Strategic GRESB Partner, Asia Research and Engagement (ARE), recently published a report assessing the costs of preparing Asia’s ports for climate change. The report focusses on the impact of sea level rise and storm surges.

Average global sea levels have been rising at an accelerating rate. Additionally, a 2016 study published in Nature found that typhoons that land in East and Southeast Asia have intensified by 12-15% over the past four decades, highlighting growing risks from storm surge. Ports will have to adapt to the new conditions.

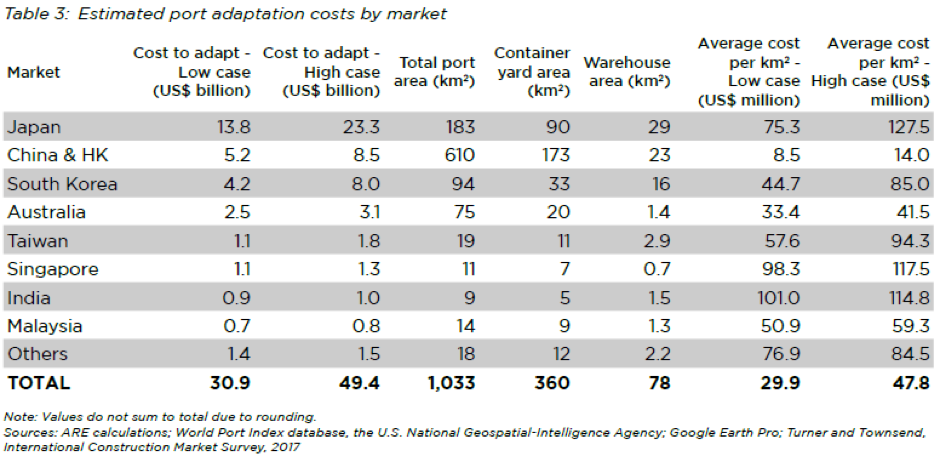

ARE estimated the costs to elevate Asia Pacific’s 53 largest ports. The results ranged from USD 31 billion to USD 49 billion depending on the choice of climate scenario, engineering assumptions, port facilities present, and the relative costs of materials and labour in each market.

The average and total adaption costs for ports in Japan are significantly higher than those in China, despite Chinese ports having significantly larger land area. Other developed nations such as South Korea, Taiwan and Singapore also shared higher materials and labour costs.

Additionally, ports that have higher warehouse-to-area ratios are more costly to adapt. This factor can clearly be seen in the cost to adapt India’s ports, where warehouses account for a large proportion of port area.

Vulnerability to both sea level rise and extreme weather conditions are covered in the new GRESB Resilience Module, an optional supplement for the GRESB Real Estate and Infrastructure Assessments. Beyond periodically assessing the vulnerability of business operations to environmental shocks and stressors, organizations should ensure that the scenarios and models used for such assessments have appropriate climate parameters. It will also be important for infrastructure operators to engage with local communities as they develop their resilience plans.

Next Steps

- Review the Resilience Module Reference Guide.

- Attend one of the GRESB | Siemens: Sustainable Real Assets Conferences for a deep-dive into resilience for investors, real estate and infrastructure companies, funds, and asset operators.

- Contact GRESB or ARE to learn more.

This article is written by Benjamin McCarron, Managing Director, Asia Research & Engagement.