Developing a truly representative carbon footprint for the real estate sector has been something of a challenge for the industry. Recent pushes from the bigger players have both served to highlight the trials ahead, as well as provide much-needed leadership for change.

Making comprehensive and substantial reductions in greenhouse gas (GHG) emissions throughout the sector is, however, still a daunting prospect. It is common knowledge that existing properties are in urgent need of mass-retrofit to reduce energy consumption, however, the carbon emitted to complete this must be duly considered when assessing the carbon impact of properties.

Revolutionizing current practice and decreasing overall emitted carbon, needed to achieve the targets expected from the sector, will require pressure from those at the top of the food chain to transform the design and manufacturing standard in the sector.

An Honest Starting Point

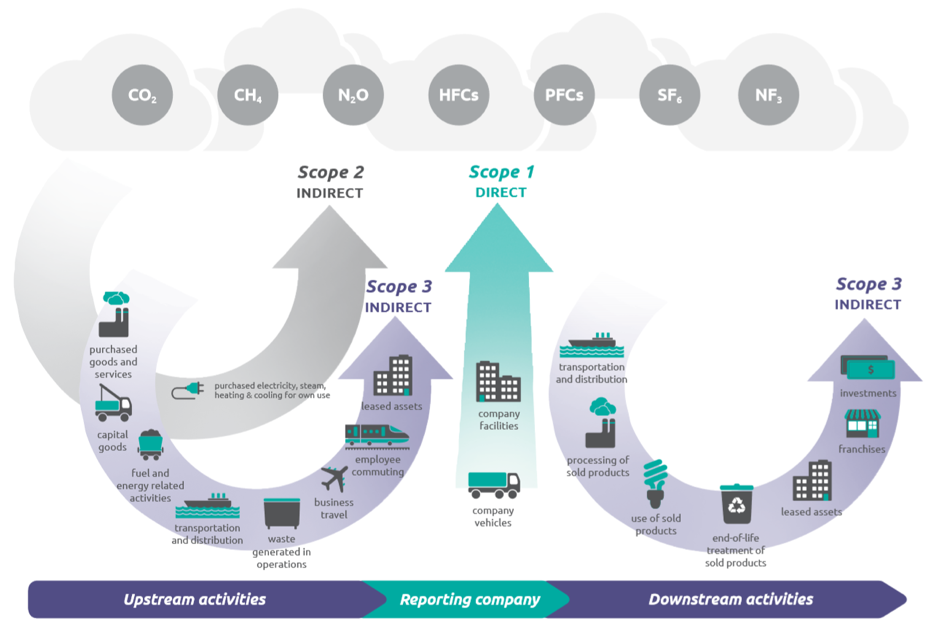

In order to set appropriate targets, businesses must initially develop an accurate appraisal of the status quo. GHG Protocol provides a world recognized methodology for assessing carbon emissions. GHG emitted should be allocated to direct, Scope 1, and indirect sources, Scopes 2 and 3. The diagram below produced by the GHG Protocol illustrates the categorization.

The real estate sector has shown a promising eagerness to mitigate their impact on climate change. With the knowledge that the construction and operation of buildings contribute around 40% of worldwide GHG emissions, the sense of responsibility is clear. Further drivers such as the EU Energy Efficiency Directive (EED) and the uptake of the GRESB assessment, have encouraged the reporting of carbon emissions across all three scopes.

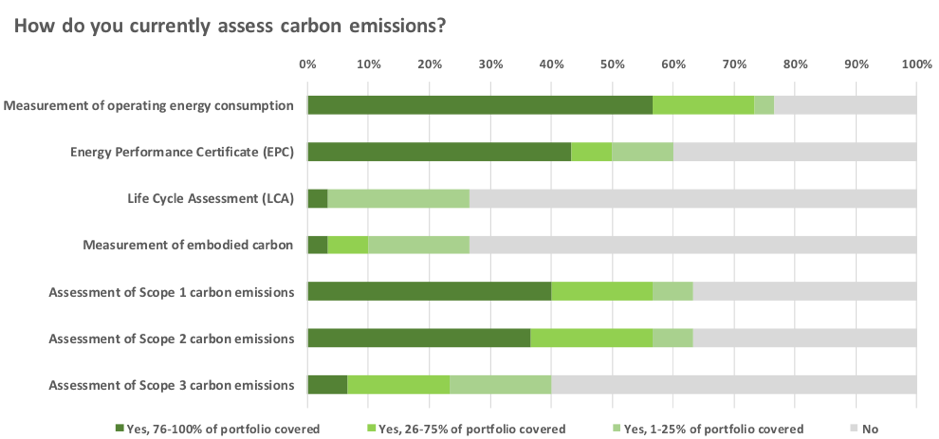

Easier to define energy uses have, to date, been the area of focus for carbon accounting and target setting. Scope 1 and 2 emissions are typically easier to measure, as much of the complicated calculation work is carried out at a national level, through the definition of fuel and electricity carbon Intensities.

The real estate sector, however, is dominated by Scope 3 emissions, but these remain relatively ill-defined, and targets are few and far between. A survey recently carried out as part of the EU-backed Carbon Risk Real Estate Monitor (CRREM) project shows the relative consideration shown to Scope 3 emissions amongst European real estate investors, see the survey data in the graph below. The CRREM research consortium consists of five EU-based institutions experienced in the field of carbon research in real estate, including GRESB.

The reason for the lack of scrutiny around Scope 3 emissions is that they are messier than Scopes 1 and 2, and their responsibility is not easily delineated. But, as is typical with an unmanageable prospect, the problem should be broken down into more concise and understandable parts, and by doing so will allow asset managers, developers, energy consultants and others in development teams to assign appropriate responsibility and control.

Narrowing Down the Problem

Scope 3 emissions are further sub-divided into several categories by the GHG Protocol. The variety and scale of these categories make the task of accurately estimating the quantity of carbon within them, a significant undertaking for companies who choose to report on it. However, GHG Protocol guidance on Scope 3 outlines that those undertaking an assessment need only report on those categories most relevant to their business activities.

Information made available from the Carbon Disclosure Project (CDP) shows that there are 5 categories most relevant to the real estate sector:

- Category 1 – Purchased Goods and Services;

- Category 3 – Fuel-and-Energy Related Activities (not included in Scopes 1 and 2);

- Category 5 – Waste Generated in Operations;

- Category 6 – Business Travel; and

- Category 13 – Downstream Leased Assets.

As expected, the construction, maintenance and ongoing energy consumption of properties make up the majority share of the real estate sector’s overall carbon emissions profile. Carbon targets should now be prioritizing these emissions streams. The GRESB Assessment has introduced the mandatory reporting of Scope 3 emissions in 2018 following pressure from investors to capture a more comprehensive view of emissions portfolios. The assessment, however, is focused on tenant emissions and does not require reporting from other categories.

Embodied Carbon in Buildings

Companies must now begin to consider the full range of major Scope 3 emissions. As new projects are bought forward, both the energy required to operate a building, as well as the energy taken to create, maintain and demolish it, should be given equal treatment. Historically this is not the case.

Reducing embodied carbon requires a fundamental change in the approach to design and wastage. Additionally, any measures specified to reduce operational carbon must demonstrate a net improvement on a lifecycle basis i.e. if an energy efficiency measure does not offset more carbon during its operation than that used to create it, the measure should be reconsidered.

Other areas, such as improving structural efficiency, have the potential to significantly reduce embodied carbon. Industry research projects, including Minimising Energy in Construction (MEICON) project funded by the UK’s Engineering and Physical Sciences Research Council (EPSRC), have demonstrated how inefficient over-design has led to buildings where half of the structural material is unnecessary and wasteful.

Simple wins, like efficient structural design, which require almost no technological innovation, and have the added advantage of reducing build costs, should be encouraged with immediate effect. Alongside this, an increased awareness of circular economy principles amongst industry professionals and a legislative framework that rewards a holistic approach to reducing carbon, rather than a one-dimensional approach, could begin to push Scope 3 in the right direction.

Any reduction in carbon emissions will need to come as a result of changes to existing properties, as well as adjusting the design approach in new build developments. By fully appraising all types of energy invested in the development of new buildings and the retrofit of existing ones, we can begin to fairly balance-out the reductions in operational energy demands, as well as the energy embodied in the construction or renovation of the building itself.

This article is written by Tom Gwilliam, Head of Energy and Carbon Management at Greengage Environmental Ltd.