During the 2023 GRESB Infrastructure Insights event held in Singapore on November 21, Karthik Jega Jeevan, Regional Sales Manager for GRESB Infrastructure, presented the GRESB benchmark results for the Asia region.

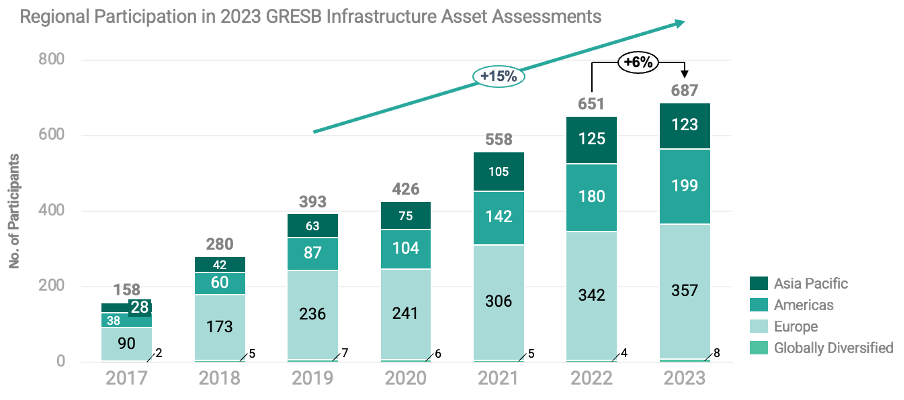

Co-hosted with Jason Tok, Market Leader Advisory, Asia, from GHD Advisory, the event was attended by some 50 invited infrastructure managers, operators, and investors, representing the key asset classes in Asia that witnessed the highest capital flows over the last three years (i.e., data infrastructure, transport, and renewable power). As of 2023, GRESB participation of infrastructure assets grew by 15% per annum over the last five years.

“GRESB participation of infrastructure assets grew by 15% per annum over the last five years”

Figure 1: Regional participation in 2023 GRESB Infrastructure Asset Assessments by region.

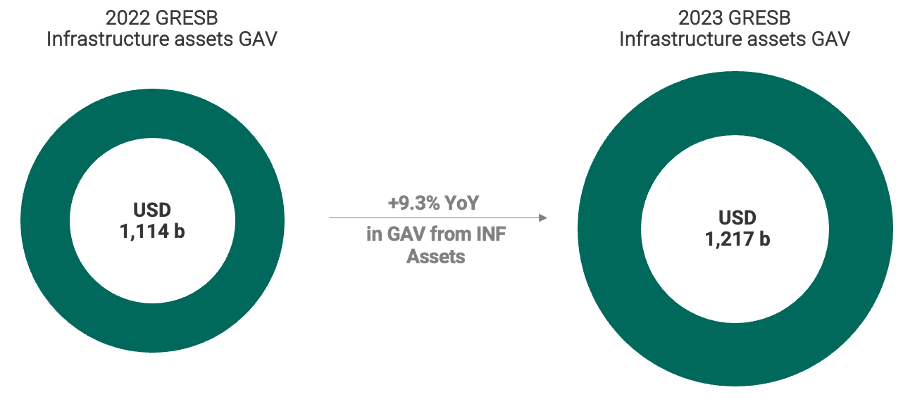

Global infrastructure assets recorded a 9.3% year-on-year increase in 2023, growing to represent more than USD 1.2 trillion in gross asset value (GAV). The results from the GRESB Infrastructure Assessments established that participants continue to recognize the importance of ESG disclosure through GRESB for global, sector-specific peer benchmarking.

“9.3% growth year-on-year in GRESB participation of infrastructure assets globally, representing over USD 1.2 trillion in GAV”

Figure 2: Year-on-year growth in GAV of infrastructure assets benchmarked by 2023 GRESB Infrastructure Asset Assessments.

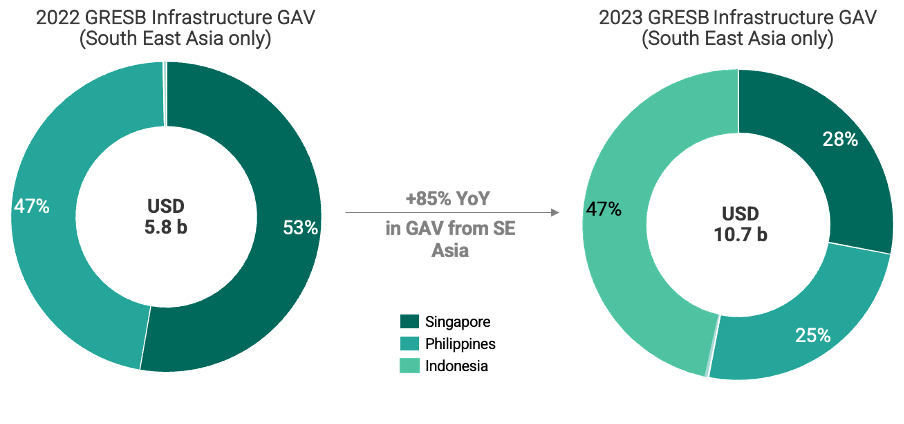

There was tremendous growth of 85% year-on-year in the GAV of infrastructure assets in Southeast Asia participating in GRESB, largely due to the increase in participants from the Data Infrastructure asset class.

“Growth of 85% year-on-year in the GAV of infrastructure assets in Southeast Asia participating in GRESB”

Figure 3: Year-on-year growth in GAV of infrastructure assets in Southeast Asia benchmarked by the 2023 GRESB Infrastructure Asset Assessments.

With a diverse panel of speakers comprising Candice Bell from Macquarie Asset Management, Romain Maire from LOGOS Property, Benjamin Towell from OCBC Bank, and Yee Chen Tan from GHD Advisory, it was established that:

- A globally-recognized, sector-specific ESG benchmark assists an investor in deriving specific KPIs and milestones that are aligned and achievable within a portfolio’s sustainability strategy and material ESG indicators

- Green loans are the most common and successful green financing mechanism in Southeast Asia

- Information on sustainability-derived milestones by lenders are crucial to empowering borrowers on their overall sustainability journey

- Sustaining a lower leverage ratio is critical for renewable power project developers to recycle capital when operating in an environment with shorter-term Power Purchase Agreements (PPAs)

- Providing clarity on various ESG disclosure requirements in the region is key to enabling growth in sustainable development

“Providing clarity on various ESG disclosure requirements in the region is key to enabling growth in sustainable development”

Figure 4: Featured speakers on the discussion panel held during the 2023 GRESB Regional Insights Singapore event for infrastructure in Asia.

Figure 5: From left to right – Yee Chen Tan (GHD Advisory); Benjamin Towell (OCBC Bank); Candice Bell (Macquarie Asset Management); Romain Maire (LOGOS Property).