Recent climate change impacts are increasing demand for the adoption of Environmental, Social, Governance (ESG) initiatives. Investors and tenants are creating a greater push for more energy and water efficiency investments, climate change resilience preparedness, and workplace health safety and productivity. As ESG becomes increasingly important, investors and regional and national regulators will progressively mandate greater transparency in these topics from the real estate sector.

Many buildings and cities are preparing climate change and resilience adaptation policies and programs to address climate change risks, infrastructure needs, and increased resource needs for water, energy, and demographic shifts. Policy and regulation will continue to drive the building industry to address these issues and increase transparency in these topics. Successful leaders must stay in front of these trends and be proactive about what is important for building occupants. More efficient use of space, more controls, and greater health and productivity should matter to all who want to remain competitive and increase their bottom line.

WHAT IS…ESG, CORPORATE RESPONSIBILITY, RESPONSIBLY INVESTING, ETC…?

ESG criteria serves as a set of standards that socially conscious investors use to screen investments. Investors, tenants and regulators are increasingly seeking energy efficiency, green building attributes and greater disclosure of ESG performance. By applying corporate responsibility or ESG practices, asset managers are cutting costs by reducing energy and water use and improving their market competitiveness among tenants and investors.

CREATING VALUE THROUGH SUSTAINABILITY

A McKinsey Global Sustainability survey 1 about the business of sustainability research found that some companies are capturing significant value by systematically focusing on sustainability. “We believe the trend is clear: more businesses will have to take a long-term strategic view of sustainability and build it into the key value creation levers that drive returns on capital, growth, and risk management, as well as the key organizational elements that support the levers. Each company’s path to capturing value from sustainability will be unique, but these underlying elements can serve as a universal point from which to get started.” According to the McKinsey survey, companies should integrate ESG issues into their business model to capture value in three key areas: Returns on Capital, Risk Management, and Growth.

Returns on Capital

- Green Sales and Marketing: Improve revenue through increased share and/or price premiums by marketing sustainability attributes.

- Regulatory Management: Mitigate risks and capture opportunities from regulation. Energy Star benchmarking policies are now required in over 9 cities and 2 states.

- Composition of Business Portfolios: Guide investment/divestment decisions at portfolio level based on sustainability.

- Sustainable Value: Improve resource management and reduce environmental impact across value chain to reduce costs and improve products’ value propositions.

- Sustainable Operations: Reduce operating costs through improved internal resource management (e.g., water, waste, energy, carbon, and employee engagement).

Risk Management

- Reputation Management: Reduce reputation risks and get credit for your actions (e.g. through proper stakeholder management).

- Operational Risk Management: Manage risk of operational disruptions (e.g., from resource scarcity, climate change impact, or community risks).

Growth

- Innovation and New Products: Develop sustainable spaces to fill needs of tenants and investors.

- New Markets: Build a better understanding of sustainability-related opportunities in new market segments/geographies and develop strategies to capture them.

SHIFTED PARADIGMS

Traditionally, the role of management is to maximize short-term profitability in order to generate cash flow and equity to fuel long-term viability. When executives are rated, rewarded, and reprimanded based on this single standard of performance it causes management to often lose sight of long-term goals and manipulation of stock prices. Over time, paradigms have shifted toward value creation. Executives have realized that improved environmental performance leads to improved shareholder value. In addition to creating sustainable shareholder value, improved environmental performance also impacts crucial organizational intangibles such as enhanced brand and reputation, improved supply chain management, and more committed employees.

INDUSTRY PROGRESSION

In 2014, CBRE reported market statistics for Sustainability Programs on a National Green Building Adoption Index 2 in which they describe the growth of programs like ENERGY STAR, LEED certified space, and reporting transparency in the last fifteen years. Although the green building industry is still in its initial stages, the progress made in such a short period is astounding.

In 2000, the first Energy Star Label for a commercial building was created. At that time, less than 500 buildings had Energy Star Labels and energy disclosure regulations did not exist in any state or city legislature in the US. In 2000, no buildings had been LEED certified and the LEED Green Associate/AP designation had not yet been created. Only 14 buildings globally responded to GRI, and neither GRESB nor CDP were up and running.

Fifteen years later, this picture has changed dramatically: more than 260,000 have been benchmarked on Energy Star Portfolio Manager, more than 25,000 labels have been created, and 14 cities/states are adopting disclosure laws with several others pending approval. LEED is now a globally recognizable brand, with 4 billion square feet certified in every major global market, and 210,000 people all over the world with LEED credentials. All but one S&P 500 firm reported to either GRI or CDP totaling over 9,500 firms. More than 707 property companies and private equity real estate funds, representing 61,000 assets and $2.3 Trillion in asset value are now reporting to GRESB according to the 2015 GRESB Survey Results.3

The green building industry is making waves and with progress like this it is becoming impossible for anyone in or affected by the real estate industry not to notice. As brands like GRESB, LEED, USGBC, GRI, and CDP become increasingly recognizable and organizations continue to adopt sustainable practices, firms who don’t join the movement will be less competitive among their peers.

REAL ESTATE LENDING, RISKS, AND ESG

Lenders have far less control over properties than borrowers or asset owners. For this reason, they often have difficulty seeing the benefits of energy efficiency, cost cutting, or other sustainability-related property features and improvements. With their sole goal being to get their principal returned along with the spread they priced during loan underwriting, risk management is the primary reason ESG should matter to lenders.

Financial/Credit, Compliance, Strategic, and Reputational Risk are the four primary risks lenders face. In this article, Sara Anzinger explains the positive effect ESG initiatives can have on these lending risks:

- Financial/Credit Risk: Managing downside risk is critical in delivering a risk-adjusted return. A recent study conducted on 80,000 CMBS loans found 20-30% lower default rates associated with Energy Star labeled and LEED Certified Buildings. Furthermore, research has shown that green buildings have higher rental rates, better quality tenant attraction and retention, and higher resale values compared to their non-green counterparts.

- Compliance Risk: As climate change continues to grow as a global issue, climate change regulation is simultaneously being created. Since legislation varies across regions, global portfolio diversification is becoming a more common debt strategy. Staying ahead of evolving regulation is crucial for lenders to protect their loans.

- Strategic Risk: Real estate debt funds are dependent upon private equity fundraising. 46% of institutions include real estate debt as part of their real estate allocation. Institutional investors have long-term investment horizons and are increasingly interested in seeing ESG integration extended beyond their equity investments, to debt and fixed income as well. Integrating sustainability into a commercial real estate lending philosophy and processes allows a debt fund to create a portfolio aligned with its investor’s values.

- Reputational Risk: The real estate sector contributes one-third of global energy consumption and greenhouse gas emissions. As financiers to building owners and operators, lenders provide the capital that makes positive or negative environmental outcomes a reality. Becoming the lender of choice to a market transformation by financing green rehabs, retrofits, and repositionings, as well as green development, can’t hurt.

IT’S ABOUT YOUR BOTTOM LINE

Time and time again it has been proven that what is good for the environment is good for business. Studies have repeatedly established associations between sustainability and improved cash flow at the building level, a clear link between building portfolio sustainability and stock market performance, and a connection between sustainable buildings and higher returns for real estate investors.

Some of the tangible values building owners and managers experience through green building investment include Lower Operating Expenses, Increase in Building value, ROI, Occupancy and Rent according to many reputable sources such as McGraw Hill’s Green Outlook 5 and IMT’s Green Building and Property Value 6.

A USGBC Business Case for Green Buildings 7 article published in 2015 is a great resource for an insightful compilation of statistical about overall trends including data about competitive differentiator, tenant attraction, financial benefits, productivity benefits and better health standards.

In addition, firms with ESG programs often gain intangible assets such as market differentiation and reputation, growing tenant demand and retention, reduced tenant turnover, reduced obsolescence, and lower energy cost risk.

Through increasing top line value and reducing operation costs, REITS with above average efficiency performance, taken as a group, are outperforming below average companies on stock price by nearly 2000 basis points.

TENANT DEMAND & PROPERTY VALUE

With the exponential growth of green buildings and affiliated organizations such as Energy Star, LEED, and GRESB over the last two decades, one wonders what is creating the growth. No single driver is stronger than tenant demand for greener workplaces. More and more tenants are seeking out green office space, and are willing to pay more to occupy it. With indoor air quality and access to natural light leading as the two most important green factors to tenants, an increasing number of real estate owners and managers are implementing these specific green features. Some industry leaders report that tenant demand is so strong that clients don’t think a building can be considered Class A unless it’s green, according to Jerry Lea, Executive Vice President of Hines. Whether tenants are demanding green occupancies based on improved productivity, lower utility costs, or even a greater concern for climate change, the result remains the same, higher rents and lower operating expenses resulting in an improved bottom line for building owners and managers.

CONCLUSION

In 2014, 45% of total US energy consumption was in real estate sectors (commercial and residential). In addition to energy usage, the built environment also plays a significant role in water, waste, and transportation use. As awareness of the environmental impact of commercial real estate continues to grow, tenants and investors are demanding sustainable real estate.

Investors, lenders, building owners, asset managers, and tenants all benefit from ESG initiatives. While tenants benefit from lower operating costs, building owners/managers have increases in rent, building values, occupancy, and retention. Meanwhile, lenders lessen their risk with reduced default rates and investors improve their ROI. As the industry evolves, the demand for efficient buildings is steadily growing. With financial, environmental, and social incentives in place the built environment will continue to transform. Firms that have not yet implemented ESG strategies must do so; otherwise, they will be left behind.

REFERENCES:

- 2011: The business of sustainability: McKinsey Global Survey results

- 2014: CBRE: National Green Building Adoption Index

- 2015: GRESB Results

- 2015: Sara Anzinger: Real Estate Lending and ESG Observations from the 2015 GRESB Survey

- 2012: McGraw Hill Construction: World Green Buildings Study

- 2013: IMT: Green Building and Property Value

- 2015: USGBC: The Business Case for Green Building

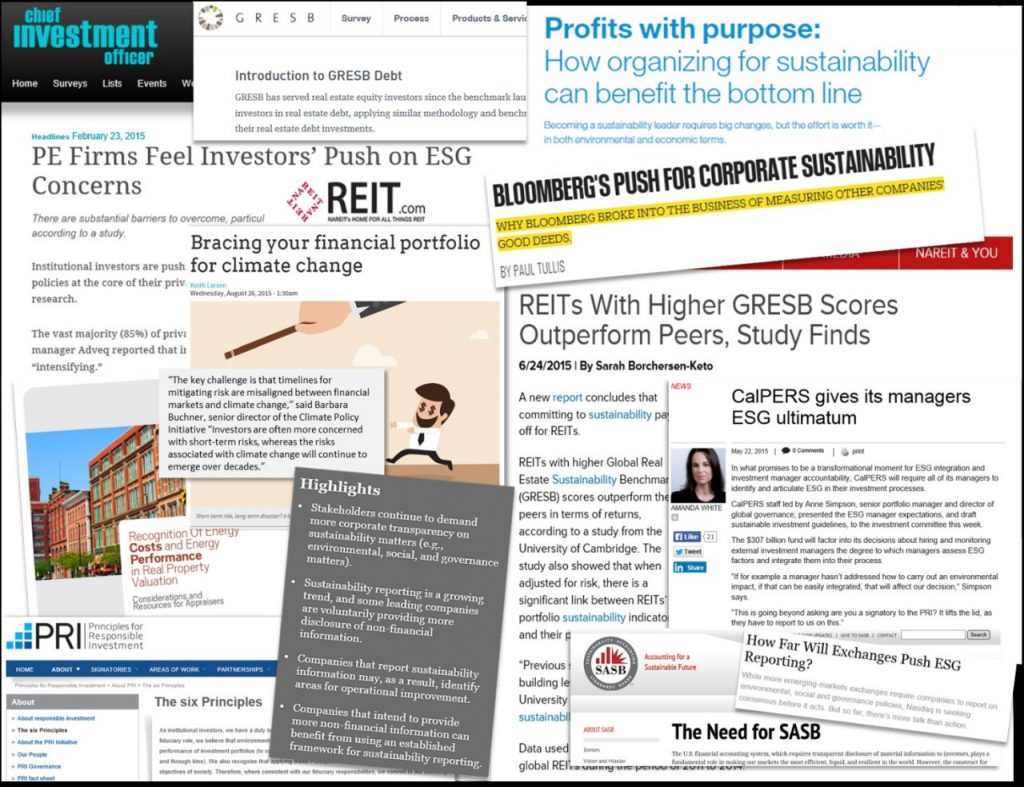

ADDITIONAL RESOURCES:

- GRESB Debt Survey

- Bloomberg’s Push For Corporate Sustainability

- CalPERS gives its managers ESG ultimatum

- PWC: Sustainability Reporting

- Bracing your financial portfolio for climate change

- S. Benchmarking Policy Landscape

- REITs With Higher GRESB Scores Outperform Peers

- PE Firms Feel Investors’ Push on ESG Concerns

- How Far Will Exchanges Push ESG Reporting?

- UNPRI Principles for Responsible Investment

- Summary of Efficiency and Property Value Studies.

- AI-IMT Guide for Appraisers: Recognition of Energy Costs and Energy Performance in Real Property Valuation.

- Value Beyond Cost Savings: How to Underwrite Sustainable Properties

- An Introduction to Retrofit Value for Owner Occupants and How to Calculate and Present Deep Retrofit Value for Owner Occupants

- Unlocking the Energy Efficiency Retrofit Investment Opportunity: A Checklist for Real Estate Owners and Asset Managers, U.N. Environmental Program: Finance Initiative

- Greening Our Built World: Costs, Benefits and Strategies

This article is by Taylor Sims.