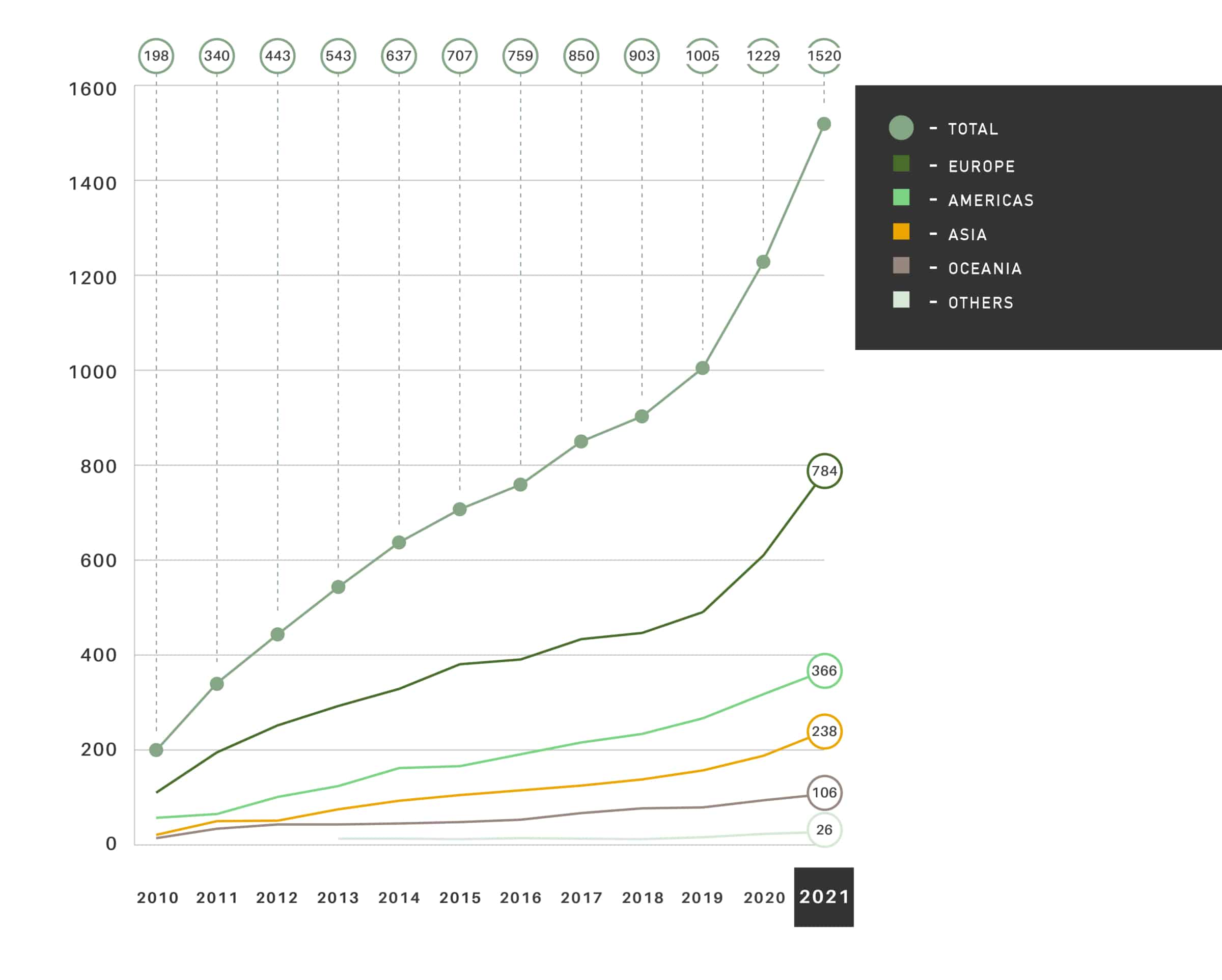

- The 2021 benchmark saw the largest ever growth in total numbers, with 1,520 entities now participating worldwide, with significant growth focused in Europe

- Average GRESB scores increased to 73 for the Standing Investments Benchmark and 79 in the Development Benchmark, following last year’s assessment restructure

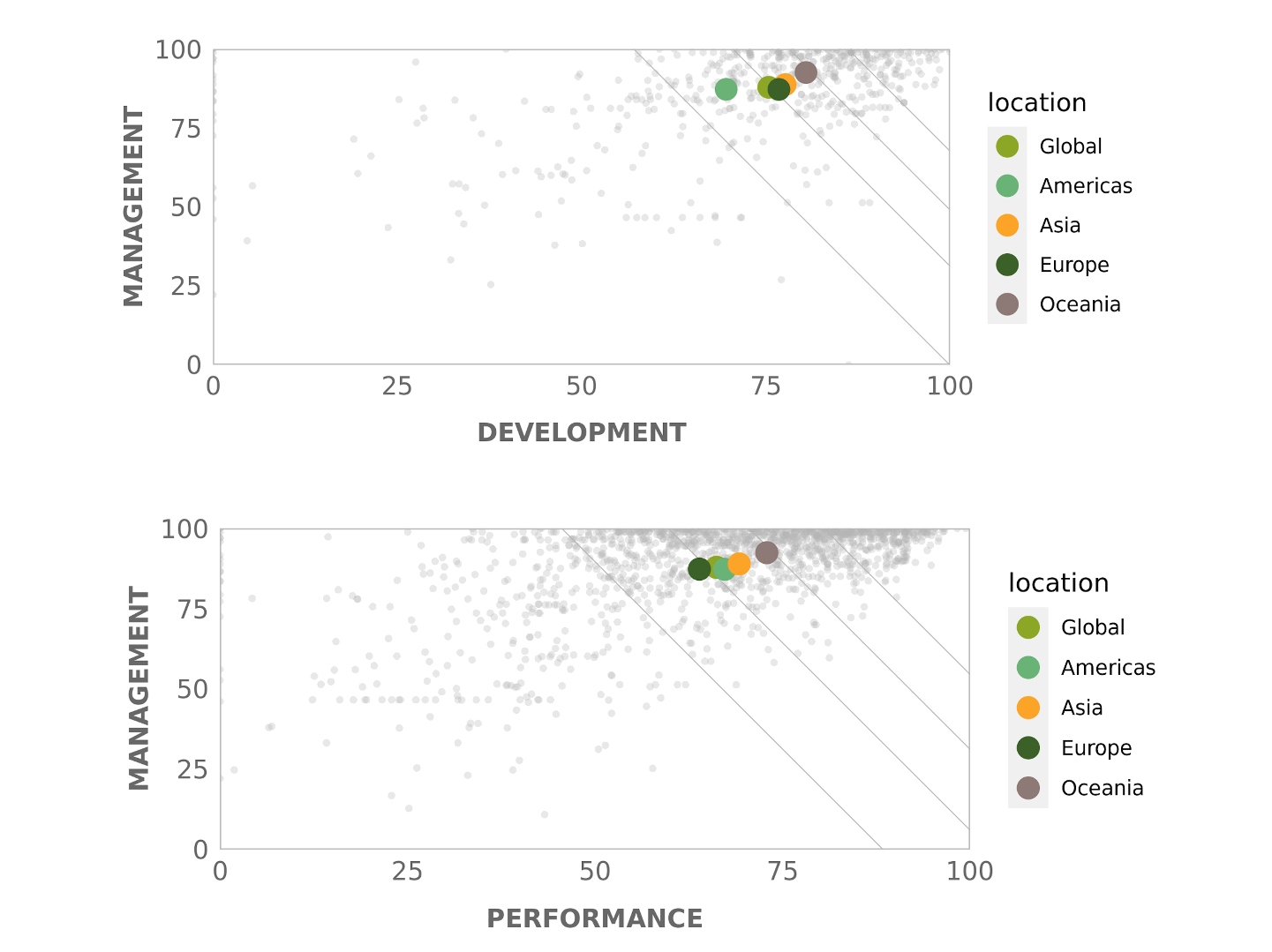

- Oceania continues to lead the way, with the highest regional average score of 79 in the Standing Benchmark and 84 in the Development Benchmark

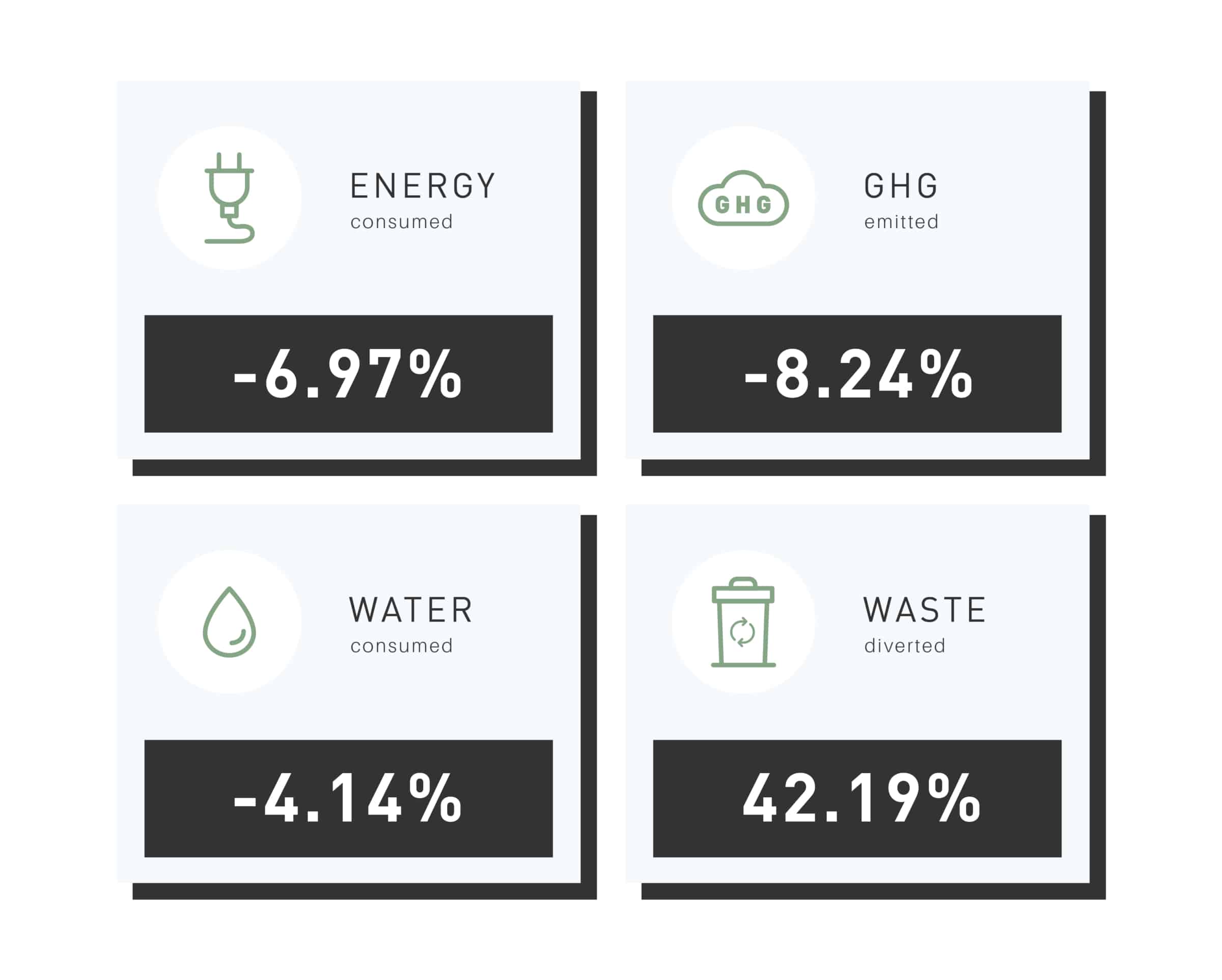

- Significant performance improvements were noted in GHG emission, water and waste reductions, a result of both Covid-19 and continued investment in improving efficiencies

Coverage and growth

Participation in the Real Estate Benchmark grew by 24% this year, to 1,520. This is the highest percentage increase the assessment has seen since 2012 and the highest ever increase in total numbers. The benchmark now covers $5.7 trillion of AuM (up from $4.8 trillion) and nearly 117,000 individual assets.

Growth has been driven mainly by Europe, which saw massive growth for the second year in a row and now accounts for nearly half of the entire benchmark. High continued growth in Europe is likely driven by both investor interest in ESG data and the industry’s focus on and attention to emerging regulations. The group of listed entities grew by 20% while the non-listed group grew by 25%.

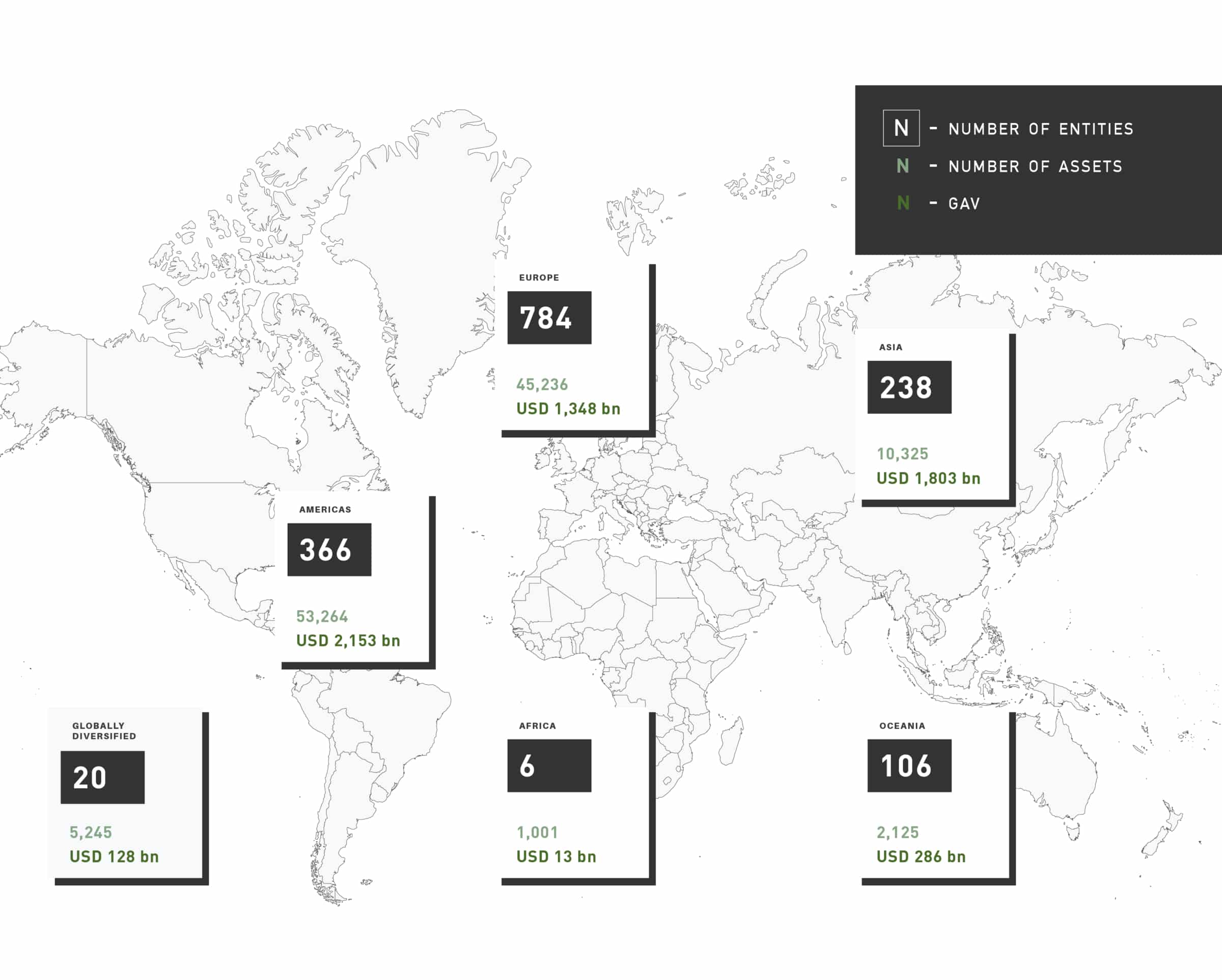

Benchmark size and asset location

This year, 1,520 property companies, REITs, funds and developers participated in the GRESB Real Estate Assessment (up from 1,229 in 2020), generating a benchmark that covers $5.7 trillion of AuM (up from $4.8 trillion). The benchmark covers nearly 117,000 assets (up from 96,000 last year), all of which are reported at the asset level. The data combines high-level overall scores with in-depth information across hundreds of ESG data points, including performance indicators such as GHG emissions, waste and energy and water consumption.

GRESB Scores

While average GRESB scores in 2020 were affected by last year’s assessment restructure, this year saw renewed score improvements. The average Standing Investments Benchmark score is 73 and the average Development Benchmark score is 79. Oceania continues to lead the way with averages scores of 79 and 84, respectively, followed by Asia with average scores of 75 and 80, and Europe and Americas very close to each other with respective average scores of 71 and 79 and 73 and 75.

Aspect Scores

Participants improved on scores across nearly every aspect of the assessment. Score improvement was particularly high in Data Monitoring & Review (a 9% average increase), underlying increased global efforts to improve verification of performance data. On the development side, the most improvement was seen in Materials, highlighting more focus on material selection and embodied carbon tracking in developments and renovations.

Scores

The GRESB Star rating is based on the GRESB Score and its quintile position relative to all participants in the GRESB Assessment, with annual calibration of the model. GRESB 5 Stars is the highest rating and recognition for being an industry leader. Each year, 20% of entities receive a GRESB 5 Star rating.

The tables below show how the GRESB Scores are distributed along the five star categories. With the increase in overall GRESB Scores, the challenge to both receive and maintain the 5 star designation persists.

-

# stars Top Limit Bottom Limit Difference Average Standing Investments Score Average Management Score Average Performance Score 5 99.61 86.44 13.17 90.65 29.01 61.64 4 86.37 79.37 6.99 82.88 28.38 54.5 3 79.36 71.82 7.53 75.4 27.63 47.78 2 71.81 61.89 9.91 67.23 26.6 40.63 1 61.76 8.78 52.99 47.95 20.8 27.15 -

# stars Top Limit Bottom Limit Difference Average Development Score Average Management Score Average Development Component Score 5 100 90.29 9.71 93.4 28.86 64.54 4 90.28 84.71 5.56 87.46 28.03 59.42 3 84.7 79.42 5.28 82.19 27.33 54.85 2 79.29 69.96 9.34 75.09 25.55 49.54 1 69.95 15.04 54.92 55.36 20.14 35.22

Performance in light of Covid

The global impact of the Covid-19 pandemic is noticeably reflected in performance scores. This year’s benchmark shows unprecedented reductions in utility usage, with like-for-like reductions in energy consumption, GHG emissions and water usage nearly threefold from previous years. These reductions were most pronounced in Asia, which saw decreases in energy consumption (8%), GHG emissions (10%) and water consumption (11%). To complement the Real Estate Assessment this year, GRESB surveyed Members and Partners on how Covid-19 has affected portfolio performance. Results showed that these sizable reductions are not solely attributable to the pandemic – participants are also making significant improvements engaging tenants and implementing efficiency measures.

Sector Leaders

The GRESB Sector Leaders are the best performers by sector, region and nature of ownership from across the GRESB Assessments.

The entity with the top GRESB Score, as well as the entities with a score within 1 point of the top score in a category will be recognized as Sector Leaders. You can find more information on Sector Leaders here.

Standing Investments Benchmark

-

Sector Fund name Fund manager Healthcare Achmea Dutch Health Care Property Fund Syntrus Achmea Real Estate & Finance Residential Altera Residential Altera Vastgoed NV Healthcare Amvest Living & Care Fund Amvest Office Australian Prime Property Fund Commercial Lendlease Retail Australian Prime Property Fund Retail Lendlease Hotel Bouwinvest Dutch Institutional Hotel Fund N.V. Bouwinvest Real Estate Investors Diversified – Office/Industrial Castellum AB Castellum AB Retail CBRE Retail Property Fund Iberica CBRE Global Investors Technology/Science Digital Realty Digital Realty Diversified Hines Master Fund Management Company S.a.r.l. on behalf of Hines Real Estate Master FCP-FIS Hines Hotel IRE European Hotel Fund FCP RAIF Invesco Real Estate Diversified – Office/Residential J.P. Morgan U.S. Value Add J.P. Morgan Asset Management Retail Klépierre KLEPIERRE Office Lendlease International Towers Sydney Trust Lendlease Industrial Logistis AEW Other Shurgard Self Storage SA Shurgard Self Storage SA Mixed use Swire Properties Limited Swire Properties Limited Diversified – Office/Retail Vasakronan Vasakronan -

Sector Legal Status Fund name Fund manager Healthcare Non-listed Achmea Dutch Health Care Property Fund Syntrus Achmea Real Estate & Finance Residential Non-listed Altera Residential Altera Vastgoed NV Healthcare Non-listed Amvest Living & Care Fund Amvest Hotel Listed Ascott Residence Trust Ascott Residence Trust Office Non-listed Australian Prime Property Fund Commercial Lendlease Retail Non-listed Australian Prime Property Fund Retail Lendlease Hotel Non-listed Bouwinvest Dutch Institutional Hotel Fund N.V. Bouwinvest Real Estate Investors Mixed use Non-listed BVK Highstreet Retail Europe Immobilienfonds Hines Diversified Listed CapitaLand Limited CapitaLand Group Diversified – Office/Industrial Listed Castellum AB Castellum AB Retail Non-listed CBRE Retail Property Fund Iberica CBRE Global Investors Office Listed Cegereal Cegereal Diversified – Office/Retail Listed City Developments Limited City Developments Limited Diversified – Office/Residential Listed Covivio Covivio Hotel Listed DiamondRock Hospitality Company DiamondRock Hospitality Company Industrial Listed GLP J-REIT GLP Japan Advisors Inc. Diversified Non-listed Hines Master Fund Management Company S.a.r.l. on behalf of Hines Real Estate Master FCP-FIS Hines Diversified – Office/Industrial Non-listed Invesco Real Estate (Asia) Invesco Real Estate Hotel Non-listed IRE European Hotel Fund FCP RAIF Invesco Real Estate Diversified – Office/Residential Non-listed J.P. Morgan U.S. Value Add J.P. Morgan Asset Management Diversified – Office/Residential Listed JBG SMITH JBG SMITH Retail Listed Klépierre KLEPIERRE Office Non-listed Lendlease International Towers Sydney Trust Lendlease Industrial Non-listed Logistis AEW Other Listed Shurgard Self Storage SA Shurgard Self Storage SA Office Listed Suntec Real Estate Investment Trust ARA Trust Management (Suntec) Limited Residential Listed UDR, Inc. UDR, Inc. Diversified – Office/Retail Non-listed Vasakronan Vasakronan Diversified – Office/Retail Listed Vornado Realty Trust Vornado Realty Trust -

Sector Region Fund name Fund manager Healthcare Europe Achmea Dutch Health Care Property Fund Syntrus Achmea Real Estate & Finance Residential Asia Advance Residence Investment Corporation AD Investment Management Co., Ltd. Residential Europe Altera Residential Altera Vastgoed NV Healthcare Europe Amvest Living & Care Fund Amvest Office Oceania Australian Prime Property Fund Commercial Lendlease Retail Oceania Australian Prime Property Fund Retail Lendlease Office Americas Beacon Capital Strategic Partners VII, L.P. Beacon Capital Partners, LLC Hotel Europe Bouwinvest Dutch Institutional Hotel Fund N.V. Bouwinvest Real Estate Investors Retail Americas Brookfield Property REIT Brookfield Properties Diversified Asia CapitaLand Limited CapitaLand Group Diversified – Office/Industrial Europe Castellum AB Castellum AB Office Europe CBRE Dutch Office Fund CBRE Global Investors Retail Europe CBRE Retail Property Fund Iberica CBRE Global Investors Diversified – Office/Retail Asia City Developments Limited City Developments Limited Office Americas CommonWealth Partners CommonWealth Partners Diversified – Office/Residential Europe Covivio Covivio Diversified – Office/Industrial Oceania Cromwell Property Trust 12 Cromwell Property Group Diversified – Office/Residential Asia DBJ Private REIT Inc. DBJ Asset Management Co., Ltd. Diversified – Office/Retail Oceania Dexus Wholesale Property Fund Dexus Technology/Science Americas Digital Realty Digital Realty Industrial Americas FIBRA Prologis Prologis Industrial Oceania Frasers Property Industrial Australia Pty Limited Frasers Property Industrial Australia Pty Limited Industrial Asia GLP J-REIT GLP Japan Advisors Inc. Diversified – Office/Industrial Oceania Growthpoint Properties Australia GrowthPoint Diversified Europe Hines Master Fund Management Company S.a.r.l. on behalf of Hines Real Estate Master FCP-FIS Hines Mixed use Europe Hufvudstaden AB Hufvudstaden AB Residential Americas Institutional Multifamily Partners LLC GID Investment Advisers LLC Hotel Europe IRE European Hotel Fund FCP RAIF Invesco Real Estate Diversified Americas J.P. Morgan U.S. Core J.P. Morgan Asset Management Diversified – Office/Residential Americas J.P. Morgan U.S. Value Add J.P. Morgan Asset Management Diversified – Office/Retail Americas Jamestown Premier Fund Jamestown, LP Hotel Asia Japan Hotel REIT Investment Corporation Japan Hotel REIT Advisors Co., Ltd. Office Americas Kilroy Realty Corporation Kilroy Realty Corporation Retail Europe Klépierre KLEPIERRE Retail Asia Lendlease Global Commercial Real Estate Investment Trust Lendlease Global Commercial Trust Management Pte Ltd Office Oceania Lendlease International Towers Sydney Trust Lendlease Office Americas Lionstone|CalStrs SA Lionstone Investments Industrial Europe Logistis AEW Diversified – Office/Industrial Americas Manulife Investment Management Global Real Estate Portfolio Manulife Investment Management Office Americas New York Life General Account – Joint Venture New York Life Investors Diversified – Office/Residential Asia NTT UD REIT Investment Corporation NTT Urban Development Asset Management Corporation Industrial Americas Prologis Brazil Logistics Venture Prologis Diversified Americas RBC Canadian Core Real Estate Fund RBC GAM – QuadReal Office Asia Suntec Real Estate Investment Trust ARA Trust Management (Suntec) Limited Retail Americas Super Regional Mall Fund Nuveen Real Estate Mixed use Asia Swire Properties Limited Swire Properties Limited Diversified – Office/Retail Americas The Cadillac Fairview Corporation The Cadillac Fairview Corporation Residential Asia Tokyo Multi Family Partnership Nuveen Real Estate Diversified – Office/Retail Europe Vasakronan Vasakronan Diversified – Office/Retail Americas Vornado Realty Trust Vornado Realty Trust -

Sector Region Legal Status Fund name Fund Manager Diversified – Office/Residential Europe Non-listed Mandatum henkivakuutusyhtiö (Mandatum Life) Sampo Oyj Industrial Europe Listed Aberdeen Standard European Logistics Income PLC Aberdeen Standard Investments Healthcare Europe Non-listed Achmea Dutch Health Care Property Fund Syntrus Achmea Real Estate & Finance Residential Asia Listed Advance Residence Investment Corporation AD Investment Management Co., Ltd. Residential Europe Non-listed Altera Residential Altera Vastgoed NV Healthcare Europe Non-listed Amvest Living & Care Fund Amvest Office Oceania Non-listed Australian Prime Property Fund Commercial Lendlease Retail Oceania Non-listed Australian Prime Property Fund Retail Lendlease Office Americas Non-listed Beacon Capital Strategic Partners VII, L.P. Beacon Capital Partners, LLC Hotel Europe Non-listed Bouwinvest Dutch Institutional Hotel Fund N.V. Bouwinvest Real Estate Investors Retail Americas Listed Brookfield Property REIT Brookfield Properties Mixed use Europe Non-listed BVK Highstreet Retail Europe Immobilienfonds Hines Diversified Asia Listed CapitaLand Limited CapitaLand Group Diversified – Office/Industrial Europe Listed Castellum AB Castellum AB Office Europe Non-listed CBRE Dutch Office Fund CBRE Global Investors Retail Europe Non-listed CBRE Retail Property Fund Iberica CBRE Global Investors Office Europe Listed Cegereal Cegereal Diversified – Office/Retail Asia Listed City Developments Limited City Developments Limited Office Americas Non-listed CommonWealth Partners CommonWealth Partners Diversified – Office/Retail Oceania Non-listed Dexus Wholesale Property Fund Dexus Diversified Asia Non-listed DREAM Private REIT Inc. Diamond Realty Management Inc. Industrial Americas Listed FIBRA Prologis Prologis Industrial Oceania Non-listed Frasers Property Industrial Australia Pty Limited Frasers Property Industrial Australia Pty Limited Diversified – Office/Retail Asia Non-listed Frasers Property Singapore Frasers Property (Singapore) Pte. Ltd Industrial Asia Listed GLP J-REIT GLP Japan Advisors Inc. Industrial Asia Non-listed Goodman Japan Core Partnership (GJCP) Goodman Group Diversified Europe Non-listed Hines Master Fund Management Company S.a.r.l. on behalf of Hines Real Estate Master FCP-FIS Hines Office Americas Listed HudsonPacificProperties, INC. HudsonPacificProperties, INC. Office Asia Non-listed IGIS Private Real Estate Investment Trust No. 35 IGIS Asset Management Residential Americas Non-listed Institutional Multifamily Partners LLC GID Investment Advisers LLC Hotel Europe Non-listed IRE European Hotel Fund FCP RAIF Invesco Real Estate Retail Americas Non-listed Ivanhoe Cambridge – managed portfolio Ivanhoe Cambridge Diversified Americas Non-listed J.P. Morgan U.S. Core J.P. Morgan Asset Management Diversified – Office/Residential Americas Non-listed J.P. Morgan U.S. Value Add J.P. Morgan Asset Management Diversified – Office/Retail Americas Non-listed Jamestown Premier Fund Jamestown, LP Hotel Asia Listed Japan Hotel REIT Investment Corporation Japan Hotel REIT Advisors Co., Ltd. Office Americas Listed Kilroy Realty Corporation Kilroy Realty Corporation Retail Europe Listed Klépierre KLEPIERRE Diversified – Office/Retail Europe Listed Land Securities Group PLC Land Securities Group PLC Diversified – Office/Industrial Europe Non-listed LaSalle E-REGI LaSalle Investment Management Kapitalverwaltungsgesellschaft mbH Retail Asia Listed Lendlease Global Commercial Real Estate Investment Trust Lendlease Global Commercial Trust Management Pte Ltd Office Oceania Non-listed Lendlease International Towers Sydney Trust Lendlease Office Americas Non-listed Lionstone|CalStrs SA Lionstone Investments Industrial Europe Non-listed Logistis AEW Diversified Asia Non-listed M&G Asia Property Fund M&G Real Estate Diversified – Office/Industrial Americas Non-listed Manulife Investment Management Global Real Estate Portfolio Manulife Investment Management Office Americas Non-listed New York Life General Account – Joint Venture New York Life Investors Retail Asia Non-listed Parkway Parade Partnership Lendlease Industrial Americas Non-listed Prologis Brazil Logistics Venture Prologis Diversified Americas Non-listed RBC Canadian Core Real Estate Fund RBC GAM – QuadReal Office Asia Listed Suntec Real Estate Investment Trust ARA Trust Management (Suntec) Limited Retail Americas Non-listed Super Regional Mall Fund Nuveen Real Estate Diversified – Office/Retail Americas Non-listed The Cadillac Fairview Corporation The Cadillac Fairview Corporation Residential Europe Listed The UNITE Group Plc The UNITE Group Plc Residential Asia Non-listed Tokyo Multi Family Partnership Nuveen Real Estate Residential Americas Listed UDR, Inc. UDR, Inc. Diversified – Office/Retail Europe Non-listed Vasakronan Vasakronan Diversified Americas Listed Ventas, Inc. Ventas, Inc. Diversified Europe Listed Wihlborgs Fastigheter AB Wihlborgs Fastigheter AB

Development Benchmark

-

Sector Fund name Fund manager Office Australian Prime Property Fund Commercial Lendlease Retail Carmila SA Carmila SA Office Castellum AB Castellum AB Hotel CBRE UK Long Income Fund CBRE Global Investors Diversified – Office/Residential FORE Partnership FORE Partnership Diversified – Office/Industrial Frasers Property Industrial Australia Pty Limited Frasers Property Industrial Australia Pty Limited Healthcare Hemsö Fastighets AB Hemsö Fastighets AB Diversified – Office/Retail Hines European Value Fund 2 Hines Diversified ISPT Core Fund ISPT Pty Ltd Industrial Logistis AEW Residential Regent Street The Crown Estate Retail Scentre Group Scentre Group Mixed use Swire Properties Limited Swire Properties Limited Industrial Tritax Big Box REIT Tritax Management LLP Residential UBS (CH) Property Fund – Direct Residential UBS Asset Management Residential UBS (CH) Property Fund – Léman Residential «Foncipars» UBS Asset Management Retail Unisuper AMP Capital Investors Limited -

Sector Legal status Fund name Fund manager Diversified Listed Alexandria Real Estate Equities, Inc. Alexandria Real Estate Equities, Inc. Office Non-listed Australian Prime Property Fund Commercial Lendlease Retail Listed Carmila SA Carmila SA Office Listed Castellum AB Castellum AB Hotel Non-listed CBRE UK Long Income Fund CBRE Global Investors Mixed use Non-listed CWTC Multi Family ICAV Hines Real Estate Ireland Limited Diversified – Office/Residential Non-listed FORE Partnership FORE Partnership Diversified – Office/Industrial Non-listed Frasers Property Industrial Australia Pty Limited Frasers Property Industrial Australia Pty Limited Residential Listed Godrej Properties Godrej Properties Healthcare Non-listed Hemsö Fastighets AB Hemsö Fastighets AB Diversified – Office/Retail Non-listed Hines European Value Fund 2 Hines Diversified Non-listed ISPT Core Fund ISPT Pty Ltd Diversified – Office/Residential Listed JBG SMITH JBG SMITH Diversified – Office/Residential Listed Kilroy Realty Corporation Kilroy Realty Corporation Industrial Non-listed Logistis AEW Residential Non-listed Regent Street The Crown Estate Retail Listed Scentre Group Scentre Group Mixed use Listed Swire Properties Limited Swire Properties Limited Diversified Listed Tokyo Tatemono Co., Ltd. Tokyo Tatemono Co., Ltd. Industrial Listed Tritax Big Box REIT Tritax Management LLP Residential Non-listed UBS (CH) Property Fund – Direct Residential UBS Asset Management Residential Non-listed UBS (CH) Property Fund – Léman Residential «Foncipars» UBS Asset Management Retail Non-listed Unisuper AMP Capital Investors Limited -

Sector Region Fund name Fund manager Diversified Americas Alexandria Real Estate Equities, Inc. Alexandria Real Estate Equities, Inc. Office Oceania Australian Prime Property Fund Commercial Lendlease Residential Americas AvalonBay Communities, Inc. AvalonBay Communities, Inc. Retail Europe Carmila SA Carmila SA Office Europe Castellum AB Castellum AB Diversified – Office/Industrial Europe CBRE Europe Value Partners 2 CBRE Global Investors Hotel Europe CBRE UK Long Income Fund CBRE Global Investors Mixed use Americas CIM Fund III, LP CIM Group Industrial Oceania Core Logistics Partnership (CLP) Charter Hall Diversified Americas CREIF KingSett Capital Mixed use Europe CWTC Multi Family ICAV Hines Real Estate Ireland Limited Office Asia DLF Limited DLF Limited Residential Americas Equity Residential Equity Residential Industrial Asia ESR Kendall Square Development JV 1 ESR Kendall Square, Inc. Retail Americas First Capital REIT First Capital REIT Diversified – Office/Residential Europe FORE Partnership FORE Partnership Industrial Oceania Goodman Australia Partnership (GAP) Goodman Group Office Americas HudsonPacificProperties, INC. HudsonPacificProperties, INC. Diversified – Office/Residential Americas JBG SMITH JBG SMITH Diversified – Office/Residential Americas Kilroy Realty Corporation Kilroy Realty Corporation Residential Oceania Lendlease Retirement Living Trust Lendlease Industrial Europe Logistis AEW Residential Americas MEPT / BGO Diversified BentallGreenOak Office Asia Mitsubishi Estate Co., Ltd. Mitsubishi Estate Co., Ltd. Industrial Americas Prologis Brazil Logistics Venture Prologis Residential Europe Regent Street The Crown Estate Mixed use Americas RioCan RioCan Real Estate Investment Trust Retail Oceania Scentre Group Scentre Group Mixed use Americas SOUTH STATION PHASE I OWNER LLC Hines Interests Limited Partnership Diversified Americas Sun Life Assurance Company of Canada BentallGreenOak Mixed use Asia Swire Properties Limited Swire Properties Limited Diversified Europe TfL Property Development TfL Office Asia The Red Sea Development Company The Red Sea Development Company Diversified Asia Tokyo Tatemono Co., Ltd. Tokyo Tatemono Co., Ltd. Industrial Europe Tritax Big Box REIT Tritax Management LLP Residential Europe UBS (CH) Property Fund – Direct Residential UBS Asset Management Residential Europe UBS (CH) Property Fund – Léman Residential «Foncipars» UBS Asset Management Retail Oceania Unisuper AMP Capital Investors Limited Office Europe Vasakronan Vasakronan Residential Asia White Peak Real Estate Investment White Peak Group -

Sector Region Legal Status Fund name Fund manager Diversified Americas Listed Alexandria Real Estate Equities, Inc. Alexandria Real Estate Equities, Inc. Office Oceania Non-listed Australian Prime Property Fund Commercial Lendlease Residential Americas Listed AvalonBay Communities, Inc. AvalonBay Communities, Inc. Residential Europe Listed Capital & Counties Properties PLC Capital & Counties Office Europe Listed Castellum AB Castellum AB Diversified – Office/Industrial Europe Non-listed CBRE Europe Value Partners 2 CBRE Global Investors Hotel Europe Non-listed CBRE UK Long Income Fund CBRE Global Investors Industrial Oceania Non-listed Core Logistics Partnership (CLP) Charter Hall Diversified Americas Non-listed CREIF KingSett Capital Mixed use Europe Non-listed CWTC Multi Family ICAV Hines Real Estate Ireland Limited Office Asia Non-listed DLF Cybercity Developers Ltd DLF Ltd Industrial Americas Listed Duke Realty Corp Duke Realty Corp Residential Americas Listed Equity Residential Equity Residential Industrial Asia Non-listed ESR Kendall Square Development JV 1 ESR Kendall Square, Inc. Diversified – Office/Residential Europe Non-listed FORE Partnership FORE Partnership Residential Asia Listed Godrej Properties Godrej Properties Industrial Oceania Non-listed Goodman Australia Partnership (GAP) Goodman Group Office Americas Listed HudsonPacificProperties, INC. HudsonPacificProperties, INC. Diversified Europe Listed Kungsleden AB Kungsleden AB Industrial Europe Non-listed Logistis AEW Residential Americas Non-listed MEPT / BGO Diversified BentallGreenOak Office Americas Non-listed NBIM Walker NBIM Office Americas Non-listed Normandy Real Estate Fund IV, L.P Normandy Real Estate Partners Diversified – Office/Residential Americas Non-listed Oxford Properties (OMERS) Oxford Properties (OMERS) Mixed use Asia Non-listed Phoenix Asia Real Estate Investments VI Phoenix Property Investors Diversified – Office/Residential Americas Non-listed Prime Canadian Property Fund BentallGreenOak Industrial Americas Non-listed Prologis Brazil Logistics Venture Prologis Residential Europe Listed Realstone Development Fund Realstone SA Residential Europe Non-listed Regent Street The Crown Estate Diversified Americas Non-listed Sun Life Assurance Company of Canada BentallGreenOak Office Asia Non-listed The Red Sea Development Company The Red Sea Development Company Residential Europe Listed The UNITE Group Plc The UNITE Group Plc Diversified Asia Listed Tokyo Tatemono Co., Ltd. Tokyo Tatemono Co., Ltd. Industrial Europe Listed Tritax Big Box REIT Tritax Management LLP Residential Europe Non-listed UBS (CH) Property Fund – Direct Residential UBS Asset Management Diversified Europe Non-listed UBS (CH) Property Fund – Direct Urban UBS Asset Management Residential Europe Non-listed UBS (CH) Property Fund – Léman Residential «Foncipars» UBS Asset Management Office Europe Non-listed Vasakronan Vasakronan Residential Asia Non-listed White Peak Real Estate Investment White Peak Group

Americas

-

The total number of participants in the region.

-

The GRESB Models compare the aggregate performance in both benchmarks (Standing Investments and Development) across countries and regions.

-

The width of each slice in the windrose shows the scoring weight of each Aspect in the Assessment. The Aspects where the regional 2021 performance exceeds the 2020 line are the Aspects where the majority of the score improvement comes from. The indicators summary breaks down the weight of each Aspect into indicators and shows the exact weight of each aspect.

Standing Investment

Development

-

The graph below shows the data coverage reported by participants in the 2021 Assessment, broken down per performance indicator and property sector. Overall trend across regions (with some exceptions) shows that efforts into improving data coverage are noticeable and Covid did not impact data collection efforts.

-

The intensity graphs are based on a subset of the GRESB Universe, consisting only of assets with 100% data coverage. Overall, the like-for-like reductions are also supported by a decrease in energy and water intensities, with significant variation across sectors and regions.

Water

Energy

-

The below shows the region’s overall improvements in energy and water consumption, greenhouse gas emissions and waste diverted since last year.

Asia

-

The total number of participants in the region.

-

The GRESB Models compare the aggregate performance in both benchmarks (Standing Investments and Development) across countries and regions.

-

The graph below shows the data coverage reported by participants in the 2021 Assessment, broken down per performance indicator and property sector. Overall trend across regions (with some exceptions) shows that efforts into improving data coverage are noticeable and Covid did not impact data collection efforts.

-

The intensity graphs are based on a subset of the GRESB Universe, consisting only of assets with 100% data coverage. Overall, the like-for-like reductions are also supported by a decrease in energy and water intensities, with significant variation across sectors and regions.

Energy

Water

-

The below shows the region’s overall improvements in energy and water consumption, greenhouse gas emissions and waste diverted since last year.

Europe

-

The total number of participants in the region.

-

The GRESB Models compare the aggregate performance in both benchmarks (Standing Investments and Development) across countries and regions.

-

The width of each slice in the windrose shows the scoring weight of each Aspect in the Assessment. The Aspects where the regional 2021 performance exceeds the 2020 line are the Aspects where the majority of the score improvement comes from. The indicators summary breaks down the weight of each Aspect into indicators and shows the exact weight of each aspect.

Development

Standing Investment

-

The graph below shows the data coverage reported by participants in the 2021 Assessment, broken down per performance indicator and property sector. Overall trend across regions (with some exceptions) shows that efforts into improving data coverage are noticeable and Covid did not impact data collection efforts.

-

The intensity graphs are based on a subset of the GRESB Universe, consisting only of assets with 100% data coverage. Overall, the like-for-like reductions are also supported by a decrease in energy and water intensities, with significant variation across sectors and regions.

Energy

Water

-

The below shows the region’s overall improvements in energy and water consumption, greenhouse gas emissions and waste diverted since last year.

Oceania

-

The total number of participants in the region. In Oceania, participation has now crossed the 100-entities mark.

-

The GRESB Models compare the aggregate performance in both benchmarks (Standing Investments and Development) across countries and regions. With a highest regional average of 79, close to 40% of entities in Oceania are have a 5-star GRESB Rating.

-

The width of each slice in the windrose shows the scoring weight of each Aspect in the Assessment. The Aspects where the regional 2021 performance exceeds the 2020 line are the Aspects where the majority of the score improvement comes from. The indicators summary breaks down the weight of each Aspect into indicators and shows the exact weight of each aspect.

Development

Standing Investment

-

The graph below shows the data coverage reported by participants in the 2021 Assessment, broken down per performance indicator and property sector. Overall trend across regions (with some exceptions) shows that efforts into improving data coverage are noticeable and Covid did not impact data collection efforts.

-

The intensity graphs are based on a subset of the GRESB Universe, consisting only of assets with 100% data coverage. Overall, the like-for-like reductions are also supported by a decrease in energy and water intensities, with significant variation across sectors and regions.

Energy

Water

-

The below shows the region’s overall improvements in energy and water consumption, greenhouse gas emissions and waste diverted since last year.