GRESB’s approach to stakeholders

Established in 2009 as an investor-led initiative that is “by industry, for industry,” GRESB places a high priority on stakeholder engagement and alignment with wider ESG frameworks. This focus is key to our credibility and relevance, and it is a major reason why we call our core stakeholders ‘members’ and ‘partners’ instead of ‘customers.’

GRESB’s stakeholder engagement strategy is built on the AA1000 AccountAbility Stakeholder Engagement Standard (2015) and references the ISEAL Alliance Standard-setting Code of Good Practice, which defines how a sustainability standard should be developed, structured and improved over time. To ensure stakeholder engagement is embedded across the organization, we have committed to the AccountAbility principles of inclusivity, materiality, responsiveness and impact.

For GRESB, our stakeholder landscape is complex, with some stakeholder groups overlapping others in terms of roles and responsibilities:

- Investors, both institutional investors (pension funds, insurance companies, sovereign wealth funds) and other investors (banks, family offices, foundations, endowments, etc.)

- Real estate & infrastructure entities, including listed property companies, developers, REITs and privately managed funds

- Industry associations, such as APREA, ANREV and ARES

- Institutions like development banks, central banks, governments, and inter-governmental organizations

- ESG framework providers, from both NGOs and the private sector

- Inter-governmental initiatives, such as those related to the United Nations

- Investor initiatives

- Green Building Councils

- Certification or rating scheme providers

- Consultants

- Media and research organizations

Stakeholder engagement

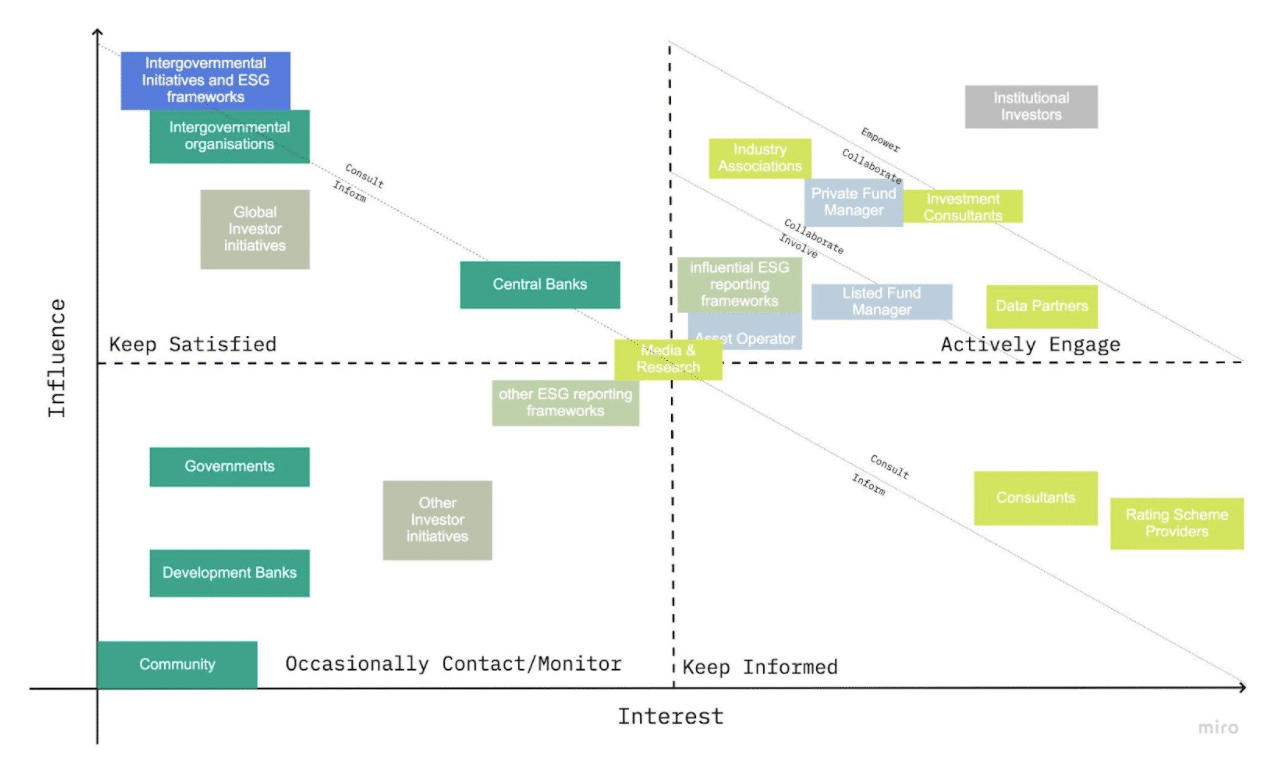

GRESB plays an important role within the world of sustainable real assets, and it is critical that we engage with the many stakeholders that operate in the ESG space. That said, we cannot and should not engage every stakeholder in the same way or at the same level.

An ‘interest-influence’ grid helps illustrate our approach, which shows active engagement with GRESB Investor Members, Participant Members and Partners, which is done primarily through the GRESB Foundation. You can see ‘influential ESG reporting frameworks’ are among our most important stakeholders, just below our own members and partners. For these frameworks, we create bilateral partnerships and engage through representation on various committees and working groups.

The ESG frameworks that GRESB engages most with include:

- Principles for Responsible Investment

- The Global Reporting Initiative (GRI)

- The Sustainability Accounting Standards Board (SASB)

- The International <IR> Framework

- EU Sustainable Finance Disclosure Regulation

- Task Force on Climate-related Financial Disclosures

- CDP

Standardizing ESG frameworks

While a number of ESG frameworks currently exist, calls to standardize reporting have been gaining momentum in recent years and some significant progress has been made.

The European Union has been leading the way with the Sustainable Finance Disclosure Regulation and EU-Taxonomy; the Big Four accounting firms have released a common set of ‘stakeholder capitalism metrics’ with the World Economic Forum; and a consortium of leading standard setting organizations – CDP, CDSB, GRI, IIRC and SASB – announces a shared vision for a comprehensive corporate reporting system.

Most recently and significantly, the International Financial Reporting Standards (IFRS) launched the International Sustainability Standards Board (ISSB) at COP26. This new body aims to introduce a baseline standard that can be adopted by companies across the globe, with an initial focus on climate disclosures.

Meanwhile, GRI and the European Financial Reporting Advisory Group (EFRAG) are co-constructing the European sustainability reporting standards (ESRSs), which will likely have a broader scope than the initial standards from the ISSB and will reflect “double materiality” for a company – that is the impact of, and on, society and the environment.

GRESB and universal frameworks

Since its inception, GRESB has served as a ‘secondary standard setter’, referencing the most useful and popular primary standards and carefully selecting those that work best and are most material for real estate and infrastructure. We work with primary standards setters to adapt their standards when necessary, and at times we have helped these primary frameworks to develop sector-specific standards.

At the moment, it is unclear whether universal standards will provide the needed sector-specific granularity; however, as efforts to standardize ESG reporting accelerates, GRESB will continue collaborating with industry partners to increase overall alignment and provide the reporting platform that GRESB Members rely on for validation, scoring and benchmarking.

Specific ESG initiatives

We work closely with various initiatives around the world. A selection of important ones include:

SFDR and EU Taxonomy

GRESB has been closely following the European Union’s sustainable finance regulatory initiative, providing consultation submissions and technical expertise through various working groups and reviews. In 2022, GRESB is launching an SFDR assessment, which will allow real estate participants to prepare SFDR reports using the GRESB Portal.

TCFD

The Financial Stability Board’s TCFD recommendations was a well supported standard with many jurisdictions planning to adopt them into regulations, which we provided alignment solutions in previous years.

PRI

Well recognized as the leading proponent of responsible investment, PRI reporting focuses on the investor and manager level (top down), which complements GRESB reporting at the fund and asset level (bottom up). GRESB is a PRI service provider signatory, holds quarterly meetings with PRI staff and makes submissions on relevant consultation aspects.

SASB

GRESB has built a strong working relationship with the Sustainability Accounting Standards Board (SASB) in the United States, which based its real estate sector standard on the GRESB real estate assessment.

Green building councils and real estate associations

GRESB counts major green building councils and most major real estate associations around the globe as industry partners, including those focused on both listed and non-listed real estate. Many representatives from these organizations sit on our governance groups, and they typically seek alignment with GRESB when they develop guidance and their own standards.

CRREM and PCAF

GRESB works closely with specialized ESG initiatives, such as the Carbon Risk Real Estate Monitor (CRREM), which seek to accelerate the decarbonization of the real estate sector, and the Partnership for Carbon Accounting Financials (PCAF), which works to develop a harmonized approach to asses and disclose GHG emissions associated with loans and investments.