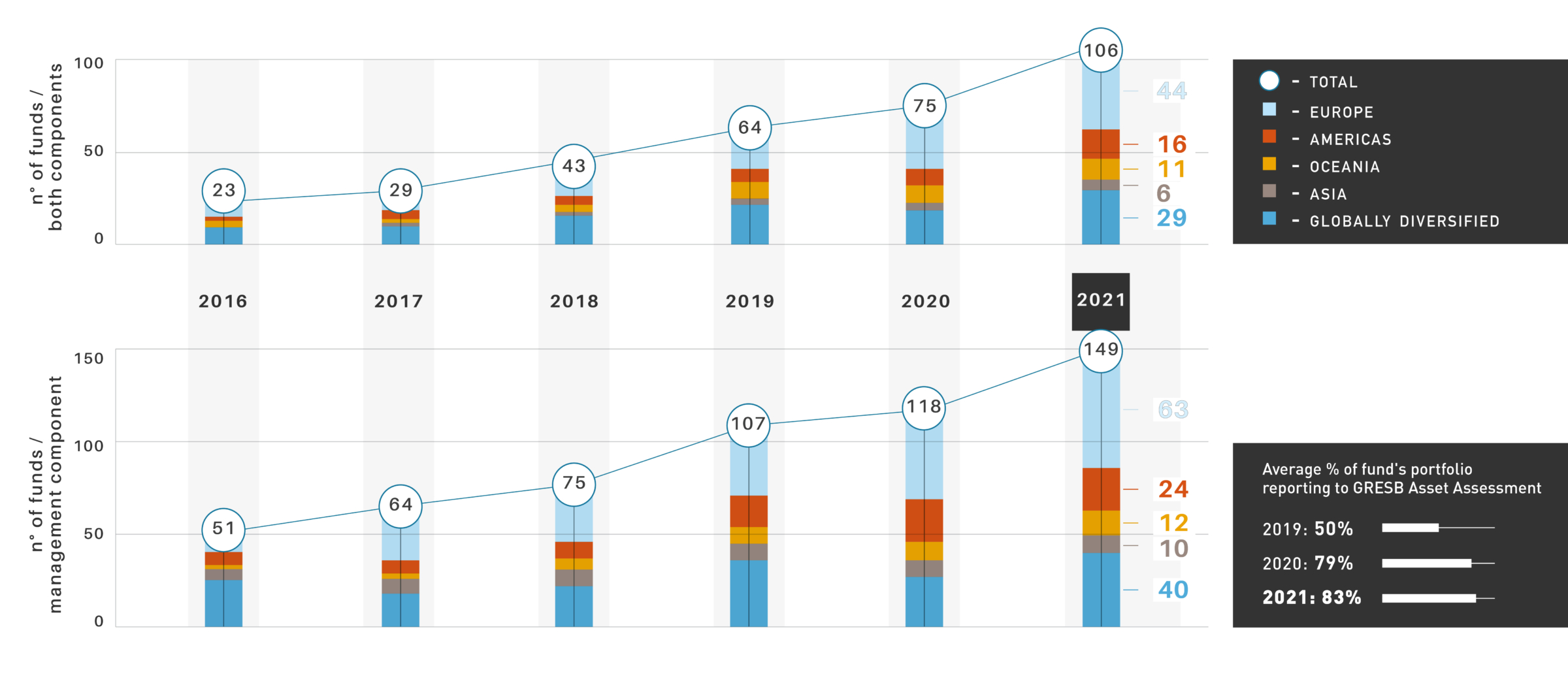

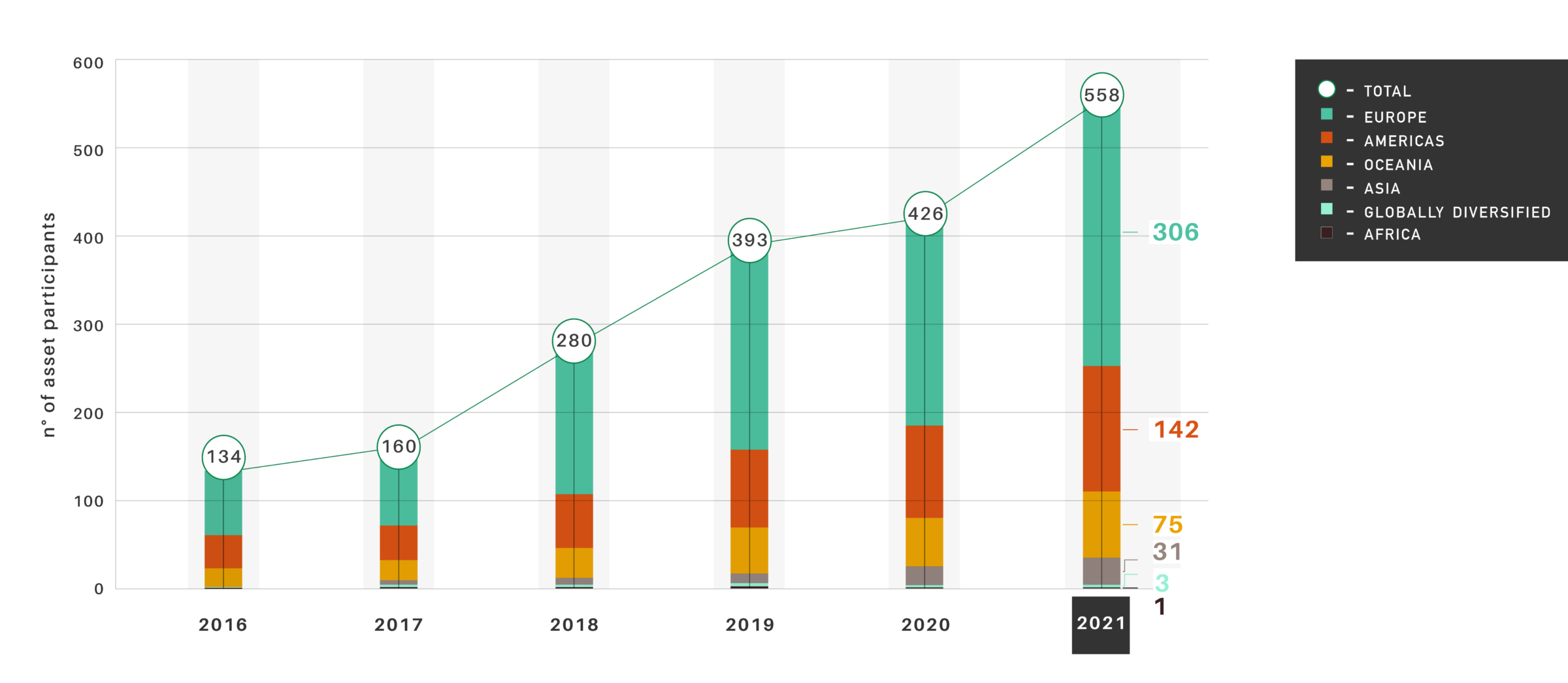

- This year saw the largest ever increase in asset participation, with 558 assets now reporting, and the second largest increase in fund participation, now at 149

- Funds completing both assessment components jumped 41% to 106, that is funds obtaining a GRESB Fund Score reflecting overall ESG performance at the portfolio level

- While few assets have net zero targets, recent commitments by managers representing 40% of reporting assets are expected to drive significant increases in the years ahead

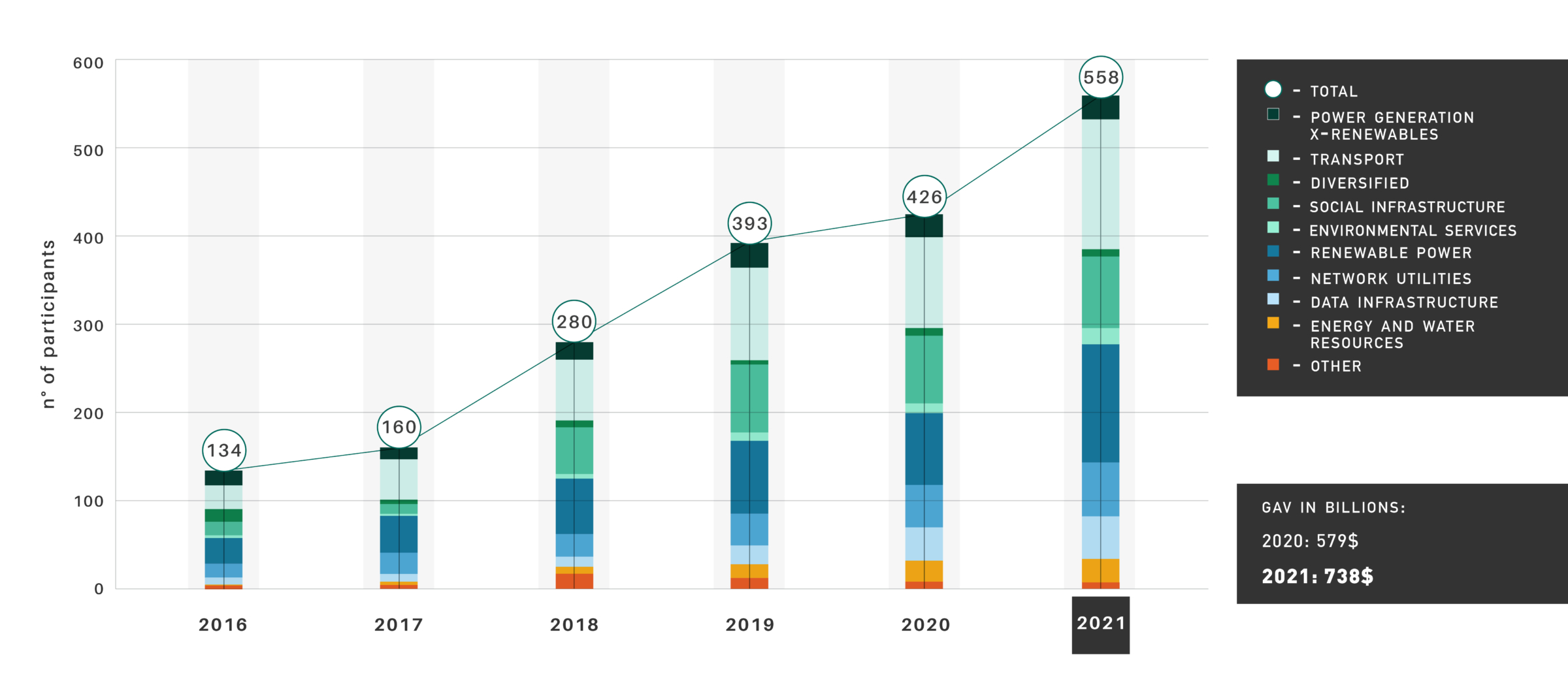

- Asset participation growth was led by Renewable Power, with a 65% increase from 2020

- Significant regional growth in asset participation was seen in the Americas (35%) and Asia (48%)

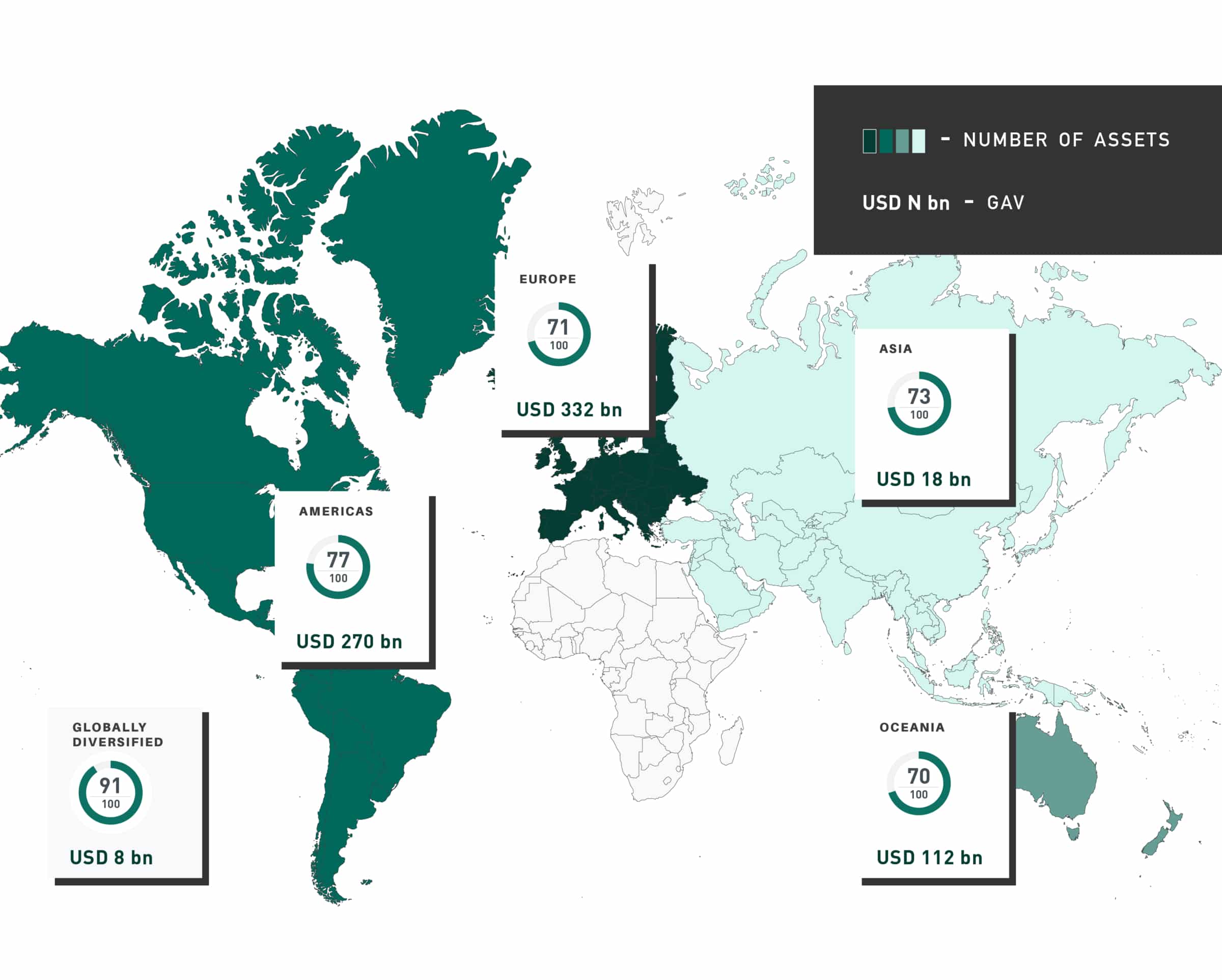

- Overall, the gross asset value reporting to GRESB has increased by more than 50% since 2019, now covering $343 billion at the fund level and $738 billion at the asset level

Fund coverage and growth

Despite the continued challenges posed by Covid-19, total participation in the Infrastructure Fund Assessment grew by 26%, to 149 funds completing the Management Component. The number of infrastructure funds completing both the Management and Performance components of the Infrastructure Fund Assessment grew by 41% to 106, that is funds obtaining a GRESB Fund Score reflecting overall ESG performance at the portfolio level.

The fund assessment covers over 30% of the IPE Real Assets Top 100 Infrastructure Investment Managers and over a third of the Infrastructure Investor Top 50, based on participation with at least one fund.

Asset coverage and growth

Participation in the Infrastructure Asset Assessment grew by 31% to cover 558 assets. While most assets are based in Europe, significant relative growth in participation numbers came from the Americas (105 to 142) and Asia (21 to 31). The assessment now covers 33 of the 34 industry sectors and 2,096 facilities across 69 countries.

Participation by sector

The average percentage of individual assets within funds reporting to GRESB continues to grow, which is now up to 83%. This increase shows that infrastructure managers are moving closer to asset-level reporting.

By sector, Renewable Power saw the highest growth in participation (65%), followed by Environmental Services (64%), Transport (44%) and Network Utilities (27%).

Regional scores and GAV

Assets reported on over 2,096 facilities (a 35.4% increase) spread across 69 countries, with coverage continuing to be dominated by OECD countries.

Europe builds upon its track record for transparency with the most funds and assets participating in the benchmark by value. Assets in Europe, Oceania and Asia scored similarly, while the American average was higher.

For assets, the average GRESB score increase was 10 points, largely coming from the Performance Component. By asset type, Diversified and Network Utilities are the top performing assets, with average GRESB scores of 80 and 79, respectively.

The asset types that improved the most since last year were Social Infrastructure, with a 22 point increase, and Diversified, with a 20 point increase.

The GRESB Model compares aggregate performance across countries and regions.

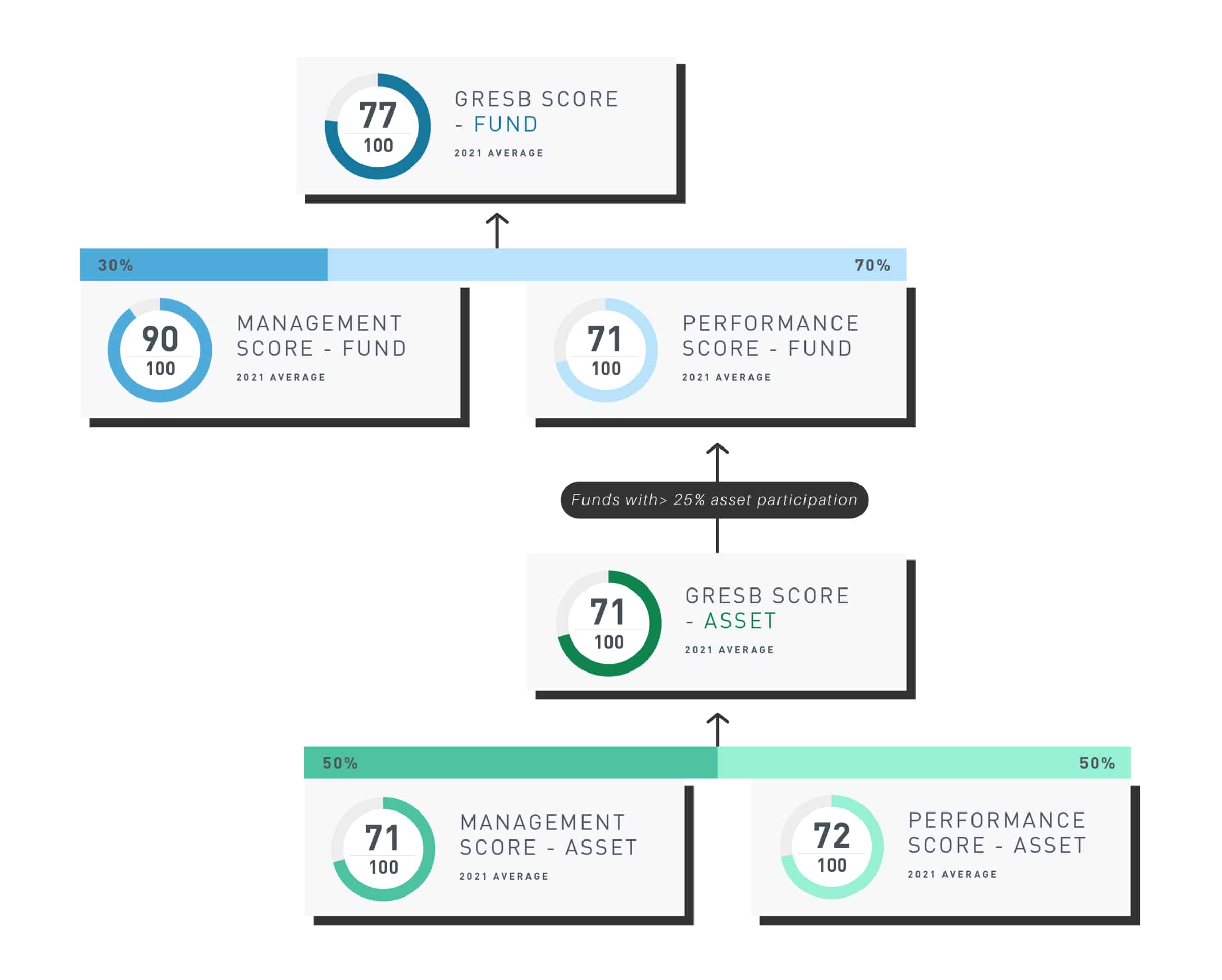

GRESB and Component Scores

When it comes to GRESB scores, both funds and assets saw significant increases this year, similar to the impressive increases seen in 2020. On average, overall GRESB scores and component scores increased from 5 to 15 points.

At the fund level, 13 entities scored the maximum 100 for the Management Component, while only two saw score decreases.

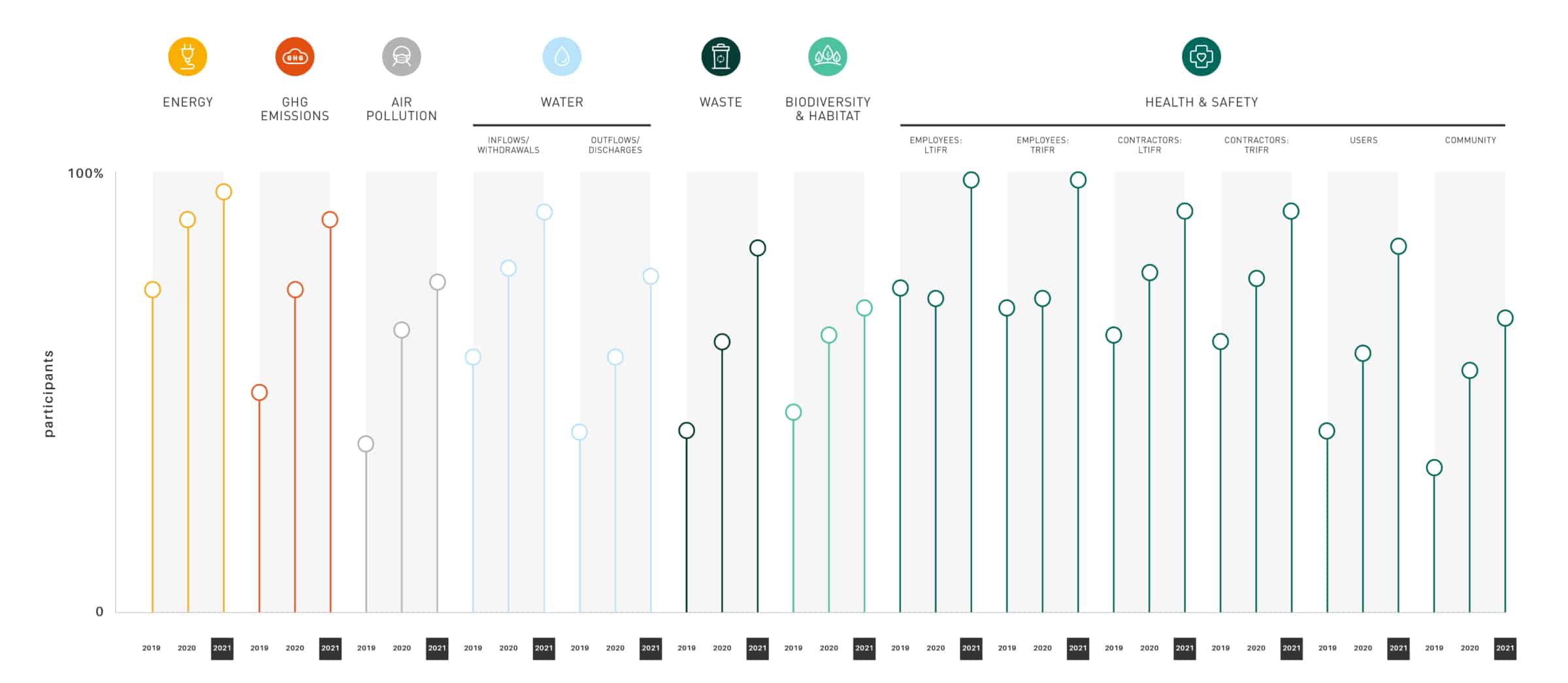

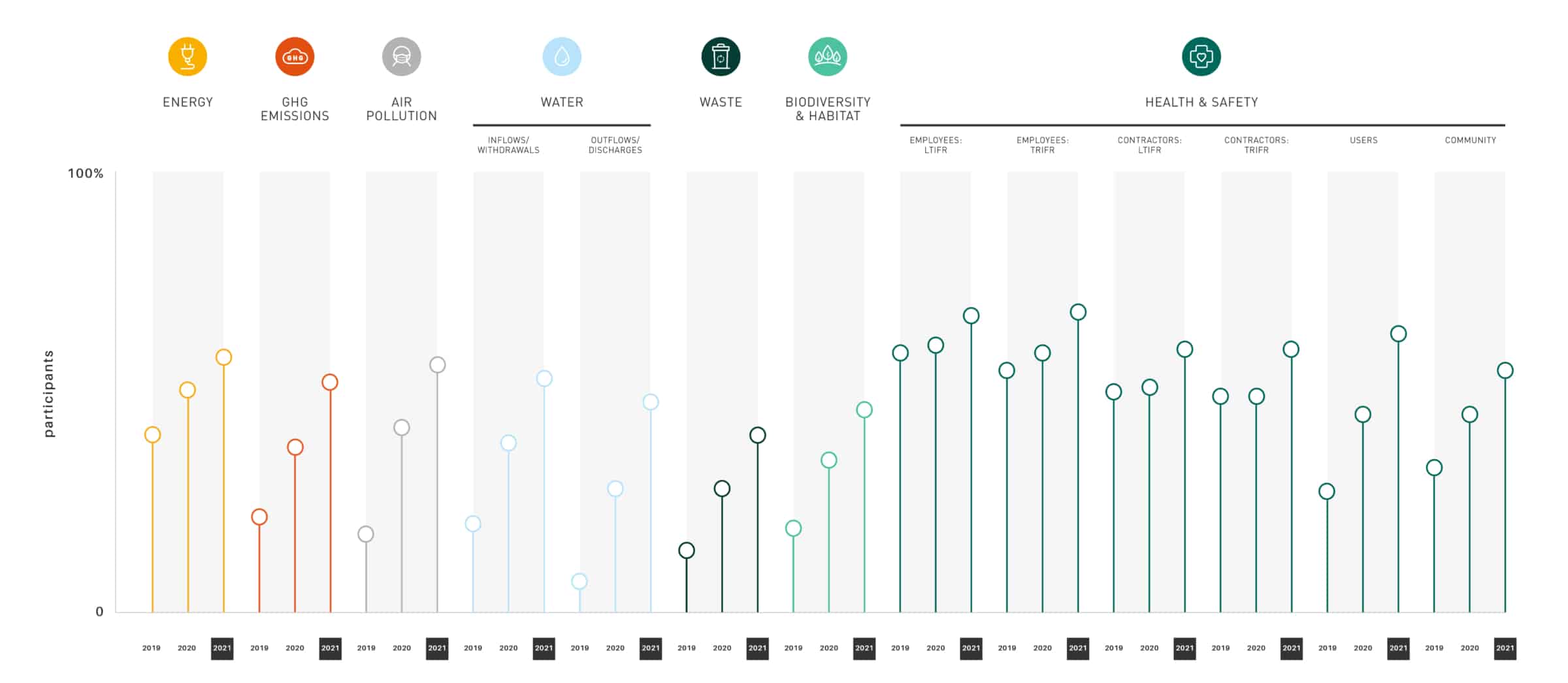

Asset performance component indicators

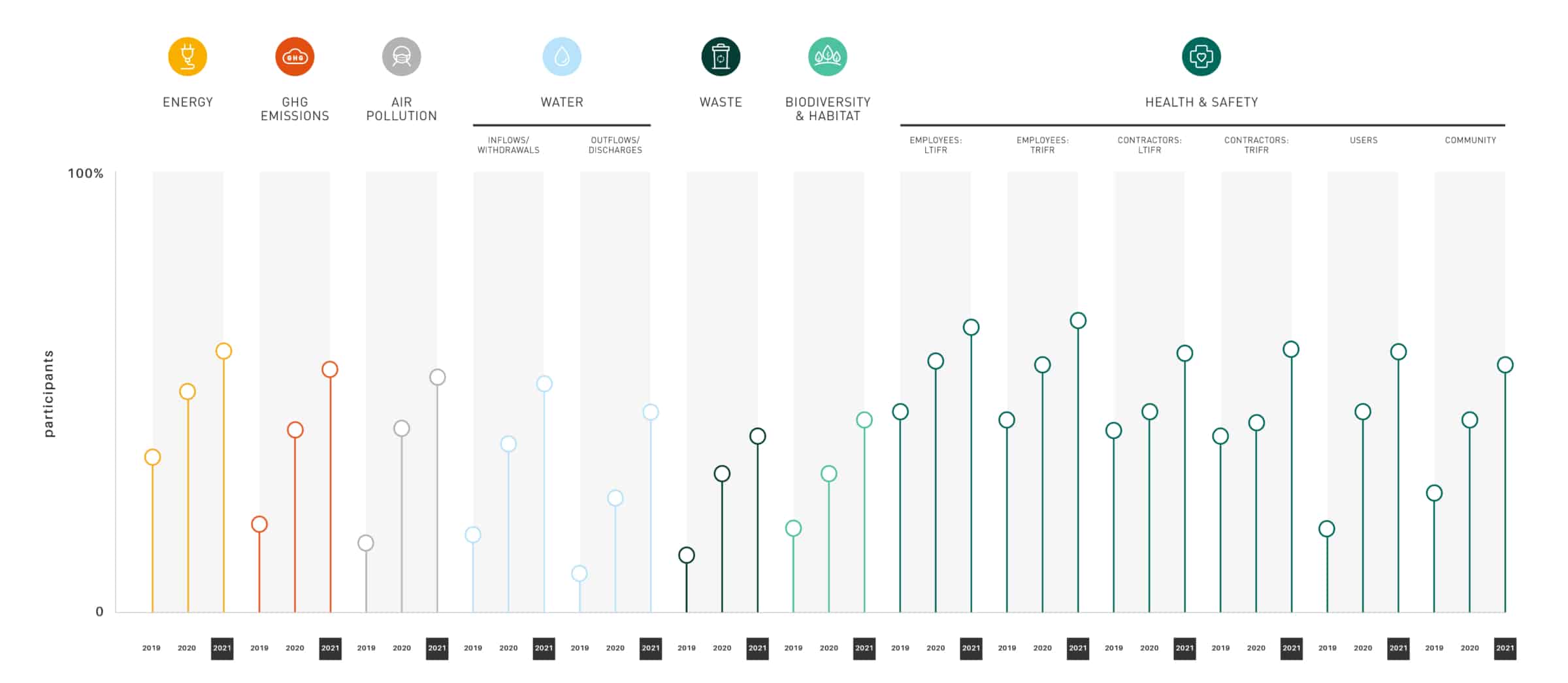

Transparency on performance indicators has increased

The Asset Performance Component indicators show the extent to which assets report on their most material ESG issues. The chart focuses on the main ESG issues covered, showing the proportion of participants that reported on each material indicator. Health and Safety reporting shot up this year, after little to no movement last year.

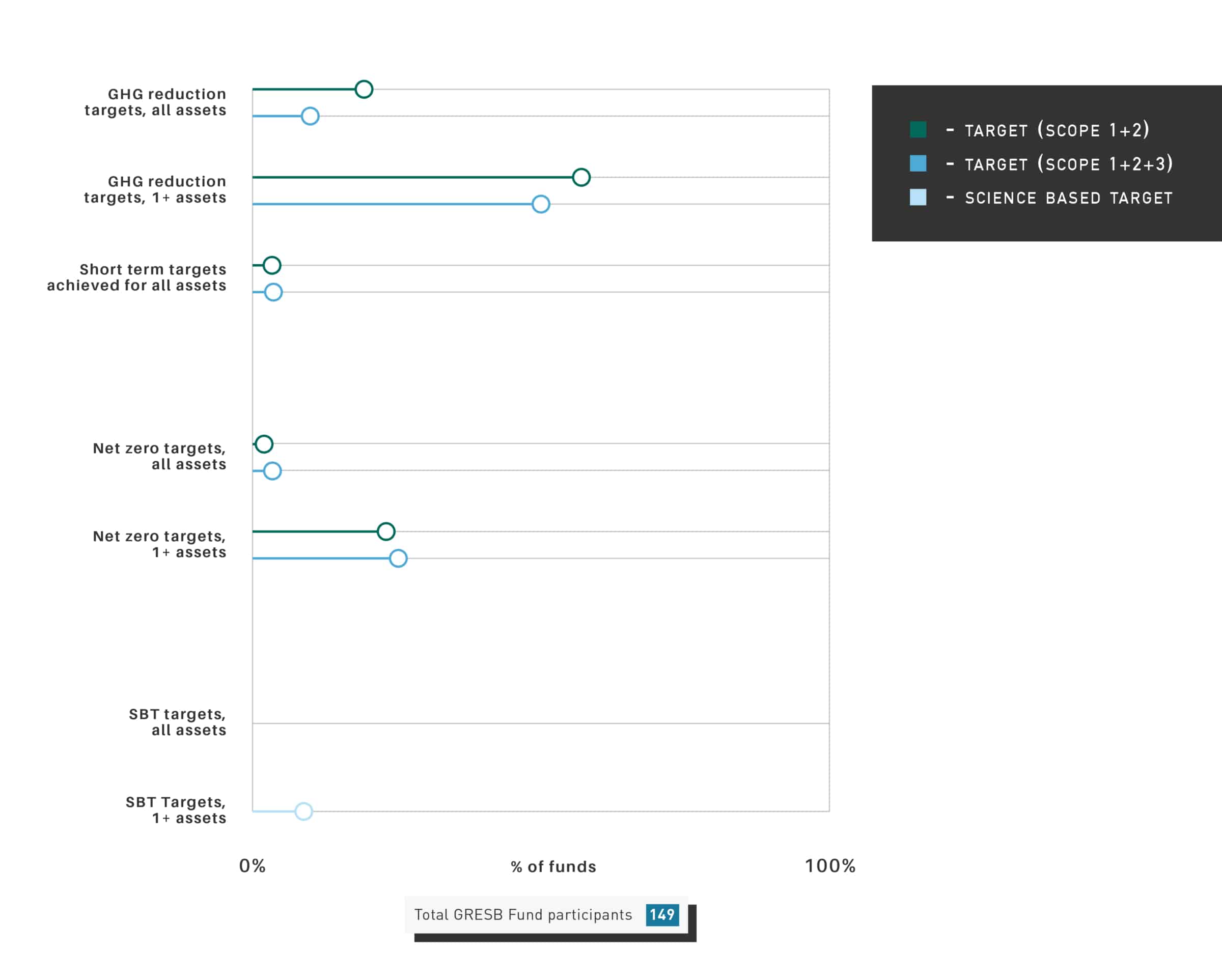

Target setting for 2021 has increased for all performance indicators

The 2021 Infrastructure Asset Assessment shows continued improvement in target setting across all performance indicators, suggesting future improvements in performance that will follow.

As net zero is a growing interest in the industry, GRESB analysed the target setting that fund managers have committed to for their underlying portfolios. We found that – while Scope 1 and 2 GHG targets are often set by managers for at least one asset in their fund (57%) – only 23% of funds participating in the assessment have an asset in their portfolio with a net zero target. Even fewer (9%) have set science-based targets.

That said, fund managers representing just over 40% of all our reporting assets became signatories to the “Net Zero Asset Managers” commitment in December 2020. We expect that in the coming years the number of net zero targets will spike, as assessment reporting reflects these recent commitments.

-

-

-

Among infrastructure assets and funds, Diversity has shown little to no improvement. While the average fund has an employee gender ratio of 40:60 between women and men, only 28% of funds’ governance and management roles are filled by women.

-

Sector Leaders

The GRESB Sector Leaders are the best performers by sector, region and nature of ownership from across the GRESB Assessments.

The entity with the top GRESB Score, as well as the entities with a score within 1 point of the top score in a category will be recognized as Sector Leaders. You can find more information on Sector Leaders here.

Sector Leaders and Most Improved

-

Sector Region Fund name Fund manager Diversified Swiss Life Funds (Lux) ESG Global Infrastructure Opportunities III, a sub-fund of Swiss Life Funds (Lux) Global Infrastructure Opportunities Umbrella, SCS, SIF Swiss Life Asset Managers Luxembourg Renewable Power Capital Dynamics Clean Energy and Infrastructure III LP Capital Dynamics Transport Arcus European Trains SCSp Arcus European Investment Manager LLP Transport Arcus A1 Investor Vehicle LLP Arcus European Investment Manager LLP Sector specific excluding Renewables and Transport Arcus Tivana Investor Vehicles Arcus European Investment Manager LLP Americas Capital Dynamics Clean Energy and Infrastructure V JV LLC Capital Dynamics Asia Takara Leben Infrastructure Fund, Inc. Takara Asset Management Co., Ltd. Europe Arcus Tivana Investor Vehicles Arcus European Investment Manager LLP Globally diversified Swiss Life Funds (Lux) ESG Global Infrastructure Opportunities III, a sub-fund of Swiss Life Funds (Lux) Global Infrastructure Opportunities Umbrella, SCS, SIF Swiss Life Asset Managers Luxembourg Oceania Queensland Airports Limited (Asset Management) Morrison & Co -

Sector Region Fund name Fund manager Diversified Aberdeen European Infrastructure Partners LP Aberdeen Fund Managers Limited Renewable Power AIP Infrastructure I AIP Infrastructure I K/S Americas Social Infrastructure Fund, L.P. Harrison Street Americas Macquarie Infrastructure Partners IV Macquarie Infrastructure Partners Inc. Europe Aberdeen European Infrastructure Partners LP Aberdeen Fund Managers Limited Globally diversified AIP Infrastructure I AIP Infrastructure I K/S Oceania Infratil Morrison & Co -

Superclass Class Asset name Asset manager Data Infrastructure TDF TDF Diversified REDEXIS GROUP REDEXIS Diversified BUUK Infrastructure No 1 Limited BUUK Infrastructure Energy and Water Resources Ital Gas Storage S.p.A. (IGS) Ital Gas Storage S.p.A.; held by North Haven Infrastructure Partners II (NHIP II), an investment managed by Morgan Stanley Infrastructure Inc. (MSIP) Environmental Services Saubermacher Dienstleistungs AG UBS Asset Management Environmental Services Seven Seas Water Corporation Seven Seas Water Corporation; held by North Haven Infrastructure Partners III (NHIP III), an investment managed by Morgan Stanley Infrastructure Inc. (MSI or MSIP) Network Utilities Celeo Redes Brasil SA Celeo Redes Brasil Other DIG AIRGAS DIG Airgas Co., Ltd. Power Generation x-Renewables Red Oak Power Facility Red Oak Power Facility; held by North Haven Infrastructure Partners II (NHIP II), an investment managed by Morgan Stanley Infrastructure Inc. (MSIP or MSIP) Power Generation x-Renewables Bayonne Energy Center Bayonne Energy Center; held by North Haven Infrastructure Partners II (NHIP II), an investment managed by Morgan Stanley Infrastructure Inc. (MSI or MSIP) Renewable Power Collgar Wind Farm Collgar Wind Farm Social Infrastructure Woodlawn Commons University of Chicago Transport Porterbrook Leasing Company Limited Alberta Investment Management Corp Transport Globalvia Globalvia Transport Perth Airport Perth Airport Pty Ltd Transport Manchester Airports Group MAG Data Infrastructure Data Transmission TDF TDF Energy and Water Resources Energy Resource Storage Companies Ital Gas Storage S.p.A. (IGS) Ital Gas Storage S.p.A.; held by North Haven Infrastructure Partners II (NHIP II), an investment managed by Morgan Stanley Infrastructure Inc. (MSIP) Network Utilities District Cooling/Heating Companies CoolCo Cincinnati CoolCo Cincinnati Network Utilities Gas Distribution Companies Phoenix Natural Gas Phoenix Natural Gas Network Utilities Water and Sewerage Companies Esval Esval S.A. Network Utilities Water and Sewerage Companies Essbio Essbio S.A. Power Generation x-Renewables Independent Power Producers Red Oak Power Facility Red Oak Power Facility; held by North Haven Infrastructure Partners II (NHIP II), an investment managed by Morgan Stanley Infrastructure Inc. (MSIP or MSIP) Power Generation x-Renewables Independent Power Producers Bayonne Energy Center Bayonne Energy Center; held by North Haven Infrastructure Partners II (NHIP II), an investment managed by Morgan Stanley Infrastructure Inc. (MSI or MSIP) Renewable Power Hydroelectric Power Generation Småkraft AS Aquila Capital Renewable Power Solar Power Generation Sonnedix Power Holding Infrastructure Investments Fund, advised by J.P. Morgan Investment Management, Inc. Renewable Power Solar Power Generation Ecoplexus Ecoplexus Renewable Power Wind Power Generation Collgar Wind Farm Collgar Wind Farm Social Infrastructure Education Services Woodlawn Commons University of Chicago Social Infrastructure Government Services TGI Arelia S.A.S Arelia S.A.S Social Infrastructure Government Services Amey Lighting (Norfolk) Limited Amey Social Infrastructure Health and Social Care Services PPP Investments I LP/PPP Investments II LP Dalmore Transport Airport Companies Perth Airport Perth Airport Pty Ltd Transport Airport Companies Manchester Airports Group MAG Transport Port Companies The Port of Virginia The Port of Virginia Transport Rail Companies Porterbrook Leasing Company Limited Alberta Investment Management Corp Transport Road Companies Globalvia Globalvia -

Superclass Class Data Infrastructure Towercom, a.s. Towercom, a.s. Data Infrastructure Land Services SA Operating Pty Limited ATF Land Services SA Holding Trust Land Services SA Energy and Water Resources Howard Midstream Energy Partners, LLC Alinda Capital Partners Environmental Services Sydney Desalination Plant Pty Limited Sydney Desalination Plant Pty Limited Network Utilities MADRILEÑA RED DE GAS MADRILEÑA RED DE GAS Power Generation x-Renewables Lordstown Energy Center Clean Energy Future – Lordstown, LLC Renewable Power Green Yellow Holding de Participation dans les Centrales Photovoltaïques 1 S.A.S. (HPCP 1) Social Infrastructure Escala Vila Franca – Sociedade Gestora do Edificio, S.A. Escala Vila Franca – Sociedade Gestora do Edificio, S.A. Transport Albali Senalizacion Albali Senalizacion S.A. Transport Twin Parking Holdings Alinda Capital Partners Data Infrastructure Data Transmission Towercom, a.s. Towercom, a.s. Network Utilities Electricity Transmission Companies Cross-Sound Cable LLC CSC Operations LLC Network Utilities Gas Distribution Companies MADRILEÑA RED DE GAS MADRILEÑA RED DE GAS Network Utilities Water and Sewerage Companies Middletown Water Joint Venture Suez Water Services Power Generation x-Renewables Independent Power Producers Lordstown Energy Center Clean Energy Future – Lordstown, LLC Renewable Power Solar Power Generation Green Yellow Holding de Participation dans les Centrales Photovoltaïques 1 S.A.S. (HPCP 1) Renewable Power Wind Power Generation Invis Energy (RPP2) Asper Investment Management Limited Social Infrastructure Education Services East Renfrewshire Schools Limited East Renfrewshire Schools Limited Social Infrastructure Government Services Auckland Prison Next Step Partners LP Social Infrastructure Health and Social Care Services Escala Vila Franca – Sociedade Gestora do Edificio, S.A. Escala Vila Franca – Sociedade Gestora do Edificio, S.A. Social Infrastructure Recreational Facilities Linteum (Lewisham) Limited Linteum (Lewisham) Limited Transport Airport Companies George Best Belfast City Airport Belfast City Airport Transport Airport Companies Port Hedland International Airport Operations Port Hedland International Airport Transport Port Companies Flinders Port Holdings Pty Ltd Flinders Port Holdings Pty Ltd Transport Rail Companies Albali Senalizacion Albali Senalizacion S.A. Transport Road Companies Autoroute de Liaison Seine Sarthe ALIS