Financial institutions increasingly need reliable, detailed, and comparable climate data to assess risks, comply with regulations, and align investments with evolving market expectations. Asset Impact, a product line of GRESB, provides asset-based climate data and analytics across 13 climate-critical sectors, spanning energy, transport, and industry.

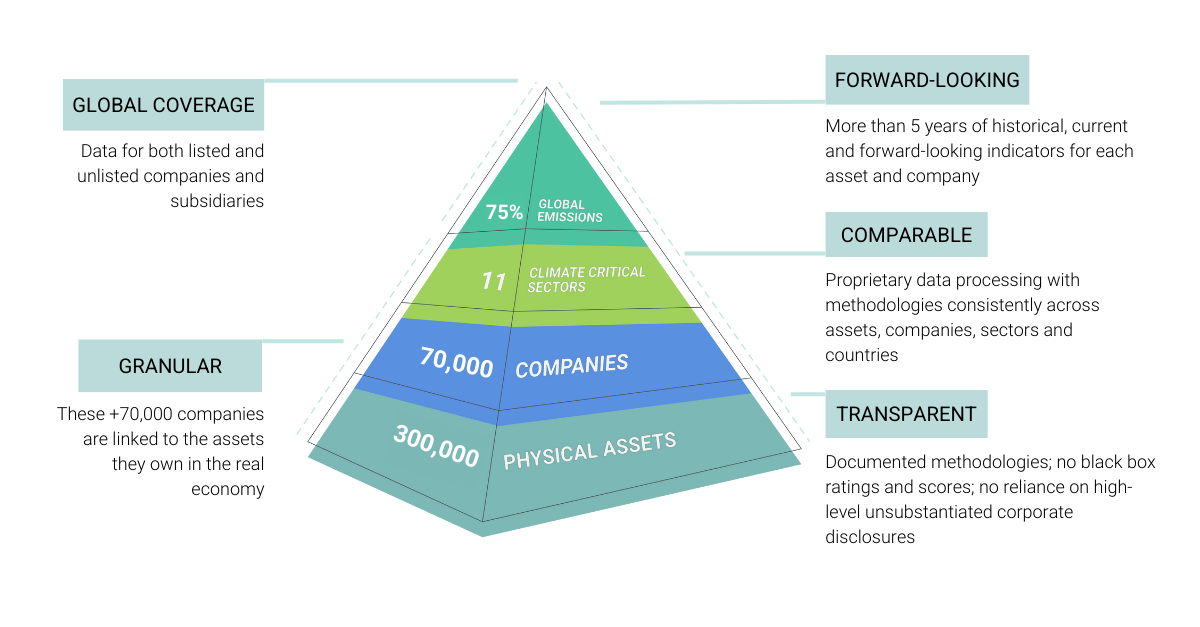

Unlike traditional disclosure-based models, Asset Impact’s approach is built on real-world data from individual physical assets—power plants, oil fields, industrial facilities, and more—and mapped to the companies that own or finance them. By integrating asset-based data, banks, asset managers, and asset owners gain comparable and transparent insights for assessing climate risks, financing transition-ready businesses, and preparing for reporting requirements.

What is asset-based data?

Since 2019, Asset Impact has pioneered the approach of asset-based data. It involves tracking emissions and production data from facilities—like power plants and steel mills—to their corporate owners and financial backers.

By mapping emissions from the asset level up, this method overcomes the limitations of self-reported data, which is often inconsistent or aggregated at the parent company level. Asset-based data provides a clearer, more reliable view of climate risk, for example by distinguishing between high- and low-emitting operations within the same corporate structure.

This approach also enables forward-looking assessments, helping investors assess the credibility of a company’s stated target by comparing it against capital expenditures plans and key climate scenarios.

Asset Impact’s data covers: up-, down-, and mid-stream oil & gas; power generation; coal; shipping; aviation; Heavy-Duty-Vehicles; Light-Duty-Vehicles; chemicals; steel; aluminium; and cement.

How do financial institutions use asset-based data?

Develop and manage a long-term climate strategy: Use granular asset-based emission and product-based metrics to set actionable, sector-specific decarbonization targets and track progress.

Manage climate risks: With data from assets, subsidiaries, parent companies and financial instruments analyze investments at multiple levels to identify high-risk exposures and optimize investment and lending strategies.

Assess corporate climate commitments: Evaluate companies’ climate targets against real investment plans and emissions performance to identify gaps between stated ambitions and actual progress.

Meet reporting requirements: Comply with EBA Pillar 3, PACTA, TCFD, and other disclosure frameworks, reducing dependence on inconsistent corporate reporting.

Engage with companies: Leverage comparable, independent insights to engage with corporate clients on transition risks, opportunities, and climate commitments.

Expanded coverage beyond real estate and infrastructure

With GRESB’s acquisition of Asset Impact, we can now support organizations working across real estate, infrastructure, and other climate-critical industries to deliver more resilient and financially attractive portfolios with real world outcomes.