New and developing technologies play an increasingly important role in understanding the impact of environmental and social short-term shocks and long-term stressors, and will act as a vital tool to manage risk and improve an organisation’s ability to be dynamic and responsive to both. Visibility into data is a key component of risk management, as well as the importance of being able to log and measure actions required to bring about change and improvements.

Actively managing risk and adapting to change within a real estate portfolio, provides a real estate owner with the opportunity to create a positive methodology to develop resilience within their portfolio and thus make themselves more appealing to investors.

Investing in resilience demonstrates that a real estate owner is prepared for any potentially disruptive event, and shows an organisation’s ability to respond to risks and opportunities which in turn develops asset resilience. This creates trust and confidence from stakeholders and consequently protects the value of the assets within a portfolio.

Ongoing Resilience Testing

With increased social and environmental unpredictability around the world, the creation of systems which rigorously test a property owner’s ability to respond to the growing implications of catastrophes or underlying risks has become significantly important. It is crucial to be able to monitor the effectiveness of resilience activities and the ability to future-proof a portfolio.

As GRESB participants, organisations are asked how they periodically assess the vulnerability of their business operations to social and environmental shocks and stressors. Operational-level assessments that organisations may decide to undertake include hydrological, biological, climatological, meteorological, and social disruption. For example, undertaking a hydrological assessment such as a Flood Risk Assessment, identifies properties that are classified as being high risk. Recommendations can then be implemented to mitigate the impact of flooding; reducing associated costs, as well as potentially reducing insurance premiums.

The GRESB Resilience Module also requires participants to demonstrate that they have established objectives and implemented strategies to promote resilience. The risk of social disruption can be mitigated by Emergency Preparedness Testing, which involves undertaking an emergency scenario exercise to ensure that an organisation’s procedures are rigorous and effective. The scenario and subsequent assessment bring together a set of conditions that are involved in an incident, allowing the emergency response team to be observed under controlled conditions, and to reveal whether all site personnel are effectively trained and aware of their responsibilities in relation to such potential incidents.

Regularly reviewing and testing an organisation’s Emergency Preparedness Plan regularly (i.e. at least once a year, or whenever there are changes within the organisation that could compromise the effectiveness of the plan), is key to evaluate its effectiveness and to ensure that the organisation can mitigate the effects of a major incident. This cyclical process ensures peace of mind, and helps to reduce the potential impacts of incidents.

Importantly, effective emergency procedures tie in closely with business continuity plans and enable businesses and sites to control the impact a series of events may have on their organisation.

Tracking risk to resolution

Likewise, property risk management technology can provide the backbone to an organisation’s resilience strategy, and a vehicle to both log and resolve actions. Once emergency preparedness testing has been carried out, this data can be stored centrally, with other key information such as inherent risks within a property for a complete view of resilience. Effective property risk management software, such as RiskWise – developed by the S2 Partnership, deliver a multitude of benefits to a real estate owner to protect and track their portfolio.

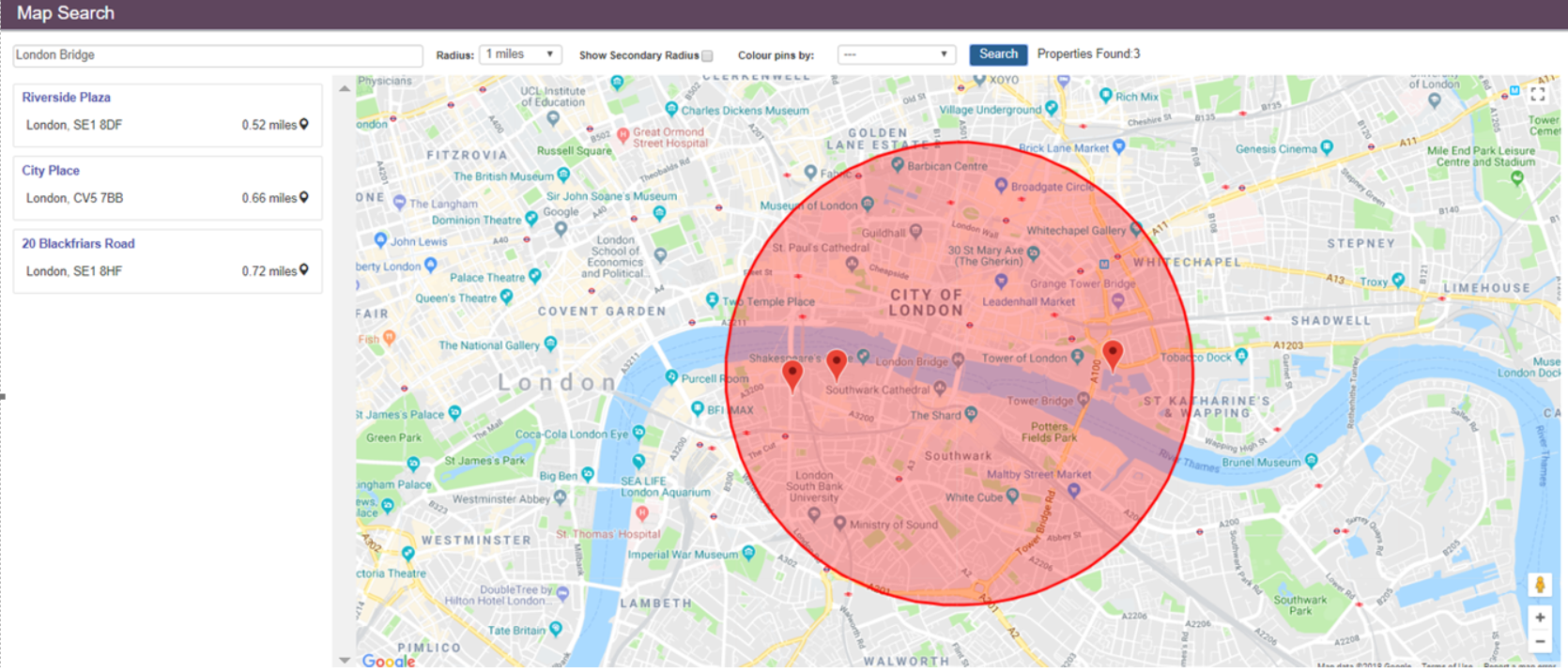

One example is the Map Search feature which provides a way to view the location of the property portfolio geographically. Within this functionality, a point of interest – such as the exact location of an incident – can be searched for by postcode or town. This will quickly highlight properties within an ‘at-risk’ radius, along with a secondary radius. The data can then be interrogated further to bring to light any properties that might be affected by the incident based on other information you store on them, such as which are managed/FRI, which have on-site security, or which properties are situated on a flood plain.

Use of the system also provides the ability to quickly access information required in the event of emergency, such as site contact details, emergency callout contractors.

RiskWise clients also use customisable fields to create their own score metric based on inherent risk data such as flood risk level, crime rate, type of construction, occupancy levels and tenant activities. This visibility helps enable a real estate owner/investor to oversee their assets, current threats and identify where improvements can be made. Invaluable consultancy can provide the owner with the ability to put in place business continuity planning and horizon scanning, with a view to future proofing their portfolio in the event of an unexpected disaster. Bespoke criteria can be defined to determine which custom fields contribute to the score, and control measures set up to improve property risk scores. An example of how control measures could positively influence a score might be if a property is constructed with timber and cladding but has sprinklers installed, the inherent risk can be reduced given the control in place.

RiskWise clients also use customisable fields to create their own score metric based on inherent risk data such as flood risk level, crime rate, type of construction, occupancy levels and tenant activities. This visibility helps enable a real estate owner/investor to oversee their assets, current threats and identify where improvements can be made. Invaluable consultancy can provide the owner with the ability to put in place business continuity planning and horizon scanning, with a view to future proofing their portfolio in the event of an unexpected disaster. Bespoke criteria can be defined to determine which custom fields contribute to the score, and control measures set up to improve property risk scores. An example of how control measures could positively influence a score might be if a property is constructed with timber and cladding but has sprinklers installed, the inherent risk can be reduced given the control in place.

Such functionality allows properties to be viewed side-by-side and compared against one another in league tables, providing a quick-view of inherent risks across a property or portfolio. League tables and key statistics on best and worst performing properties is quickly visible, providing instant notifications of significant risk changes and the ability to track progress of risk actions and provide a full audit trail. It is possible to review properties by their inherent risk, operational risk (including their actions), alongside levels of incidents.

Looking to the future, an opportunity exists for real estate owners to incorporate much more detailed analysis of sustainability and risk issues into their portfolios. Owners will also benefit from carrying out a more robust assessment of their inherent risks with a view to developing comprehensive strategies to assess, monitor and manage risks from social and environmental shocks and stressors – whatever form they take. Through property risk management software it is possible to reduce administration of resilience processes, minimise claims volume and deliver improved, proactive risk management.

As a GRESB Premier Partner, the S2 Partnership works with clients worldwide, implementing RiskWise and undertaking risk assessments and Emergency Preparedness Testing to assist organisations with portfolio risk management to help meet GRESB objectives, and drive continued environmental, social and governance performance improvements. To find out how the S2 Partnership can help your organisation, please contact us.

This article is written by Ambrose Daly, Marketing & Communications Project Manager, S2 Partnership.