Our industry is engaged in an important dialogue to improve sustainability through ESG transparency and industry collaboration. This article is a contribution to this larger conversation and does not necessarily reflect GRESB’s position.

Introduction

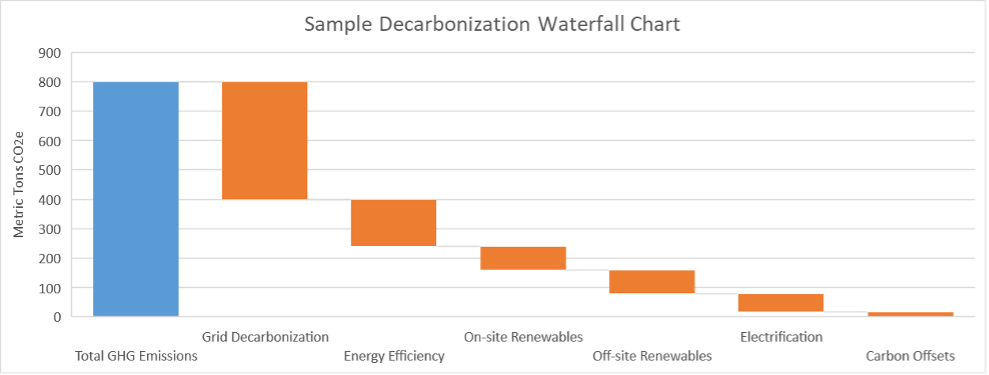

In the face of growing climate challenges, the push for decarbonizing commercial real estate (CRE) portfolios has gained urgency. With “decarbonization waterfall” charts, like the one shown below laying out methods such as grid decarbonization, energy efficiency, on and off-site renewable energy, electrification, and carbon offsets, it is clear the CRE sector has multiple pathways to reduce its environmental footprint. This article outlines a practical and structured approach that can guide CRE portfolio owners toward meaningful decarbonization outcomes that meet both environmental commitments and investor expectations.

Figure 1: Sample Decarbonization Waterfall Chart

Establishing a baseline through GHG emissions accounting

To effectively decarbonize a CRE portfolio, a precise greenhouse gas (GHG) emissions inventory is essential. By accounting for emissions at the portfolio level, property owners can establish their emissions baseline, set realistic reduction targets, and track progress. This inventory also estimates energy data for properties lacking comprehensive utility coverage, differentiating between on-site fossil fuel use and grid electricity. It is recommended to work with a consultant who is experienced with inventories on commercial real estate portfolios and following guidance outlined by the Greenhouse Gas Protocol and the Partnership for Carbon Accounting Financials (PCAF).1 2

It is also important to understand the kind of target you are setting —absolute or intensity-based— as well as how you will track progress. Absolute targets focus on reducing total emissions, while intensity-based metrics measure emissions per square foot. Base year recalculation policies and type of base year – fixed or rolling – will address what actions you will take if your portfolio changes in composition and if assets are purchased or sold.

Leveraging grid decarbonization potential

Two key metrics influence the rate at which a portfolio can decarbonize: the proportion of energy use from grid electricity versus on-site fossil fuels and the rate of predicted grid decarbonization in each asset location. While emissions from on-site fuel use will stay constant, emissions from purchased electricity will fall as the grid integrates more renewable sources.

Using tools like the National Renewable Energy Laboratory’s (NREL) Cambium dataset3, property managers can assess how grid changes will impact each property in the portfolio. This insight is crucial, as properties in areas with aggressive grid decarbonization targets (e.g., those with state Renewable Portfolio Standards) may require fewer additional investments to decarbonize.

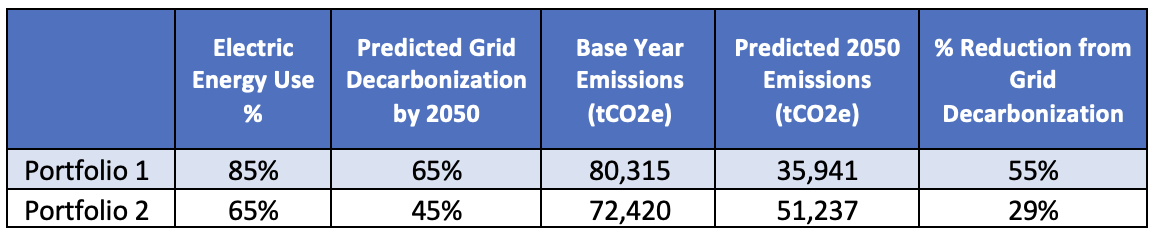

The chart below demonstrates two hypothetical portfolios with different decarbonization potentials. Portfolio 1, with low fossil fuel use and high predicted grid decarbonization, is on track for a 55% carbon reduction by 2050 with minimal intervention. In contrast, Portfolio 2 will see only a 29% reduction, necessitating further investment in energy efficiency and renewable solutions.

Table 1: Sample Grid Decarbonization Exercise

At this point, it is possible to perform high-level calculations to get an idea of how much to budget to meet decarbonization commitments using the remaining tranches. Average costs can be applied, but some costs are easier to determine than others and some need to be incurred annually, like purchasing Renewable Energy Certificates (RECs) or Carbon Offsets, whereas an investment in energy efficiency or on-site solar might be a one-time investment.

Decarbonization strategies at the asset level

Energy efficiency as a foundation: Implementing energy efficiency measures is typically the most cost-effective decarbonization strategy, as it reduces utility costs while lowering emissions. Conducting an ASHRAE Level II Energy and Water audit can identify these opportunities such as installing LED lighting, heat pumps, or performing retro-commissioning. Audits can also identify opportunities to replace existing fossil-fuel powered equipment with electric alternatives.

Returning to the Grid Decarbonization exercise already performed, we have an idea of how much energy reduction will be needed to meet carbon commitments; for Portfolio 1, Grid Decarbonization will account for a 55% carbon reduction by 2050, leaving a 45% reduction to be accounted for via other tranches. We can assume that some of that will be met with on and off-site renewables, but generally we should find that a 1-2% annual energy efficiency improvement at the portfolio level will keep on track. The most cost-effective way to achieve this isn’t to target a 1-2% efficiency improvement at each asset; it’s to target a larger improvement at your poorer performing assets.

Prioritizing assets through transition risk assessment: Partner Energy advises viewing properties through three lenses for decarbonization improvements:

- Regulatory compliance: Properties in cities with Building Performance Standards (BPS) or Audit & Tune-Up requirements must meet specific energy targets, or face penalties. Understanding these local regulations helps prioritize properties where energy audits or retrofits can avoid future costs. This topic has been covered previously by GreenGen.4

- Energy/Carbon performance: Portfolio managers should assess properties based on ENERGY STAR Scores or Energy Use Intensity (EUI), focusing on assets that are energy-intensive, emit large amounts of carbon, and/or are located in dirtier grid regions. Managers can also prioritize assets by the amount of electric versus fossil fuel energy they use. ENERGY STAR Portfolio Manager Data Explorer can be helpful with contextualizing these rankings and includes a Percent Electricity metric.5

- Carbon Risk Real Estate Monitor (CRREM): For properties at risk of “stranding” (becoming non-compliant with future carbon and energy standards), using CRREM can help prioritize those properties that require immediate decarbonization investments.

Given that CRREM curves are relatively new, not available for all countries, and still being updated for others, we recommend prioritizing regulatory compliance and energy/carbon performance over CRREM stranding years, but strand years are still applicable and can be valuable indicators.

After completing a Transition Risk Assessment Exercise, you will understand which properties require or will benefit from energy audits over the next 5-10 years. We recommend performing this assessment annually to account for acquisitions, new BPS, and changes in asset performance.

From plan to action: Turning efficiency goals into impact

After identifying high-priority properties, energy audits on selected assets generate valuable data for planning efficiency improvements. One of the most challenging next steps in decarbonizing CRE is moving from concept to action, where planning translates into concrete, on-the-ground project implementation and tracking. The true value of these audits lies in using the data effectively to identify projects that align with each asset’s capital expense plan, prioritizing measures with favorable paybacks, and addressing equipment nearing end-of-life to minimize disruption and optimize spending.

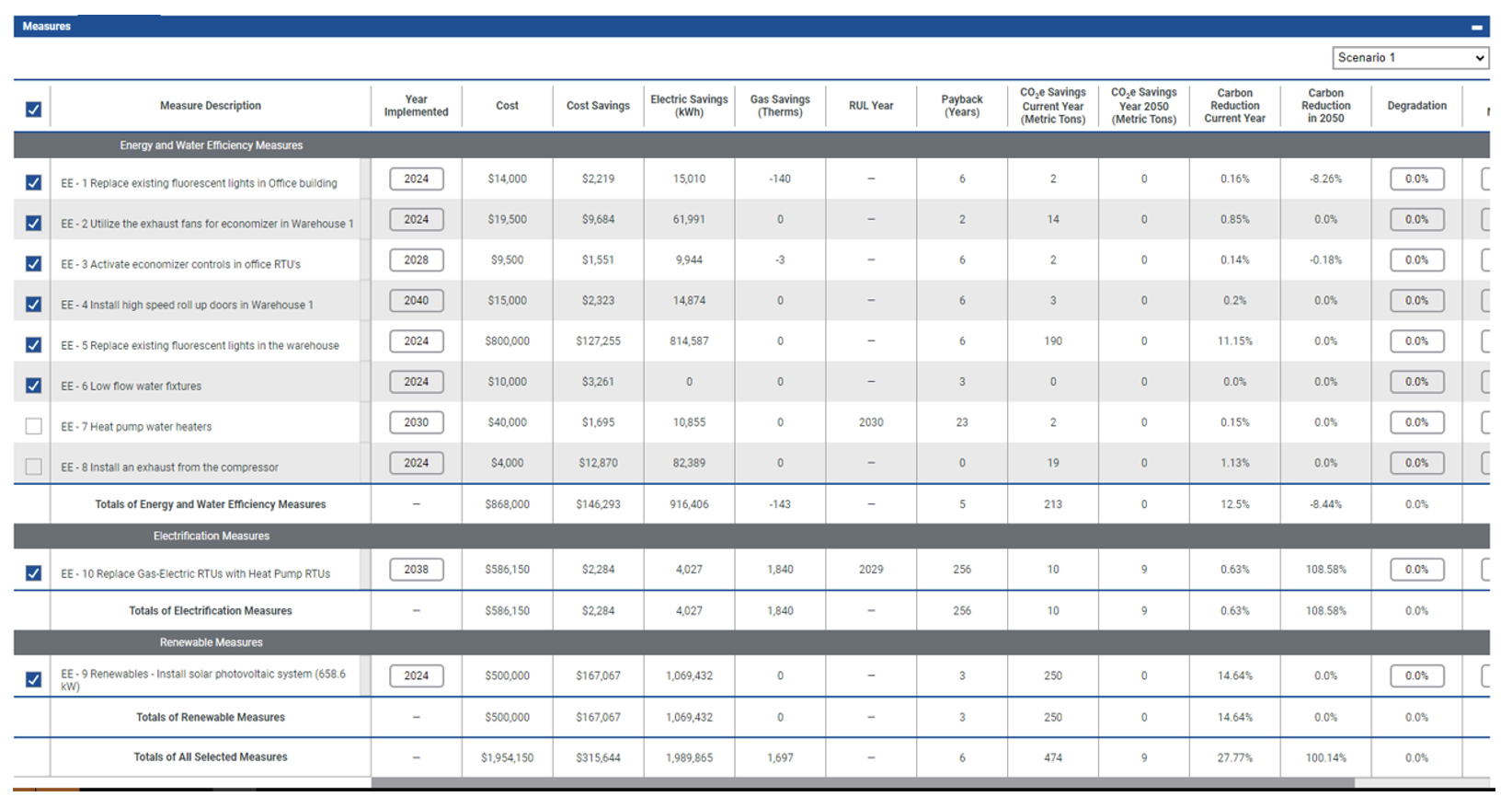

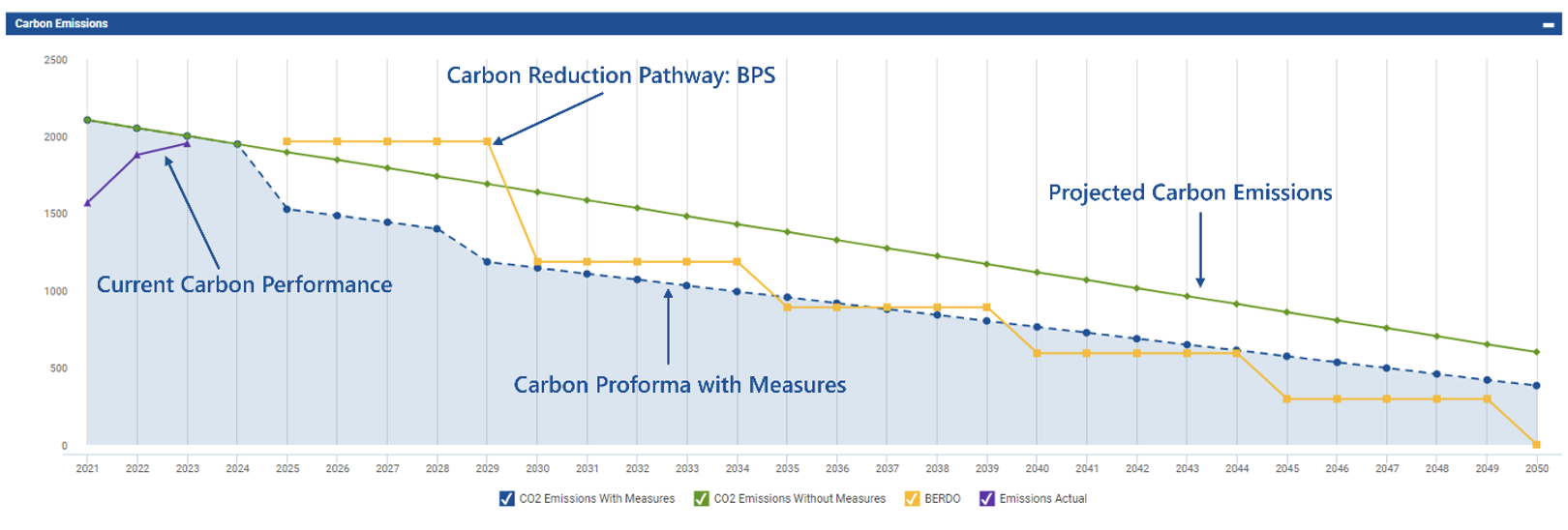

Audit results should be delivered in a consistent, easily analyzable format—such as Excel—to facilitate aggregated analysis across the portfolio. Multiple ESG platforms support project tracking and analysis to guide asset owners and managers in developing a decarbonization roadmap. For example, Partner Energy’s SiteLynx Carbon Proforma enables users to assess audit findings at the asset level, select high-impact measures, and project the effects on emissions, energy costs, and regulatory compliance. Additional features, such as energy and carbon tracking through integrations with common utility tracking programs like ENERGY STAR Portfolio Manager, project scenario analysis, as well as data export and auditability, should be considered when selecting an ESG platform. These tools allow asset owners to choose projects best suited for their properties, while fund managers can aggregate selected measures to evaluate portfolio-wide impacts over time.

Figure 2: Energy and Carbon Reduction measure selection table and year selection based on ASHRAE Audits. The table summarizes KPIs such as energy and utility cost savings, GHG savings, Existing Equipment Expected Replacement Year (RUL Year), and Simple Payback

Figure 3: Asset performance when exposed to Boston’s BERDO building performance standard (BPS). The chart includes a business as usual/do nothing scenario, as well as the impact of the decarbonization measures selected by the use. Different measures are selected for implementation in different years, strategically selecting implementation based on CapEx plans, age of existing equipment, and effect on ordinance penalties.

Additional considerations

This above approach can also be applied to evaluate the feasibility and costs of on- and off-site renewable energy investments or other decarbonization strategies. For best results, partner with consultants who specialize in CRE and adhere to industry best practices and standards. Periodic re-assessment of the portfolio ensures the decarbonization strategy remains aligned with evolving regulations, technologies, financial incentives, and market demands. Similar approaches should be employed during due diligence to understand risks and develop capital plans that align with fund goals.

Conclusion

Decarbonizing commercial real estate portfolios is complex, requiring a blend of technical expertise, financial planning, and comfort in uncertainty. However, by developing a strategic decarbonization roadmap—performing a GHG Inventory, grid decarbonization analysis, efficiency project prioritization and transition risk assessments —portfolio owners can make significant strides toward achieving their decarbonization commitments. As the regulatory and technological landscape continues to evolve, CRE portfolios that embrace these strategies will be well-equipped for a sustainable future.

This article was written by Brady Mills, Director at Partner Energy.

References:

1 “Welcome to the Greenhouse Gas Protocol.” Greenhouse Gas Protocol. Accessed November 22, 2024. https://ghgprotocol.org/.

2 “Enabling financial institutions to assess and disclose greenhouse gas emissions associated with financial activities.” Partnership for Carbon Accounting Financials. Accessed November 22, 2024. https://carbonaccountingfinancials.com/.

3 “Energy Analysis.” NREL. Accessed November 22, 2024. https://www.nrel.gov/analysis/cambium.html.

4 O’Shea, Katie. “Navigating Nationwide Building Performance Standards.” GRESB. Accessed November 22, 2024. https://www.gresb.com/nl-en/navigating-nationwide-building-performance-standards/.

5 “ENERGY STAR Portfolio Manager Data Explorer.” Energy Star. Accessed November 22, 2024. https://www.energystar.gov/buildings/resources-topic/portfolio-manager-data-explorer.