Knightscope K5 Robotic Security Guard. Image: Shutterstock

Digital disruption, proptech, cybersecurity, AI, Alexa, smart buildings, smart cities, driverless cars – these are all hot topics of discussion around real estate today. Digital technologies, which have been emerging for some time, are now integrating with each other, and their take-up is being accelerated by high levels of investment and public acceptance, drivers like medicine and environmental sustainability, and by geopolitical forces such as the quest for military power. Humankind is now crossing a threshold into a digitalized way of life which will be transformational for our species, and highly consequential for real estate and our cities.

Digitalization offers extraordinary benefits – but it is a double-edged sword. To date we have largely focused on one edge of the sword – the opportunities – without adequately considering the risks such technologies presents. This is fundamentally an issue of resiliency with digitalization-enhanced issues such as inequality, mental well-being and privacy likely to be very destabilizing socially and economically.

Facebook’s recent $119billion one day share price fall, the largest in share market history, is the result of an insufficient approach to privacy and the market struggling to price the associated risk. The Sidewalk Toronto development in the Toronto Port Lands, with the community raising tough questions around what Alphabet, as a developer, will do with their data, is an example of the social contract being renegotiated in the age of digitalization.

There are many digitalization-driven environmental, social and governance (ESG) issues, both risks and opportunities, that we now need to focus on. These will progressively translate into responsible investment frameworks for real assets.

Introducing: Crossing the Threshold – a primer for sustainable digitalization in real estate and cites

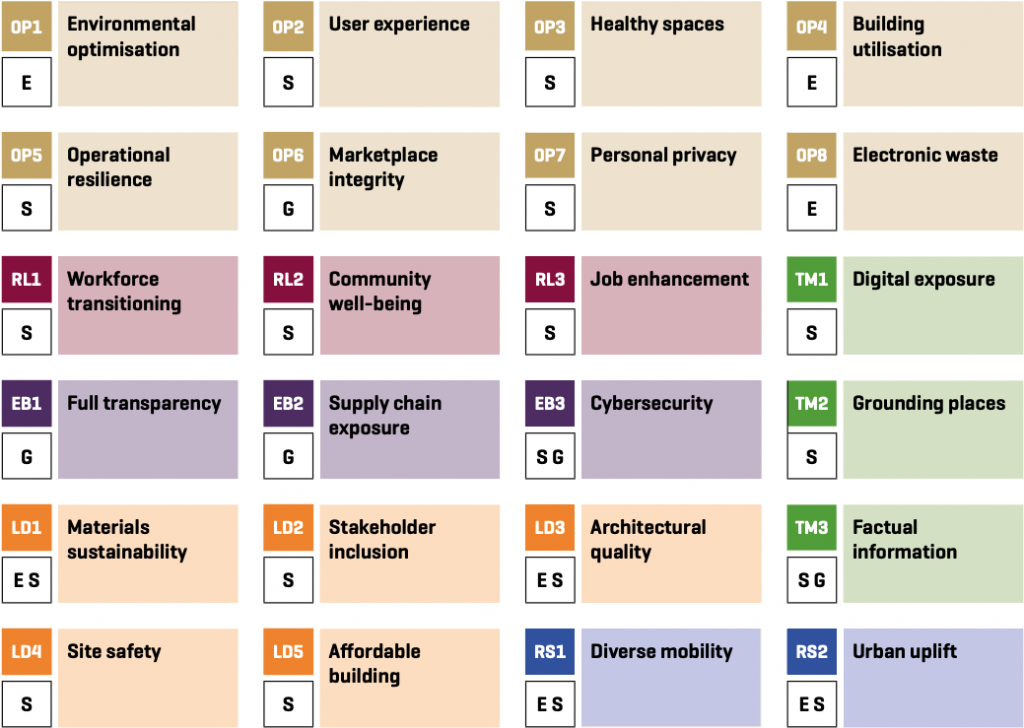

Crossing the Threshold, authored by Morphosis and published by RICS, is a call for action and leadership across industry and government. It explores 6 key digitalization-driven transformations in real estate and cities:

Optimized performance: Transformation of the operation of buildings, cities and real estate markets.

Optimized performance: Transformation of the operation of buildings, cities and real estate markets.- Reworked labor: Transformation of the labor force.

- Exposed business: Transformation of the public exposure of organizations.

- Liberated developments: Transformation of development and construction.

- Reinvented streets: Transformation of urban mobility and form.

- Troubled minds: Transformation of the human experience.

To help organizations begin to embrace sustainable digitalization it offers a Framework for action, as well as a Map of Focal issues; 24 ESG issues that are driven by digitalization and will be consequential to many real estate stakeholders.

We find ourselves at a critical juncture, facing some big choices that will shape our future. We must recognize digitalization for what it is: a megatrend that sits alongside other megatrends such as urbanization, climate change and resource security to define our global sustainability agenda. Digitalization must now become sustainable.

Download the primer from: https://www.morphosis.com.au/crossing-the-threshold/As responsible investing has become mainstream for real asset owners around the globe, it also requires them to understand how digital technologies will impact the environmental, social and governance aspects of their investments. Clearly, investors need to actively engage with their managers on these material issues in order to navigate ‘sustainable