Our industry is engaged in an important dialogue to improve sustainability through ESG transparency and industry collaboration. This article is a contribution to this larger conversation and does not necessarily reflect GRESB’s position.

In the face of growing concern about the climate crisis, the overwhelming majority of countries around the world adopted the Paris Agreement in December 2015, the central aim of which includes pursuing efforts to limit global temperature rise to 1.5°C by reducing carbon emissions by 45% by 2030 and achieving net zero carbon by 2050. This ambitious target has caused governments to carefully assess where the greatest opportunity for change and improvement lies.

The real estate sector (both building and construction) is one of the heaviest contributors to climate change: according to the IEA Global Status Report (International Energy Agency) in 2020, the sector was responsible for around 36% of global energy use and 39% of energy related carbon dioxide emissions.

This clearly poses great risks to the sector but could also provide great opportunities through building-level initiatives such as decarbonization retrofits and new construction methodologies and technologies. The required decarbonization efforts can be identified and informed by the Carbon Risk Real Estate Monitor (CRREM), a tool which provides the real estate industry with transparent, science-based decarbonization pathways aligned with the Paris Climate Accords.

Seven years later, how much closer are we to reaching this target? Following COP27 in November of this year, IEMA CEO, Sarah Mukherjee MBE, believes that the target to limit global heating to 1.5°C is “just about alive.”

This is hardly surprising when one looks at the facts. While global spending on building construction and renovation in 2018 was at a total of USD 4.5 trillion, only 3% was energy efficiency-related spending. This figure increased by only 3% in 2019. The pandemic lowered the overall carbon impact in 2020 but the return to offices, as well as the growing demand for natural gas in emerging economies, meant that by 2021 global carbon emissions from the operation of buildings rebounded to pre 2019 levels.

This trend is echoed in the 2022 GRESB results.

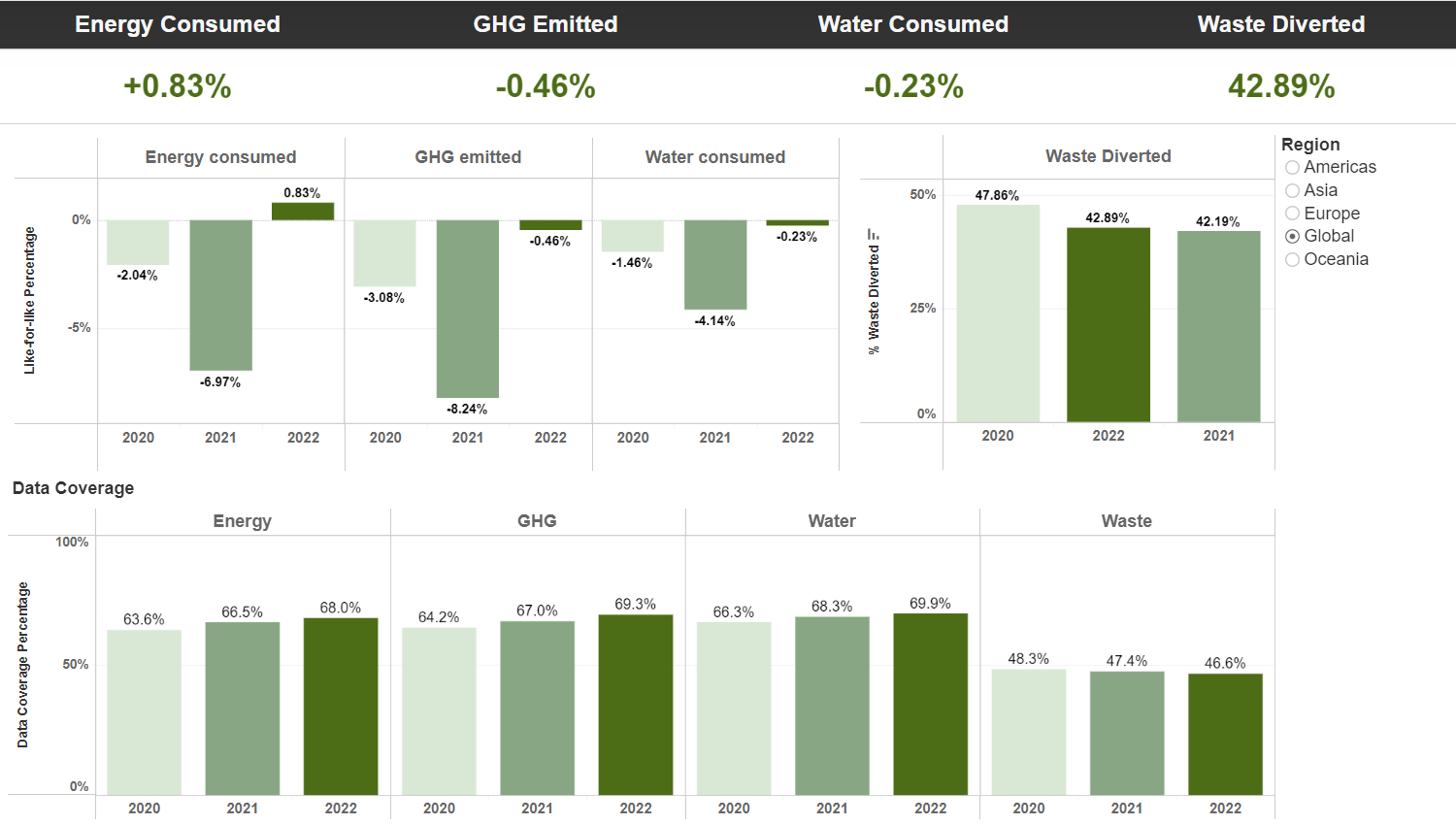

Looking at like-for-like (LFL) consumption change, we observe increases across the benchmark. The increase in energy consumption is most significant in Europe (3.08% LFL consumption change). Oceania is the only region where the recovery from the pandemic has not resulted in an increase in y-o-y consumption and entities from that region were able to continue to showcase significant LFL reductions across Energy, GHG, and Water. At the global level, the “like-for-like” trend is +0.83% energy and -0.46% GHG. In Europe, the overall LFL trend of participants was +3.08% energy and +0.81% GHG. It is perhaps unsurprising, as we emerge into a post COVID-era, that the global energy LFL trends indicate a rebound compared to pre-COVID levels, but more concerningly they reiterate that we are on the wrong trajectory if we are to meet the commitments set out to achieve net zero by 2050.

Even more alarming is that across global GRESB participants (including all regions and sectors) the average year of stranding is projected to be 2024. The European benchmark region fares only slightly better, reporting a projected stranding date of 2026. These figures suggest that the current work being done falls far short of the net zero commitments set out for 2050. Action across the real estate sector is now needed to realize these commitments, maximizing efficiencies and accelerating the use of low carbon technologies. As António Guterres, the UN Secretary General, said at COP27, “we must have zero tolerance for greenwashing’.”

Gaps in data coverage are also adding to the difficulties in reducing greenhouse gas emissions. One of the main ways the real estate sector can lower their carbon emissions is by reducing the energy intensity of buildings. The best way one can reduce energy intensity is by knowing what that intensity is in the first place. This is where data coverage plays a huge role, and it is notable that there is still work to do to improve data coverage (GRESB 2022 submission energy data coverage was 59.6% for Americas versus 70.06% in Europe).

Using data to drive decarbonization

Acquiring quality data is key to mapping out the actual performance of an asset against CRREM benchmarks, especially as these benchmarks are set to change in 2023. CRREM has partnered with the Science Based Targets initiative (SBTi) to align their underlying methodologies and therefore provide the real estate sector with one single set of 1.5°C aligned, in-use emissions pathways. Users can expect the introduction of separate pathways depending on whether refrigerants are included or not, as well as a split for industrial distribution warehouse (depending on if they are kept warm or actively cooled).

What does this mean for CRREM pathways and carbon reducing targets for assets? The overall expectation is that target pathways will be steeper leading up to 2035 before flattening.

Can we still meet the 1.5 degree target?

Possibly, but only if steeper decarbonization targets are adopted for a number of reasons. Firstly, the current global carbon budget (set to 2050) requires a 10% reduction every year, which will in turn cause decarbonization curves to be steeper. Since the sector has already exceeded its yearly carbon budget, the pathways must now be even steeper in order to make up for the increase in consumption, or risk falling short of 2050 targets; this represents a 45-65% cut in energy intensity for residential buildings and 65-75 % for commercial properties by 2030 (when compared to 2015 levels). Other reasons, such as a more ambitious decarbonization of the electric grid and alterations of methodology to include transmissions and distribution losses (for electricity) all contribute to steeper CRREM pathways going forward.

With the sector exceeding its carbon budget and CRREEM pathways becoming more unforgiving, a more robust move towards better data coverage, integrating renewable energy and electrification of the sector are high priority areas for the real estate sector in 2023.

At EVORA we understand these challenges and are acutely aware of the importance of collecting quality data to address them. Organizations that have robust data collection frameworks in place, understand their CRREM positioning, either at an asset and/or portfolio level, and have developed clear strategies for decarbonizing their portfolios. These businesses are best placed to achieve the commitments the real estate sector have set out and should now move from the discovery and planning phase into aggressive action in order to meet their commitments. In the words of António Guterres “we cannot overstate the urgency of our task. The world is in a race against time. We cannot afford slow movers, fake movers or any form of greenwashing”.

This article was written by Alexandra Sicot-Koontz, Junior Consultant, and Katie Brown, Senior Consultant at EVORA Global.