Our industry is engaged in an important dialogue to improve sustainability through ESG transparency and industry collaboration. This article is a contribution to this larger conversation and does not necessarily reflect GRESB’s position.

In recent months, announcements from GRESB and the Science-Based Targets Initiative (SBTi) have highlighted the growing prominence of embodied carbon in ESG accounting and reporting. Embodied carbon is the emissions associated with building materials production, transport, installation, maintenance, and end-of-life phases. Since embodied carbon emissions make up 10% of all energy-related greenhouse gas emissions globally, these updates from GRESB and SBTi address a crucial but often neglected component of global emissions.

In August 2024, SBTi released final target-setting pathways for companies in the buildings sector to align their Scope 1, 2, and 3 greenhouse gas emissions with a 1.5°C future. While other decarbonization pathways, such as those from the Carbon Risk Real Estate Monitor (CRREM) initiative, have traditionally focused on operational carbon (emissions associated with energy used to operate the building), SBTi has most recently included embodied carbon. In the same month as SBTi’s buildings sector pathway release, GRESB announced substantial changes related to its standards that will increase the prominence of embodied carbon within its Real Estate Assessment. These updates demonstrate the growing inclusion of embodied carbon in accounting and target setting for real estate companies.

Growing expectations from investors and regulations

Investors and regulators are paying increasing attention to embodied carbon, leading to rising expectations around its management.

Driven by investor demand, GRESB is amending its 2025 Assessment to include additional embodied carbon indicators. The updates cover all three components: Management, Performance, and Development, with the most substantial modifications focused on upfront embodied carbon in the Development component. GRESB is also amending the Assessment to ask about companies’ strategies on embodied carbon-related policy, target-setting, leasing and tenant engagement, measurement, performance, and disclosure.

Additionally, expectations are growing for companies to set and work towards net zero targets. A 2023 survey by BNP Paribas of institutional investors found that 41% of respondents currently have net zero priorities, and 48% note that net zero will become a priority in the next two years. Currently, 37% of corporate net zero targets include Scope 3 (indirect) emissions, which is aligned with SBTi requirements for science-based target setting. For real estate companies, embodied carbon is typically included in a Scope 3 inventory.

Increasingly, state and local regulators are implementing rules round embodied carbon. At the beginning of this year, California’s CALGreen building code mandates that certain new construction projects include embodied carbon considerations. Some of the CALGreen options for compliance build off embodied carbon-related credit requirements outlined in LEED (Leadership in Energy and Environmental Design), the most prominent green building rating system globally.

Net zero and embodied carbon continue to be trending topics for real estate investors, as properties with lower carbon footprints will likely be more resilient to regulatory changes and market shifts. Developers and owners of new properties can enhance the sustainability and marketability of their projects by adopting low-carbon materials and construction practices and measuring their progress as part of any net zero goals.

Why focus on embodied carbon?

Due to the “time value of carbon”, near-term emissions reductions can significantly slow the rate of global warming and prevent the most severe impacts of climate change while providing more time to adapt and develop long-term solutions. For new construction projects, emissions related to material sourcing, manufacturing, and installation are released to the atmosphere immediately, while operational carbon emissions build over the lifetime of a building’s operation. Additionally, as buildings become more energy efficient and grids decarbonize, embodied carbon emissions will account for more of a building’s total emissions; building developers and owners can aim to reduce embodied carbon to mitigate this risk of increased emissions that will be impossible to reduce in the long-term.

How can we measure and reduce embodied carbon?

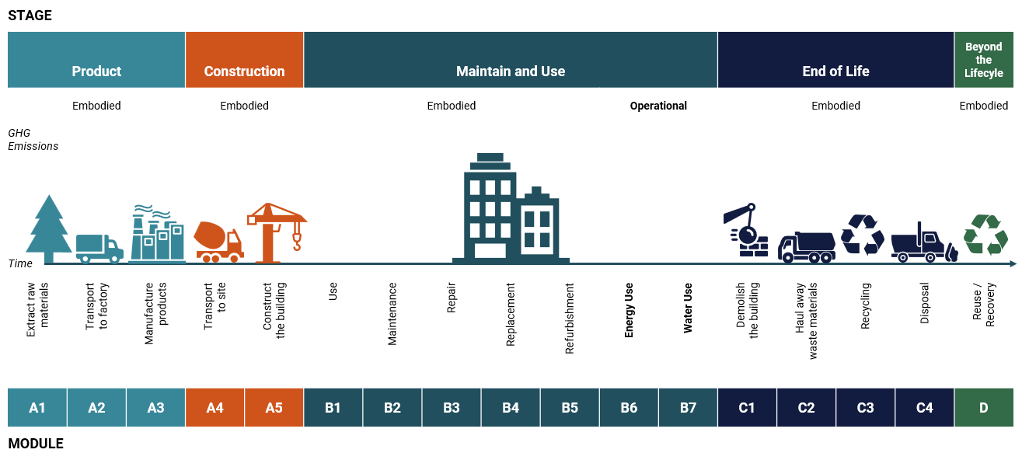

Life Cycle Assessments (LCAs) are a key tool in measuring embodied carbon, providing a comprehensive analysis of the environmental impacts of materials from the beginning to the end of a material’s life or from “cradle to grave”. While the majority of the current focus is on “upfront carbon”, or emissions related to the manufacturing, transportation, and installation of building materials (modules A1-A5), there are other areas where embodied carbon emissions can occur. Namely, these can happen during the building’s operations or end of life, through activities like renovations or demolition.

LCAs provide embodied carbon data commonly found in a material’s Environmental Product Declaration (EPD) and can be specific to the product or an average across the material’s industry.

When conducting LCAs, it is essential to consider materials such as concrete, steel, aluminum, and insulation, commonly used in construction and typically have high carbon footprints. These assessments should be conducted early in the design phase to identify opportunities for using low-carbon alternatives and optimizing material efficiency. Moreover, renovating existing buildings instead of building new developments should be considered to reduce embodied carbon where possible.

What is in the new SBTi guidance for buildings?

The Science Based Targets Initiative (SBTi) is a globally recognized standard for companies to develop pathways to reduce their greenhouse gas emissions; for companies to receive verification by SBTi, the organization requires that companies set targets to reduce Scope 1, 2, and 3 emissions. For real estate companies, Scope 1 and 2 (direct and indirect) emissions are typically more straightforward to measure (through leveraging building utility bill data, refrigerant maintenance records, etc.), while Scope 3 emissions (indirect emissions in the value chain) present challenges in both measurement and management. Depending on the category of Scope 3 emissions, operational and embodied carbon emissions can be a significant source of emissions for real estate owner-occupants, owner-lessors, developers, and property managers.

Over 6,200 companies across various sectors, have set approved targets through SBTi. As the adoption of Science Based Targets continues to grow, SBTi periodically releases updated sector-specific guidance aimed at addressing each sector’s most critical sources of emissions.

The recently released Building Sector guidance from SBTi emphasizes two key sources of building emissions: in-use operational emissions and embodied carbon. SBTi requires that the Building Sector target setting guidance is used for:

- Companies whose operational emissions from owned or managed buildings are 20% or more of their total Scope 1, 2, and 3 emissions

- Companies whose embodied emissions from new developments or acquisitions exceed 20% of their total Scope 1, 2, and 3 emissions in any of the three years leading up to setting their target

How do operational and embodied emissions relate to Scope 1, 2, and 3?

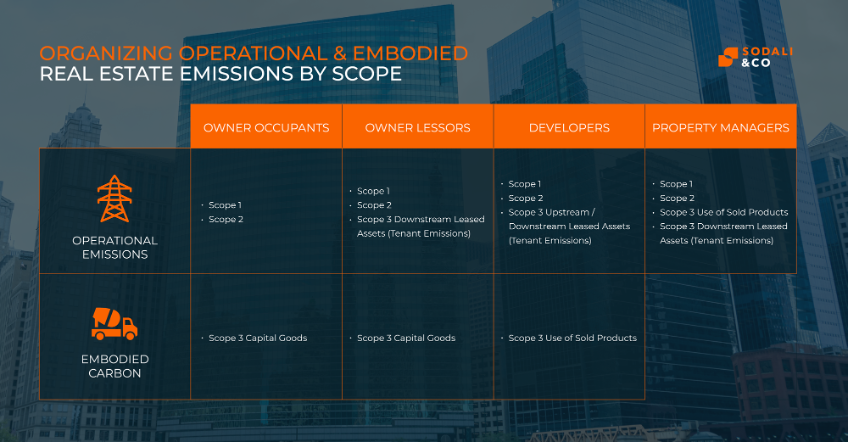

Organizing operational and embodied emissions in a fulsome greenhouse gas inventory largely depends on a company’s real estate investment strategy. For building owners that occupy their assets, in-use operational emissions encompass all Scope 1 and 2 building-related emissions. For building owners who lease their assets to another entity, in-use operational emissions are part of their Scope 3 category 13 (downstream leased assets) emissions. Building developers’ in-use operational emissions are encapsulated in their Scope 1 and 2 emissions in cases where developers build and occupy their buildings. If buildings are developed for a third party, operational in-use emissions will sit in the leasing company’s downstream leased asset emissions.

Building owners (occupants and lessors) will largely organize embodied carbon in Scope 3 category 2 emissions (capital goods) if their buildings undergo renovation activities. Building developers will include embodied carbon as Scope 3 category 1 and 2 (purchased goods and services and capital goods) for construction materials, in addition to the use of sold products for buildings that are sold.

Taking action on Scope 3 and embodied carbon

There is growing demand for net-zero targets that include Scope 3 emissions, as well as increased investor and industry focus on embodied carbon in assessments and certifications like GRESB and LEED. We recommend that companies with real estate portfolios and developments begin assessing their embodied emissions by conducting LCAs and using the results as input to their GHG inventory. Consider leveraging SBTi’s Building Sector guidance on embodied emissions reduction pathways if setting net zero targets.

This article was written by Nicole Nishizawa, Senior Associate, Sustainability and Michael Gardner Brown, Associate, Sustainability & Climate at Sodali & Co.

References:

Science Based Targets. “Buildings.” Accessed November 8, 2024. https://sciencebasedtargets.org/sectors/buildings

BNP Paribas. “Institutional Investors Accelerate Their Low-Carbon Transition Strategies, BNP Paribas ESG Global Survey Finds.” Accessed November 8, 2024. https://securities.cib.bnpparibas/institutional-investors-accelerate-their-low-carbon-transition-strategies-bnp-paribas-esg-global-survey-finds/

YouTube. “CALGreen Mandatory Embodied Carbon Reduction Regulations.” Accessed November 8, 2024. https://www.youtube.com/watch?v=aLmSLZcHotU

Carbon Leadership Forum. “The Time Value of Carbon.” Accessed November 8, 2024. https://carbonleadershipforum.org/the-time-value-of-carbon/