ANREV and GRESB recently published “The Influence of ESG on Asia Pacific Real Estate Fund Performance.” This new report delivers an in-depth look at how ESG integration impacts non-listed real estate fund performance in the Asia-Pacific region. Offering valuable insights into the growing alignment between sustainability practices and fund returns, the report demonstrates how ESG practices can enhance both portfolio resilience and returns.

Key Takeaways

- Strong management and governance drive performance: A significant positive relationship exists between high management and governance scores and fund returns. Funds that allocate resources and implement effective policies to achieve strong management scores demonstrate robust organizational control, which serves as a reliable indicator of fund success and sustained performance.

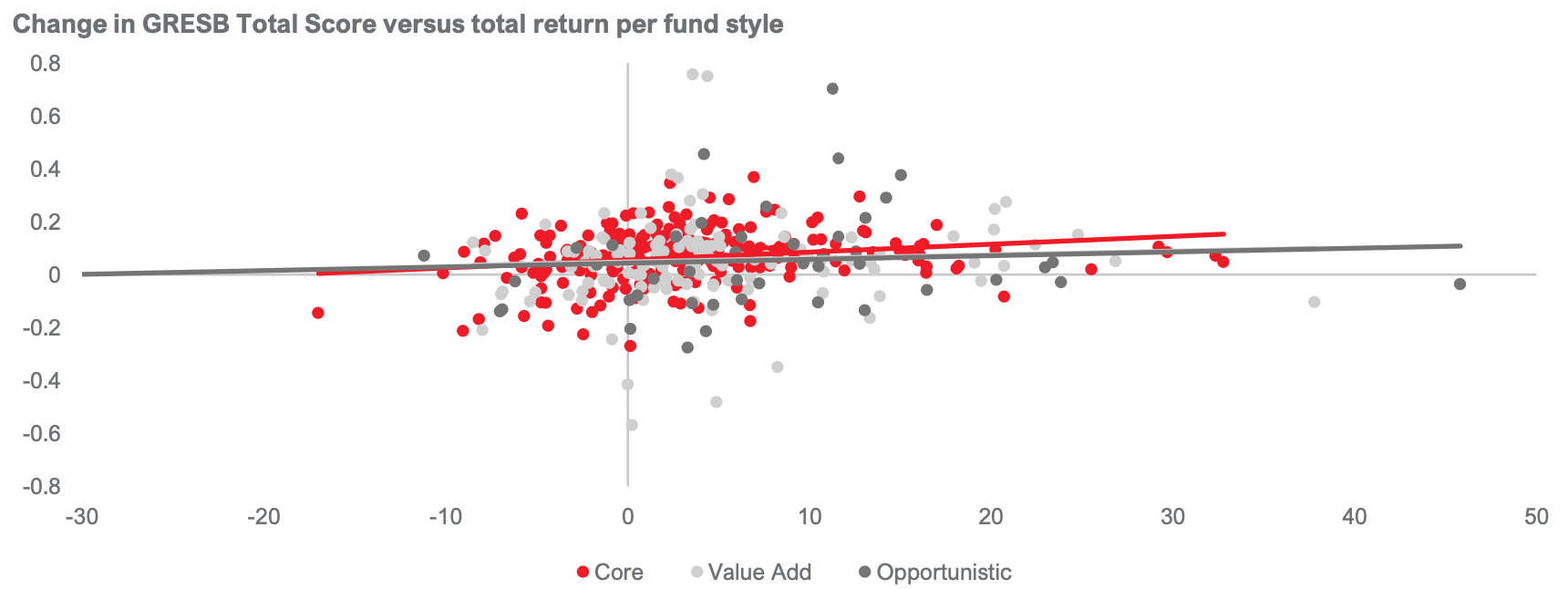

- Positive trends for early adopters: Funds joining GRESB early on appear to generate higher returns, indicating that continued ESG improvements can drive financial success.

- Return drivers in ESG-integrated funds: Larger, open-end, sector-focused funds, and those with low leverage are more likely to achieve high GRESB scores and better performance, showcasing the advantage of economies of scale and specialization.

By combining GRESB’s comprehensive ESG benchmarking data with ANREV’s extensive fund database, this report illustrates how high GRESB scores contribute to both environmental responsibility and enhanced financial stability, offering insights into potential long-term value for fund managers and investors. Additionally, the analysis identifies trends among early and late GRESB adopters, offering a nuanced view of how sustained ESG efforts and high governance standards are linked to enhanced fund outcomes. Drawing from over a decade of GRESB data, the findings are essential for investors looking to understand the benefits of ESG in enhancing portfolio resilience and returns.