the grid.

Exported renewable energy is not subtracted from the building’s energy consumption before calculation of the GHG emissions. This is consistent with the GHG Protocol’s Scope 2 Guidance**. Exported renewable energy is not included in the GHG emissions calculation in any way.

-

The calculation of GHG intensity is accomplished by dividing absolute GHG emissions (kgCO2e) by the floor area (m2), over which the corresponding energy was consumed. Asset-level GHG intensities can be aggregated to portfolio-level GHG intensities by taking the floor area-weighted average of the asset-level intensities.

With that you have a complete, globally applicable, portfolio-level understanding of GHG-intensity that uses the most granular data available for any reported or estimated data.

The GRESB methodology provides a number of benefits. It:

- Works for all assets and property subtypes globally

- Takes advantage of the most granular level of GRESB reporting with GHG emissions built-up from energy data reported for each floor area type

- Leverages GRESB’s global database of real estate assets to estimate missing data with the most representative sample possible

- Serves real estate assets for which no energy consumption data is provided

For a more detailed breakdown of the methodology – complete with edge cases, formulas, and GRESB variables – refer to the Appendix of the Transition Risk Report.

For a quick primer on GEM, listen to our recent Pulse episode: Diving into GEM: The methodology behind REAL.

Talk to us about GEM and GHG estimations

"*" indicates required fields