Name: Thomas Stanchak, Director of Sustainability

Firm: Stoneweg US, LLC

GRESB Assessments or tool: GRESB Real Estate Assessment

AuM: USD 1.7 billion as of Sept. 30, 2022

Focus region: United States

Entities: Varia US Properties AG

Starting Year with GRESB: 2022

Did you work with a partner or a consultant? Yes

What motivated you to start participating in the GRESB Assessments and what were you doing for ESG/sustainability prior to joining GRESB?

We were motivated to participate in GRESB because we wanted to receive a relevant and unambiguous assessment of our ESG activities. In addition, stakeholders with a significant share interest in the company encouraged us to engage with the assessment.

Since the founding of the company, we have sought to implement sustainability/ESG practices, but this effort lacked a coherent strategy until 2021 when we created a comprehensive ESG policy. Once we defined our ESG policy, which included specific sustainability practices, we were able to begin a programmatic approach to achieving our ESG objectives. Benchmarking with GRESB was the natural next step in understanding what we achieved and where there were opportunities to improve.

How long had you considered doing GRESB before you started?

GRESB was on our radar as early as 2020, but we did not make a concrete decision to submit in 2022 until Q3 of 2021 when we worked with our ESG consultant to complete a GRESB gap analysis. The result of this gap analysis was that we would likely score ~39 on the GRESB 0-100 scale, primarily due to the challenges with capturing and organizing performance data. Following the results of the gap analysis we focused on putting a portfolio-wide system of utility and sustainability management in place which was a tremendous contribution to achieving our first-year score of 64, compared to the gap-analysis estimate of 39.

Has your perspective on ESG reporting and benchmarks changed since starting GRESB? If so, how, and do you see things differently compared to when you started?

There is a long-arc to performance data, and the time to get started with implementing a system to capture and report utility use is now. Each day that goes by puts the recognition of your efforts further in the future.

For example, we’ve implemented a solution to capture tenant energy use, but this got into full-swing in Q4 of 2022. The full benefit of this information won’t be realized in our GRESB Performance scoring until our 2024 submission when we will be able to include a significant amount in our performance reporting. Furthermore, it won’t be until our 2025 submission until we can demonstrate year-over-year results using this data. In our case, the arc of going from starting implementation of collecting performance data to the full benefit is expected to be three years.

Another way of looking at things is third-party assurance. This seems like a lost opportunity for first-time submitters who may likely be unaware there is a significant benefit in scoring to have an expert look at their utility management data and provide objective verification.

What did you find most helpful when preparing and completing your assessment submission? What did you find most challenging?

The submission is quite lengthy and, for newcomers, it may be difficult to understand the context of some of the questions. There is a real benefit to working with a consultant with demonstrated expertise, as well as some understanding of your business. It’s invaluable to find GRESB support when you are just setting out.

The asset-level worksheet can be intimidating for a portfolio of significant size. This was probably the most challenging. Fortunately for me, I came from the asset management side of our business and can bring an intimate understanding of each of our real estate assets. This makes answering the questions much more straightforward if you’ve been involved in the operations and business plan execution overtime.

What did you find most valuable in the resulting GRESB benchmarks and data and how have you been using them?

The GRESB benchmark report is well known and respected among real estate investors. After we completed the submission, there was a lot of anticipation about the results. We were really pleased when the preliminary results were shared. I personally feel that the scoring breakdown in terms of management and performance, as well as ESG, accurately reflect our company’s accomplishments in terms of sustainability and ESG through the end of 2021.

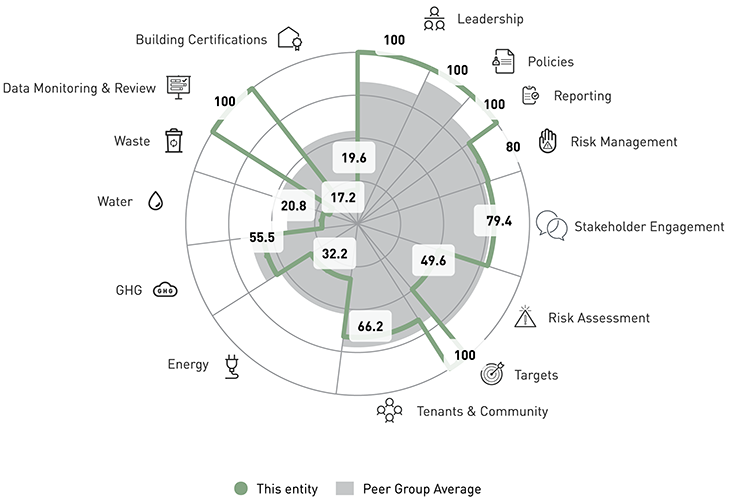

I shared the results with our corporate staff, executive team, and board members. Again, the breakdown of the results made explaining the score result fairly easy. The windrose graph is also really helpful when explaining to stakeholders where we performed well, but especially where there is an opportunity for us to improve.

We have issued a press release and posted our benchmark report on our website for investors and analysts. Completing the submission and receiving the benchmark report was a milestone for our ESG initiative and we were proud to share the results.

We also just took part in a webinar with the Green Building Initiative (GBI) about GRESB and our experience as a first-time submitter. We hope this encourages other real estate managers to get organized around ESG and submit to the GRESB benchmark as well.

I believe the most valuable result of the GRESB benchmark report is the legitimacy it lends to the good work we’re doing across our portfolio. As a result of GRESB participation and reporting, we now have a baseline to point to and measure our performance against year over year as we continue to adopt additional sustainability practices.

What sustainability-related changes have you made since starting GRESB and what are the most important insights or learnings you’ve uncovered with GRESB data?

Collecting utility data, particularly whole building energy data is really difficult for multifamily real estate investors at scale. The utility companies that service the vast majority of the locations where we invest are not cooperative with sharing aggregate resident energy use. We took a lot of really meaningful steps in the second half of 2022 to put together processes and systems to capture and report whole building data. What I’ve learned and often share is that the arc of performance data is long and investors shouldn’t delay setting up the organization to begin collecting this data. The most benefit in terms of performance scoring from the systems we put in place recently to capture energy use from our leased areas won’t be realized on the benchmark report until our 2024 submission.

How are you preparing for next year’s Assessments? Please share how you are leveraging your first-year results and learnings to prepare for your second-year submission.

We created an action plan based on an abstract of where we fell short, which was primarily in the performance and environmental categories. We’re working to adopt the best practices scored by the GRESB benchmark, but doing so in a thoughtful and effective way that makes the most sense for where we are at in our sustainability journey. I’m really looking forward to participating in next year’s benchmark so I can share with our stakeholders how much we’ve accomplished in terms of sustainability since the end of 2021.

Now that you have done GRESB, what advice would you have given yourself prior to doing the assessment?

Find a way to capture whole building data and begin using Energy Star Portfolio Manager right away. There is such a long arc to performance reporting and a big penalty to starting data collection in a meaningful way too late.