Each year, GRESB assesses and benchmarks the ESG performance of thousands of real estate companies and funds worldwide, providing timely insights into ESG-related risks and opportunities. With every new reporting cycle recording an increase in participation and a growing number of first-year participants, it is crucial to gain deeper insights into the performance of new joiners during their first year of reporting.

While first-year participants may feel that they face a steep learning curve, taking the time to learn the ropes of reporting practices and technicalities are simply the “growing pains” that an entity encounters when improving its sustainability performance across all ESG dimensions.

In this article, we examine data and trends from recent GRESB Real Estate Benchmarks to shed light on the performance of first-year participants and explore their progress year over year.

A growing benchmark

The ever expanding GRESB benchmark is a reflection of the growing importance of ESG in the real estate sector. The 2022 GRESB Real Estate Benchmark witnessed the largest ever growth in participation numbers, with 1,820 entities now participating worldwide, covering USD 6.9 trillion of Gross Asset Value (GAV) across 74 countries. Of these, 300 entities were new participants.

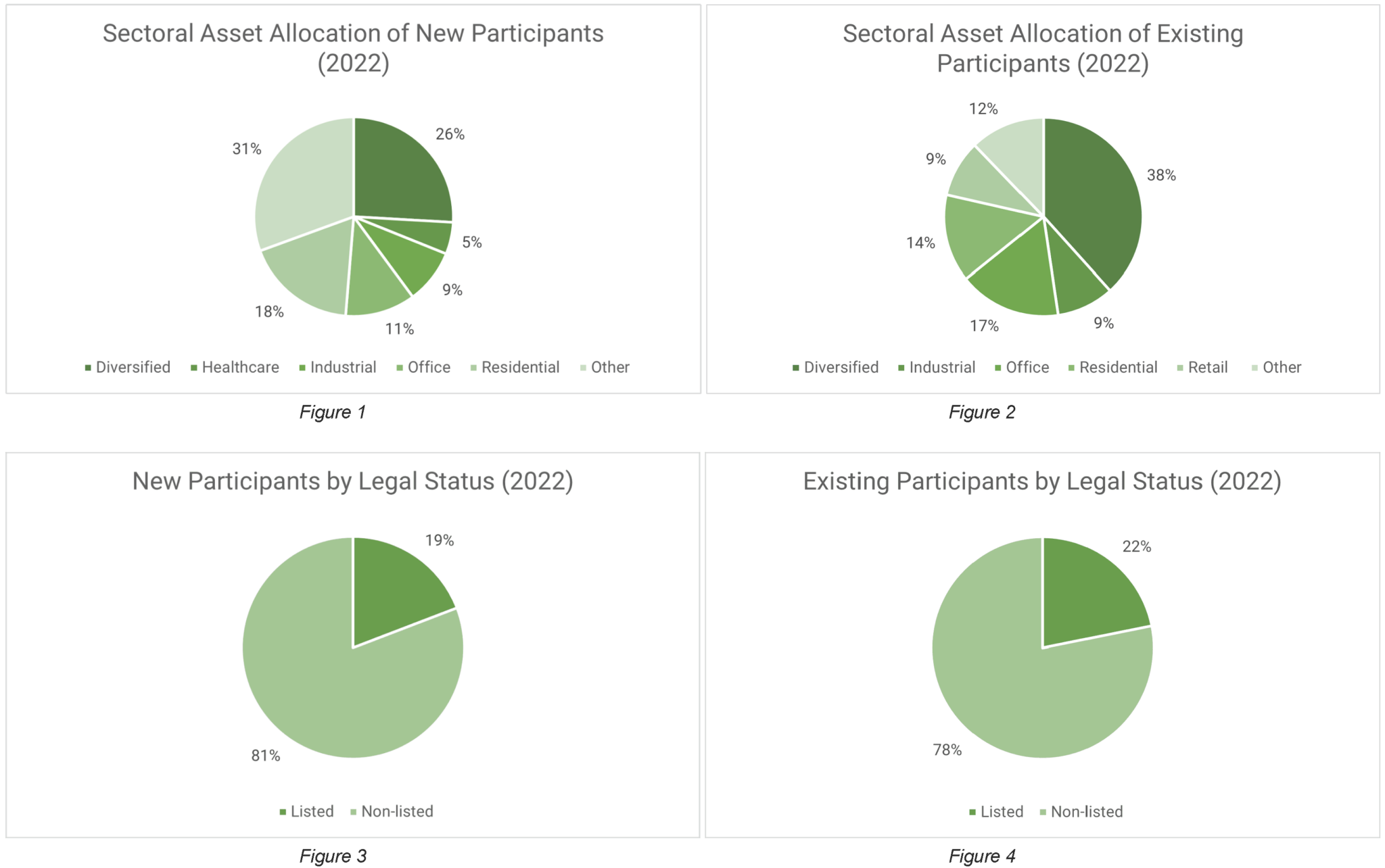

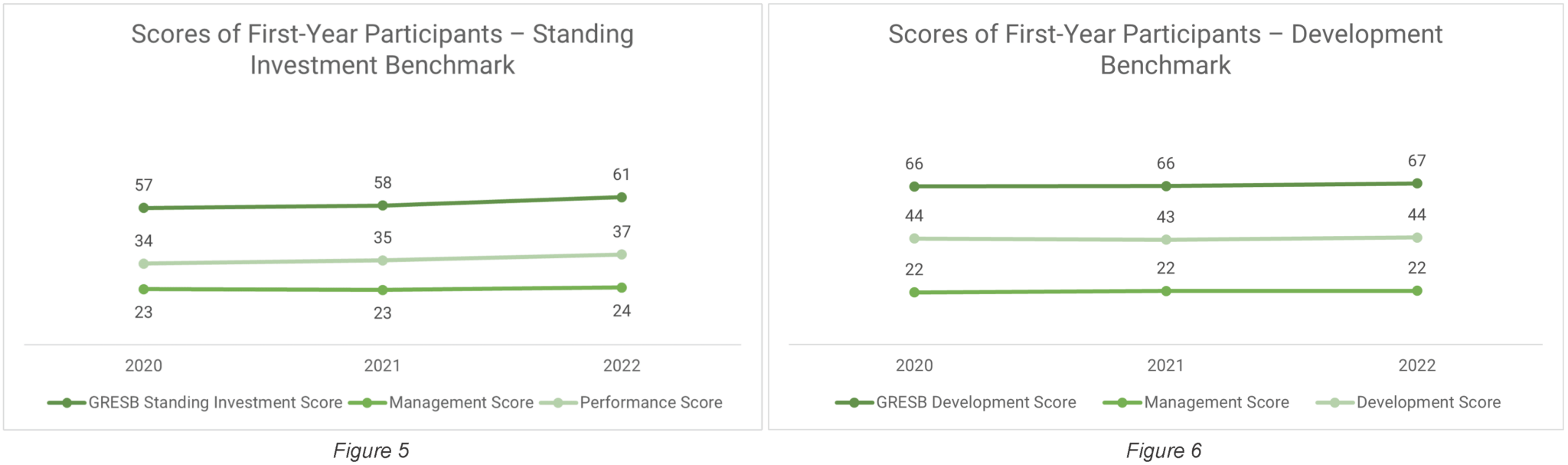

In terms of sectoral allocation, new participants in 2022 match the already existing benchmark allocation (Figure 1 and 2). The majority of portfolios reporting to GRESB are classified as diversified (signifying that 75% or more of an entity’s GAV does not belong to a single property sector), followed by the sectors of Industrial, Residential, and Office. The same notion seems to apply to the allocation of first-year participants by their legal status, with most new and existing participants being classified as non-listed funds (Figure 3 and 4).

Has the performance of first-year participants changed over time?

In terms of starting scores, data from 2020, 2021, and 2022 indicates that scores for first-year participants have remained relatively stable over the past three years (Figure 5 and 6). Significant score increases occur in the subsequent year, as organizations learn from their benchmark and apply insights.

While we notice a small uptick in scores — especially around the Performance component in the Standing Investment Benchmark — the rest of the component scores have not experienced material fluctuations.

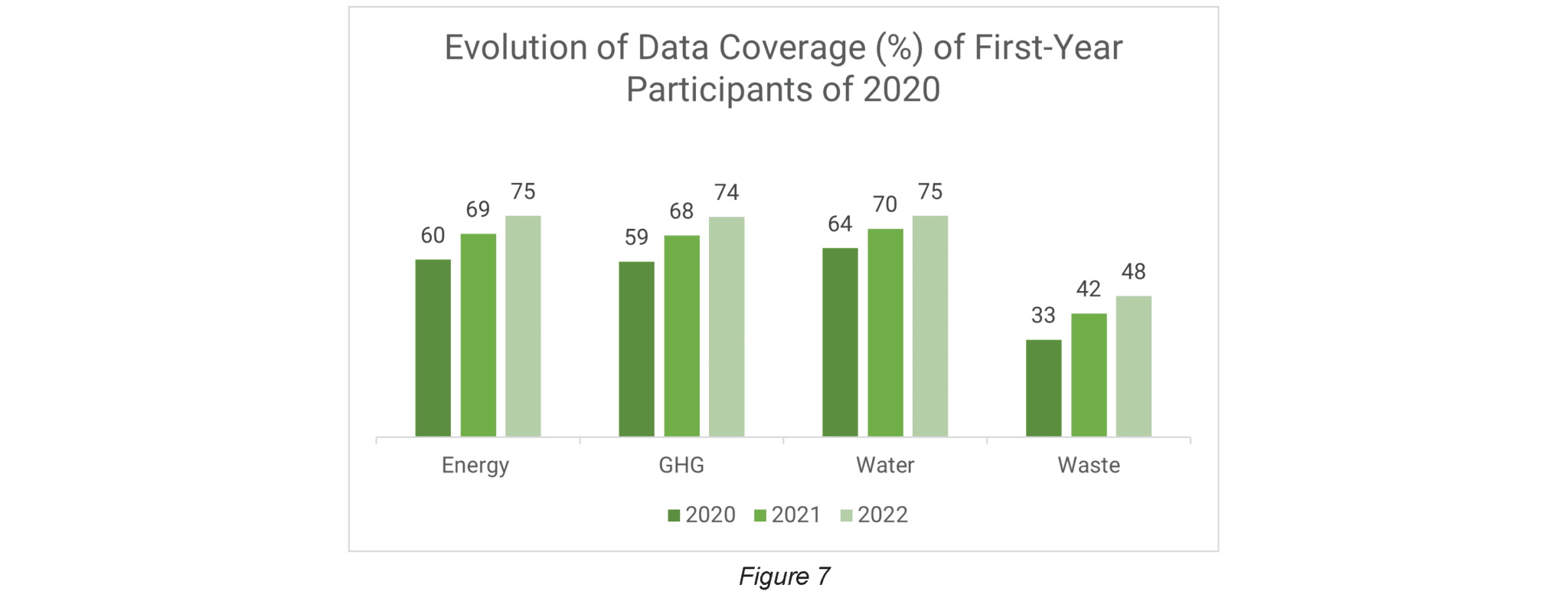

The score increase across the Performance component can be attributed to the improvement of data coverage across reporting years (see Figure 8). Data coverage accounts for a material portion of the Performance component score as it reflects an entity’s knowledge of its portfolio’s consumption profile. A gradual improvement in data coverage figures can be seen across all performance indicators — Energy, GHG emissions, and Water tend to oscillate around the same level, whereas Waste, although gradually improving, remains one of the most difficult utilities for which to collect information.

Overall, it seems that first-year participants may have a better understanding of the consumption profile of their portfolios over the years. Although we cannot know with certainty, this increased knowledge could be a result of entities implementing more efficient tenant engagement processes.

Scores improve substantially following the first year of participation

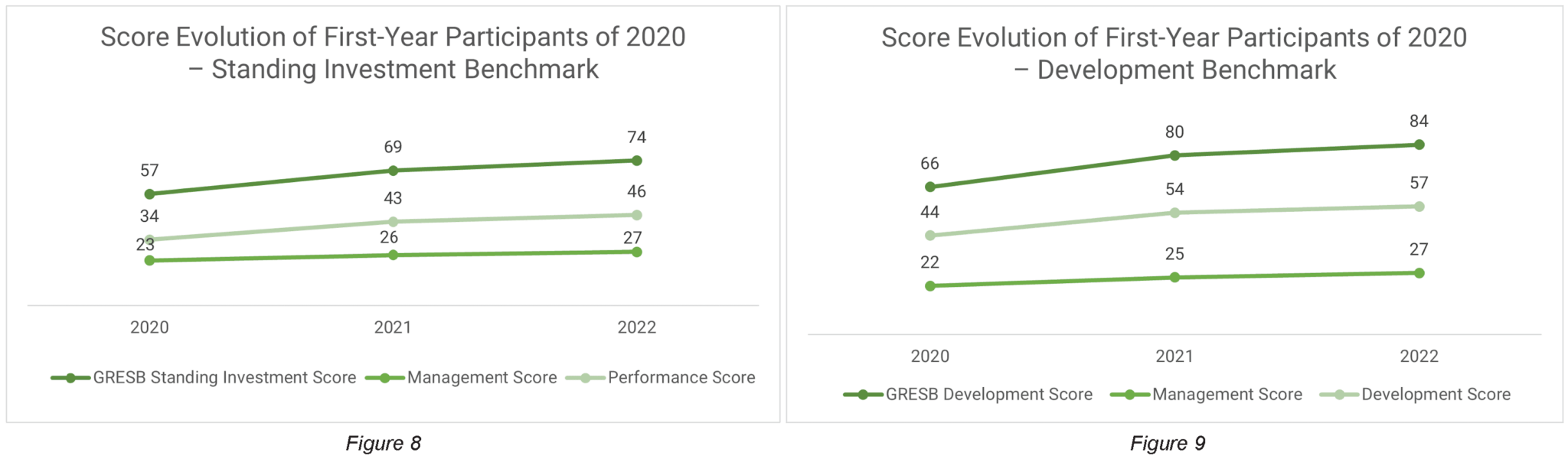

Looking at the performance of participants who joined GRESB in 2020, we can see that after the first year of reporting the average participant score increases by 10 points in both the Performance and Development components and by 3 points in the Management component (Figure 8 and 9). After the second year of participation, scores continue to rise, albeit more slowly, with an average 3-point increase across the Performance and Development component and by 1-2 points in the Management component.

Between the first and third year of reporting, the average GRESB Standing Investment score of participants increases from 57 to 74, nearly reaching the 2022 average benchmark score of 77. In the Development Benchmark, the average participant who joined in 2020 has closed the gap with its established counterparts, with both sets of average participants achieving an average GRESB score of 84 in 2022. As such, a lower first-year score should not discourage participants from continuing their journey with GRESB as it is merely the expected first step towards becoming more sustainable and significant improvements can be seen within a year of participation.

Additionally, first year participants who took advantage of the Response Check service offered by GRESB in collaboration with Sustainability Assurance Services (formerly SRI), our third party validation partner, tend to score, on average, 2.7–5.6 points higher than participants who did not. This service can be quite useful to first-time managers as it provides them with a thorough examination of their assessment response and helps maximize the value from their sustainability efforts.

Outlook

Although some first-year participants may feel intimidated by having their operational performance and managerial policies evaluated against competitors who have entered their sustainability journey years before them, they should know that it only takes two years on average to close the gap.

While first-year real estate participants tend to start out with an average score of 59 for the Standing Investment Benchmark, and 66 for the Development Benchmark, this should not discourage new joiners. In fact, the performance data of participants who first joined GRESB in 2020 reveals that within just two reporting years average scores increased by 17 and 18 points, respectively.

Additionally, creating a plan for future improvement requires acknowledging and addressing areas of weakness while building upon the existing strengths that are shown in an entity’s first GRESB Benchmark Report. Not to mention, participating in the GRESB Assessments and contributing to increasing ESG transparency across the sector can help financial institutions gain a better understanding of how sustainable the real estate industry truly is.

As topics like impact investing and social value emerge in the agenda of many companies’ boards, it is now more crucial than ever for companies to start addressing ESG issues that are material to their business operations. Reporting to GRESB is a very good way to start.

Learn more about getting started with GRESB

For any questions, please contact us.